Louisiana Budget and Transportation Stabilization Trust, Amendment 1 (2015)

| Amendment 1 | |

|---|---|

| |

| Type | Amendment |

| Origin | Louisiana Legislature |

| Topic | State and local government budgets, spending and finance |

| Status | Defeated |

The Louisiana Budget and Transportation Stabilization Trust, Amendment 1 was on the October 24, 2015 ballot in Louisiana as a legislatively referred constitutional amendment, where it was defeated. The measure would have taken a portion of the state's revenue from minerals and directed it into a new, constitutionally protected fund for state transportation projects.[1]

Introduction

The purpose of the amendment was to provide another funding source for transportation projects. The existing Budget Stabilization Fund, also known as the Rainy Day Fund, would have been renamed to the Budget and Transportation Stabilization Trust (BTST) and that fund would have been broken into two subfunds: one to act as the original Budget Stabilization Fund and another to become a new transportation fund.[2]

After the state collected $750 million from mineral taxes and royalties in a fiscal year, revenue would then have gone into the first subfund, the Budget Stabilization Subfund, until it reached $500 million. Once the first subfund was full, the revenue would have been deposited into the second subfund, the Transportation Stabilization Subfund, at the beginning of the next fiscal year until it reached $500 million. After the second subfund was full, any excess revenue would have been deposited into the state's general fund.[2]

The Budget Stabilization Subfund would have been used if the state had a spending deficit and the Transportation Stabilization Subfund would have been used for roads and other infrastructure projects, such as state bridges and highways.[2]

The Louisiana Legislature would have been allowed to increase the amount of revenue the state had to collect from mineral before money went into the subfunds, which would start at $750 million, every five years with a two-thirds vote. The process would have begun in the 2015-16 fiscal year. The amendment would not have raised taxes or affected the state's existing primary source of infrastructure funding, the Transportation Trust Fund.[1]

The measure was introduced into the Louisiana Legislature by Sen. Robert Adley (R-36) as Senate Bill 202.[3]

Election results

| Louisiana Amendment 1 | ||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| 515,366 | 52.5% | |||

| Yes | 466,140 | 47.5% | ||

Election results via: Louisiana Secretary of State

Text of measure

Ballot title

The ballot text was as follows:[1]

| “ | Do you support an amendment to rename the Budget Stabilization Fund to the Budget and Transportation Stabilization Trust; to authorize the mineral revenue base to be increased every five years; to create the Budget Stabilization Subfund as a subfund in the Trust, to be funded with mineral revenues until reaching a maximum balance of five hundred million dollars, to be appropriated and used when the state has a deficit; to create the Transportation Stabilization Subfund as a subfund in the Trust, to be funded with mineral revenues until reaching a maximum balance of five hundred million dollars, to be appropriated and used for planning, design, construction, and maintenance connected with the state highway program, with twenty percent dedicated for use by the Louisiana Intermodal Connector Program; and to provide for the interruption of deposits into the Budget Stabilization Subfund and the Transportation Trust Subfund the year that the state has a deficit and the following year with the resumption of deposit of mineral revenues in the Budget and Transportation Stabilization Trust thereafter? (Amends Article VII, Section 10(D)(2)(d), 10.3(A) (introductory paragraph) and (A)(2)(a)(introductory paragraph) and (b), and 10.5(B); adds Article VII, Section 10.3(A)(2)(c))[4] |

” |

Constitutional changes

| Louisiana Constitution |

|---|

|

| Preamble |

| Articles |

| 1 • 2 • 3 • 4 • 5 • 6 • 7 • 8 • 9 • 10 • 11 • 12 • 13 • 14 |

- See also: Article VII, Louisiana Constitution

The proposed amendment would have amended Section 10 of Article VII of the Louisiana Constitution. The following underlined text would have been added and struck-through text would have been deleted by the measure's approval:[1]

| Amendment to Section 10 of Article VII of the Louisiana Constitution | |||||

|---|---|---|---|---|---|

| §10. Expenditure of State Funds Section 10

§10.3. Budget and Transportation Stabilization Fund Trust

§10.5. Mineral Revenue Audit and Settlement Fund | |||||

Fiscal note

The fiscal note for the amendment read:[5]

