Health savings accounts

This article does not receive scheduled updates. If you would like to help our coverage grow, consider donating to Ballotpedia. Contact our team to suggest an update.

| Healthcare policy in the U.S. |

|---|

| Obamacare overview |

| Obamacare lawsuits |

| Medicare and Medicaid |

| Healthcare statistics |

Health savings accounts are financial accounts that allow for tax-free (at the federal level) deposits and withdrawals for healthcare expenses. Health savings accounts were permanently written into the tax code when former-President George W. Bush signed the Medicare Prescription Drug Improvement and Modernization Act in 2003. The accounts are coupled with high-deductible health plans and are designed to allow individuals to save for future out-of-pocket healthcare expenses. Health savings accounts stay with individuals through retirement, even if they change jobs.

Supporters argue that expanded use of health savings accounts could reduce healthcare spending and costs and lower the number of uninsured individuals. Critics say the accounts are harmful for low-income individuals and expanded use of the accounts could exacerbate the uninsured rate.

Overview

Health savings accounts are financial accounts that allow for tax-free deposits and withdrawals for healthcare expenses. In order to open a health savings account (HSA), an individual must first be enrolled in a high-deductible health plan and have no other comprehensive health insurance plan. For 2016, the Internal Revenue Service (IRS) defined high-deductible health plans as plans with deductibles of at least $1,300 for an individual and $2,600 for a family. Individuals covered by such plans would have to pay the full deductible amount before the insurance company would begin making any payments. High-deductible health plans typically have lower premiums than regular plans.[1][2]

Deposits into health savings accounts are not taxed at the federal level. Account owners can also earn tax-free interest on the money inside the accounts, and make tax-free withdrawals for qualified medical expenses, which are determined by the IRS. Some of these expenses include services that may not be covered by traditional insurance plans, such as acupuncture and eyeglasses. Most states don't tax HSA funds either, with five exceptions. According to Optum Financial Services, Alabama, California, and New Jersey tax contributions made to HSAs, while New Hampshire and Tennessee tax HSA earnings from interest (but not contributions).[3][4]

The IRS caps the amount individuals can contribute to their HSA per year; for 2016, contributions were capped at $3,350 for individuals and $6,750 for families. The money in an HSA rolls over from year to year, and the account is portable, meaning it stays with the owner even if he or she changes jobs. Withdrawals for nonqualified expenses are taxed as regular income and assessed a 20 percent penalty. However, after retirement, money can be withdrawn from the HSA for any reason without penalty, though it will be taxed as regular income.[2][5]

Differences from other medical accounts

- Health savings accounts vs. health reimbursement arrangements

- A health reimbursement arrangement or account (HRA) is a benefit fund from which an employer reimburses employees for out-of-pocket medical expenses that are not covered by the employee's health plan. Like health savings accounts, HRAs are typically paired with high-deductible health plans, although this is not a legal requirement. HRAs are also tax free. Unlike health savings accounts, HRAs are owned by the employer and do not go with the employee once he or she changes jobs. Only employers can contribute to HRAs.[6][7]

- Health savings accounts vs. flexible spending accounts

- Flexible spending accounts (FSAs) are set up by an employer for an employee to use for out-of-pocket medical expenses. Both an employer and employee can contribute funds to the account. Like health savings accounts, the amount that can be contributed per year is capped—the maximum annual contribution to an FSA is $2,500. Contributions are tax free. Unlike health savings accounts, the money in an FSA does not roll over from year to year; an individual must use the money in the account or lose it at the end of the year. The employer owns the account and it does not go with the employee once he or she changes jobs.[7]

- Health savings accounts vs. medical savings accounts

- Medical savings accounts (MSAs) were the legal precursor to health savings accounts. The primary difference between them is that health savings accounts are less restricted than MSAs were. The required deductible of MSA-qualified health plans was higher than what is required of health savings accounts. MSAs also had lower annual contribution limits and either an employer or an employee could contribute, but not both. Additionally, MSAs were limited to employees at small businesses and the self-employed; health savings accounts are available to anyone with a high-deductible health plan.[8]

