Economy and Society: February 4, 2026

In this week’s edition of Economy and Society:

- Senate Banking chair aligns with Trump on ESG

- UK regulator warns retailers about environmental claims

- ESG legislation update

- Wells Fargo moves proxy voting in-house

- Net-zero financial services alliance disbands

- Morningstar finds drop in social proposal support

In Washington, D.C., and around the world

Senate Banking chair aligns with Trump on ESG

What’s the story?

On Jan. 22, 2026, Senate Banking Committee Chairman Sen. Tim Scott (R-S.C.) said that he supports President Donald Trump’s (R) efforts to limit the use of non-financial screening criteria in banking and financial regulation. Scott said his focus as chairman has been preventing federal regulators and financial institutions from denying services to lawful businesses and individuals based on policy considerations rather than individualized financial risk.

Scott pointed to Trump’s August 2025 executive order, Guaranteeing Fair Banking for All Americans, which directed federal banking regulators to review whether supervisory guidance or examination practices had encouraged banks to restrict services based on environmental, social, and governance (ESG) considerations. The order instructed agencies to ensure that access to banking services is based on objective, customer-specific risk rather than broad classifications applied to entire industries.

Why does it matter?

Republicans frame the debate over ESG criteria around access to financial services rather than corporate disclosure, emphasizing an anti-discrimination and anti-ESG-screening approach. They say the use of non-financial screening practices limited access to banking for some lawful industries and consumers, even when regulators did not identify legal violations or elevated credit risk.

Democrats on the Senate Banking Committee have raised concerns about Trump-era banking deregulation and its effects on financial stability and access to services. In a Dec. 12, 2025, letter Democratic committee members — including Sen. Elizabeth Warren (D-Mass.), the committee’s ranking member — said, “Members of the Committee need answers from Trump’s prudential regulators, whose actions have drastic implications for the financial and economic security of our constituents.”

If Congress codifies limits on ESG considerations through legislation, future administrations would have less discretion to reinstate climate- or social-risk frameworks through agency guidance or rulemaking.

What’s the background?

Between 2020 and 2023, some large banks adopted internal policies that subjected customers in sectors such as energy production and firearms manufacturing to heightened scrutiny or restrictions on access to banking services. In a December 2025 review, the Office of the Comptroller of the Currency said these practices were often based on internal policy judgments rather than individualized credit risk and said it was not alleging violations of law.

Trump’s August 2025 order is part of a broader pullback from climate- and policy-driven financial regulation. In October 2025, federal regulators withdrew climate-risk principles for large banks, citing concerns about applying uniform climate frameworks across institutions with different risk profiles.

The administration also moved to limit the role of non-financial considerations in securities regulation. In June 2025, the Securities and Exchange Commission (SEC) withdrew proposed ESG disclosure rules, and also ended its defense of existing climate reporting requirements in federal court.

UK regulator warns retailers about environmental claims

What’s the story?

On Jan. 22, 2026, the UK’s Competition and Markets Authority (CMA) released new guidance clarifying that retailers and manufacturers share responsibility for environmental claims made about products across the supply chain. The guidance said businesses may be liable for misleading green claims even when they repeat information provided by suppliers. The CMA said a retailer may be deemed to repeat an environmental claim simply by stocking a product that carries a false or misleading label.

The guidance builds on the CMA’s Green Claims Code, first published in September 2021. It responds to requests from stakeholders seeking clarity on how consumer protection law applies when multiple companies contribute to product marketing. The CMA said businesses must take steps to verify claims made directly or indirectly, including claims passed along from other companies. If a business cannot verify an environmental claim, the CMA said the business should consider changing how the claim is presented or reassessing its trading relationship with the supplier.

Why does it matter?

The guidance clarifies that liability for greenwashing, when a company makes environmental claims that are false or misleading, does not stop with the company that created a claim. Retailers and suppliers that rely on supplier information would face enforcement risk if claims mislead consumers. The CMA said it would consider who engaged in the commercial practice and whether companies had internal processes to verify claims when prioritizing enforcement.

