State budget issues, 2010-2011

| Budget policy on Ballotpedia |

|---|

| |

| State budget and finance information |

State and local government budgets faced budget gaps as the recession led to lower than anticipated revenues from taxes. States faced a combined gap of at least $127 billion through fiscal year 2012.[1] Yolanda Kodrzycki, an economist at the Federal Reserve Bank of Boston, told the National Governors Association meeting in July 2010 that budgeting for next year would be "just as tough" for state budget makers.[2]

- See also: State budget issues, 2009-2010

See also: Find your state budget

State deficits data

Aggregate state debt exceeded $1.8 trillion according to State Budget Solutions.[3]

As displayed in the following tables, "research by State Budget Solutions reveals the total official financial liability for each state according to the latest comprehensive annual data available. The research included total debt outstanding, recent budget shortfalls, pension and retirement health care liabilities, and Unemployment Trust Fund loans. The research also looks at the overall financial landscape for each state by considering top income tax rates, past economic performance, and economic outlook."[3]

The Securities and Exchange Commission conducted hearings about municipal bond financial disclosures as part of concern about accuracy, timeliness, and fiscal transparency.[4] The Meredith Whitney Advisory Group recently published a report saying that municipal spending had doubled since 2000.[5] The following municipalities have even considered declaring bankruptcy: Los Angeles, Detroit, Harrisburg, PA, and Jefferson County, AL.[5]

Per capita

As of 2009, total state debt averaged almost $17,000 for each of the 107 million private sector workers in the United States.[3] .

Income tax rates were obtained from the Federation of Tax Administrators and state rankings are from the American Legislative Exchange Council’s 2010 report “Rich States, Poor States.” Outstanding debt and outstanding debt per capita were obtained from each state’s Comprehensive Annual Financial Report, which may have lagged data by one to three years.

| State | Max Personal Income Tax Rate (%)1 | Max Corporate Income Tax Rate (%)2 | Economic Outlook Ranking3 | Economic Performance Ranking4 | Debt Per Capita5 | Debt Per Capita Ranking | Outstanding Debt (In Thousands)6 |

