| “

|

Section 1: DEFINITIONS

Board: Shall mean the Board of Trustees of the System.

Member: Shall mean any person who by virtue of his employment status is participating

in the System.

Pensionable Earnings: Shall have the same meaning as the term "pensionable earnings"

as that term is defined in Chapter 22 of the Omaha Municipal Code.

Retiree: Shall mean any person receiving a disability or regular service retirement, who

is no longer contributing to the System.

System: Shall mean the Police and Fire Retirement System.

Section 2: CONTRIBUTIONS

To fund all benefits within this Article, each member and the CITY shall contribute to the

System. Effective January 1, 2014, the member shall contribute every bi-weekly payroll

period 15.35% of his/her pensionable earnings. The member's contribution shall be

deducted prior to federal income tax withholding as allowed by IRS 414(h). The CITY

shall contribute annually 20.17%) of each employee's pensionable earnings.

Commencing in the 2018 contract year through the 2025 contract year the member shall

contribute an additional .75% of his/her pensionable earnings to the system and the CITY

shall contribute an additional like sum (.75%) to the system. The additional .75%

contribution by the member and the similar contribution by the CITY is subject to a sunset

provision and shall end following expiration of the 2025 contract year and that obligation

will not renew even if there is an automatic contract extension pursuant to Article 47.

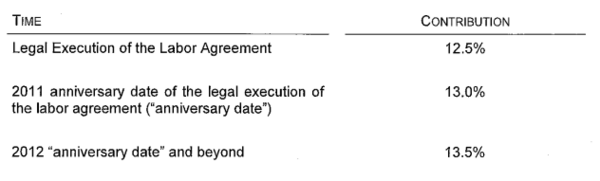

Section 3: UNFUNDED ACTUARIAL LIABILITY CONTRIBUTIONS AND BENEFIT

REDUCTIONS

As of January 1, 2009, the Police & Fire Pension System has an unfunded actuarial

liability of approximately $520 million dollars, as determined by the actuary firm of

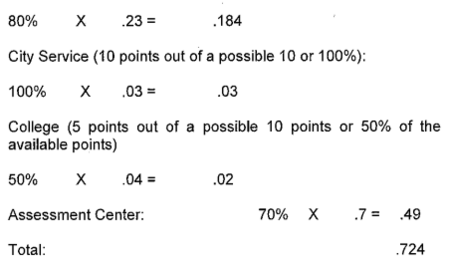

Milliman Inc. The City and the members, through the collective bargaining process, have

agreed that by the end of this labor agreement, each will contribute at least 13.5% of

payroll (either through additional cash contributions or benefit reductions), as verified by

the actuary firm of Milliman Inc., in order to take the necessary steps to reduce this

unfunded actuarial liability over time and make the pension system financially viable. The

members have agreed that they will achieve their percentage of payroll through various

benefit reductions and cash contributions detailed in this labor agreement with savings

verified by the actuary firm of Milliman Inc.

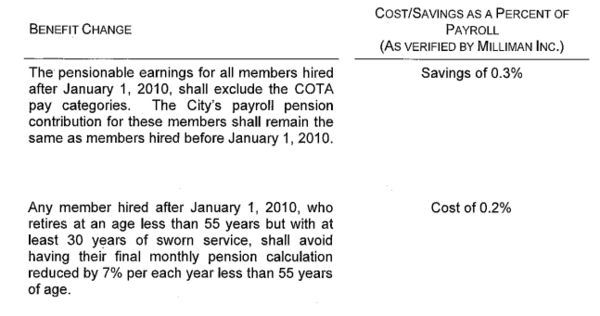

Those savings and cash contributions, as a package, are:

Other pension changes (detailed in other areas of Article 34) that are effective upon the

legal execution of the labor agreements are:

Upon the legal execution of this agreement, the City shall, contribute annually a cash

contribution of payroll equal to the following:

The City's contribution will be paid no later then the first payroll period of 2012. The City

shall pay all interest on any delayed contributions to the pension system as determined

by the pension board's actuary.

The City's monetary contributions toward this unfunded actuarial liability shall not be

considered pension contributions in any litigation before the Commission of Industrial

Relations or used as a basis for comparison with member contributions for any purposes

under the Nebraska Industrial Relations Act. The parties agree that this limitation is not

intended in any way to waive the requirements and language of City of Omaha Section 6.09 and that neither party will advance such an argument in any dispute or litigation that

should ever arise between the parties.

Section 4: RETIREMENT BENEFITS

Pensions will be calculated using the applicable percent of the member's pay from the

highest consecutive 26 bi-weekly payroll periods within the final 130 pay periods of

service, unless changed below.

