Become part of the movement for unbiased, accessible election information. Donate today.

Missouri Temporary Sales and Use Tax Increase for Transportation, Amendment 7 (August 2014)

| ||||||||||||

The Missouri Temporary Sales Tax Increase for Transportation, Amendment 7 was on the August 5, 2014, primary election ballot in Missouri as a legislatively referred constitutional amendment, where it was defeated.

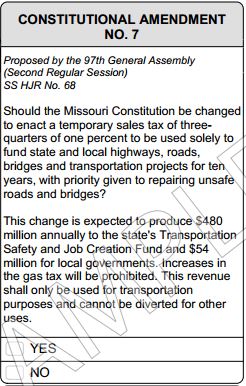

The measure would have imposed a temporary 0.75 percent increase on the state sales and use tax to fund transportation projects. The duration of the tax would have been no more than 10 years. The measure was sponsored by Rep. Dave Hinson (R-119) and Rep. Dave Schatz (R-61) in the Missouri House of Representatives, where it was known as House Joint Resolution 68. It was also supported by Sen. Mike Kehoe (R-6).[1][2][3][4]

In May 2014, Gov. Jay Nixon (D) chose to place this measure, along with four others, on the August 5 primary election ballot, instead of the November 4 general election ballot.[3] If the measure had been approved by voters, it would have marked the first statewide tax increase since 1993 and the first tax increase for roads since 1992.[5]

Aftermath

How Missouri will handle transportation funding in light of voters' rejection of Amendment 7 remains to be seen. One of the projects which would have been funded by Amendment 7 was Missouri's portion of Interstate 49 that is supposed to connect to the Bella Vista Bypass at the border with Arkansas. A five mile stretch that would have been funded by this Amendment is the only remaining portion of the project that has not secured funding.[6]

Election results

Below are the certified election results:

| Missouri Amendment 7 | ||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| 591,932 | 59.18% | |||

| Yes | 408,288 | 40.82% | ||

Election results via: Missouri Secretary of State

Text of measure

Ballot title

The language appeared on the ballot as:

| “ |  [7] [7]

|

” |

The official ballot title and fair ballot language were as follows:[8]

| “ | Official Ballot Title:

Fair Ballot Language:

|

” |

Constitutional changes

If it had been approved, Amendment 7 would have repealed Section 30(d) of Article IV of the Missouri Constitution and replaced it with two new sections: 30(d) and 30(e).[1]

Note: Hover over the text and scroll to see the full text.

2. All of the provisions of sections 29, 30(a), 30(b), 30(c) and , 30(d), and 30(e) shall be self executing. All of the provisions of sections 29, 30(a), 30(b), 30(c) [and] , 30(d), and 30(e) are severable. If any provision of sections 29, 30(a), 30(b), 30(c) and, 30(d), and 30(e) is found by a court of competent jurisdiction to be unconstitutional or unconstitutionally enacted, the remaining provisions of these sections shall be and remain valid.

3. The provisions of sections 29, 30(a), 30(b), 30(c) and 30(d) this section and section 30(e) shall become effective on July 1, 2005 January 1, 2015.

Section 30(e). 1. To provide additional moneys for state highway system purposes and uses, city streets, county roads and state transportation system purposes and uses: First, an additional state sales tax of three-quarters of one percent is hereby levied and imposed upon all transactions on which the Missouri state sales tax is imposed, subject to the provisions of and to be collected as provided in the Sales Tax Law and the rules adopted in connection therewith; and Second, an additional state use tax of three-quarters of one percent is hereby levied and imposed upon all transactions on which the Missouri state use tax is imposed, subject to the provisions of and to be collected as provided in the Compensating Use Tax Law and the rules adopted in connection therewith. No tax levied or imposed under this section shall apply to the retail sale of food as defined in the Sales Tax Law.

2. The proceeds from the additional state sales and use taxes imposed under this section shall be collected, apportioned, distributed, and deposited by the department of revenue as provided in this section. The term "proceeds from the additional state sales and use taxes" used in this subsection shall mean and include all proceeds collected by the department of revenue reduced only by refunds for overpayments and erroneous payments of such taxes as permitted by law and the department's actual costs to collect these proceeds, which shall not exceed one percent of the total amount of the tax collected. The department's actual costs to collect these proceeds shall be limited to actual costs incurred by the department of revenue, including any other entity or person designated by law or by the department to collect or to provide goods or services used to collect the additional state sales and use taxes.

3. The proceeds from the additional state sales and use taxes imposed under this section shall be apportioned, distributed, and deposited by the director of revenue as follows:

(1) Five percent of the proceeds shall be deposited into a special trust fund known as the "County Aid Transportation Fund." Moneys in the county aid transportation fund shall be apportioned and distributed to the various counties of the state based on the county road mileage and assessed rural land valuation calculations in subdivision (1) of subsection 1 of section 30(a) of this article, except that five percent of these moneys shall be apportioned and distributed solely to cities not within any county in this state. Moneys in this fund shall be expended at the sole discretion of the various counties for any of the county road and bridge purposes and uses provided in subdivision (1) of subsection 1 of section 30(a) of this article, any state highway system purposes and uses authorized under section 30(b) of this article, or for any county transportation system purposes and uses as set forth in subdivision (4) of this subsection;