| “ | EXPENDITURE EXPLANATION

There is no anticipated direct material effect on governmental expenditures as a result of this measure. REVENUE EXPLANATION Based on the May 2015 official revenue forecasts, there is no expected excess mineral revenue for FY16, and no deposits would be expected into the Budget Stabilization Subfund. By the end of FY15, the balance of the Budget Stabilization Fund will be approximately $470 million, and current law schedules a $25 million deposit in FY16. During FY16, and inclusive of Fund earnings, the $500 million balance may be met. If so, excess mineral revenue could begin being deposited into the Transportation Stabilization Subfund starting in FY17. However, the May 2015 official forecast includes no excess mineral revenue in FY17. For FY18 - FY20 there is currently expected excess mineral revenue of $4.4 million (FY18), $7.2 million (FY19), and $9.3 million (FY20). Under the provisions of current law (Act 646 of 2014), these amounts are expected to be deposited into the Budget Stabilization Fund. This constitutional amendment will redirect them into the Transportation Stabilization Subfund. Those deposits are depicted in the table above, but are offset by like amounts that will not be deposited into the Budget Stabilization Fund (the Budget Stabilization Subfund of this bill).[4] |

” |

Background

Mineral revenue

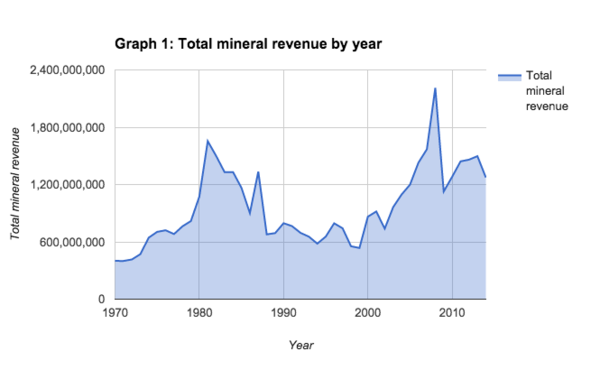

Between 2004 and 2014, Louisiana received, on average, $1.45 billion in mineral revenue per year. State revenue from taxes and royalties on minerals peaked at $2.21 billion in 2008. Revenue fell to $1.27 billion in 2014.[6] Graph 1 details state mineral revenue between 1970 and 2014.

The amount of mineral revenue the state would receive was expected to fall in 2015, and the state expected no revenue will flow into the BTST. Assuming mineral production remained constant in Louisiana, oil prices would need to spike to $100 per barrel for revenue to start flowing into the BTST.[7] As of July 28, 2015, a barrel of oil was valued at $47.69. The last time oil prices were at or above $100 was in July 2015.[8]

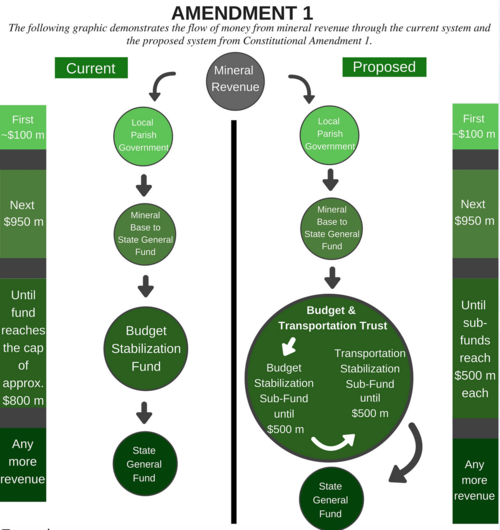

The chart below created by the Public Affairs Research Council of Louisiana shows how the system works and how the system would have changed if the amendment was approved.

Support

Sen. Robert Adley (R-36) sponsored the measure in the Louisiana Legislature.[9]

Arguments in favor

Rep. Karen St. Germain (D-60), chairwoman of the House Committee on Transportation, Highways and Public Works, argued:[10]

| “ | These amendments would authorize using existing state revenues to build new roads and bridges and repair the ones we have. Neither amendment would create a new tax or raise an existing one; nor would the money be spent on anything but transportation infrastructure.