| Alabama | 5 | 4.23 | 17 | 26 | $357 | 5 | $1,663,232 |

| Alaska | N/A | 9.4 | 22 | 9 | $2,936 | 43 | $1,995,349 |

| Arizona | 4.54 | 6.97 | 3 | 8 | $1,249 | 22 | $8,115,545 |

| Arkansas | 7 | 6.5 | 13 | 17 | $902 | 20 | $2,598,939 |

| California | 10.55 | 8.84 | 46 | 38 | $2,808 | 41 | $107,092,107 |

| Colorado | 4.63 | 4.63 | 2 | 15 | $1,247 | 21 | $5,972,627 |

| Connecticut | 6.5 | 7.5 | 36 | 45 | $5,181 | 50 | $18,137,626 |

| Delaware | 6.95 | 9.98 | 37 | 30 | $2,984 | 44 | $2,614,869 |

| Florida | N/A | 5.5 | 5 | 6 | $1,495 | 30 | $28,128,000 |

| Georgia | 6 | 6 | 9 | 27 | $1,354 | 25 | $13,110,432 |

| Hawaii | 11 | 6.4 | 39 | 16 | $4,375 | 49 | $5,651,975 |

| Idaho | 7.8 | 7.6 | 7 | 10 | $661 | 10 | $1,015,845 |

| Illinois | 3 | 7.3 | 47 | 48 | $1,837 | 32 | $23,610,974 |

| Indiana | 3.4 | 8.5 | 20 | 47 | $201 | 3 | $1,286,107 |

| Iowa | 8.98 | 9.9 | 28 | 41 | $780 | 16 | $2,342,414 |

| Kansas | 6.45 | 7.05 | 25 | 40 | $1,934 | 34 | $5,450,878 |

| Kentucky | 6 | 8.2 | 40 | 31 | $1,292 | 23 | $5,515,889 |

| Louisiana | 6 | 5.2 | 16 | 34 | $2,541 | 38 | $11,111,263 |

| Maine | 8.5 | 8.93 | 44 | 19 | $698 | 12 | $942,407 |

| Maryland | 9.3 | 8.25 | 29 | 20 | $2,482 | 37 | $13,983,112 |

| Massachusetts | 5.3 | 9.5 | 32 | 43 | $3,340 | 47 | $21,536,894 |

| Michigan | 4.35 | 9.01 | 26 | 50 | $855 | 18 | $8,549,000 |

| Minnesota | 7.85 | 9.8 | 38 | 36 | $863 | 19 | $5,443,002 |

| Mississippi | 5 | 5 | 18 | 42 | $1,483 | 29 | $4,358,761 |

| Missouri | 6 | 5.81 | 15 | 35 | $668 | 11 | $3,950,022 |

| Montana | 6.9 | 6.75 | 33 | 2 | $401 | 6 | $387,480 |

| Nebraska | 6.84 | 7.81 | 34 | 29 | $24 | 1 | $42,692 |

| Nevada | N/A | N/A | 11 | 13 | $1,501 | 31 | $3,903,469 |

| New Hampshire | N/A | 8.5 | 30 | 28 | $798 | 17 | $1,059,968 |

| New Jersey | 10.75 | 9 | 48 | 39 | $4,073 | 48 | $51,216,527 |

| New Mexico | 4.9 | 7.6 | 35 | 5 | $3,010 | 46 | $6,050,683 |

| New York | 10.5 | 15.95 | 50 | 37 | $2,693 | 40 | $52,493,000 |

| North Carolina | 7.75 | 6.9 | 21 | 23 | $768 | 15 | $7,207,211 |

| North Dakota | 4.86 | 4.23 | 12 | 11 | $2,682 | 39 | $1,720,591 |

| Ohio | 8.24 | 5.14 | 42 | 49 | $1,438 | 28 | $16,519,326 |

| Oklahoma | 5.5 | 6 | 14 | 7 | $575 | 7 | $2,122,197 |

| Oregon | 11 | 11.55 | 41 | 25 | $2,830 | 42 | $10,816,228 |

| Pennsylvania | 3.07 | 13.97 | 43 | 46 | $743 | 14 | $9,254,592 |

| Rhode Island | 9.9 | 9 | 45 | 33 | $3,000 | 45 | $2,730,259 |

| South Carolina | 7 | 5 | 31 | 24 | $1,847 | 33 | $8,320,109 |

| South Dakota | N/A | N/A | 4 | 12 | $617 | 8 | $496,029 |

| Tennessee | N/A | 6.5 | 10 | 32 | $229 | 4 | $1,429,427 |

| Texas | N/A | 5.56 | 19 | 3 | $1,368 | 26 | $33,945,000 |

| Utah | 5 | 5 | 1 | 18 | $1,415 | 27 | $3,970,000 |

| Vermont | 9.4 | 8.5 | 49 | 22 | $737 | 13 | $457,890 |

| Virginia | 5.75 | 6 | 8 | 4 | $638 | 9 | $5,003,955 |

| Washington | N/A | 5.22 | 24 | 14 | $2,479 | 36 | $16,533,000 |

| West Virginia | 6.5 | 8.5 | 27 | 21 | $1,319 | 24 | $2,393,715 |

| Wisconsin | 7.75 | 7.9 | 23 | 44 | $2,024 | 35 | $11,393,755 |

| Wyoming | N/A | N/A | 6 | 1 | $88 | 2 | $46,970 |

| Total | N/A | N/A | N/A | N/A | N/A | N/A | $553,691,342 |

Pension & unemployment data

Pension and OPEB liabilities were obtained from PEW’s “Trillion Dollar Gap” report on pension funds as of 2008. Official Unfunded Pension Liabilities based on assumptions of annual investment returns of 7 percent to 8.5 percent are from the CAFRs of each state’s major pension funds.

- Figures for unemployment Trust Fund Loans are from the National Council of State Legislatures, and budget shortfalls are from the Wall Street Journal and the Center on Budget and Policy Priorities. Total State debt is the sum of outstanding official debt, pension and OPEB liabilities, Unemployment loans, and budget gap. Figures for debt per private worker were computed using data from the Bureau of Labor Statistics.