(2) Five percent of the proceeds shall be deposited into a special trust fund known as the "Municipal Aid Transportation Fund." Moneys in the municipal aid transportation fund shall be apportioned and distributed to the various incorporated cities, towns, and villages in the state based on the population ratio calculations in subdivision (2) of subsection 1 of section 30(a) of this article. Moneys in this fund shall be expended at the sole discretion of the various incorporated cities, towns, and villages for any of the city road, street and bridge purposes and uses provided in subdivision (2) of subsection 1 of section 30(a) of this article, any state highway system purposes and uses authorized under section 30(b) of this article, or for any city transportation system purposes and uses as set forth in subdivision (4) of this subsection;

(3) Ninety percent of the proceeds shall be deposited into a special trust fund known as the "Transportation Safety and Job Creation Fund", which is created within the state treasury. Moneys in the transportation safety and job creation fund shall stand appropriated without legislative action to be used and expended at the sole discretion of the highways and transportation commission for the following purposes and uses, and no other:

- (a) For deposit into the state road fund for state highway system purposes and uses authorized under section 30(b) of this article; or

- (b) For state transportation system purposes and uses as set forth in subdivision (4) of this subsection;

(4) The term "transportation system purposes and uses" shall include authority for the commission, any county or any city to plan, locate, relocate, establish, acquire, construct, maintain, control, operate, develop, and fund public transportation facilities such as, but not limited to, aviation, mass transportation, transportation for elderly and handicapped persons, railroads, ports, waterborne commerce, intermodal connections, bicycle, and pedestrian improvements;

(5) All interest earned on moneys deposited into the county aid transportation fund, the municipal aid transportation fund or the transportation safety and job creation fund shall be credited to and deposited into such fund. The unexpended balance remaining in the county aid transportation fund, the municipal aid transportation fund, and the transportation safety and job creation fund at the end of the biennium and after all warrants on same have been discharged and the appropriation, if applicable, has lapsed, shall not be transferred and placed to the credit of the general revenue fund of the state or any other fund;

(6) The moneys apportioned or distributed under this section to the transportation safety and job creation fund, county aid transportation fund, and municipal aid transportation fund shall not be included within "total state revenues" under section 17 of article X of the Constitution of Missouri, nor be considered an "expense of state government" under section 20 of article X of the Constitution of Missouri, nor be considered "state revenue" under section 3(b) of article IX of the Constitution of Missouri.

4. (1) The general assembly, counties, and municipalities are prohibited from increasing or decreasing the tax upon, or measured by, motor fuel used to propel highway motor vehicles from the rate of the tax authorized by law on January 1, 2014, while this section is in effect.

(2) The state highways and transportation commission shall not authorize, own, or operate a toll highway or toll bridge on a state highway or bridge while the sales and use tax authorized by this section is in effect. A county or municipality shall not authorize, own or operate a toll highway or toll bridge on any highway or bridge under its jurisdiction while the sales and use tax authorized by this section is in effect.

(3) Prior to the effective date of this section and prior to any subsequent election in which this section shall be submitted to voters for approval, the commission shall approve its list of projects, programs, and facilities, with a priority given to safety, on the state highway system and state transportation system that shall be funded from the proceeds from the additional sales and use taxes deposited into the transportation safety and job creation fund under this section. Starting in the second calendar year following the effective date of this section, the commission shall annually submit a report to the governor, general assembly, and joint committee on transportation oversight that shall include the status of the approved list of projects, programs, and facilities on the state highway system and state transportation system. During the ten-year period the temporary tax is in effect, the commission shall include the approved projects, programs, and facilities in one or more of the five-year statewide transportation improvement programs approved by the commission. A taxpayer of the state shall have standing to bring suit to compel the commission’s inclusion of approved projects in a five-year statewide transportation improvement program. All such suits shall be brought in the circuit court of Cole County.

(4) Upon voter approval of the temporary three-quarters of one percent state sales and use tax in this section at the general election held in 2014, or at a special election to be called by the governor for that purpose, this section shall be effective January 1, 2015, and shall continue for ten years. This section shall be resubmitted to the voters for approval at the general election held in 2024. The secretary of state shall submit the ballot measure for such ten-year resubmission. If approved by a simple majority of votes cast, this section shall continue to be effective for an additional temporary ten-year period. Every ten years thereafter, the secretary of state shall submit to the voters for approval the issue of whether the sales and use tax authorized by this section shall be imposed for another ten-year period. If at any subsequent general election a simple majority of votes cast do not approve such issue, then this section shall terminate on December thirty-first of the calendar year when the last election was held. [7]

Fiscal note

The following fiscal note was submitted to voters:[1]

| “ | This change is expected to produce $480 million annually to the state's Transportation Safety and Job Creation Fund and $54 million for local governments. Increases in the gas tax will be prohibited. This revenue shall only be used for transportation purposes and cannot be diverted for other uses.[7] | ” |

Background

- See also: Missouri budget policy

According to the Missouri Department of Transportation, revenue for transportation projects had declined due to inflation, a lack of fuel tax revenues and a loss of temporary funding. The fuel tax was said to have lost its effectiveness because it had not been raised in 20 years and vehicles had increased in efficiency.[9] A similar measure that would have provided a temporary increase of the sales tax by one cent for 10 years was prevented from reaching the ballot by a Republican-led filibuster.[10]