Both amendments would, however, allow for increases in what the state spends on roads and bridges. Constitutional Amendment No. 1 would permit a portion of the mineral revenues currently going to the Budget Stabilization Fund — often called the Rainy Day Fund — to be utilized for roads and bridges once the rainy day fund was completely full. Constitutional Amendment No. 2 would authorize the treasurer to invest state funds in the state infrastructure bank that was created this past session. The treasurer already invests these funds on Wall Street, but this amendment would allow him to invest in Louisiana roads and bridges. If approved, these dollars could be invested in the infrastructure bank, which would in turn make loans to local and regional governments for transportation infrastructure.[4] |

” |

The League of Women Voters of Louisiana published an analysis with the following supporting arguments:[11]

| “ | This measure will provide a source of income for state highways and intermodal transportation and can be used to match federal dollars. It continues to provide a means to keep the state budget stable. It does not raise taxes for citizens or businesses.[4] | ” |

Christopher G. Humphreys, president of the Louisiana Section of the American Society of Civil Engineers, argued:[12]

| “ | Louisiana’s roads and bridges are in deplorable condition. Nearly four years ago, the American Society of Civil Engineers released the 2012 Report Card for Louisiana’s Infrastructure indicating that the condition of our roads and bridges is dismal, receiving a grade of D and D+, respectively.

Over the last two decades, chronic underfunding of Louisiana’s infrastructure has led to an alarming rate of deterioration. Using a simple metaphor, we no longer are facing a leaking roof; we are facing a roof replacement. Our road and bridge network no longer provides the required basic services. Most Louisiana citizens believe our infrastructure is the backbone of our economy, yet few believe it is meeting our needs. Our capacity and maintenance needs have outgrown the state’s ability to maintain the system. The result is slower economic growth and fewer jobs. Louisiana voters have an opportunity to help in the Oct. 24 election. Amendments 1 and 2 will provide additional revenue for infrastructure projects without raising taxes: Voting “yes” on Amendments 1 and 2 will increase much-needed investment into the state’s transportation network. ... Voting “yes” on Amendments 1 and 2 will not raise taxes while putting us on a path to improving our transportation network. Most importantly, it will send a clear message to the incoming state leadership that Louisiana will not accept a D as its infrastructure grade. Many states have successfully utilized infrastructure banks as a way to increase investment into projects and address the backlog of needs. Georgia started its infrastructure bank because it was facing challenges similar to ours. Since then, Georgia has leveraged more than $50 million to support $208 million in infrastructure investments that have increased mobility, enhanced communities and strengthened Georgia’s economy. We all recognize that Louisiana roads and bridges need serious attention. Now, we have an opportunity to take action by voting “yes” on these amendments and taking charge of our dying infrastructure.[4] |

” |

State Treasurer John Neely Kennedy, who supported both Amendment 1 and Amendment 2, said:[13]

| “ | We have to do something about infrastructure. The advantage of both of these amendments is that it would generate additional money for roads without raising taxes.[4] | ” |

The Public Affairs Research Council of Louisiana found the following arguments supporting the measure:[2]

| “ | This amendment preserves the basic purpose of a budget stabilization fund while putting idle money to use toward state infrastructure projects. The current state savings account is put to use too rarely and inadequately, which is a bad deal for taxpayers. Although the plan likely will contribute only scarce resources to highways in the next several years, it provides a good long-term solution to state transportation needs. Texas recently adopted a similar reform for its rainy day fund to free up money for transportation work.

By comparison, the new highway funding would be better protected than the money in Louisiana’s other major infrastructure source -- the Transportation Trust Fund (TTF) -- which has been raided for other purposes. This additional funding would supplement transportation funding along with the TTF. The new Trust can still be tapped on a “rainy day” to bailout the state budget. The current fund has been tapped only five times. Also, the amendment would allow the new stabilization subfund to be tapped without having to redirect money from the general fund immediately. That new rule patches a major problem with the current rainy day system.[4] |

” |

Opposition

Arguments against

The Council for a Better Louisiana, or CABL, argued:[14]

| “ | The proposal would lower the amount of oil and gas revenue Louisiana puts into its so-called "rainy day fund," an account the state can use to weather emergencies or severe economic downturns. It would redirect that money to an account aimed at helping to chip away at an estimated $12 billion backlog of state road and bridge maintenance.