| State | Pension UAAL7 | Pension UAAL Ranking | OPEB UAAL8 | OPEB UAAL Ranking | Pension UAAL + OPEB UAAL | Pension UAAL + OPEB UAAL Ranking | Unemployment Trust Fund Loans as of 6/29/20109 | Unemployment Trust Fund Loans Ranking |

| Alabama | $9,228,918,000 | 31 | $15,549,411,000 | 39 | $24,778,329,031 | 39 | $283,001,164 | 9 |

| Alaska | $3,522,661,000 | 19 | $4,032,052,000 | 27 | $7,554,713,019 | 19 | $0 | N/A |

| Arizona | $7,871,120,000 | 27 | $808,818,000 | 14 | $8,679,938,027 | 23 | $7,016,253 | 1 |

| Arkansas | $2,752,546,000 | 17 | $1,822,241,000 | 20 | $4,574,787,017 | 13 | $330,853,383 | 10 |

| California | $59,492,498,000 | 50 | $62,463,000,000 | 48 | $121,955,498,050 | 50 | $7,207,436,466 | 31 |

| Colorado | $16,813,048,000 | 45 | $1,127,179,000 | 16 | $17,940,227,045 | 33 | $169,126,150 | 6 |

| Connecticut | $15,858,500,000 | 44 | $26,018,800,000 | 41 | $41,877,300,044 | 43 | $498,452,705 | 15 |

| Delaware | $129,359,000 | 4 | $5,409,600,000 | 29 | $5,538,959,004 | 15 | $12,901,505 | 2 |

| Florida | -$1,798,789,000 | 2 | $3,081,834,000 | 26 | $1,283,045,002 | 5 | $1,612,500,000 | 22 |

| Georgia | $6,384,903,000 | 25 | $18,322,123,000 | 40 | $24,707,026,025 | 38 | $416,000,000 | 13 |

| Hawaii | $5,168,108,000 | 24 | $10,791,300,000 | 34 | $15,959,408,024 | 32 | $0 | N/A |

| Idaho | $772,200,000 | 11 | $489,421,000 | 8 | $1,261,621,011 | 4 | $202,401,700 | 7 |

| Illinois | $54,383,939,000 | 49 | $39,946,678,000 | 46 | $94,330,617,049 | 48 | $2,239,582,343 | 25 |

| Indiana | $9,825,830,000 | 32 | $442,268,000 | 7 | $10,268,098,032 | 25 | $1,709,743,840 | 23 |

| Iowa | $2,694,794,000 | 16 | $404,300,000 | 6 | $3,099,094,016 | 10 | $0 | N/A |

| Kansas | $8,279,168,000 | 29 | $316,640,000 | 4 | $8,595,808,029 | 22 | $88,159,421 | 4 |

| Kentucky | $12,328,429,000 | 40 | $11,660,245,000 | 35 | $23,988,674,040 | 36 | $795,100,000 | 18 |

| Louisiana | $11,658,734,000 | 38 | $12,542,953,000 | 36 | $24,201,687,038 | 37 | $0 | N/A |

| Maine | $2,782,173,000 | 18 | $4,347,702,000 | 28 | $7,129,875,018 | 17 | $0 | N/A |

| Maryland | $10,926,099,000 | 36 | $14,723,420,000 | 37 | $25,649,519,036 | 40 | $133,840,765 | 5 |

| Massachusetts | $21,759,452,000 | 47 | $15,031,600,000 | 38 | $36,791,052,047 | 42 | $387,313,005 | 12 |

| Michigan | $11,514,600,000 | 37 | $39,878,500,000 | 45 | $51,393,100,037 | 47 | $3,876,782,333 | 30 |

| Minnesota | $10,771,507,000 | 35 | $1,011,400,000 | 15 | $11,782,907,035 | 28 | $580,825,783 | 16 |

| Mississippi | $7,971,277,000 | 28 | $570,248,000 | 9 | $8,541,525,028 | 21 | $0 | N/A |

| Missouri | $9,025,293,000 | 30 | $2,851,826,000 | 23 | $11,877,119,030 | 29 | $722,116,933 | 17 |

| Montana | $1,549,503,000 | 13 | $631,918,000 | 11 | $2,181,421,013 | 9 | $0 | N/A |

| Nebraska | $754,748,000 | 10 | N/A | 50 | $754,748,010 | 3 | $0 | N/A |

| Nevada | $7,281,752,000 | 26 | $2,211,439,000 | 21 | $9,493,191,026 | 24 | $438,155,817 | 14 |

| New Hampshire | $2,522,175,000 | 15 | $3,054,188,000 | 25 | $5,576,363,015 | 16 | $0 | N/A |

| New Jersey | $34,434,055,000 | 48 | $68,900,000,000 | 49 | $103,334,055,048 | 49 | $1,749,563,533 | 24 |

