Help us improve in just 2 minutes—share your thoughts in our reader survey.

Texas Proposition 7, Increase Distributions to School Fund Amendment (2019)

| Texas Proposition 7 | |

|---|---|

| |

| Election date November 5, 2019 | |

| Topic State and local government budgets, spending and finance and Education | |

| Status | |

| Type Constitutional amendment | Origin State legislature |

Texas Proposition 7, the Increase Distributions to School Fund Amendment, was on the ballot in Texas as a legislatively referred constitutional amendment on November 5, 2019. The measure was approved.

| A "yes" vote supported this amendment to allow the General Land Office and State Board of Education to each transfer $600 million from the Permanent School Fund's lands and properties proceeds to the Available School Fund each year. |

| A "no" vote opposed this amendment, thereby keeping the amount of revenue that the General Land Office is permitted to transfer from the Permanent School Fund's lands and properties proceeds to the Available School Fund at $300 million per year and excluding the State Board of Education from making transfers from the fund's lands and properties proceeds. |

Election results

|

Texas Proposition 7 |

||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| 1,459,578 | 74.12% | |||

| No | 509,590 | 25.88% | ||

Overview

What are the Permanent School Fund and Available School Fund?

The Permanent School Fund (PSF) was created in 1854 for the purpose of investing revenue from state-owned lands, such as leasing mineral rights to oil and gas companies and grazing rights to ranchers. The Texas General Land Office (GLO) manages state-owned lands, transferring the revenue from activities on the lands to the State Board of Education (SBE), which invests the revenue. Some of the interest revenue, but not the principal, is allocated to the Available School Fund (ASF), which then distributes the funding to school districts throughout the state each year.

In 2011, voters approved Proposition 6, which gave the GLO the power to direct up to $300 million in proceeds from activities on state-owned lands to the ASF each year.

What did Proposition 7 change about education spending?

Proposition 7 increased the maximum amount of revenue the GLO can direct to the ASF each year from $300 million to $600 million. The ballot measure allowed the SBE to direct up to $600 million per year from land-related proceeds.[1]

Text of measure

Ballot title

The ballot title was as follows:[1]

| “ |

The constitutional amendment allowing increased distributions to the available school fund.[2] |

” |

Constitutional changes

- See also: Article 7, Texas Constitution

The measure amended Section 5(g) of Article 7 of the Texas Constitution. The following underlined text was added and struck-through text was deleted:[1]

(g) Notwithstanding any other provision of this constitution or of a statute, the State Board of Education, the General Land Office, or an another entity other than the State Board of Education that has responsibility for the management of revenues derived from permanent school fund land or other properties may, in its sole discretion and in addition to other distributions authorized under this constitution or a statute, distribute to the available school fund each year revenue derived during that year from the land or properties, not to exceed $300 $600 million by each entity each year.[2]

Readability score

- See also: Ballot measure readability scores, 2019

| Using the Flesch-Kincaid Grade Level (FKGL and Flesch Reading Ease (FRE) formulas, Ballotpedia scored the readability of the ballot title and summary for this measure. Readability scores are designed to indicate the reading difficulty of text. The Flesch-Kincaid formulas account for the number of words, syllables, and sentences in a text; they do not account for the difficulty of the ideas in the text. The Texas State Legislature wrote the ballot language for this measure.

|

Support

Rep. Dan Huberty (R-127), Sen. Larry Taylor (R-11), and Sen. Royce West (D-23) sponsored the constitutional amendment in the state legislature.[3]

Arguments

The League of Women Voters of Texas published arguments for and arguments against the ballot measure. The following is the argument in support:[4]

| “ |

|

” |

Opposition

Arguments

The League of Women Voters of Texas published arguments for and arguments against the ballot measure. The following is the argument in opposition:[4]

| “ |

|

” |

Campaign finance

| Total campaign contributions: | |

| Support: | $0.00 |

| Opposition: | $0.00 |

There were no ballot measure committees registered in support of the measure or in opposition to the measure.[5]

Media editorials

- See also: 2019 ballot measure media endorsements

Support

- Austin American-Statesman: “YES to allow two agencies — the State Land Board and the State Board of Education — to put more of their investment income into a fund that supports school districts.”[6]

- The Austin Chronicle: “This simply raises the constitutional cap on annual disbursements from the state's Permanent School Fund from $300 million to $600 million – money that's already been included in the 2020-21 budget as part of the school-finance package adopted this year. Why does this cap exist?”[7]

- Corpus Christi Caller-Times: “Constitutionally mandated inflation indexing might be a more permanent solution. But for now this will have to do. Texas has been underspending on education for years.”[8]

