Local ballot measures in California: 2015 in review

December 4, 2015

- By: Josh Altic

In California, nearly every aspect of local politics can be touched directly by voters through ballot measures. In 2015 alone, voters were responsible for deciding the fate of more than a billion dollars in new debt and dozens of proposed taxes, as well as issues that directly affect their everyday lives, including housing, oil and gas drilling, the locations of grocery stores, the preservation of open space and park land, and the fate of sports stadiums and marijuana dispensaries.

In 2015, Californians voted on 107 local measures, approving 70 of them and defeating 36. One measure was withdrawn before the election, and election results for it were not counted. The number of measures on the ballot, while continuing the standard election cycle pattern for local measures in California, was slightly less than the number of measures Californians saw in 2013 and 2011. Below is a chart showing the number of local measures decided each year in California since 2011.

|

|

|

Out of the total 107 measures, 64 concerned either bond issues or taxes. The single most common topic besides bonds and taxes was zoning and development, which was the issue at stake in 15 measures that voters used to decide a wide range of issues. Topics included residential development, open space and park land preservation, oil and gas drilling, sports stadiums, grocery stores, short-term rentals and more. The following chart shows a breakdown of the different issues decided through local measures in 2015. The totals do not add up to 107 because some measures dealt with more than one topic. For example, several measures authorized both a bond issue and a parcel tax, and others concerned both development and housing.

|

|

|

Zoning and development

Besides tax and bond measures, zoning and development-related measures were the next most common issue decided by voters at the ballot. Measures concerning zoning, land use and development usually directly affect at least a segment of the voters, resulting in a fair number of active campaigns both in support and opposition. Such measures are often put on the ballot through citizen initiatives or veto referendums. Fifteen measures were put on the ballot in 2015, and voters approved seven and rejected eight of the proposed measures. Five out of the fifteen measures that made the ballot were put there through a signature petition drive. Three other notable measures qualified for the ballot through signature petitions but were directly approved, precluding the necessity for elections.

In San Anselmo, voters saw competing measures about the future use of the city's Memorial Park. The city council drafted a plan to use the park as an emergency flood detention basin, but a group of residents objected to the plan and collected signatures for an initiative to restrict the use of the park to recreation only and put a stop to the city's redesign plan. The city council responded by putting their own measure on the ballot. Voters decided in favor of the citizen initiative. They also voted two pro-initiative candidates into city council positions, rejecting two candidates who supported the competing council-referred measure.

Other notable development-related measures included Modesto's "Stamp Out Sprawl" initiative, which was designed to restrict low-density residential development, and a measure seeking voter permission for an oil drilling project in Hermosa Beach. Modesto voters approved the residential development initiative, and voters in Hermosa Beach rejected the oil drilling project.

An increasingly common type of measure requires voter approval for certain development projects or zoning changes. An example of this sort of initiative was on the ballot in the town of Mammoth in October 2015. Measure Z required voter approval for any future changes to short-term rental restrictions in residential areas of the town. Past initiatives requiring voter approval for development caused two notable ballot measures this year. Both the oil drilling proposal in Hermosa Beach and an initiative backed by the San Francisco Giants that sought approval for a specific development proposal in San Francisco were required by previously approved measures of this type. The Giants' Mission District development proposal, Prop. D, was the second measure to be required by San Francisco's Proposition B, a citizen initiative approved in June 2014 that requires voter approval of any waterfront development.

Two initiatives that were sponsored by NFL teams, which qualified for 2015 ballots in Carson and Inglewood, concerned the construction of new NFL stadiums, one for the St. Louis Rams and one to be shared by the San Diego Chargers and the Oakland Raiders. Both proposals were directly approved by the respective city councils, making a vote of the people unnecessary. The NFL is scheduled to make a decision in early 2016 about which team or teams will be allowed to relocate to the Los Angeles area, a discussion that would not be possible without the initiatives. Although voters did not cast ballots on these proposals, they did make them possible by signing petitions circulated by the respective teams.[1]

The other measure that qualified for the ballot but did not go before voters was a veto referendum against a proposed development project in San Diego called the One Paseo project. After the city council approved the proposal, a group of opponents collected enough signatures to put a referendum before voters. Ultimately, a compromise was reached, and the city rescinded its approval of the initial development proposal.