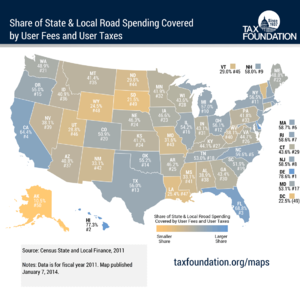

According to the Tax Foundation, 31.6 percent of state and local road spending in Missouri was covered by user fees and taxes in 2011. Specifically, 0.6 percent came from tolls and user fees, 22.5 percent came from fuel taxes and 8.5 percent from license taxes.[11]

Legislative debate

| Budget policy is a major issue in Missouri. To learn more, see "Missouri state budget." |

HJR 68 passed in the House on April 9, 2014, and the Senate responded with a substitute bill. It was then returned to the House on April 29, 2014, where it was ultimately approved. It was passed in the Senate on April 29, 2014. Initially, action on the measure was stalled due to an amendment eliminating funding for bicycle paths. Supporters of this amendment argued that the transportation tax increase should only fund core infrastructure improvements. House Democrats threatened to withdraw support for the bill while arguing that Missouri should support alternative forms of transportation. Additionally, the Senate substitute resolution reduced the House's original tax increase of 1 percent to 0.75 percent. This version, which was the one that ultimately was referred to the ballot, prohibited the state, cities and counties from operating toll roads or bridges while the temporary tax increase was in effect. Additionally, if it had been approved by voters, it would have prohibited increases in the fuel tax during this period.[2][12][9]

These debates were not the only hurdles for the passage of the resolution by the House. An income tax cut also stalled the measure. A veto override by the Republicans created a $620 million income tax cut. This led some Democrats, such as Rep. Stephen Webber (D-46), to reconsider their votes on the tax increase for transportation. Webber said that due to the income tax cuts, the tax increase for transportation could further shift the tax burden from the wealthy onto the middle class. He stated, "I’m certainly willing to ask people to sacrifice money in order to build this state, but I’m not willing to continue asking the middle class to sacrifice a disproportionate share."[13]

Democrats said they would be willing to pass the tax increase if Republicans would compromise on expanding Medicare in the state. Majority Floor Leader Rep. John Diehl, Jr. (R-89) accused Democrats of holding the measure hostage from a vote. The measure's sponsor, Rep. Hinson, stated that he still believed the measure would pass before the end of the session, which it ultimately did.[13]

MoDOT project list

On July 9, 2014, the Missouri Department of Transportation (MoDOT) approved hundreds of transportation projects that would have been funded if Amendment 7 had been approved. The projects largely focused on roads and bridges. A full list of the projects approved can be read here. (dead link).[14]

Support

Supporters

Officials

- Rep. Dave Hinson (R-119)

- Rep. Dave Schatz (R-61)

- Sen. Mike Kehoe (R-6)

- US Sen. Claire McCaskill (D)

Former officials

- Bill McKenna, former Missouri transportation commissioner & co-chair of Missourians for Safe Transportation and New Jobs

- Rudy Farber, former Missouri transportation commissioner & co-chair of Missourians for Safe Transportation and New Jobs

Organizations

- Missouri Department of Transportation[15]

- Missouri Chamber of Commerce and Industry[16]

- Missourians For Safe Transportation & New Jobs Inc.[17]

- Missouri Transportation PAC[18]

- Missouri Bicycle and Pedestrian Federation (MoBikeFed)

- Missouri State Troopers

Arguments

- The Missouri Chamber of Commerce and Industry supported the measure as a necessary move to avoid a funding shortfall. According to the chamber,

| “ | By 2017, it’s estimated that the department’s funding will drop to $325 million. At that level, department leaders have warned that they won’t be able to even maintain the state’s existing infrastructure. The new sales tax is designed to provide the funding needed to maintain and improve Missouri’s transportation infrastructure.[19][7] | ” |

- Dave Nichols, director of the Missouri Department of Transportation, argued that the legislation would help improve the economy and keep people safe by making needed transportation improvements.[20]

- Co-chairmen of Missourians for Safe Transportation and New Jobs, Bill McKenna and Rudy Farber, argued that the beneficial progress engendered by Amendment 7 would be evident before the measure's renewal in 10 years. They also argued that raising the gas tax would not provide enough revenue for the transportation needs and "would place Missouri at a competitive disadvantage with other states." Furthermore, they contended the tax would support not just bridges and highways, but other alternative modes of transportation.[21]

- The League of Women Voters provided a nonpartisan voter guide for all amendments in Missouri. The group included the following argument in favor of Amendment 7: "Supporters say roads and bridges are in poor condition and revenue from the state gasoline tax isn't sufficient, partly because of an increase in fuel-efficient and hybrid cars."[22]

- The Franklin County Democrats provided summaries and arguments written by Rep. Jeanne Kirkton (D-91) for and against each amendment on the August ballot. She provided the following arguments in favor of Amendment 7:

| “ | Existing transportation funding barely allows MoDOT to maintain the existing state highway system. Without a new revenue source, it won’t even be able to do that within a few years.