| New Mexico | $4,519,887,000 | 22 | $2,946,290,000 | 24 | $7,466,177,022 | 18 | $0 | N/A |

| New York | -$10,428,000,000 | 1 | $56,286,000,000 | 47 | $45,858,000,001 | 45 | $3,176,873,428 | 29 |

| North Carolina | $504,760,000 | 8 | $28,741,560,000 | 44 | $29,246,320,008 | 41 | $2,288,985,365 | 26 |

| North Dakota | $546,500,000 | 9 | $81,276,000 | 2 | $627,776,009 | 2 | $0 | N/A |

| Ohio | $19,502,065,000 | 46 | $27,025,738,000 | 42 | $46,527,803,046 | 46 | $2,314,186,799 | 27 |

| Oklahoma | $13,172,407,000 | 41 | $359,800,000 | 5 | $13,532,207,041 | 31 | $0 | N/A |

| Oregon | $10,739,000,000 | 34 | $609,793,000 | 10 | $11,348,793,034 | 27 | $0 | N/A |

| Pennsylvania | $13,724,480,000 | 42 | $9,956,800,000 | 33 | $23,681,280,042 | 35 | $3,008,614,961 | 28 |

| Rhode Island | $4,353,892,000 | 21 | $788,189,000 | 13 | $5,142,081,021 | 14 | $225,472,937 | 8 |

| South Carolina | $12,052,684,000 | 39 | $8,638,076,000 | 32 | $20,690,760,039 | 34 | $886,662,352 | 19 |

| South Dakota | $182,870,000 | 5 | $76,406,000 | 1 | $259,276,005 | 1 | $0 | N/A |

| Tennessee | $1,602,802,000 | 14 | $1,746,879,000 | 19 | $3,349,681,014 | 11 | $0 | N/A |

| Texas | $13,781,228,000 | 43 | $28,611,584,000 | 43 | $42,392,812,043 | 44 | $1,290,700,472 | 20 |

| Utah | $3,611,399,000 | 20 | $672,843,000 | 12 | $4,284,242,020 | 12 | $0 | N/A |

| Vermont | $461,551,000 | 7 | $1,614,581,000 | 17 | $2,076,132,007 | 8 | $32,657,065 | 3 |

| Virginia | $10,723,000,000 | 33 | $2,621,000,000 | 22 | $13,344,000,033 | 30 | $346,876,000 | 11 |

| Washington | -$179,100,000 | 3 | $7,901,610,000 | 31 | $7,722,510,003 | 20 | $0 | N/A |

| West Virginia | $4,968,709,000 | 23 | $6,108,398,000 | 30 | $11,077,107,023 | 26 | $0 | N/A |

| Wisconsin | $252,600,000 | 6 | $1,700,396,000 | 18 | $1,952,996,006 | 7 | $1,424,768,541 | 21 |

| Wyoming | $1,444,353,000 | 12 | $174,161,000 | 3 | $1,618,514,012 | 6 | $0 | N/A |

| Total | $452,195,687,000 | N/A | $555,102,484,000 | N/A | $1,007,298,172,275 | N/A | $38,456,671,022 | N/A |

Total debt

| State | FY2010 Total Budget Gap (In Millions)10 | FY 2010 Total Budget Gap Ranking | Total Debt11 | Total Debt Ranking |

