Fact check: Did Sen. Richard Burr vote to cut Social Security?

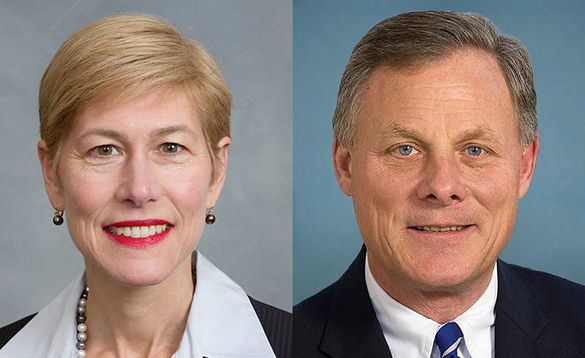

U.S. Senate Candidate Deborah Ross and U.S. Senator Richard Burr

September 13, 2016

By Humberto Sanchez

North Carolina Republican Sen. Richard Burr is running for a third term, which he has said will be his last.[1] He is facing a challenge from Democrat Deborah Ross.

At an August 4 event, Ross sought to make the case that Burr posed a threat to Social Security. "He has voted to cut Social Security," Ross was quoted saying in The Fayetteville Observer.[2]

Is Ross’ claim accurate? No. The votes cited by the Ross campaign were procedural measures that had no direct effect on Social Security funding or benefits.

Background

Burr was first elected to the U.S. House of Representatives in 1994. He served in the House for 10 years before being elected to the U.S. Senate in 2004. He is currently finishing his second term in the Senate and serves as chairman of the Senate Select Committee on Intelligence. He also sits on the Health, Education, Labor, and Pensions Committee as well as the Finance Committee.[3]

Ross served as the head of the North Carolina chapter of the American Civil Liberties Union between 1994 and 2002. Ross was then elected to the North Carolina State House, where she served between 2003 and 2013. She stepped down to become general counsel for GoTriangle—a company that provides regional bus service to Wake, Durham, and Orange counties—in 2013.[4]

Ross campaign’s case

As part of the rationale for its claim, the Ross campaign cited Burr’s July 2011 vote against tabling the Cut, Cap and Balance bill, a measure that would have cut spending by $111 million between fiscal year 2011 and fiscal year 2012 and capped spending at 22.5 percent of the gross domestic product (GDP) in fiscal 2012.[5] That cap would have ramped down to 19.9 percent of GDP by fiscal 2021. The measure would have also required the passage of a balanced budget amendment to the Constitution before the debt limit could be raised.[6][7]

The bill passed the Republican-controlled House on July 19, 2011. The measure then went to the Senate, which at the time was controlled by Democrats. The Senate Democrats used a procedural motion (a motion to table the motion to proceed) to prevent a vote on the bill.[6] Burr opposed that procedural motion to delay a vote on the bill.[8]

Moreover, the Cut, Cap and Balance bill included language protecting Social Security, according to Burr’s campaign spokeswoman Rebecca Watkins, who noted that section 101 exempted Social Security and other entitlements from spending limits. In addition, section 102 of the bill exempted Social Security from sequestration.[6][9]

According to the Ross campaign, enactment of the bill would have resulted in cuts to Social Security in the out years due to the spending caps and other requirements.[5] However, Burr’s vote was procedural only and not a position on the actual measure.

Ross’ campaign also pointed to Burr’s vote in March 2015 against a measure to make it more difficult to pass legislation that would cut benefits, raise the retirement age, or privatize Social Security. The bill would have established a 60-vote threshold in the Senate for passage of such legislation.[10] Ross’ campaign argues that Burr’s vote was tantamount to a cut in Social Security. However, this too was a procedural vote, not a vote on the substance of the bill.

According to Burr’s spokeswoman, the senator voted against the measure because Social Security was already protected with a 60-vote threshold under the Byrd Rule. (The rule is applied in the budget process to prevent “extraneous” provisions from being added to a reconciliation bill or resolution.)[11][9]

During the budget debate in March 2013, Burr voted for an amendment offered by Sen. Ron Johnson (R-Wis.) to create a 60-vote “point of order” against any budget resolution in which revenues and outlays do not assume that Social Security and Medicare will be solvent for the next 75 years.[12] But this was also a procedural measure that would not have resulted in a cut to the program.

Ross’ campaign argued that a vote in favor of the amendment could result in cuts to the program.[5] Burr’s campaign said that they view the measure as pro-Social Security because it is designed to spark action to make the program solvent over 75 years. Under current estimates, funds for the program will be depleted in 2034.[13][9]

Ross’ campaign also noted that when the House debated and approved a balanced budget amendment to the Constitution in 1995, Burr voted three times against exempting Social Security from balanced budget amendment calculations: on January 26, 1995 (Wise substitute); another time on January 26, 1995 (Conyers substitute); and a third time on January 26, 1995 (Bonior substitute).[14][5][9] But requiring that the costs of Social Security be taken into account when balancing the budget is different from instituting cuts in Social Security. And it doesn’t necessarily follow that requiring the costs of Social Security be taken into account when balancing the budget would lead to cuts in the program. That would have to be a separate action taken by lawmakers.

Ross’ campaign also cited Burr’s votes in March 2006 and March 2007 in favor of legislation that would have created a reserve fund for Social Security, which would have prevented any surplus from being transferred to the general fund (and spent on other government programs).[15][16] According to Ross’ campaign, the bill could lead to the privatization of Social Security, which they believe could lead to cuts in benefits.[5] However, creation of a reserve fund to prevent Social Security funds from being tapped for other uses does not constitute a cut in Social Security. Any changes to the program in the future would require additional action by Congress.