Amendment 7 will provide a massive stimulus to Missouri’s economy, not only by creating road construction jobs in the short term but also by enhancing commerce in the long term with a greatly improved state transportation system. Amendment 7 will enhance highway safety by allowing MoDOT to make long overdue improvements to unsafe roads and bridges. Failing to make these necessary investments will cost lives. Funding additional transportation improvements solely through fuel taxes, as some Amendment 7 opponents urge, is unrealistic since Missouri would need to increase its fuel tax from 17 cents a gallon to 35 cents a gallon to generate the same amount of revenue a three-quarter-cent sales tax would provide. All Missourians use the transportation system, directly or indirectly; even people who don’t drive. Since everyone benefits from an improved transportation system, everyone should help pay for it.[23][7] |

” |

| —Rep. Kirkton | ||

- The Missouri Bicycle and Pedestrian Federation endorsed Amendment 7 on July 25, 2014, due in part to its support for alternate forms of transportation, including biking, walking and mass transit.[24]

Campaign contributions

| Total campaign cash | |

| $2,069,607.64 | |

| $2,172.40 | |

As of the July 2014 quarterly report to the Missouri Ethics Commission, two campaign committees were registered as supporting this measure. A political action committee (PAC), Consulting Engineers Council Of Mo., was also registered as supporting the amendment. The PAC totals in the following chart are only for 2014 contributions and expenditures. The PAC had $12,147.59 on hand as of the July report.[25][26][27][28]

Campaign committee & PAC info:

| Campaign committee or PAC | Amount raised | Amount spent |

|---|---|---|

| Missourians For Safe Transportation & New Jobs Inc. | $2,039,072.13 | $430,373.44 |

| Missouri Transportation PAC | $30,002.00 | $3,524.77 |

| Consulting Engineers Council Of Mo. | $533.51 | $12,000.00 |

| Total | $2,069,607.64 | $445,898.21 |

Opposition

Missourians For Better Transportation Solutions led the campaign in opposition to Amendment 7.[29]

Opponents

- Gov. Jay Nixon (D)[30]

- Joseph Miller, policy researcher at the Show-Me Institute[31]

- Missouri Association for Social Welfare (MASW)[32]

- Southwest Missouri Democrats[33]

Arguments

Much of the opposition to this measure occurred during its legislative debate. Those arguments focused on support for alternative transportation forms and concern that the taxes would unfairly burden some groups. House Democrats threatened to withdraw support for the bill, arguing that Missouri should support alternative forms of transportation. Additionally, a veto override by the Republicans led to the passage of a $620 million income tax cut, which led some Democrats, such as Rep. Stephen Webber (D-46), to reconsider their votes on the tax increase for transportation. Webber said that due to the income tax cuts, the tax increase for transportation could further shift the tax burden from the wealthy onto the middle class. Webber's view was shared by others who found it hypocritical to cut income taxes while raising a sales tax. Others said higher sales taxes disproportionately tax young, poor and minority citizens.[2][12][9][13][34]

- Gov. Nixon stated his opposition to Amendment 7, saying, "The burden of this $6.1 billion sales tax increase would fall disproportionately on Missouri’s working families and seniors by increasing the cost of everyday necessities like diapers and over-the-counter medication, while giving the heaviest users of our roads a free pass."[30] The governor stated that while the transportation system needed extensive work, he disagreed with the methods used by this legislation to address that need.[35]

- Joseph Miller, a policy researcher at the Show-Me Institute which promotes free markets and private over public solutions, argued against the measure. He disagreed with Amendment 7 because it would not place the tax burden on those who use the roads most. He said, "The fundamental problem with MoDOT funding, which a sales tax would only exacerbate, is that people who use the roads are paying less than their fair share." Miller additionally argued that if the state made drivers pay for the roads, it would not only be more fair, but the charges would "discourage overuse of highways and create a sustainable funding structure for MoDOT." He stated that drivers would choose to drive less or buy more fuel-efficient vehicles if gas prices rise due to increased taxes and tolls.[31] Similar to what some state legislators pointed out while debating HJR 68, Miller also claimed that Missouri's failure to raise gas taxes should be one of the first things remedied in the transportation budget. He said,

| “ | At 17 cents a gallon, Missouri has one of the lowest gas taxes in the country. This is not automatically a bad thing, but it is an issue when state road maintenance is underfunded. If Missouri simply raised its rate to adjust for the inflation since the tax was set in 1996, MoDOT calculated it would get additional revenues of more than $150 million per year.[31][7] | ” |

| —Joseph Miller | ||

- The League of Women Voters provided a nonpartisan voters guide for all amendments in Missouri. The group included the following arguments in opposition to Amendment 7:

| “ | Opponents say the burden of the sales tax hike would fall most heavily on lower-income people. Opponents also complain that the trucking industry, which causes great wear and tear on Missouri roads, would pay relatively little of the extra tax.[7] | ” |

| —League of Women Voters[22] | ||

- The Franklin County Democrats provided summaries and arguments written by Rep. Jeanne Kirkton (D-91) for and against each amendment on the August ballot. She provided the following arguments in opposition to Amendment 7:

| “ | There is no disputing that Missouri needs more revenue for transportation, but a general sales and use tax is the wrong way to do it.