Turnout

The average voter turnout for local measures in 2015 was 35.46 percent. Five measures in 2015 attracted lower than 10 percent voter turnout.

Ironically, only 8.2 percent and 9.9 percent of registered voters cast ballots on two measures in Los Angeles that were specifically designed to increase voter turnout. Los Angeles City Charter Amendments 1 and 2 were both approved on March 3, 2015, changing the election schedule for both city and Los Angeles Unified School District elections to an even-numbered year cycle. Supporters said this change would result in a higher voter turnout. Opponents claimed that the proposal would bury city and school district ballot items under high-profile federal and state races.

In the city of Paramount, only 4.6 percent of voters came out on March 3, 2015, to decide a utility users tax measure, Measure P.

Only 9.67 percent of Chino voters cast ballots on Measure V, a measure to rezone 12.7 acres in the city from commercial to residential use.

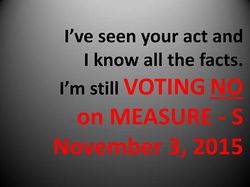

In Compton Unified School District, the 51st-largest school district in California, 7.1 percent of registered voters decided the fate of Measure S, a bond issue that authorized $350 million in new school debt. Ultimately, the measure passed the required 55 percent supermajority vote by a margin of just 46 votes, less than 1 percent of the votes cast. The Compton school district served nearly 25,000 students in 2015, but fewer than 5,000 residents voted on the measure that was key to the future of the school's capital assets and finances.

Besides Measure S in the Compton Unified School District, all of the measures with the lowest voter turnout this year were voted on in March. The average turnout for races not decided during the November election in 2015 was actually a little higher overall than the average turnout for measures voted on in November, however. Specifically, the average for non-November measures was 36.44 percent, while the average for November measures was 34.78 percent.

The highest turnout in 2015 occurred in a small road improvement zone in San Luis Obispo County, where all 12 of the registered voters in the district cast a vote on Measure A, a $1,815 per year parcel tax measure. Eight voted in favor, and four voted against. The eight "yes" votes were exactly the number required to reach the two-thirds (66.67%) vote.

Housing

- See also: Local housing on the ballot

Five of the six housing-related measures decided in 2015 were on the ballot for voters in San Francisco. In fact, housing was the most important issue in the city, which had the second highest average rental costs in the nation, falling just below New York. Gabriel Metcalf, president and CEO of public policy research company SPUR, said, “It’s the No. 1 issue in every poll.” Five propositions on the ballot dealt with housing and development, either directly or indirectly, and proposed solutions for the housing availability issues facing the city were essential to candidate platforms. Voters decided housing-related propositions that addressed affordable housing bonds, restrictions on short-term rentals, a moratorium on market-rate construction in the city's Mission District, housing developments on surplus public lands and a specific development proposal on the waterfront.[2]

The battle over San Francisco's "Airbnb Initiative" proved the most expensive local ballot measure battle in California this year and culminated with voters rejecting Proposition F by a margin of 55-45 percent. Proposition F was designed to restrict short-term rentals and allow the city to impose penalties on hosting platforms such as Airbnb for short-term rental posts that violated the measure's provisions. The support campaign for the proposition, which was financially backed by the hotel industry, raised about $778,488 for the measure's campaign. Airbnb, however, poured over $8 million into an opposition war chest of nearly $8.5 million.