Support

Health savings accounts (HSAs) are part of an approach to healthcare called consumer-directed care, which aims to place greater responsibility on consumers for their healthcare budgets. Supporters of HSAs say that when consumers have a greater financial stake in their healthcare decisions, they will make more cost-effective and health-conscious choices. They also say the design of high-deductible health plans makes it easier for consumers to budget for their healthcare costs, because the plans explicitly outline the individual's total out-of-pocket costs.[1][9]

| “ |

HSAs create a strong financial incentive for the employee to manage health care costs carefully, because the account balance is owned by the employee.[10] |

” |

| —RAND Corporation[1] | ||

Advocates of HSAs argue that greater use of the accounts will also incentivize consumers to shop around for healthcare, and in response, doctors and providers will lower their prices as they compete for patients. This in turn will ultimately lead to lower healthcare spending and costs overall.[11]

Supporters also assert that high-deductible health plans coupled with HSAs provide more affordable coverage. This coupled with HSA tax deductions will incentivize people who were previously uninsured to purchase health insurance. High-deductible plans typically have lower monthly premiums while still covering major medical expenses, and the contributions to an HSA are tax-free, providing additional motivation to sign up. Thus, HSAs could help lower the uninsured rate, supporters argue.[12]

HSA advocates also say the accounts provide financial security for the future. They argue government and private health and retirement programs are at risk for providing inadequate services in the future and may be scaled back. An HSA allows consumers to protect themselves against the possibility these programs could be curtailed or unavailable.[13]

Criticism

Critics of health savings accounts (HSAs) say they make healthcare unaffordable for low-income individuals and reduce their ability to access care. They say such consumers may be attracted to HSA-eligible high-deductible health plans because of their low monthly premiums, but will be unable to meet the financial requirements of the deductible and subsequent coinsurance that typically applies until the enrollee meets the out-of-pocket maximum, which can be as high as $6,500 for a single person.[1]

Those who oppose health savings accounts also point out that such out-of-pocket costs may also deter individuals from going to the doctor when a health problem arises, which could lead to more expensive complications down the road. They say that in plans with greater cost sharing, enrollees are less likely to visit a doctor, and that this effect is compounded among low-income individuals who are more sensitive to increases in costs. They also say consumers lack the information they need to make cost-effective healthcare decisions, as cost and quality information is typically not disclosed up-front by providers.[1][14]

Due to these factors, critics contend that health savings accounts do not lower the number of individuals who are uninsured. They say the accounts are "more attractive to healthy individuals and families who have had few major medical expenses." As healthier people leave their traditional health insurance plans for HSA-eligible high-deductible plans, premiums will rise for the less healthy, lower income individuals who remain in the traditional plans, potentially raising their monthly premiums and making coverage more unaffordable.[14][15]

Furthermore, critics argue that "low-income individuals and families do not face high enough tax liability to benefit in a significant way from tax deductions associated with HSAs." Because low-income individuals, who make up the majority of the uninsured, would see little benefit from an HSA, and because HSA-eligible plans could cause premiums in traditional plans to rise, HSAs could exacerbate the uninsured rate, rather than lowering it.[1][15]

History

- See Ballotpedia's page on the history of healthcare policy in the United States to learn more abut historical healthcare legislation.

Health savings accounts were developed as a successor to medical savings accounts (MSAs), which were introduced in congressional bills as early as 1992. Policymakers and healthcare analysts were concerned about the effects of "overinsurance," referring to individuals "overusing their medical benefits on trivial medical issues," on rising healthcare costs. Medical savings accounts were put forth as a way to encourage people to be more prudent with their healthcare expenditures. Around that time, a few companies in the private sector, such as Quaker Oats and Golden Rule Insurance, had started offering MSAs to their employees as well, and lobbied for the accounts to be made tax deductible.[16][17]

However, it was not until 1996 that MSAs were formally established in the tax code on an experimental basis under the Health Insurance Portability and Accountability Act (HIPAA). HIPAA made MSAs tax deductible, but limited the total number of accounts that could be created to 750,000 and restricted eligibility to self-employed individuals and small businesses.[16][18]

MSAs were slow to catch on—the design of the program and its tax effects were complex, and only 150,000 accounts were opened over the course of the pilot. In 2003, Congress revised the MSA concept, such as by expanding eligibility, to create health savings accounts (HSAs). Then-President George W. Bush signed into law the Medicare Prescription Drug Improvement and Modernization Act, making HSAs a permanent part of the tax code and eliminating MSAs.[5][16][19][20]