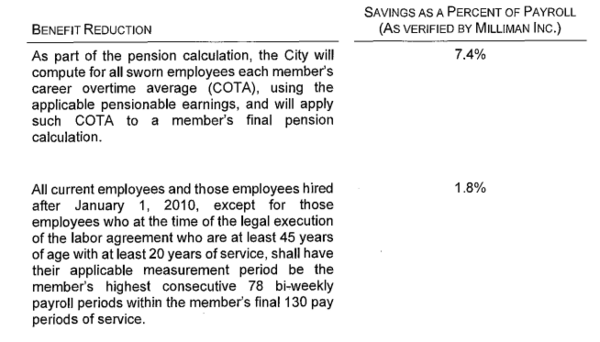

Effective September 19, 2010, as part of the pension calculation, the City will compute

each retiring member's career overtime average (COTA). Career overtime average

(COTA) is calculated as follows: each hour an employee earns for overtime (e.g. court

time, call-in pay, comp time paid as cash, or any other methods the City has paid such

employee for "overtime" hours and for which a member has paid a pension contribution)

shall be computed back to their date of hire or 1991 {whichever is later) and divided by

the number of years the employee has served after December 31, 1990, thus arriving at

his career overtime average, which shall be included in the employee's pension

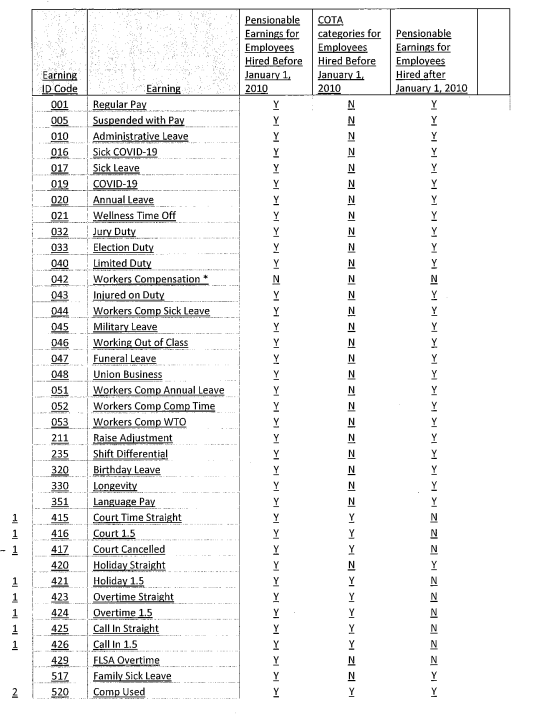

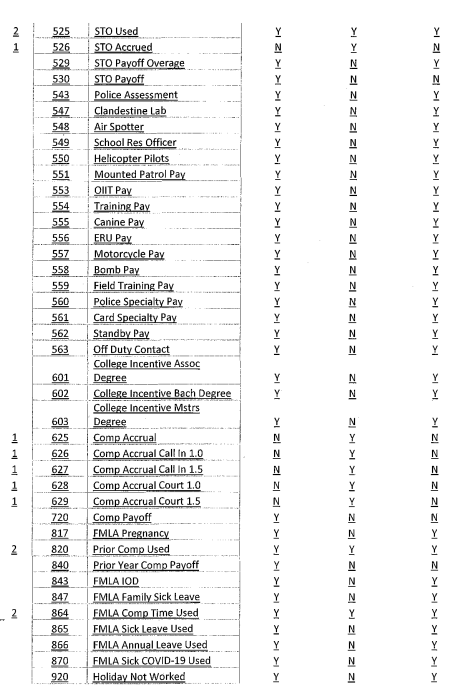

calculation. A listing of a member's pensionable earnings and COTA pay categories is

listed in Appendix "C".

Pensionable earnings are used to determine the member's final monthly pension benefits

and shall be equal to the sum of the member's COTA multiplied by the member's average

hourly pay rate plus the member's pensionable pay, pursuant to Chapter 22, (except for

any "overtime" worked or paid in the applicable period). Both the member's hourly pay

rate and pensionable pay shall be averaged over their highest applicable measurement

period.

The intent of the COTA is to ensure that each employee's final pensionable year(s) are

representative of that individual employee's career overtime earnings. Using a member's

COTA eliminates a member's ability to "spike" their pension.

The pension benefit is based upon the ordinances in effect at the time employment is

severed or terminated (i.e., pensions are calculated using the method and percentage in

effect at the time the member leaves CITY employment). Changes to the pension benefit

enacted after the date a member leaves CITY service shall not be applicable to such

member.