| Alabama | $1,600 | 26 | $28,324,562,195 | 32 |

| Alaska | $1,300 | 22 | $10,850,062,019 | 16 |

| Arizona | $5,100 | 42 | $21,902,499,280 | 26 |

| Arkansas | $395 | 8 | $7,899,579,400 | 11 |

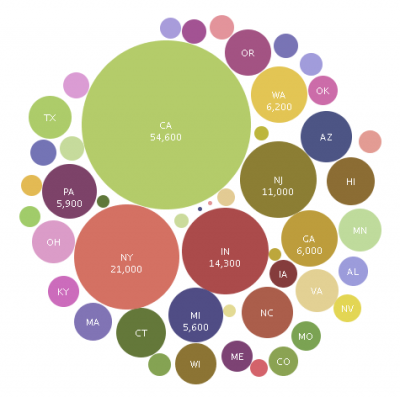

| California | $54,600 | 50 | $290,855,041,516 | 50 |

| Colorado | $1,600 | 27 | $25,681,980,195 | 28 |

| Connecticut | $4,700 | 40 | $65,213,378,749 | 43 |

| Delaware | $557 | 10 | $8,723,729,509 | 12 |

| Florida | $817 | 12 | $31,840,545,002 | 35 |

| Georgia | $6,000 | 45 | $44,233,458,025 | 41 |

| Hawaii | $4,500 | 39 | $26,111,383,024 | 29 |

| Idaho | $1,200 | 19 | $3,679,867,711 | 7 |

| Illinois | $562 | 11 | $120,743,173,392 | 47 |

| Indiana | $14,300 | 48 | $27,563,948,872 | 31 |

| Iowa | $1,400 | 24 | $6,841,508,016 | 9 |

| Kansas | $1,300 | 23 | $15,434,845,450 | 21 |

| Kentucky | $1,800 | 30 | $32,099,663,040 | 36 |

| Louisiana | $1,200 | 20 | $36,512,950,038 | 37 |

| Maine | $1,900 | 31 | $9,972,282,018 | 15 |

| Maryland | $849 | 13 | $40,615,471,801 | 38 |

| Massachusetts | $2,800 | 32 | $61,515,259,052 | 42 |

| Michigan | $5,600 | 43 | $69,418,882,370 | 45 |

| Minnesota | $3,400 | 34 | $21,206,734,818 | 25 |

| Mississippi | $917 | 14 | $13,817,286,028 | 18 |

| Missouri | $1,700 | 29 | $18,249,257,963 | 24 |

| Montana | $0 | 1 | $2,568,901,013 | 5 |

| Nebraska | $305 | 6 | $1,102,440,010 | 2 |

| Nevada | $1,500 | 25 | $15,334,815,843 | 20 |

| New Hampshire | $430 | 9 | $7,066,331,015 | 10 |

| New Jersey | $11,000 | 47 | $167,300,145,581 | 49 |

| New Mexico | $995 | 16 | $14,511,860,022 | 19 |

| New York | $21,000 | 49 | $122,527,873,429 | 48 |

| North Carolina | $5,000 | 41 | $43,742,516,373 | 40 |

| North Dakota | $0 | 2 | $2,348,367,009 | 4 |

| Ohio | $3,600 | 36 | $68,961,315,845 | 44 |

| Oklahoma | $1,600 | 28 | $17,254,404,041 | 22 |

| Oregon | $4,200 | 38 | $26,365,021,034 | 30 |

| Pennsylvania | $5,900 | 44 | $41,844,487,003 | 39 |

| Rhode Island | $990 | 15 | $9,087,812,958 | 13 |

| South Carolina | $1,200 | 21 | $31,097,531,391 | 34 |

| South Dakota | $48 | 4 | $803,305,005 | 1 |

| Tennessee | $1,100 | 18 | $5,879,108,014 | 8 |

| Texas | $3,500 | 35 | $81,128,512,515 | 46 |

| Utah | $1,000 | 17 | $9,254,242,020 | 14 |

| Vermont | $306 | 7 | $2,872,679,072 | 6 |

| Virginia | $3,600 | 37 | $22,294,831,033 | 27 |

| Washington | $6,200 | 46 | $30,455,510,003 | 33 |

| West Virginia | $304 | 5 | $13,774,822,023 | 17 |

| Wisconsin | $3,200 | 33 | $17,971,519,547 | 23 |

| Wyoming | $34 | 3 | $1,699,484,012 | 3 |

| Total | $197,109 | N/A | $1,796,555,185,297 | N/A |

Taxes

In 2010, taxpayers paid $25 billion more in taxes to state and municipal governments then they did in 2007.[6] The total tax increase was 2 percent, while the average household income dropped 3 percent.[6]

Declines in Spending

The Fiscal Survey of States issued in June 2010 by the National Governors Association and National Association of State Budget Officers noted a decline in state general fund spending, with declines in state spending anticipated in FY2011 after declines in spending in both FY2009 and FY2010.[1] FY2010 general fund expenditures were estimated to be $612.9 billion compared to $657.9 billion in FY2009, a 6.8 percent decline.[1] In FY2008, spending was $687.3 billion.[1]