Growth

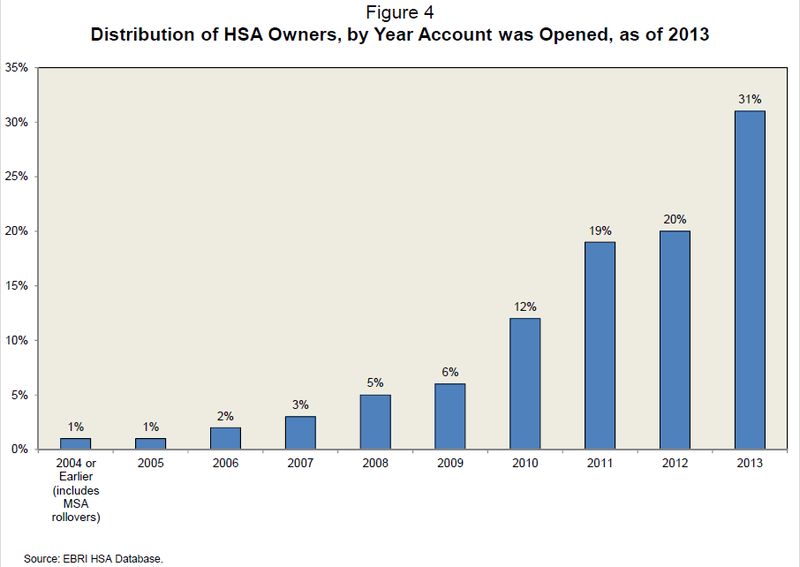

While the creation of HSAs remained relatively steady in the first few years of the program, between 2011 and 2013, the number of opened accounts increased sharply. According to the Employee Benefits Research Institute, of all HSAs opened between 2004 and 2013, 70 percent were opened after 2011. According to Denevir, an investment advisor and consultant firm for the health savings account industry, in 2013 there were 10.7 million HSAs in existence. By 2015, this figure had increased to 16.7 million.[21][22][23]

Due to the legal design of HSAs, the rise in the number of accounts is closely related to the increase in high-deductible health plans. According to America's Health Insurance Plans, just over 1 million individuals were in HSA-eligible high-deductible health plans in 2005; by 2015, this figure had increased to nearly 20 million. Additionally, the primary market in which HSA-eligible high-deductible health plans are sold has changed. In 2005, high-deductible health plans were largely sold in the individual market, to those without employer-sponsored insurance. Over the decade, this shifted and by 2015, 78 percent of plans with high-deductibles were sold to employees at large companies.[24]

Broken down by state, Texas had the highest number of enrollees in HSA-eligible high-deductible health plans, at about 1.5 million. Hawaii had the fewest with just 652 enrollees in such plans. Below is a table displaying HSA-eligible high-deductible health plan enrollment figures by state. Click [show] on the red bar below to view the table.[24]

| Enrollment in HSA-eligible high-deductible health plans by state, 2015 | |||

|---|---|---|---|

| State | Enrollment | State | Enrollment |

| Alabama | 65,100 | Montana | 81,971 |

| Alaska | 42,681 | Nebraska | 133,667 |

| Arizona | 227,400 | Nevada | 74,611 |

| Arkansas | 78,367 | New Hampshire | 81,156 |

| California | 719,457 | New Jersey | 396,956 |

| Colorado | 329,025 | New Mexico | 38,524 |

| Connecticut | 289,967 | New York | 615,556 |

| District of Columbia | 28,277 | North Carolina | 391,951 |

| Delaware | 33,615 | North Dakota | 50,995 |

| Florida | 719,122 | Ohio | 841,970 |

| Georgia | 330,423 | Oklahoma | 112,604 |

| Hawaii | 652 | Oregon | 129,443 |

| Idaho | 84,678 | Pennsylvania | 843,182 |

| Illinois | 1,280,655 | Rhode Island | 14,267 |

| Indiana | 491,338 | South Carolina | 103,070 |

| Iowa | 177,733 | South Dakota | 44,974 |

| Kansas | 134,177 | Tennessee | 461,129 |

| Kentucky | 179,869 | Texas | 1,533,416 |

| Louisiana | 206,909 | Utah | 157,630 |

| Maine | 106,668 | Vermont | 54,874 |

| Maryland | 387,585 | Virginia | 416,484 |

| Massachusetts | 244,465 | Washington | 541,223 |

| Michigan | 267,548 | West Virginia | 30,542 |

| Minnesota | 834,594 | Wisconsin | 227,060 |

| Mississippi | 41,317 | Wyoming | 20,044 |

| Missouri | 251,605 | United States | 14,950,526 |

| Source: America's Health Insurance Plans, "2015 Census of Health Savings Account - High Deductible Health Plans" | |||