In order to insure that pension eligible members may make an informed retirement choice,

each such member shall have from the later of (1) the date this agreement becomes

legally effective; or (2) twenty (20) calendar days after the City provides the final COTA

calculation to the Association and member, to determine if they wish to retire under the

pension benefits existing prior to this labor agreement. If a pension eligible member

chooses to retire under the pension benefits existing prior to this labor agreement, they

must submit their retirement paperwork to the City of Omaha Human Resources

Department and work their last day of actual employment on or before the date calculated

pursuant to the previous sentence. This provision is intended to insure that an employee

who makes a decision to retire in that time period will receive the pension benefits existing prior to this labor agreement and not in this labor agreement.

The pensionable earnings for all members hired after January 1, 2010, shall exclude the

COTA pay categories. The City's payroll pension contribution for these members shall

remain the same as members hired before January 1, 2010.

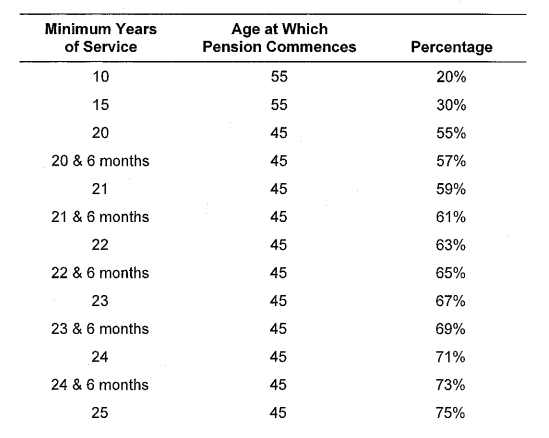

Any member who is at least 45 years old and has at least 20 years of service may retire

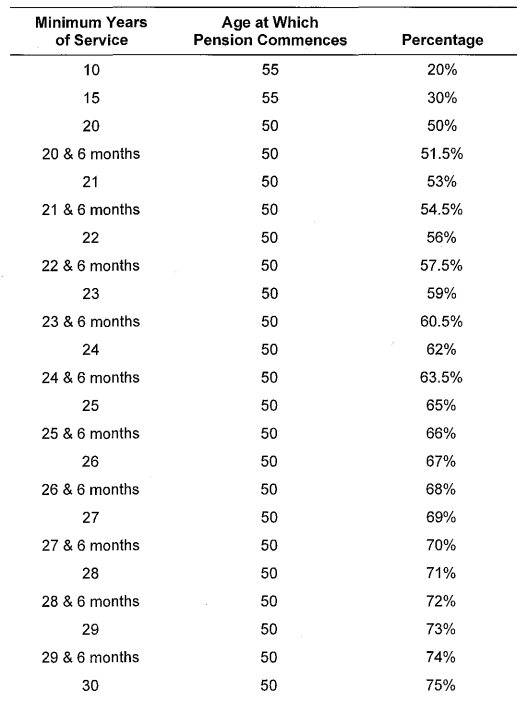

with a normal service retirement according to the chart below.

As of September 19, 2010, any member with at least 20 years of service and who then

subsequently reaches the requisite years of service and age for their pension to

commence, may retire with a normal service retirement according to the chart below.

However, the applicable measurement period for this group is the member's highest

consecutive 78 bi-weekly payroll periods within the member's final 130 pay periods of

service.

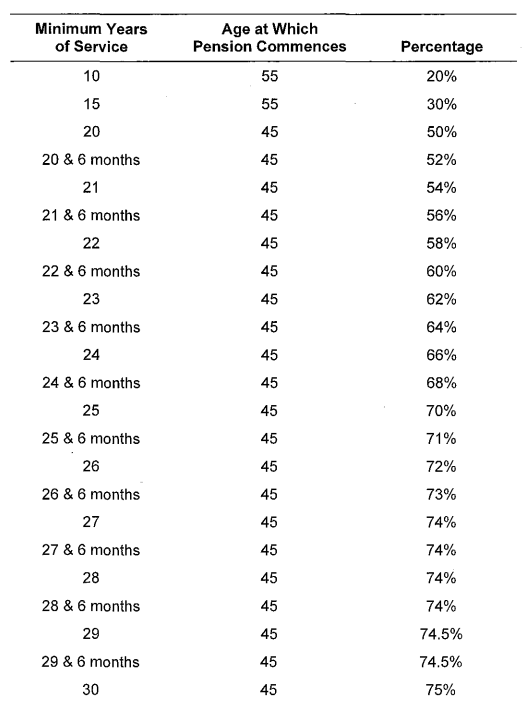

As of September 19, 2010, any member with less than 20 years of service and who then

subsequently reaches the requisite years of service and age for their pension to

commence, may retire with a normal service retirement according to the chart below.

However, the applicable measurement period for this group is the member's highest

consecutive 78 bi-weekly payroll periods within the member's final 130 pay periods of

service.