- The Dallas Morning News: “School funding in Texas is complicated. It includes one mechanism to fund public schools with proceeds from oil and gas production and other investments in public land. That fund has performed like gangbusters with the oil boom, but school children haven’t shared in the bounty because the state constitution caps the amount that can be transferred from the Public School Fund, which manages the land assets, into the Available School Fund, which distributes money to school districts.”[9]

- The Eagle: “In a complicated formula, increasing the amount of money in the Available School Fund would mean more money to local school districts and could — could — mean lower property taxes, although not significantly lower.”[10]

- Fort Worth Star-Telegram: “The amendment would raise that limit to $600 million. State investment managers and accountants, overseen by elected officials, can be trusted to make prudent withdrawals.”[11]

- Houston Chronicle: “The change would raise the cap on distributions from $300 million to $600 million — which could mean more money for schools and potentially less pressure on local property taxes.”[12][13]

- Longview News-Journal: “The current cap is an arbitrary one, and increasing the amount available to schools could reduce the need for raising local property taxes and schools seeking more funds from other sources.”[14]

- San Antonio Express-News: "Public education is still in need of dedicated permanent funding."[15]

- Waco Tribune-Herald: “This is in-the-weeds, procedural policy that nonetheless boosts educational funding. While we expect our state legislators to spend more time scrutinizing the School Land Board’s investments, the amendment offers a way to increase funding for public education without raising taxes.”[16]

Opposition

Ballotpedia had not identified media editorial boards in opposition to the ballot measure. If you are aware of a media editorial board position that is not listed below, please email the editorial link to editor@ballotpedia.org.

Overview of media editorials

The following table provides an overview of the positions that media editorial boards had taken on the Texas 2019 ballot measures:

Background

Texas Permanent School Fund

As of 2019, the Texas Permanent School Fund (PSF) was a state investment fund created in 1854. The PSF's principal came from leasing state-owned lands, including leasing mineral rights to oil and gas companies, grazing rights to ranchers, land to wind farms, and others. The Texas State Board of Education (SBE) and General Land Office (GLO) managed the PSF. The SBE manages the PSF's financial assets. The GLO manages the management, sale, and leasing of PSF land. The revenue from leasing state-owned lands was invested in bonds and equities, such as corporate stocks. Some of the interest revenue, but not the principal, was allocated to education funds, including the Available School Fund (ASF), each year.[17]

As of August 31, 2018, the PSF had a balance of $44.07 billion, which was a net increase of $2.65 million from the previous year after transfers to other funds.[18]

Texas Available School Fund

The Texas Available School Fund (ASF) was established to provide state revenue for school districts and charter schools on a per-student basis.[19] As of 2019, state law required the ASF to receive revenue from the following:[20]

- State Board of Education's (SBE) allocation from the permanent school fund, which is an amount not to exceed 6 percent of the average market value of the permanent school fund for the previous 16 state fiscal quarters;

- General Land Office's (GLO) allocation from the permanent school fund, which is an amount not to exceed $300 million;

- 25 percent of the revenue from state occupation taxes;

- 25 percent of the revenue from state gasoline and special fuels excise taxes; and

- other legislative appropriations.

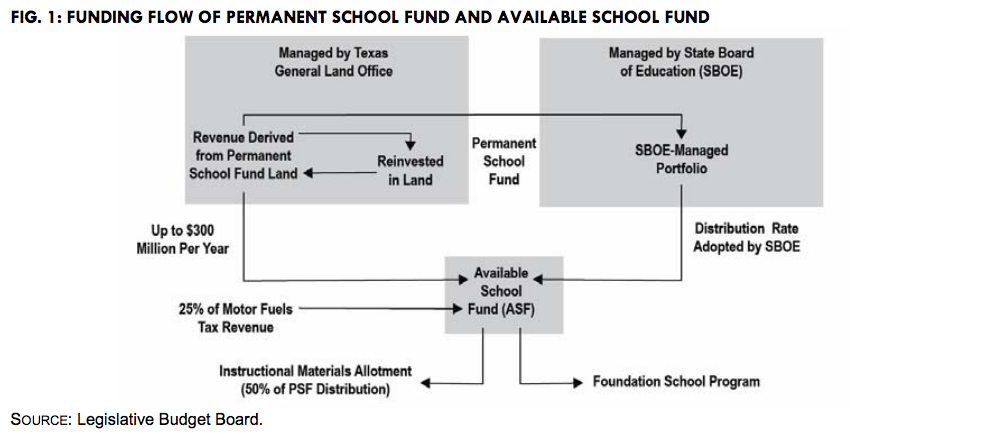

The Texas Legislative Budget Board produced the following flowchart to illustrate the movement of revenue from the Permanent School Fund to the Available School Fund:[21]

Referred amendments on the ballot

- See also: List of Texas ballot measures

The following statistics are based on ballot measures between 1995 and 2018 in Texas:

- Ballots featured 159 constitutional amendments.