Budget Cuts Made After FY2010 Budget Passed

| State | FY 2010 Size of Cuts ($ in millions) | Programs Exempted from Cuts |

|---|---|---|

| Alabama | 426.7 | Debt service and federal court decrees |

| Arkansas | 205.9 | |

| Arizona | 120.0 | |

| California | 1,000.0 | |

| Colorado | 500.1 | |

| Connecticut | 158.5 | Program funding which is compulsory for ARRA funding |

| Delaware | ||

| Florida | 3,000.0 | |

| Georgia | 1,253.4 | |

| Hawaii | 342.6 | Employees health insurance |

| Idaho | 87.8 | |

| Illinois | 382.9 | Debt service, statutory exemptions, and federal mandates |

| Iowa | 564.4 | |

| Indiana | 726.5 | Student financial aid, transportation, and public assistance |

| Kansas | 262.0 | Debt Service |

| Kentucky | 1,110.5 | Corrections, Prosecutors, Debt service, Retirement contributions, Parks, Revenue/tax collection efforts, Mental

Health/mental retardation programs, Corrections, Student financial aid |

| Louisiana | 247.9 | Programs which are Constitutionally required were not cut |

| Maryland | 565.0 | Mandated K-12 expenditures and debt service |

| Massachusetts | 2,394.0 | Debt Service |

| Minnesota | 89.0 | Military and veterans affairs, core public safety |

| Mississippi | 499.1 | Debt service and statutory exemptions |

| Missouri | 380.4 | K-12 foundation formula and higher education Institutions |

| Nebraska | 55.0 | |

| Nevada | 107.5 | |

| New Hampshire | 25.0 | Appropriation reductions to the University System of NH, the NH Community College System and the Department of Education – Adequacy Funding |

| New Jersey | 2,028.0 | Debt Service |

| New Mexico | 368.9 | |

| New York | 1,083.0 | |

| North Carolina | 500 | Debt Service, Medicaid, CHIPS |

| Oklahoma | 709.1 | |

| Pennsylvania | 135.0 | After budget enactment, the Governor does not have the authority to reduce appropriations to the Attorney General, Auditor General and Treasurer (which are independently elected); the legislature and judiciary |

| Rhode Island | 155.4 | |

| South Carolina | 566.5 | Higher Education Scholarships and Tuition Grants; Southern Regional Education Board Professional Scholarship Programs and Fees; Debt Service; Aid to Fire Districts; First Responder Interoperability; National Guard Pension Fund; Compensation of County Registration Board Members & County Election Commissioners; Commission on Indigent Defense Legal Services Corporation; Clemson University Public Service Authorities; Boll Weevil Eradication Program; Department of Revenue; Homestead Exemption Fund |

| South Dakota | 5.5 | |

| Texas | 527.4 | |

| Utah | 39.0 | Public education |

| Vermont | 21.0 | |

| Virginia | 1,044.0 | |

| Washington | 130.0 | K-12 basic education, debt service, retirement contributions |

| West Virginia | 120.0 | Debt service & retirement |

| Total | $ 21,973.0 | ---- |

Rainy Day Funds

Because prior economic downturns resulted in lower than anticipated revenue collections, states established “rainy day” accounts during times of economic expansion. These accounts were intended to help stabilize budgets from future declines in tax collections and mitigate the disruption to state services during an economic downturn. [1]

Total Year-End Balances as a Percentage of Expenditures, Fiscal 2009 to Fiscal 2011 (number of states)[1]

| Percentage | Fiscal 2009 (Actual) | Fiscal 2010 (Estimated) | Fiscal 2011(Recommended) |

|---|---|---|---|

| Less than 1.0% | 11 | 14 | 15 |

| 1.0% to 4.9% | 16 | 16 | 17 |

| 5.0% to 9.9% | 14 | 12 | 10 |

| 10% or more | 9 | 8 | 8 |

See also

Footnotes

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 "The Fiscal Survey of States" National Governors Association and National Association of State Budget Officers June 2010 Cite error: Invalid

<ref>tag; name "June 2010" defined multiple times with different content - ↑ Business Week "State Budget Woes ‘Just as Tough’ in 2011, Fed Economist Says" July 10, 2010

- ↑ 3.0 3.1 3.2 Watchdog, States hide trillions in debt, July 26, 2010

- ↑ Watchdog, Muni meltdown must be part of fiscal solution, Sept. 23, 2010

- ↑ 5.0 5.1 National Review Online, The Next Crisis Will Come from the States, Sept. 29, 2010

- ↑ 6.0 6.1 Watchdog, Taxed $25 billion more, but it’s not enough, Sept. 30, 2010