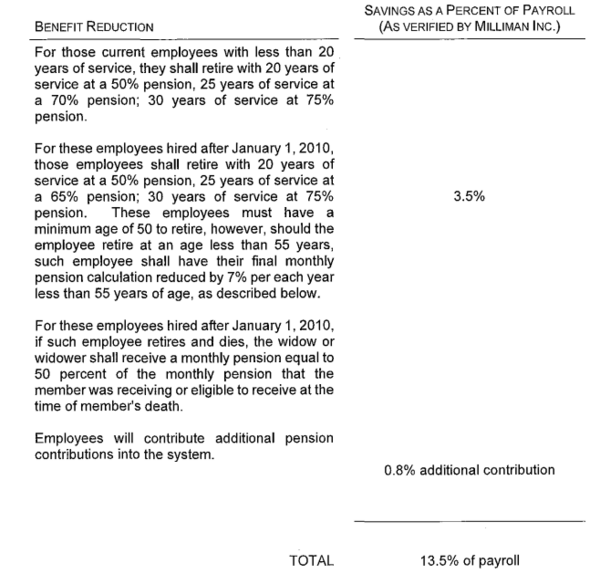

Any member hired after January 1, 2010, who then subsequently reaches the requisite

years of service and age for their pension to commence, may retire with a normal service

retirement according to the chart below. The pensions for these members will be

calculated using the applicable percent of the member's pay from the highest consecutive

78 bi-weekly payroll periods within the member's final 130 pay periods of service (the

member's annual figure will be determined by taking the highest 78 bi-weekly payroll periods and dividing by 3 then apply the applicable percent of the member's pay). Any of

these members who retire under the chart below at an age less than 55 years with less

than 30 years of sworn service, shall have their final monthly pension calculation, as

shown in the chart below, reduced by 7% per each year less than 55 years of age. For

example, if an employee is 50 years old and has 26 years of service, then he may retire

according to the chart below, however, their final monthly pension calculation will be

reduced by 35% (7% x 5 years less than 55 years old).

Section 5: DEFERRED RETIREMENT OPTION PROGRAM - "DROP"

Effective September 19, 2010, the parties agree to implement a cost-neutral DROP

option.

Eligibility for this option is as follows:

- Current members with at least 20 years of service as of September 19, 201 O are eligible to participate in the DROP option at 22.5 years of service, if they are at least 45 years of age.

- All other pension members, who have reached minimum pension age, may participate in the DROP option at 25 years of service.

The wages of the DROP participant shall include all wages normally earned by a similarly

situated sworn employee and the DROP participant shall continue to pay pension

contributions into the system as if they were an active employee. The City will also

contribute its pension contribution for such DROP participant into the pension system. A

DROP participant shall be considered an active employee for all purposes except the

following: the DROP participant is not eligible for early deferred retirement, for promotion,

for longevity pay, for tuition reimbursement, and for either service or non-service

connected disability retirement (except as provided in the section entitled "Service

connected disability" below).

The parties intend that the DROP option is designed to be at least cost-neutral to the

pension plan. The Board of Trustees of the Police pension system and the actuaries will

monitor the DROP option each year and will report its conclusions to the City and the

ASSOCIATION.

In designing a cost-neutral DROP option, the parties agree that the DROP option will

include the following features:

- 1. The member must make an irrevocable election to participate in DROP for the DROP election period. A member who makes the irrevocable election shall be called a DROP participant. A member shall apply for DROP on a form prescribed by the Pension Board and shall agree to sever employment at the end of the DROP election period. The DROP election period shall be for a minimum for three years and a maximum for 5 years. A DROP participant who does not complete the DROP election period shall be ineligible for the payment of the portion of his/her DROP account balance that represents the interest credit with respect to the DROP election period. The above shall not apply ifthe DROP participant is required to sever employment because of the mandatory retirement age, does not complete the DROP election period due to hardship or disability as described below, or the DROP participant dies.

- 2. During the DROP election period, an amount equal to the retirement benefit that the DROP participant would have received if the DROP participant had retired on the day before his or her DROP election period shall be credited to the DROP participant's DROP account. The DROP account is a notional account in the pension plan.

- 3. The member's DROP account shall be credited annually with interest as determined by the Pension Board, in consultation with the actuary, in the range of 0 to 7%. The credit rate shall be determined after the close of the calendar year, with respect to the calendar year. For example, the interest crediting rate for 2010 shall be determined in the first quarter of 2011 and shall be credited to the DROP account as of December 31, 2010. The credited interest rate is intended to be cost-neutral. In order to further this goal, interest may only be crediting in a year in which rate of return on the investments of the pension plan reach the assumed investment rate of return (on a market value basis) and with respect to such a year the interest credited may not exceed 50% of the actual rate of return. For example, if the assumed investment rate of return is 8%, interest may only be credited with respect to 2010 if the pension fund earns 8% in 2010; and in that event, the DROP interest credited for 2010 cannot exceed 4%.