The document also reflects the CMA’s expanded enforcement authority under the Digital Markets, Competition and Consumers Act 2024, which took effect in April 2025 and allows the agency to issue fines without going to court.

What’s the background?

The CMA published the Green Claims Code in September 2021 to outline how consumer protection law applies to environmental claims. Since then, the regulator has issued sector-specific guidance and opened investigations into green marketing practices. The new document expands that framework by explaining how responsibility applies across complex supply chains and includes checklists for retailers and manufacturers.

In the states

ESG legislation update

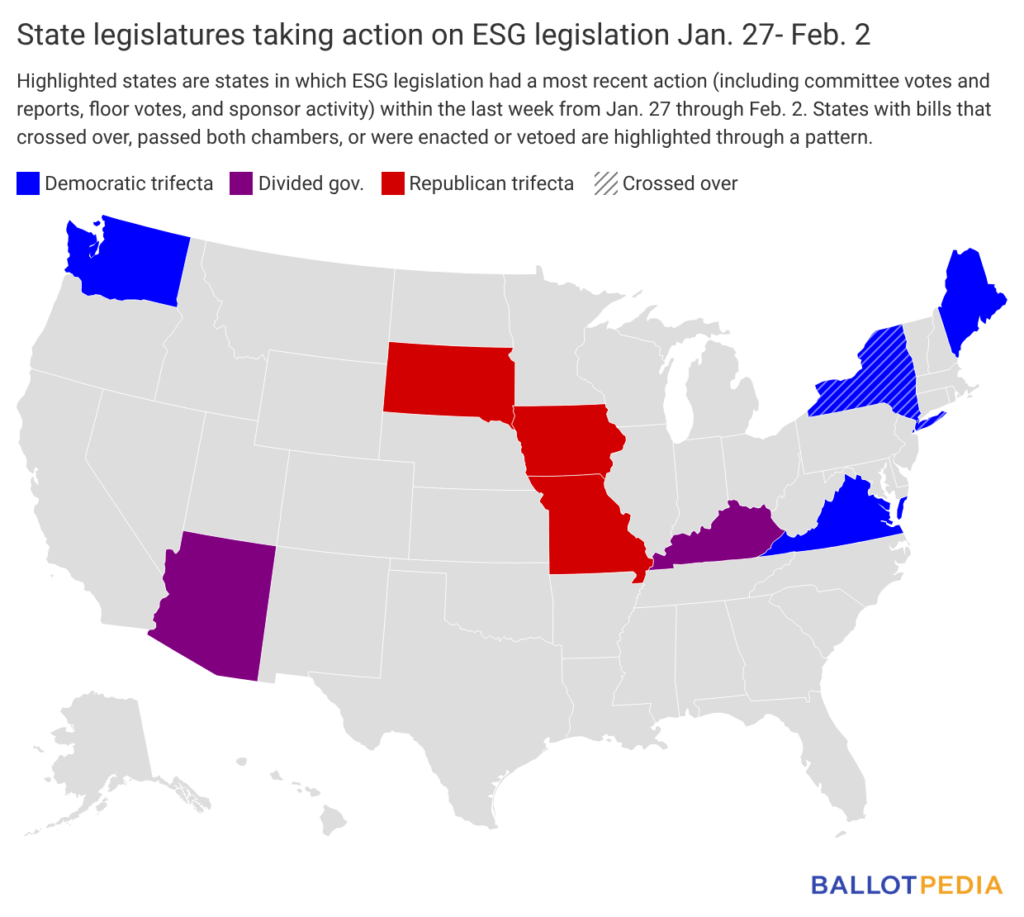

Nine states took action on 14 ESG-related bills last week (since Jan. 27, 2026).

States with legislative activity on ESG last week are highlighted in the map below. Click here to see the details of each bill in the legislation tracker.

On Wall Street and in the private sector

Wells Fargo moves proxy voting in-house

What’s the story?

On Jan. 29, 2026, Wells Fargo announced that its Wealth & Investment Management division launched a proprietary system to manage proxy voting internally, ending its use of outside proxy advisory services. The firm said it will now direct proxy voting for client assets where it has both investment discretion and voting authority using its own custom policies focused on clients’ long-term economic interests. Wells Fargo Wealth & Investment Management oversees about $2.5 trillion in client assets, according to the firm.