Sales taxes are regressive and disproportionately impact the poor and middle class. Just a week before approving Amendment 7, lawmakers enacted an income tax cut of $800 million a year that primarily will benefit a wealthy few. If the state can afford to give a massive tax cut to the wealthy, it doesn’t need to impose the largest tax increase in history on everybody else. Sales taxes are already too high. Combined state and local sales taxes are close to 10 percent in many areas of Missouri and even top 10 percent in some places. Missouri should fund transportation the way it always has, through user fees such as the fuel tax, which is among the lowest in the country and hasn’t been increased in nearly two decades. Increasing the sales tax rather than the fuel tax to fund transportation lets the trucking industry off the hook, even though its large trucks do most of the damage to our highways. Missourians who don’t drive, including many who are elderly, disabled or too poor to afford a car, shouldn’t have to share in the burden of paying for new roads.[23][7] |

” |

| —Rep. Kirkton | ||

Campaign contributions

Missourians For Better Transportation Solutions was the only committee registered with the Missouri Ethics Commission in opposition to Amendment 7, as of June 9, 2014.[18] The following totals are accurate as of the committee's July 2014 quarterly report.[36]

PAC info:

| PAC | Amount raised | Amount spent |

|---|---|---|

| Missourians For Better Transportation Solutions | $2,172.40 | $998.00 |

| Total | $2,172.40 | $998.00 |

Top 5 contributors:

| Donor | Amount |

|---|---|

| Debra Shrout | $500.00 |

| Ed Zagorac | $200 |

| Les Sterman | $200 |

| Terry Ganey | $200 |

| Cara Spencer | $172.53 |

Reports and analyses

AP analysis

Gov. Nixon's decision to place this measure and four others on the August primary election ballot instead of the November general election ballot could have had political and legal ramifications, according to Associated Press reporter David A. Lieb. For example, it was presumed that Amendment 1 would draw many rural residents to the polls in November. Since rural Missouri voters tend to vote for Republicans over Democrats, it could have been a bigger boon to Republican candidates to have those voters come out to the November election, rather than the August primary. Similarly, the lawsuit over Amendment 5 was dismissed, at least in part, due to time constraints that would not have applied if the measure was on the November ballot, instead. Lieb summarized the potential impact of gubernatorial placement of ballot measures on the primary ballot, saying, "a governor who doesn't like a particular ballot measure could diminish its political impact by placing it on the August ballot, but that also could hinder the ability of opponents to challenge it in court."[37]

Media editorial positions

Support

- The Daily Star-Journal said,

| “ | Getting Amendment 7 onto the ballot took years of research, hearings and legislative wrangling, with the 1-cent plan being cut to 0.75 cents, and the tax does not apply to food, medicine and other essentials. If the tax now fails, as some short-sighted individuals advocate, then roads and bridges will suffer.[7] | ” |

| —The Daily Star-Journal[38] | ||

- The Kirksville Daily Express said,

| “ | The transportation sales tax issue and veteran’s lottery ticket measures are ones we support, though we wish we didn’t have to. The bottom line is these are critical issues that should have been addressed by the Missouri Legislature, which instead passed a tax cut and punted these poorly funded issues to voters. We’d rather see better and more balanced approaches to both issues, but simply don’t trust that the Legislature can get it done.[7] | ” |

| —Kirksville Daily Express[39] | ||

- The News Tribune said,

| “ | Support Amendment 7, a three-quarter cent, 10-year sales tax for transportation. Despite misgivings about veering from user-based funding, all Missourians benefit from a safe, reliable transportation system.[7] | ” |

| —News Tribune[40] | ||

- The Columbia Daily Tribune said,

| “ | Transportation needs are serious, and the Missouri Department of Transportation has developed a good plan for spending the anticipated revenue. The sales tax will be widely dispersed among outside buyers of goods and services as well as state residents. Voters should say “yes.[7] | ” |

| —Henry J. Waters, III, editor of Columbia Daily Tribune[41] | ||

- The Joplin Globe said,

| “ | We think the long-term economic impact will be seen when better roads make Missouri a more attractive option for doing business. [...] [Low-income] and fixed-income residents have been given some level of protection, more than they would get if Missouri were to look at other options for raising the money, such as boosting the gasoline tax. [...] If the cost of improving roads is shifted to the trucking industry, those costs will be passed along to consumers. [...] In short, there is no free lunch for anyone, but with the sales tax plan and its exemptions, at least the price of the lunch won’t jump.[7] | ” |

| —The Joplin Globe | ||

- The Springfield News-Leader said,

| “ | Some Missourians have argued that the General Assembly has dropped the ball on transportation, that the legislature should fund needed road maintenance and expansions. It may be true that our legislature has steered clear of that path, but we believe that could be a good thing. By passing an amendment that clearly lays out what must be completed with funds from the tax, we have taken the politics out of the money pot.[7] | ” |

| —Editorial Board, Springfield News-Leader[42] | ||

- The Missourian said,

| “ | Nobody likes a tax increase. Everybody likes to operate their vehicles and in most cases people have to drive to work and use their cars and trucks for other vital purposes in their everyday lives. We must have the roads and bridges to serve their needs. Without more revenue, MoDOT won’t be able to maintain what we have in a first-class condition, much less make needed improvements. MoDOT is a responsible state agency. It has done well on what resources it has. The fat in the operation was cut some years ago. We have confidence MoDOT will spend added revenue wisely. This is not a major tax hike. If there is a recognition of the need, and the improvements that will be made with added revenue, we believe Missourians will support this tax increase.[7] | ” |

| —The Missourian[43] | ||

- St. Joseph News-Press was highly critical of the amendment, saying,

| “ | Historically, roads in Missouri have been funded by the users — primarily by taxes that motorists and truck operators pay on fuel and vehicle purchases. The ballot plan amounts to what is said to be the largest tax increase in state history, a projected $5.3 billion to $6.1 billion over 10 years. And it apparently would mark the first time general sales tax revenues have been earmarked for roads and bridges.