- 4. It is understood that the awarding of interest into an employee's DROP account is at the complete discretion of the Pension Board within the parameters set above. The Pension Board in the exercise of its discretion shall offset any negative balances experienced by such system during the DROP period of prior years.

- 5. Upon actual retirement at the end of the DROP election period or at mandatory retirement age (whichever is earlier}, a DROP participant is entitled to receive his/her DROP account balance and to begin receipt of his/her retirement benefit that was calculated as of the day before his/her DROP election period.

- 6. The DROP account balance shall be distributed in a lump sum with the first monthly retirement benefit after severance from employment. Any additional interest shall be distributed when determined.

- 7. The DROP account balance (and any additional interest) shall be treated as an eligible rollover distribution to the extent permitted by law.

Notwithstanding paragraph 1 above that requires an irrevocable election to complete the

DROP election period, a member may withdraw, without penalty, from DROP prior to the

expiration of the member's DROP election period for the following reasons, subject to the

approval of the Pension Board:

- a. Hardship/Non-Service Connected Disability: A DROP participant may apply to withdraw from the DROP option in the case of unexpected, life-changing situations, including the death of a spouse and terminal illness of a spouse or child, or upon the granting by the Pension Board of a non-service connected disability for an injury suffered during the DROP period. A DROP participant whose application to withdraw on account of either hardship or a non-service connected disability approved by the Pension Board shall receive, as of the date of his/her severance from employment, his/her DROP account balance and shall commence his/her retirement benefit calculated as of the day before his/her DROP election period.

- b. Service connected disability: A DROP participant who is granted a service connected disability for injuries suffered during the DROP period shall be entitled to withdraw the funds in his DROP account, however, he shall receive no additional sums as disability payments (he maintains the same pension that he had been entitled to upon entering the DROP option). Such employee's medical bills shall be paid under contract provisions for a normal service retirement, not under the provisions for a service-connected disability. However, such employee shall receive workers compensation benefits to which may be entitled.

If an employee is injured during the DROP period and is assigned light duty, the provisions

of Article 25 shall be followed and may not be waived by the parties.

In the event that a DROP participant dies during a DROP election period, the DROP

participant's DROP account balance shall be paid to his/her spouse or children or estate,

pursuant to other provisions of this contract and the applicable pension rules.

The Pension Board may adopt administrative policies, procedures, and forms to

implement this DROP option.

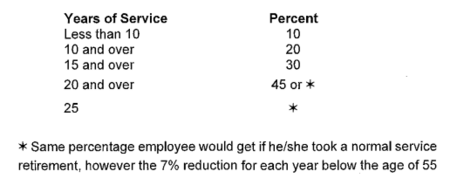

Section 6: RETIREMENT - INJURY - ILLNESS

Any member of the Police and Fire Retirement System, covered by this Agreement, who

should sustain an injury or illness not in the line of duty and as a result becomes unfit for

active duty shall receive the following percentage of the member's average final monthly

compensation.

- years shall not apply.

Pension payments for service-connected disability retirements shall be reduced by the

dollar amount equivalent to any worker's compensation benefits paid to the retiree times

the percentage contributed to the System by the CITY. Pursuant to Omaha Municipal

Code Section 22-78, a member of the System who receives a service connected disability

retirement is entitled to have the medically necessary expenses for the injury or sickness

for which he/she receives such disability pension, paid by the System. CITY and

ASSOCIATION have agreed that as to members of the System which are represented by

the ASSOCIATION that the System is no longer responsible for any medical expenses

that might be incurred by an individual who receives a service-connected disability

pension. The City shall be responsible for work related medical expenses if it has

accepted compensability or has been deemed to have liability for the work related injury

and remains obligated to pay the medical expenses pursuant to its statutory obligations

under the Nebraska Workers Compensation Act.

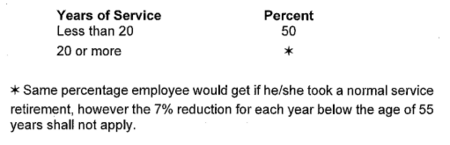

Any member of the Police and Fire Retirement System, covered by this Agreement, who

should sustain an injury or illness in the line of duty and as a result becomes unfit for

active duty shall receive the following percentage of the member's average final monthly

compensation.

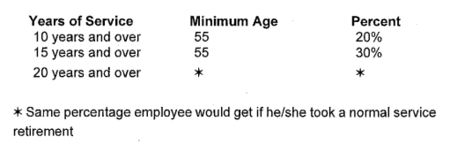

Section 7: DEFERRED RETIREMENT

Any member of the Police and Fire Retirement System whose employment with the City

shall be severed or terminated prior to attaining eligibility for a normal service retirement

but who has served at least ten (10) years, can elect to leave the contribution in the

system and thereby shall be eligible for a deferred service retirement pension, computed

on the member's years of service credit and average final monthly compensation as of

the date of termination as follows:

An employee who "vests" his/her pension rights pursuant to the above, shall not thereafter

be entitled to any benefits upon commencement of pension provided for retirees

elsewhere in this Agreement (e.g. health insurance).