CABL opposes the amendment for two main reasons: -- It would reduce the amount of money in the state's rainy day fund from 4 percent of total revenue to 2.5 percent. Budget experts across the U.S. suggest states should keep 5 percent to 10 percent of their revenue on hand for emergencies, so Louisiana is already below that, imperiling state services and programs if rough times hit. -- Already, higher education and health care are among few areas protected by law from state budget cuts, and reducing the amount of money in the rainy day fund would further threaten those priorities.[4] |

” |

The League of Women Voters of Louisiana published an analysis with the following argument against the amendment:[11]

| “ | The Transportation Subfund will only collect money when there are excess mineral revenues. It does not provide for the current needs of the underfunded state highways. It is uncertain when this money will be available for the state highway programs and to develop intermodal transportation. It addresses future and not present needs.[4] | ” |

The Public Affairs Research Council of Louisiana found the following arguments against the measure:[2]

| “ | The amendment shortchanges the state on fiscal stability while delivering only limited new funding to transportation for years to come. The amendment’s transportation spending restrictions unnecessarily limit the state’s flexibility in choosing priority highway projects as well as overall budget priorities.

The amendment would create confusion because it was not drafted clearly. For example, the amendment creates a trust with two subfunds but leaves unclear whether the Constitution’s rules for appropriations apply to one or both. Adding further problems, the amendment does not specify how non-mineral revenue that currently is designated for the Budget Stabilization Fund would be distributed under the new Trust and its subfunds. (See Special Section.) The conflicting legal interpretations might be resolved as the new law is implemented or else might create difficulties in making the new Trust work as imagined. The maximum size of the stabilization fund would shrink from more than $800 million to just $500 million. That $500 million is a static number that would not increase as the state budget grows. The potential insufficiency of the new stabilization subfund could threaten the state’s credit rating. Just as potential homebuyers must demonstrate to lenders they have the ability to pay their mortgage, states must show lenders they will be able to pay back bonds even if times get tough. A strong rainy day fund helps make that case. Credit rating agencies will be evaluating whether this amendment, combined with ongoing concerns about the state’s pension obligations and fiscal structural issues, could result in a credit re-evaluation and higher interest rates for the state.[4] |

” |

Media editorials

Support

Rolfe McCollister, publisher of the Greater Baton Rouge Business Report, urged a vote in favor of the amendment:[15]

| “ | This creates a new transportation projects fund and restructures the Rainy Day fund. Mineral revenues currently flow to the general fund up to $950 million annually. After that they flow to the Rainy Day Fund, which is currently around $500 million. This would cap that and create a fund for state roads and bridges. So, once the general fund and Rainy Day numbers were met, the revenue would go into a new fund, which is protected. It seems prudent and would put these extra funds to use funding state roads and bridges.[4] | ” |

Path to the ballot

- See also: Amending the Louisiana Constitution

The proposed constitutional amendment was filed by Sen. Robert Adley (R-36) as Senate Bill 202 on April 2, 2015.[3]

The measure needed to be approved through a two-thirds vote in both legislative chambers to be placed on the ballot. Louisiana is one of sixteen states that require a two-thirds supermajority.

On May 25, 2015, the Louisiana Senate approved the amendment, with 37 senators voting "yea" and zero voting "nay." The Louisiana House unanimously approved the amendment on June 8, 2015.[3]

Senate vote

May 25, 2015, Senate vote

| Louisiana SB 202 Senate Vote | ||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| 37 | 100.00% | |||

| No | 0 | 0.00% | ||

House vote

June 8, 2015, House vote

| Louisiana SB 202 House Vote | ||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| 96 | 100.00% | |||

| No | 0 | 0.00% | ||

Abstentions

Although no legislators voted against referring Amendment 1, 11 legislators abstained from voting on the amendment. These legislators were:

- Rep. John Anders (D-21)

- Rep. Austin Badon (D-100)

- Rep. Wesley Bishop (D-99)

- Rep. George Cromer (R-90)

- Rep. Ray Garofalo (R-103)

- Rep. Katrina Jackson (D-16)

- Rep. Joseph Lopinto (R-80)

- Rep. Helena Moreno (D-93)

- Rep. Barbara Norton (D-3)

- Sen. David Heitmeier (D-7)

- Sen. Karen Peterson (D-5)