The change makes Wells Fargo the second of the four largest U.S. banks by assets to move away from external proxy advisors, following a similar announcement by JPMorgan Chase earlier in January. Wells Fargo said the new system would give the firm greater independence and reduce reliance on third parties. According to a Wall Street Journal report, Wells Fargo has also cut ties with Institutional Shareholder Services (ISS), a proxy advisory firm that provides voting recommendations and governance research to institutional investors.

Why does it matter?

Proxy advisory firms play a central role in how large asset managers vote on shareholder proposals. By moving proxy voting in-house, Wells Fargo will have more direct control over voting decisions and less exposure to outside recommendations.

What’s the background?

Proxy advisory firms provide institutional investors with research, voting recommendations, and administrative services related to shareholder voting. ISS and Glass Lewis dominate the U.S. market. Together account for more than 90% of the proxy advisory industry, according to a September 2025 Congressional Research Service report. Their recommendations are widely used by asset managers when voting on shareholder proposals.

The federal government's scrutiny of proxy advisors increased in December 2025, when Donald Trump issued an executive order directing the SEC to expand oversight of proxy advisors. The order followed congressional hearings on proxy advisors’ influence in May 2025, as well as an SEC decision to limit no-action responses for the 2025–26 proxy season in November. 2025.

Net-zero financial services alliance disbands

What’s the story?

On Jan. 28, 2026, the Net-Zero Financial Services Providers Alliance (NZFSPA) said that it is ending operations as a standalone organization. The group, launched in 2021, as part of the United Nations–backed Glasgow Financial Alliance for Net Zero (GFANZ), brought together financial services firms — including exchanges, auditors, index providers, and research and data companies — to align services and products with net-zero climate goals.

The coalition had 18 founding members and committed to setting science-based climate targets. In its announcement, the alliance said it had completed and published target-setting frameworks for its member firms, which would remain available as reference materials after the group stops operating independently.

Why does it matter?

The decision adds to a broader pullback and restructuring among GFANZ-affiliated initiatives, many of which have faced political pressure in the United States. Republican officials have criticized coordinated climate initiatives by financial institutions, saying participation could raise antitrust concerns or amount to boycotts of energy companies. That scrutiny has increased since President Donald Trump returned to office.

The alliance’s closure does not end all of its work. Its exchange-focused members will move into the UN Sustainable Stock Exchanges initiative, reflecting a shift away from cross-industry coalitions toward narrower, function-specific frameworks rather than formal membership groups.

What’s the background?

The NZFSPA was created in 2021 as part of GFANZ, an umbrella group that also included the Net Zero Banking Alliance, the Net Zero Asset Managers initiative, and the Net-Zero Insurance Alliance. Several of those groups have either disbanded or paused operations over the past two years.

The Net Zero Banking Alliance ended operations in October 2025, and the Net Zero Asset Managers initiative disbanded in January 2025 before later relaunching with a narrower scope.

In the spotlight

Morningstar finds drop in social proposal support

What’s the story?

A new report from Morningstar, released Jan. 28, 2026, found that average support for shareholder proposals on environmental and social topics declined each year over the past three proxy years. Support fell from 18.8% in the 2023 proxy year to 15.2% in 2024, and then to 11.6% in 2025, according to the report. Support for governance-related shareholder proposals remained near 30% over the same period.

The report analyzed proxy voting patterns at U.S. companies using voting data from 50 of the largest U.S. managers of equity and allocation funds, focusing on companies in the Morningstar US Large-Mid Cap Index. It also found that support for management resolutions increased slightly, rising from about 95% in 2023 and 2024 to just over 96% in 2025.

Why does it matter?

Shareholder proposals are a primary way investors raise environmental and social issues at public companies. The steady decline in support indicates that large asset managers are backing fewer of these proposals, even as they continue to reach company ballots.

Morningstar also found that the largest asset managers showed lower support for shareholder proposals than smaller firms. Because those managers hold larger ownership stakes, their voting patterns shape overall results.