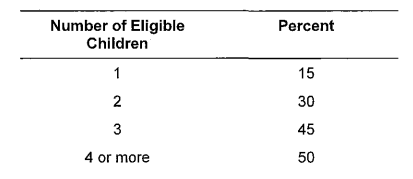

Section 8: CHILDREN'S PENSION

A monthly pension shall be payable to each unmarried child under the age of eighteen

(18) of a deceased member or retiree. The monthly pension shall be based on the

deceased's total annual compensation from the member's designated measure period,

described above.

The percent of the deceased's annual total compensation from the highest consecutive

26 bi-weekly payroll periods within the last five (5) years of service shall be divided equally

among eligible children. The pension for each child shall be paid monthly to age 18 or

death or marriage, whichever occurs first. In the event any child is totally disabled at the

time of death of a member or retiree and has been so totally disabled or totally dependent

for support since prior to age 18, whether or not such child was under the age of 18 at

the time of such death, such monthly pension benefit shall be paid until the cessation of

total disability or dependency for support, whichever occurs first. Any payment made

under the section, regardless of whether due or hereinafter to become due, at the option

of the CITY, may be paid to any parent or guardian of the child or children for his/her or

their care, either method of payment being in full satisfaction of the requirements of this

section.

Section 9: WIDOW OR WIDOWER

Beginning March 6, 2003, a monthly pension shall be payable to a widow or widower of

an active or retired member of the Police and Fire Retirement System as long as the

widow/widower was legally married to the deceased member at least one full year prior

to the member's death. As of the date of ratification of this agreement, the definition of

widow or widower is changed to reflect and only recognize the widow/widower as

someone who was legally married to an active member at time of death or a retired

member on or before their date of retirement. Benefits will continue for the widow/widower

until death unless he or she shall remarry. If widow/widower should remarry all rights to

such pension shall be terminated forever. That pension shall be as follows:

- A. If an active member with less than twenty-five (25) years of service dies from causes connected with service, the widow or widower shall be paid a monthly pension equal to 49 percent of the deceased member's average final monthly compensation. If an active member with twenty-five (25) years of service or more dies from causes connected with service, the widow will receive 69 percent of the deceased member's average final monthly compensation.

- In the event such active member shall die as a result of injuries or illness sustained in the line of duty and:

- widow or widower was not legally married to said member for a full year, or

- if the widow/widower should remarry after commencing benefits under this section, or

- if spouse of deceased member predeceased him or her,

- then benefits normally payable under this Section to a widow/widower shall be placed in a trust fund for the education of the minor child(ren), if any, of the deceased member, until such child(ren) attain age 18, marry, or die. Said benefit will be paid into the trust equally for each child(ren).

- B. If an active member dies from causes not connected with service, the widow or widower shall be paid a monthly pension as follows:

- If the deceased member had at least three (3) years and up to ten (10) years service credit under the Police and Fire Pension System, such member's widow or widower shall receive a pension equal to 35 percent of the deceased active member's average final monthly compensation. In addition, for a deceased member who has over ten (10) years of service, the widow or widower will be compensated an additional 1.4% for each additional year of service up to the deceased member having twenty (20) years of service. Therefore, a deceased member having twenty (20) years of service credit will entitle his/her widow to receive 49 percent of his/her average final monthly compensation. A widow of a member who dies having twenty (20) years of service credit up to and including twenty-four (24) years of service credit will be entitled to receive 49 percent of his/her average final monthly compensation.

- If the deceased member had 25 or more years of service, such member's widow/widower shall receive a pension equal to 69 percent of the deceased member's average final monthly compensation.

If a retired employee dies, the widow or widower shall receive a monthly pension equal

to 75 percent of the monthly pension that the member was receiving or eligible to receive

at the time of member's death. For employees hired after January 1, 2010, this benefit is

reduced to 50 percent.

Section 10: REFUND OF CONTRIBUTIONS

Refunds of accumulated contributions to the System shall be made from the System as follows:

- (1) Upon approval by the System's Board of an application for refund of contributions when employment is terminated and the member is not eligible for retirement, full refund of member contributions with interest shall be made.

- (2) Upon approval by the System's Board of a former member's application for refund of contributions when the former member had elected deferred service retirement and is not yet eligible to receive pension payments, full refund of employee contributions with interest shall be made.