The issue of housing and restrictions on short-term rentals was also on the ballot for voters in the town of Mammoth Lakes in October 2015. Town voters approved a citizen initiative called Measure Z that was designed to prevent any changes to the city's zoning restrictions on short-term housing rentals in residential areas of the town without voter approval. Proponents argued that the expansion of short-term rentals would remove units from the long-term housing market and cause "noise, crowds, traffic, parking and garbage/wildlife issues." Opponents, including several town council members, said the initiative unnecessarily removes authority and flexibility from the town council and could have unintended zoning-related consequences. They also argued that it could prove harmful to the town's economy.[3]

Bonds and taxes

Bonds

Across cities, school districts and special districts, voters approved 16 bond issue measures, representing a total of $1,822,880,000 in new proposed debt. Ten of the bond issues were proposed by school districts, and all but one were approved. Voters in Walnut Valley Unified School District defeated a $208 million bond issue. Voters in nine other districts approved bond issues totaling over $1.143 billion in new school debt. In 2015, bond issues were on the ballot in three cities in California. The largest bond issue was approved in San Francisco, authorizing a $310 million loan to be put toward affordable housing. Voters in Los Altos rejected a $65 million bond issue, and San Carlos voters rejected a $45 million bond issue. Voters in three special districts approved bond issues, which amounted to $51.85 million in new debt.

In the Mountain View School District, voters in the district's second facilities improvement district voted on a $171 million bond issue. Eighteen district residents came out to vote on Measure W; 16 approved the measure and two voted "no." This resulted in each vote representing $9.5 million in new school debt, more than twice what the average American earns in his or her lifetime. The improvement district had 93 registered voters. The voter turnout for the bond measure was a little over 19 percent.

Parcel taxes

- See also: Parcel tax elections in California

Cities, school districts and special districts throughout California use parcel taxes, which are tax assessments based on the characteristics of parcels of property rather than assessed value, to generate local revenue. A two-thirds (66.67%) vote is required for the approval of a parcel tax. In 2015, 10 school districts proposed either a parcel tax continuation, an increase to the existing parcel tax or an entirely new parcel tax. Voters approved all 10 measures. Voters decided 21 other parcel tax measures for cities and special districts in 2015. Voters approved only six of the non-school parcel taxes, rejecting the other 15. Out of the defeated measures, eight received majority approval, while the other seven were rejected by a majority of voters. This provided a total approval rate of 51.6 percent, which is slightly lower than the average over the last decade. From 2003 through 2014, 56 percent of parcel tax measures were approved.

Sales taxes

- See also: Sales tax in California

Cities and counties in California have a choice when it comes to imposing local sales taxes. They can propose a general sales tax, which requires a simple majority for approval and directs revenue into the general fund of the city or county to be used for any government purpose. The other option is to propose a special sales tax with revenue earmarked for a specific purpose, such as road repair, law enforcement or fire safety. A special sales tax, however, requires a two-thirds (66.67%) vote for approval. In 2015, the nine cities and one county that proposed sales tax measures chose to ask for general taxes, avoiding the supermajority requirement. Each measure, however, listed proposed uses of the sales tax revenue in the ballot question. For example, Measure G, which was on the ballot for voters in Modesto, asked voters if they wanted to implement the "Safer Neighborhoods Initiative by restoring police patrols, crime prevention, gang suppression and youth development efforts; removing tagging; reducing nuisance properties; strengthening fire/emergency services; increasing neighborhood collaboration; and to maintain other general city services." The Sonoma County Taxpayers Association objected to the ballot language and sued the city, arguing that it was misleading to list specific purposes for a general sales tax. The group said that the ballot question should have started by talking about "general city services" instead of putting that piece of information at the bottom of a list of proposed revenue uses.

In 2014, 18 of the 65 sales tax measures were for special sales taxes. Nine of the special sales taxes, which required a supermajority for approval, were defeated, amounting to a 50 percent approval rate. Out of the 47 general sales tax measures, 10 were defeated, amounting to an approval rate of 78.7 percent. In 2013, there were 11 sales tax measures. Only one was defeated. There was only one special sales tax in 2013. It was approved.

Hotel taxes

- See also: Hotel taxes in California

Voters in three cities and two counties approved hotel tax increases, three to a rate of 10 percent and two to a rate of 12 percent.

See also

- Local ballot measures, California

- Parcel tax elections in California

- Sales tax in California

- Hotel taxes in California

- School bond elections in California

- City, county and special district bond elections in California

Footnotes

| |||||