Recent news

The link below is to the most recent stories in a Google news search for the terms health savings accounts. These results are automatically generated from Google. Ballotpedia does not curate or endorse these articles.

See also

External links

- How Stuff Works "Medical and Health Savings Accounts"

- Kaiser Health News, "FAQ On HSAs: The Basics Of Health Savings Accounts"

- National Conference of State Legislatures, "State Actions on Health Savings Accounts (HSAs) and Consumer-Directed Health Plans, 2004-2015"

- Galen Institute, "The Debate Over Health Savings Accounts"

- The Commonwealth Fund, "Health Savings Accounts: Why They Won't Cure What Ails U.S. Health Care"

- Denevir, "2015 Year-End Devenir HSA Research Report"

Footnotes

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 Kaiser Health News, "FAQ On HSAs: The Basics Of Health Savings Accounts," November 9, 2011

- ↑ 2.0 2.1 Society for Human Resource Management, "IRS Issues 2016 HSA Contribution Limits," May 6, 2015

- ↑ Optum Financial Services, "Qualified medical expenses," accessed April 7, 2016

- ↑ Optum Financial Services, "State Tax Information," accessed April 4, 2016

- ↑ 5.0 5.1 National Conference of State Legislatures, "State Actions on Health Savings Accounts (HSAs) and Consumer-Directed Health Plans, 2004-2015," accessed April 4, 2016

- ↑ TASC, "Health Reimbursement Arrangement," accessed APril 7, 2016

- ↑ 7.0 7.1 ZaneBenefits, "HRA vs HSA vs FSA vs PRA Comparison Chart," May 10, 2012

- ↑ HSAConnect, "MSA - Medical Savings Accounts," accessed April 7, 2016

- ↑ Galen Institute, "HSAs also work for lower-income individuals," April 30, 2012

- ↑ Note: This text is quoted verbatim from the original source. Any inconsistencies are attributable to the original source.

- ↑ Mayo Clinic, "Health savings accounts: Is an HSA right for you?" accessed April 7, 2016

- ↑ Galen Institute, "The Debate Over Health Savings Accounts," April 6, 2006

- ↑ The Heritage Foundation, "Building on the Successes of Health Savings Accounts," October 20, 2006

- ↑ 14.0 14.1 The Commonwealth Fund, "Health Savings Accounts: Why They Won't Cure What Ails U.S. Health Care," June 1, 2006

- ↑ 15.0 15.1 The Henry J. Kaiser Family Foundation, "Health Savings Accounts and High Deductible Health Plans: Are They An Option for Low-Income Families?" September 9, 2006

- ↑ 16.0 16.1 16.2 ZaneBenefits, "History of Health Savings Accounts - MSAs to HSAs," May 15, 2012

- ↑ How Stuff Works, "Medical and Health Savings Accounts," accessed April 5, 2016

- ↑ National Center for Policy Analysis, "A Brief History of Health Savings Accounts," December 9, 2013

- ↑ Dent, Brian. University of Baltimore Law Forum, "Medical Savings Accounts: Efficient and Equitable? Is It Too Soon to Tell?" accessed April 5, 2016

- ↑ HealthEquity, "How an HSA works," accessed April 5, 2016

- ↑ Employee Benefits Research Institute, "HSA Balances, Contributions, Distributions, and Other Vital Statistics—A First Look at Data from the EBRI HSA Database on the 10th Anniversary of the HSA," accessed April 6, 2016

- ↑ Denevir, "Year-End 2013 Devenir HSA Research Report," February 12, 2014

- ↑ Denevir, "2015 Year-End Devenir HSA Research Report," February 17, 2016

- ↑ 24.0 24.1 America's Health Insurance Plans, "2015 Census of Health Savings Account - High Deductible Health Plans," accessed April 6, 2016