In March 2005, Burr voted against a non-binding (sense of the Senate) resolution that called on Congress to reject any Social Security plan that required “deep benefit cuts or a massive increase in debt.”[17][5]

Burr’s spokeswoman said he voted against it because it did not rule out tax increases to keep Social Security solvent.[9] In any event, rejection of the resolution would not—and did not—result in cuts to Social Security.

Burr campaign disagrees

Burr’s campaign asserts that he has “a strong record of voting to protect Social Security and the benefits of retirees,” his spokeswoman, Rebecca Watkins, told Ballotpedia.[9]

Watkins cited his April 2015 vote for a motion by Sen. Bernie Sanders (I-Vt.) during consideration of the budget to block any effort to cut Social Security benefits, increase the retirement age, or privatize the program. But the measure was a non-binding motion to instruct budget conferees. There were no repercussions should the conferees ignore the motion.[18][19][9]

Watkins also cited an amendment to legislation extending a raft of tax breaks that Burr offered in March 2010 that would have given a $250 payment to seniors, veterans, and persons with disabilities to compensate for the lack of a cost-of-living adjustment that year.[20][21] The amendment failed to receive the 60 votes needed to clear a procedural hurdle, so the amendment never received a vote on the substance.[22][9]

And Burr also voted in 2009 to clear a procedural hurdle on a measure that would have temporarily reduced to 50 percent the amount of Social Security benefits subject to income taxes, down from 85 percent. But this was only a vote on process and not on the substance of the measure, which would have increased the amount of money in some senior citizens’ pockets by reducing their taxes.[23][9]

Conclusion

North Carolina Sen. Richard Burr is facing Deborah Ross in the November 8 general election.

Ross claims that Burr has voted to cut Social Security.[2]

Is that accurate? No. Burr has not voted to cut Social Security. The votes cited by the Ross campaign were procedural votes that had no direct effect on Social Security funding or benefits.

See also

Launched in October 2015 and active through October 2018, Fact Check by Ballotpedia examined claims made by elected officials, political appointees, and political candidates at the federal, state, and local levels. We evaluated claims made by politicians of all backgrounds and affiliations, subjecting them to the same objective and neutral examination process. As of 2026, Ballotpedia staff periodically review these articles to revaluate and reaffirm our conclusions. Please email us with questions, comments, or concerns about these articles. To learn more about fact-checking, click here.

Sources and Notes

- ↑ The Charlotte Observer, "US Sen. Richard Burr says 2016 will be his last run for elected office," July 20, 2016

- ↑ 2.0 2.1 Fayetteville Observer, "Senate candidate Ross attacks incumbent Burr on Medicare, Social Security benefits," August 4, 2016

- ↑ Richard Burr, U.S. Senator for North Carolina, "Senator Burr," accessed August 29, 2016

- ↑ Deborah Ross, U.S. Senate, "Meet Deborah," accessed August 29, 2016

- ↑ 5.0 5.1 5.2 5.3 5.4 5.5 Fact Check by Ballotpedia staff, "Email communications with Ross spokesman Austin Vevurka," August 23, 2016

- ↑ 6.0 6.1 6.2 Congress.gov, "H.R.2560 - Cut, Cap, and Balance Act of 2011," accessed August 29, 2016

- ↑ The Christian Science Monitor, "Cut, cap, and balance: What does it mean? The highlights," July 19, 2011

- ↑ United States Senate, "On the Motion to Table (Motion to Table the Motion to Proceed to Consider H.R. 2560," July 22, 2011

- ↑ 9.0 9.1 9.2 9.3 9.4 9.5 9.6 9.7 9.8 Fact Check by Ballotpedia staff, "Email communications with Burr spokeswoman Rebecca Watkins," August 26, 2016

- ↑ Congress.gov, "S.Amdt.471 to S.Con.Res.11," accessed August 29, 2016

- ↑ U.S. House of Representatives Committee on Rules, "Summary of the Byrd Rule," accessed August 29, 2016

- ↑ Congress.gov, "S.Amdt.213 to S.Con.Res.8," accessed August 29, 2016

- ↑ Social Security Administration, "A Summary of the 2016 Annual Reports," accessed August 29, 2016

- ↑ The Washington Post, "House Passes Balanced Budget Amendment," January 27, 1995

- ↑ Congress.gov, "S.Amdt.3087 to S.Con.Res.83," accessed August 29, 2016

- ↑ Congress.gov, "S.Amdt.489 to S.Con.Res.21," accessed August 29, 2016

- ↑ Congress.gov, "S.Amdt.145 to S.Con.Res.18," accessed August 29, 2016

- ↑ Congress.gov, "Congressional Record, April 15, 2015, 114th Congress, 1st Session Issue: Vol. 161, No. 54 — Daily Edition," accessed August 29, 2016 (Pages S2202-S2212)

- ↑ Wikileaks, "CRS Report to Congress, Congressional Budget Resolutions: Motions to Instruct Conferees, May 16, 2008," accessed August 29, 2016

- ↑ CNSNews, "Democrats Make a $250 Pitch to Senior Voters," October 19, 2010

- ↑ Congress.gov, "S.Amdt.3390 to S.Amdt.3336," accessed August 29, 2016

- ↑ Congressional Research Service, Points of Order in the Congressional Budget Process," October 20, 2015

- ↑ Congress.gov, "S.Amdt.242 to S.Amdt.98," accessed August 29, 2016

Contact

More from Fact Check by Ballotpedia

| Fact check/Have more than 92 percent of Rep. Rob Bishop's campaign contributions come from out-of-state PACs and energy companies? August 27, 2016 |

| Fact check/Has Republican Sen. John Boozman enacted only five bills in his congressional career? August 26, 2016 |

| Fact check/Are ratings for MSNBC’s Morning Joe program high or low? August 23, 2016 |

Follow us on Facebook and Twitter