This matters because lower-income residents pay a higher proportion of their incomes in sales tax but use the highways less than average. Meanwhile, the truck operators who stand to benefit greatly from road investments hardly would be impacted.[44][7] |

” |

| —St. Joseph News-Press | ||

However, the paper ultimately endorsed the measure, saying,

| “ | Voters have turned down a gas tax increase in the past and tell pollsters they have little interest in approving toll roads. A case can be made steeply higher levies on the trucking industry would come with higher costs passed along to consumers.

We still would like to see these options given further consideration, but the priority must be a funding plan voters will approve. We agree Amendment 7 offers the best chance of success and we recommend a “yes” vote on Aug. 5.[45][7] |

” |

| —St. Joseph News-Press | ||

- The Columbia Daily Tribune said,

| “ | All of us would like to fix transportation without resorting to a sales tax, but this is not a realistic option. In Missouri, we have avoided biting this bullet as long as we should. The benefits of improving transportation will accrue to everyone. A good portion of sales tax revenue will come from visitors as well as residents, painlessly enlarging the pool. [...] Time to bite the bullet and vote “Yes” on Amendment 7.[46][7] | ” |

| —Columbia Daily Tribune | ||

Opposition

- The Sullivan Journal said,

| “ | Taxes don't generate business. Sure, a few shovels will move and pavement will pour. But putting MoDOT in charge of 90 percent of our money is like putting the proverbial cat in charge of the fishbowl. The cat gets fat, the fish gets...well, we know what the fish gets. Toll roads, gas taxes, and other user fees may be a better solution to crumbling infrastructure. Putting the burden on the backs of every consumer in Missouri is not.[7] | ” |

| —Sullivan Journal[47] | ||

- The West Plains Daily Quill said,

| “ | The fuel tax is now 17.3 cent per gallon. It is one of the lowest gas tax rates in the country and hasn’t been adjusted in 20 years. Companies that run trucks on Missouri highways and across its bridges would not share a greater tax burden. Over the road truckers are exempt from state sales taxes on new trucks and repair parts.[7] | ” |

| —Frank L. Martin III, editor and publisher of West Plains Daily Quill[48] | ||

- The Southeast Missourian said,

| “ |

Though we generally believe in low taxes, we have endorsed various tax increase measures in the past. This depends on the type of tax, how much it is, and if there is a track record for success. However, a statewide sales tax is not the best solution to solve transporation [sic] infrastructure improvements.[7] |

” |

| —Southeast Missourian[49] | ||

- St. Louis Post-Dispatch said in an editorial outlining 10 reasons not to vote for Amendment 7,

| “ | Missouri’s roads and bridges need the work. The state’s economy could use a jolt. But this is the wrong tax at the wrong time and in some ways, for the wrong purposes. Let us count the ways we hate it.[7] | ” |

| —Editorial Board[50] | ||

- The Kansas City Star said in an editorial following Gov. Nixon's decision to place the measure on the August ballot,

| “ | This is yet another regressive tax, piled on top of other sales taxes local communities have approved. Also, legislators refused to put a gasoline tax on the ballot, even though that user-pays model has been followed for decades, and Missouri has one of the nation’s lowest gas taxes. Plus, the state is asking for extra revenue right after lawmakers passed a tax cut that favors the wealthy.[...] Along with Nixon’s decision last week, the transportation sales tax has the definite feeling of being rushed to voters.[51][7] | ” |

| —The Kansas City Star | ||

- The St. Louis American encouraged its readers to vote no on the amendment, saying,

| “ | The promise that this tax will create jobs sounds good, but other than short-term construction jobs, history and common sense tell us it won’t happen. And MoDOT is certainly capable of fixing deficient bridges and making other safety improvements to roadways with its current budget or with a very small tax increase.[...] The proposal will increase the combined sales tax rate in the city to over 11 percent in some places, making it hard on consumers and local businesses. It will make it more difficult for the city and the state to pay for truly essential services in the future. And it will lead to a further expansion of the highway network in suburban and rural areas that has encouraged and enabled the drain of population and jobs from the core of our region.[52][7] | ” |

| —The St. Louis American | ||

Lawsuit

| Missouri Constitution |

|---|

|

| Preamble |

| Articles |

| I • II • III • IV • V • VI • VII • VIII • IX • X • XI • XII • XIII • XIV |

On June 12, 2014, the Missouri Association for Social Welfare filed a lawsuit challenging the ballot language for Amendment 7. The group was represented by Gaylin Rich Carver, an attorney with Carver & Michael, LLC in Jefferson City. Gov. Nixon's wife, Georganne Wheeler Nixon, was listed on the Carver & Michael law firm's website as their PC of Counsel. The lawsuit contended that the cost estimate provided was insufficient. It also claimed that the summary failed to include that the measure would also raise the state use tax. It further posited that the ballot language should note the current sales tax rate of 4.225 percent.[53] Supporters of the measure claimed that the lawsuit was an effort to confuse voters. According to the Associated Press, using lawsuits to challenge ballot measure language has been common in Missouri over the last 10 years. While some have been successful in forcing ballot language changes, "many have not."[53]

On July 1, 2014, Missouri 19th Judicial Circuit Court Judge Jon Beetem dismissed the lawsuit by ruling the ballot summary of this measure and another regarding the right to bear arms sufficient and fair.[54]

Path to the ballot

- See also: Amending the Missouri Constitution

Either chamber of the Missouri General Assembly is allowed to propose an amendment. A majority of members in both chambers must approve it in order to refer the measure to the ballot. If the measure is approved by a simple majority of voters, it becomes part of the Missouri Constitution.