State profile

| Demographic data for Louisiana | ||

|---|---|---|

| Louisiana | U.S. | |

| Total population: | 4,668,960 | 316,515,021 |

| Land area (sq mi): | 43,204 | 3,531,905 |

| Race and ethnicity** | ||

| White: | 62.8% | 73.6% |

| Black/African American: | 32.1% | 12.6% |

| Asian: | 1.7% | 5.1% |

| Native American: | 0.6% | 0.8% |

| Pacific Islander: | 0% | 0.2% |

| Two or more: | 1.8% | 3% |

| Hispanic/Latino: | 4.7% | 17.1% |

| Education | ||

| High school graduation rate: | 83.4% | 86.7% |

| College graduation rate: | 22.5% | 29.8% |

| Income | ||

| Median household income: | $45,047 | $53,889 |

| Persons below poverty level: | 23.3% | 11.3% |

| Source: U.S. Census Bureau, "American Community Survey" (5-year estimates 2010-2015) Click here for more information on the 2020 census and here for more on its impact on the redistricting process in Louisiana. **Note: Percentages for race and ethnicity may add up to more than 100 percent because respondents may report more than one race and the Hispanic/Latino ethnicity may be selected in conjunction with any race. Read more about race and ethnicity in the census here. | ||

Presidential voting pattern

- See also: Presidential voting trends in Louisiana

Louisiana voted Republican in all seven presidential elections between 2000 and 2024.

More Louisiana coverage on Ballotpedia

- Elections in Louisiana

- United States congressional delegations from Louisiana

- Public policy in Louisiana

- Endorsers in Louisiana

- Louisiana fact checks

- More...

See also

External links

- Senate Bill 202

- Louisiana Constitutional Amendments For Consideration for October 24, 2015 Ballot

- Public Affairs Research Council Guide to the 2015 Constitutional Amendments

- League of Women Voters of Louisiana's 2015 proposed constitutional amendments analysis

Footnotes

- ↑ 1.0 1.1 1.2 1.3 Louisiana Legislature, "Senate Bill 202," accessed October 16, 2015

- ↑ 2.0 2.1 2.2 2.3 2.4 Public Affairs Research Council of Louisiana, "PAR Guide to the 2015 Constitutional Amendments," accessed October 15, 2015

- ↑ 3.0 3.1 3.2 Louisiana Legislature, "Senate Bill 202 Info," accessed June 5, 2015

- ↑ 4.00 4.01 4.02 4.03 4.04 4.05 4.06 4.07 4.08 4.09 4.10 4.11 Note: This text is quoted verbatim from the original source. Any inconsistencies are attributable to the original source. Cite error: Invalid

<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content - ↑ Louisiana Legislature, "SB 202 Fiscal Note," accessed July 28, 2015

- ↑ Louisiana Department of Natural Resources, "Louisiana State Total Mineral Revenue," accessed July 28, 2015

- ↑ The New Orleans Advocate, "Political Horizons: No real relief on roads anytime soon," July 16, 2015

- ↑ NASDAQ, "Crude Oil," accessed July 28, 2015

- ↑ Louisiana Secretary of State, "2015 Proposed Constitutional Amendments," accessed September 16, 2015

- ↑ The Advocate, "Letters: A yes vote on two Louisiana constitutional amendments on the Oct. 24 ballot can improve transportation," October 5, 2015

- ↑ 11.0 11.1 League of Women Voters of Louisiana, "Analysis of state constitutional amendments on October 24, 2015 ballot," accessed September 16, 2015

- ↑ The Advocate, "Letters: Louisiana voters need to vote ‘yes’ on Amendments 1 and 2 to help the state’s dying infrastructure," October 13, 2015

- ↑ The Advocate, "Transportation aid tops short list of constitutional amendments," October 9, 2015

- ↑ Dailycomet.com, "Government watchdog group weighs in on proposed amendments," October 13, 2015

- ↑ Greater Baton Rouge Business Report, "Publisher: Endorsements for the Oct. 24 election," October 13, 2015

|

State of Louisiana Baton Rouge (capital) |

|---|---|

| Elections |

What's on my ballot? | Elections in 2025 | How to vote | How to run for office | Ballot measures |

| Government |

Who represents me? | U.S. President | U.S. Congress | Federal courts | State executives | State legislature | State and local courts | Counties | Cities | School districts | Public policy |