- (3) Upon the death of an employee or retiree where no widow or widower or children are left surviving who are entitled to pension benefits, a lump sum refund equal to the employee's accumulated contributions, or the retiree's balance of accumulated contributions in excess of total pension payments made to the retiree, or $500.00, whichever is greater, shall be made to the designated beneficiary or heirs at law.

- (4) Upon cessation of pension benefits to a widow or widower or child(ren), a lump sum payment equal to the balance, if any, of the deceased's accumulated contributions in excess of the total amount of pension payments made to the retiree, widow, widower, and child(ren) shall be made to the widow or widower or child who is last to cease receiving a pension benefit from the System. Upon the payment of such lump sum amount, if any, the widow or widower and children shall have no future rights and privileges under the System.

- (5) Such refund as provided herein shall forever forfeit any and all rights to pension benefits from the System.

Section 11: DEATH BENEFITS

Within three (3) business days from the date the Human Resources Department receives appropriate certification of a member's or retiree's death, a lump sum death benefit shall be paid to the deceased's designated beneficiary.

- A. Upon the death of a member where a widow or widower or child(ren) are left surviving who are eligible for pension benefits, a lump sum death benefit equal to one year's pay plan salary shall be made. One year's pay plan salary shall be based on the top step pay rate for Police Officer from the current pay plan.

- B. Upon the death of a retiree where a widow or widower or child(ren) are left surviving who are eligible for pension benefits, a lump sum death benefit of $1,000.00 shall be made. The lump sum death benefit shall be charged against and deducted from the accumulated contributions of the deceased retiree.

- C. Upon the death of a member or retiree where there is no widow or widower or child(ren) surviving who are eligible for pension benefits, a lump sum equal to the deceased member's accumulated contributions, if any, or $500.00, whichever is greater, shall be made to the designated beneficiary.

Section 12: EARLY DEFERRED RETIREMENT OPTION

Any sworn police employee who is eligible for a normal service retirement within ten (10) months, may apply for, and be granted, an early, deferred retirement according to the following rules:

- (1) Such employee must sign a binding agreement to retire on a date certain within the ensuing twenty (20) pay periods ("mandatory retirement date").

- (2) Additionally, such employee must declare a "binding separation date" (last day the employee will perform job duties). Employee must elect an "early deferred retirement" (time between the binding separation date and the mandatory retirement date) up to a maximum of twenty (20) pay periods.

- (3) It is the employee's obligation, with the assistance of the Human Resources and Finance Department, to determine the employee's "payout bank" (the dollar amount the employee is entitled to in sick and annual leave payoff upon retirement pursuant to other Articles of this agreement). In order to be eligible for this early deferred retirement option, an employee must have a sufficient "payout bank" to cover all "early deferred retirement" time and any service years assessment salary reduction obligation (if applicable; see Article 37, Section 9). From the time between the binding separation date and the mandatory retirement date, the employee shall be paid his/her regular salary by reducing the balance of the employee's payout bank.

- (4) When an employee is on "early deferred retirement" time, he/she shall be assigned to a "5-2" schedule (Monday through Friday, excluding weekends, on the "B" Shift). Such employee shall be entitled to receive an hourly rate equal to the hourly pay schedule rate the employee was receiving immediately before the employee elected to go on "early deferred retirement" time. This means that from the time between the binding separation date and the mandatory retirement date, the employee shall be paid his/her regular salary by reducing the balance of the employee's payout bank.

- The City shall pay to the employee any college incentive pay and longevity pay that the employee was being paid even though the employee is not performing any work for the City. Should a holiday occur on the employee's "5-2" schedule, or if the employee has a birthday during the "early deferred retirement" time, the employee shall be paid for the respective Holiday Leave and Birthday Leave (both leaves equivalent to 8 hours pay at regular rate of pay) by the City. If the employee is required to attend court or other tribunal sessions during his/her "early deferred retirement" time, no additional pay shall accrue for such attendance during what would have been the employee's normal working hours (Monday through Friday, 8:00 A.M. to 4:00 P.M.). If, however, an employee is required to attend such tribunals outside of his/her normal working hours such time shall be compensable as court time, pursuant to Article 19, or overtime, pursuant to Article 21, depending on the circumstances. If an employee is "called in" to actually perform services during this "early deferred retirement" time, he/she shall be compensated according to Article 19, Section 2 ("call in")

- (5) The Human Resources and Finance Department shall calculate the binding separation date and the mandatory retirement date, as set forth above, and shall prepare such agreements for the employee's signature. The Police and Fire Pension Board must approve both such signed agreements prior to becoming effective.

- (6) During the "early deferred retirement" period, an employee shall accrue sick and annual leave pursuant to other Articles of this agreement. At the end of the "early deferred retirement" period, the employee will be paid for accumulated sick and annual leave balances in cash upon retirement pursuant to other provisions of this labor agreement.