HJR 68 was passed in the House on April 9, 2014, by a vote of 96 to 53. It was then referred to the Senate, where an alternative version was proposed. This version was approved by a vote of 22 to 10 in the Senate on April 29, 2014, and was then sent back to the House for approval. The House ultimately approved the amended proposal on May 14, 2014, by a vote of 105 to 43.[55]

Senate vote

April 29, 2014 Senate vote

| Missouri HJR 68 Senate vote | ||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| 22 | 69% | |||

| No | 10 | 31% | ||

House vote

May 14, 2014 House vote

| Missouri HJR 68 House vote | ||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| 105 | 71% | |||

| No | 43 | 29% | ||

See also

- Missouri 2014 ballot measures

- 2014 ballot measures

- List of Missouri ballot measures

- Missouri budget policy

External links

- Open States, Missouri HJR 68: Proposes a constitutional amendment imposing a 1% temporary increase in the state sales and use tax to be used for transportation projects

- Senate Substitute for HJR 68

- Missourians for Safe Transportation and New Jobs, Inc. website, Facebook profile, YouTube channel & Twitter feed

- Missourians for Better Transportation Solutions "Vote No on Amendment 7" website, Facebook profile and Twitter feed

Additional reading

- Governing, "Missouri Voters Won't Raise Sales Tax to Fund Transportation," August 6, 2014

- PoliticMo, "Missouri voters back constitutional “right to farm”, oppose new tax for roads," August 6, 2014

- The Washington Post, "Why are ballot measures so darn confusing? Because they are supposed to be.," August 5, 2014

- Missouri Libertarian Party, "User Fees Better than Sales Tax for Roads," July 28, 2014

- Governing, "Missouri Tax Hike Splits Transportation Advocates," July 28, 2014

- KTVO, "KTVO breaks down transportation sales tax increase ballot measure," July 18, 2014

- Associated Press, "Money flowing to Missouri transportation tax group," July 13, 2014

- Fox 26 KNPN, "Supporters tout higher sales tax for gas," July 13, 2014

- The Daily Dunklin Democrat, "Highway 412 included in MoDOT priorities list," July 11, 2014

- PoliticMO, "All you need to know about the August 5 sales tax measure," June 17, 2014

- Lake News Online, "Missouri lawmakers send 8 issues to voters," May 24, 2014

- El Dorado Springs Sun, "TAX REFORM IN MISSOURI: GENERAL ASSEMBLY MAKES HISTORY IN 2014," May 22, 2014

- Go By Truck, "States Move on Funding, More," May 16, 2014

- Land Line Mag.com, "Missouri voters to decide on $5 billion road plan," May 15, 2014

- U.S. PIRG, "Do Roads Pay for Themselves? Setting the Record Straight on Transportation Funding," January 2011

Footnotes

- ↑ 1.0 1.1 1.2 Missouri State Legislature, "SENATE SUBSTITUTE FOR HOUSE JOINT RESOLUTION NO. 68 JOINT RESOLUTION," accessed May 14, 2014

- ↑ 2.0 2.1 2.2 Open States, "Missouri 2014 Regular Session: HJR 68 Proposes a constitutional amendment imposing a 1% temporary increase in the state sales and use tax to be used for transportation projects," accessed May 14, 2014

- ↑ 3.0 3.1 MissouriNet, "Senate sponsor OK with transportation tax on August ballot," May 26, 2014

- ↑ St. Louis Post-Dispatch, "McCaskill backs Missouri transportation sales tax," May 21, 2014 (dead link)

- ↑ Columbia Daily Tribune, "Transportation sales tax to go on Missouri ballot," May 15, 2014

- ↑ The City Wire, "Missouri vote leaves Bella Vista bypass/I-49 connection in limbo," August 6, 2014

- ↑ 7.00 7.01 7.02 7.03 7.04 7.05 7.06 7.07 7.08 7.09 7.10 7.11 7.12 7.13 7.14 7.15 7.16 7.17 7.18 7.19 7.20 7.21 7.22 7.23 7.24 Note: This text is quoted verbatim from the original source. Any inconsistencies are attributable to the original source. Cite error: Invalid

<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content - ↑ Missouri Secretary of State, "2014 Ballot Measures," accessed July 1, 2013

- ↑ 9.0 9.1 9.2 emissourian.com, "Smaller Version of Transportation Sales Tax Passes Senate," May 3, 2014

- ↑ STLToday.com, "Republican split in Mo. Senate kills transportation sales tax," May 17, 2013

- ↑ Tax Foundation, "Gasoline Taxes and User Fees Pay for Only Half of State & Local Road Spending," January 3, 2014

- ↑ 12.0 12.1 Transportation Investment Advocacy Center, "Missouri House Avoids Action on Penny Tax Transportation Bill," April 22, 2014

- ↑ 13.0 13.1 13.2 Missourian, "Tax increase to fund transportation stalls in House," May 13, 2014

- ↑ KOAM 7, "Missouri Highways and Transportation Commission today approved a list of hundreds of transportation projects," July 9, 2014

