Fremont Union High School District Parcel Tax, Measure J (November 2014)

| Voting on taxes | ||||||||

|---|---|---|---|---|---|---|---|---|

| ||||||||

| Ballot measures | ||||||||

| By state | ||||||||

| By year | ||||||||

| Not on ballot | ||||||||

| ||||||||

A Fremont Union High School District Parcel Tax, Measure J ballot question was on the November 4, 2014 election ballot for voters in the Fremont Union High School District in Santa Clara County, California. It was approved.

Measure J renewed its existing parcel tax of $98 for six more years beginning July 1, 2016. Revenue from the levy was meant to protect math, science, English, foreign language, music and art classes, maintain class sizes and retain high quality teachers and staff. Individuals aged 65 and older were offered an exemption from the tax.[1]

A two-thirds (66.67%) vote was required for the approval of Measure J.

Election results

| Fremont Union High School District, Measure J | ||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| 35,415 | 71.37% | |||

| No | 14,210 | 28.63% | ||

Election results via: Santa Clara County Elections Office

Text of measure

Ballot question

The question on the ballot:[1]

| “ |

To renew its existing parcel tax without increasing the cost or changing the structure of the proposal voters first approved in 2004, shall the Fremont Union High School District continue to levy a $98 parcel tax for 6 more years beginning July 1, 2016 to protect the math, science, English, foreign language, music and art classes currently offered, maintain class sizes, retain high quality teachers and staff and offer an exemption to individuals age 65 and over? [2] |

” |

Impartial analysis

The following impartial analysis was prepared for Measure J:[3]

| “ |

A school district may levy a special tax upon approval by two-thirds of the votes cast on a measure pursuant to section 4 of article XIIIA of the California Constitution and sections 50075 et seq. of the California Government Code. The Board of Trustees (Board) for the Fremont Union High School District (District) proposes Measure J, renewing an existing parcel tax first enacted in 2004 and subsequently renewed in 2010, to continue to be levied at $98 per parcel per year for an additional six years. If approved, the parcel tax will commence on July 1, 2016 and expire on June 30, 2022. The proposed tax exempts any parcel that is owned and occupied by a person 65 years of age or older. It also exempts persons receiving Supplemental Security Income for a disability, regardless of age. State law requires the District to state the specific purposes for which the tax proceeds will be used and only spend the proceeds of the tax for these purposes. The stated purposes of the tax proposed by Measure J are to provide financial support to local school programs according to priorities established by the Board, including: (1) protecting teaching positions; (2) avoiding increased class sizes; and (3) assuring that the District’s high school students are prepared to successfully compete for college and university admission. The District is required by law to provide additional accountability measures for the proceeds. These measures include: (1) depositing the proceeds into a fund that is separate and apart from other District funds; and (2) providing an annual written report to the Board detailing the amount of funds collected and expended and the status of any project authorized to be funded from the tax proceeds. The Board will, in addition, establish an independent advisory committee of citizens to ensure that proceeds from the tax are used only for the specific purposes authorized by Measure J. Measure J was placed on the ballot by the Board. A "yes" vote is a vote to approve a parcel tax of $98 per parcel on parcels within the District for six years. A "no" vote is a vote to not approve a parcel tax of $98 per parcel on parcels within the District for six years.[2] |

” |

| —Orry P. Korb, County Counsel and Susan Swain, Lead Deputy County Counsel[3] | ||

Support

Supporters

- Charlie Olson, Orchardist

- Dolly Sandoval, Former Cupertino Mayor

- Manuela Rodriguez, Longtime community supporter

- Michael Chang, Trustee, Santa Clara County Board of Education

- Sandi Spires, Parent Volunteer

Arguments

The following was submitted as the official arguments in favor of Measure J:[3]

| “ |

Approval of Measure J will renew a local school parcel tax first approved by voters in 2004. Renewal will continue to provide the high schools in the Fremont Union High School District, Cupertino, Fremont, Homestead, Lynbrook and Monta Vista High Schools, with stable, reliable funding that cannot be disrupted or seized by the state. Measure J will not increase taxes. Parcel tax funds have been used at all five of the District's comprehensive high schools to:

Renewal of Measure J is an investment in a high school district ranked as the third highest performing in California. There are serious consequences if we fail to renew this $98 parcel tax. Without Measure J funds the District

This will result in fewer course options for students including college prep, advanced placement, and honors course as well as fewer electives such as arts, music, and career technical education. Learn more at www.JandK.org. Public oversight will be careful and complete. The language of Measure J requires that all expenditures be monitored by an Independent Citizens' Oversight Committee and subject to an annual independent audit. Measure J offers all senior citizens and the disabled a complete exemption from the $98 annual cost. Please join us and vote Yes on Measure J[2] |

” |

| —Charlie Olson, Dolly Sandoval, Manuela Rodriguez, Michael Chang and Sandi Spires[3] | ||

Opposition

Opponents

- Mark W.A. Hinkle, President: Silicon Valley Taxpayers Association

- Edward Leo Wimmers, Chair, Libertarian Party of Santa Clara County

- Brian S. Darby, District Resident

- Steven B. Haug, Treasurer, Silicon Valley Taxpayers Association

Arguments

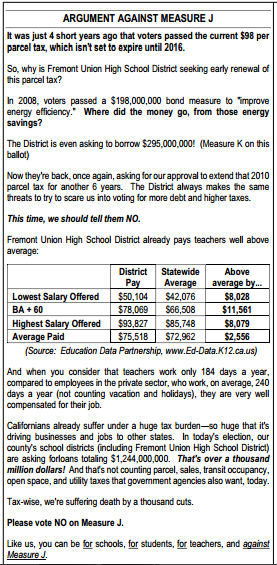

The following was submitted as the official arguments in opposition to Measure J:[3]

See also

- Parcel tax elections in California

- Parcel tax

- California parcel tax on the ballot

- Local school tax on the ballot

- Santa Clara County, California ballot measures

- November 4, 2014 ballot measures in California

External links

Footnotes

- ↑ 1.0 1.1 Santa Clara County Registrar of Voters website, "List of Ballot Measures," accessed October 15, 2014

- ↑ 2.0 2.1 2.2 Note: This text is quoted verbatim from the original source. Any inconsistencies are attributable to the original source.

- ↑ 3.0 3.1 3.2 3.3 3.4 Voter's Edge, "Santa Clara County Ballot Information," accessed October 15, 2014

| |||||