- (7) The Human Resources and Finance Departments shall issue, if necessary, reasonable rules and regulations to administer and regulate this early, deferred retirement option. The rules and regulations shall be implemented upon the mutual consent of the parties.

- (8) An employee electing the Early Deferred Retirement Option may not participate in the DROP option.

Section 13: PENSION SUPPLEMENT

The CITY will provide a pension supplement of three percent (3%) or fifty dollars ($50)

per month, whichever amount is less, beginning in the thirty-seventh (37th) month of

retirement. This supplement shall continue on an annual basis with increases effective

on the pension anniversary date. For all employees that retire the first pay period after

March 6, 2003, the benefits will begin on the thirteen (13th) month of retirement. The cost

of changing of this benefit from 37 months to 13 months has been determined by the

actuary firm of Milliman & Robertson, Inc. to be 0.36% of payroll. The amount shall be

paid as follows:

- Beginning the first pay period after March 6, 2003, the City shall pay one-half of the cost (0.18%) into the pension .system or trust account for the duration of this agreement.

- Beginning the first pay period after March 6, 2003, employees shall pay 0.18% into the pension system or trust account for the duration of this agreement.

The above method of payment has been determined by Milliman & Robertson, Inc. to be

sufficient to fully fund this benefit increase.

For any member participating in the DROP option, their pension supplements shall

continue on an annual basis with increases effective on the member's pension

anniversary date.

Section 14: "QUALIFIED PLAN"

The CITY shall take such action as is necessary so that the System will continue to be a

plan qualified under applicable Internal Revenue Service rules, which status will allow the

employee to pay his portion of the pension contribution before federal income tax is

withheld.

Section 15:

Any employee who has any of his/her highest twenty-six (26) pay periods, for the

purposes of calculation of pension under this labor agreement, fall within payroll years

2004, 2005, or 2006 shall receive an additional 3.5% added on to his/her gross wages for

any of those twenty-six pay periods upon which his/her pension is calculated. It is

understood that this money will be paid as wages to each employee for any time (in 2004,

2005, or 2006) that is used to calculate his/her highest twenty-six pay periods. This

means that, from the gross amount, normal wage deductions will be taken, including

pension contribution, and that the pension contribution will be paid into the pension

system.

Any employee whose highest twenty-six (26) pay periods, for the purposes of pension

calculation, include any time period which falls within payroll years 2004 or 2005; and

whose pension calculation is reduced because of the "special time off bank" obligation, in

Article 20, Section 9, shall have the following apply:

- Those holidays in which the employee worked and would have received compensation in wages paid at the time earned, may be added at the employee's discretion to their highest 26 pay period for the purposes of calculation of his/her pension.

- This applies only to those holidays actually worked and not those holidays an employee takes holiday leave.

The intent of this provision is to not have the "special time off' bank obligation (Article 20,

Section 9) reduce the highest 26 pay period amount for the purposes of calculation of

pension. However, if an employee cashes out, any or all of his/her time off bank in order

to enhance the highest 26 pay period amount for purposes of calculation of pension, the

employee shall have the option of choosing whichever calculation would be more

beneficial to the employee.

Section 16: SPLITTING OF THE POLICE AND FIRE RETIREMENT SYSTEM

The City has been informed by the ASSOCIATION, and also by the Professional Firefighters Association, Local 385, that they desire to change the current pension system by dividing it. into two separate systems; one a Police pension system and one a Fire pension system. While nothing has been agreed to between the parties, it is anticipated that the following guidelines could govern such separation:

- A. The two pension systems would segregate the funds of each party, however, the funds could be co-mingled for investment purposes only.

- B. The actuary firm of Milliman, USA has been the actuary firm for the pension system for some time and could be responsible for aiding and assisting the parties in separating the system, including the determination of how to separate the funds.

- C. In order to effectuate the contemplated separation of the pension system, each ASSOCIATION individually must vote in favor of the separation by a majority vote of those voting on the issue.

- The City agrees to provide any information necessary to the ASSOCIATION or to Milliman, USA, so that such separation may be accomplished. Additionally, the City will agree to such separation as long as the pension system pays the entire cost for such separation and the separation does not result in any increased contributions to either the City or the employee.

- D. The new Police Pension Board, created by this separation of the current sy.stem, would consist of the following members: two (2) sworn Police employees elected similar to the election of current members; the City Human Resources Director; the City Finance Director; a member of the City Council selected by Council procedures; and two (2) appointments by the Mayor. Of these seven (7) people, one (1) member must be a woman and one (1) member must be a member of a minority group (other than being a woman).

- E. The City and the Police ASSOCIATION agree to explore a base wage percentage payout system in determining pension amounts. The Police ASSOCIATION will be responsible for any and all costs for determining the cost of such change. Any change to a base wage percentage payout system will require mutual agreement of the parties.[2]

|

”

|