- ↑ The Missouri Times, "Press release: Statement from MoDOT Director Dave Nichols on the passage of HJR 68," May 14, 2014

- ↑ Missouri Chamber of Commerce and Industry, "NEWS RELEASE: Transportation funding measure goes to Missouri voters," May 14, 2014

- ↑ Columbia Daily Tribune, "Two tax issues in the works: Voters to get say in cuts, highways," November 11, 2013

- ↑ 18.0 18.1 Missouri Ethics Commission, "Ballot Measures by Election Search," accessed May 27, 2014

- ↑ Missouri Chamber of Commerce and Industry, "NEWS RELEASE: Transportation funding measure goes to Missouri voters," May 14, 2014

- ↑ The Missouri Times, "Press release: Statement from MoDOT Director Dave Nichols on the passage of HJR 68," May 14, 2014

- ↑ St. Louis Post-Dispatch, "Backers of Missouri's transportation sales tax defend ballot measure," June 23, 2014

- ↑ 22.0 22.1 League of Women Voters' Voter Guide, "Constitutional Amendment 7," accessed July 21, 2014

- ↑ 23.0 23.1 Franklin County Democrats, "Primary Election Day, August 5th Ballot Measures," July 8, 2014

- ↑ Missouri Bicycle and Pedestrian Federation, "MoBikeFed endorses Amendment 7, the first Missouri transportation funding plan in history to incorporate biking, walking; Vote August 5th," July 25, 2014

- ↑ Missourui Ethics Commission, "MISSOURI TRANSPORTATION PAC Initial 15 Day Report," December 19, 2013

- ↑ Missouri Ethics Commission, "MISSOURIANS FOR SAFE TRANSPORTATION & NEW JOBS INC Initial 15 Day Report," September 24, 2013

- ↑ Missouri Ethics Commission, "Missourians for Safe Transportation & New Jobs Inc. January Quarterly Report," January 15, 2014

- ↑ Missouri Ethics Commission, "Missourians for Safe Transportation & New Jobs Inc. April Quarterly Report Amended," April 21, 2014

- ↑ Missourians For Better Transportation Solutions, "Homepage," accessed November 30, 2014

- ↑ 30.0 30.1 PoliticMO, "Nixon opposes transportation tax ballot measure," June 2, 2014

- ↑ 31.0 31.1 31.2 Show-Me Institute, "Ballot Initiative Lets Motorists Off Hook," November 25, 2014

- ↑ MASW, "MASW Calls for No Votes On Amendments 1, 5, and 7," accessed July 15, 2014

- ↑ The Joplin Globe, "Neosho lawmaker stands by ballot proposal on farming," July 16, 2014

- ↑ The Missouri Times, "Transportation tax increase shaping up as race against time," May 5, 2014

- ↑ KFVS CBS, "Three quarter cent sales tax on August 5 MO ballot could impact transportation," June 12, 2014

- ↑ Missouri Ethics Commission, "MISSOURIANS FOR BETTER TRANSPORTATION SOLUTIONS July 2014 Quarterly Report," July 13, 2014

- ↑ Associated Press, "Analysis: Timing of elections can have political, legal effects for Missouri ballot measures," July 6, 2014

- ↑ The Daily Star-Journal, "State highway tax needed for state," August 1, 2014

- ↑ Kirksville Daily Express, "Our View: How we're voting in the primary," August 3, 2014

- ↑ News Tribune, "Our Opinion: End of discussion; time to vote," August 4, 2014

- ↑ Columbia Daily Tribune, "Amendments: Cluttering the Constitution," July 27, 2014

- ↑ Springfield News-Leader, "Our Voice: Vote ‘Yes’ on Amendment 7," July 19, 2014

- ↑ The Missourian, "Now It’s Up to Voters," May 22, 2014

- ↑ LakeExpo.com, "EDITORIAL: More sales tax for transportation locks in inequity," June 16, 2014

- ↑ St. Josephe News-Press, "Road tax emerges as best option," July 19, 2014

- ↑ Columbia Daily Tribune, "Amendment 7," July 20, 2014

- ↑ Sullivan Journal, "Say "No" to Amendment 7 and Amendment 1 Right To Farm," August 3, 2014

- ↑ West Plains Daily Quill, "Don’t vote for record tax hike," July 25, 2014

- ↑ Southeast Missourian, "Editorial: Our take on August ballot issues," July 27, 2014

- ↑ St. Louis Post-Dispatch, "Editorial: Ten good reasons to vote against the transportation sales tax," May 31, 2014

- ↑ The Kansas City Star, "Missouri rushes transportation sales tax to the ballot," June 3, 2014

- ↑ The St. Louis American, "Vote no Amendment 7," June 26, 2014

- ↑ 53.0 53.1 The Rolla Daily News, "Lawsuit challenges Mo. sales transportation tax," June 13, 2014

- ↑ Associated Press, "Missouri judge rejects challenges to ballot items," July 1, 2014

- ↑ OpenStates.org, "HJR 68, Missouri House Joint Resolution," accessed May 26, 2014

State of Missouri Jefferson City (capital) | |

|---|---|

| Elections |

What's on my ballot? | Elections in 2025 | How to vote | How to run for office | Ballot measures |

| Government |

Who represents me? | U.S. President | U.S. Congress | Federal courts | State executives | State legislature | State and local courts | Counties | Cities | School districts | Public policy |