- An average of 13 measures appeared on odd-year statewide ballots.

- The number of ballot measures on odd-year statewide ballots ranged from 7 to 22.

- Voters approved 91 percent (145 of 159) and rejected 9 percent (14 of 159) of the constitutional amendments.

| Legislatively-referred constitutional amendments, 1995-2018 | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Total number | Approved | Percent approved | Defeated | Percent defeated | Odd-year average | Odd-year median | Odd-year minimum | Odd-year maximum | |

| 159 | 145 | 91.2% | 14 | 8.8% | 13.1 | 12.5 | 7 | 22 | |

In 2019, 216 constitutional amendments had been filed in the Texas State Legislature. Legislators were permitted to file constitutional amendments through March 8, 2019, unless permission was given to introduce an amendment after the deadline. Between 2009 and 2017, an average of 187 constitutional amendments were filed during regular legislative sessions. The state legislature approved an average of nine constitutional amendments during regular legislative sessions. Therefore, the average rate of certification during regular legislative sessions was 4.7 percent. In 2019, 10 of the 216 proposed constitutional amendments were certified for the ballot, meaning the rate of certification was 4.6 percent.

Path to the ballot

- See also: Amending the Texas Constitution

In Texas, a two-thirds vote is needed in each chamber of the Texas State Legislature to refer a constitutional amendment to the ballot for voter consideration.

The constitutional amendment was introduced into the state legislature as House Joint Resolution 151 (HJR 151) on March 8, 2019.[3]

On April 24, 2019, the state House approved HJR 151, with 139 members supporting the amendment, four members opposing the amendment, and seven members not voting. At least 100 votes were needed. On May 19, 2019, the state Senate approved HJR 151 in a unanimous vote.[3]

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

How to cast a vote

- See also: Voting in Texas

Poll times

In Texas, all polling places are open from 7:00 a.m. to 7:00 p.m. local time. Texas is divided between the Central and Mountain time zones. An individual who is in line at the time polls close must be allowed to vote.[22]

Registration Texas

- Check your voter registration status here.

To register to vote in Texas, an applicant must be a United States citizen, a resident of the county in which he or she is registering, and at least 17 years and 10 months old.[23]

The deadline to register to vote is 30 days before the election. Prospective voters can request a postage-paid voter registration form online or complete the form online and return it to the county voter registrar. Applications are also available at a variety of locations including the county voter registrar’s office, the secretary of state’s office, libraries, and high schools. Voter registration certificates are mailed to newly registered voters.[24]

Automatic registration

Texas does not practice automatic voter registration.[25]

Online registration

- See also: Online voter registration

Texas does not permit online voter registration.[25]

Same-day registration

Texas does not allow same-day voter registration.[25]

Residency requirements

Prospective voters must reside in the county in which they are registering to vote.[26]

Verification of citizenship

Texas does not require proof of citizenship for voter registration. An individual applying to register to vote must attest that they are a U.S. citizen under penalty of perjury.

State law requires election officials to conduct a check of registered voters' citizenship status. Section 18.068 of the Texas Election Code says the following:

| “ |

The secretary of state shall quarterly compare the information received under Section 16.001 of this code and Section 62.113, Government Code, to the statewide computerized voter registration list. If the secretary determines that a voter on the registration list is deceased or has been excused or disqualified from jury service because the voter is not a citizen, the secretary shall send notice of the determination to the voter registrar of the counties considered appropriate by the secretary.[2] |

” |

| —Section 18.068, Texas Election Code[27] | ||

In January 2019, the Texas secretary of state’s office announced that it would be providing local election officials with a list of registered voters who obtained driver’s licenses or IDs with documentation such as work visas or green cards. Counties would then be able to require voters on the list to provide proof of citizenship within 30 days.[28] The review was halted by a federal judge in February 2019, and Secretary of State David Whitley rescinded the advisory in April.[29][30] A news release from Whitley’s office stated that “... going forward, the Texas Secretary of State's office will send to county voter registrars only the matching records of individuals who registered to vote before identifying themselves as non-U.S. citizens to DPS when applying for a driver's license or personal identification card. This will ensure that naturalized U.S. citizens who lawfully registered to vote are not impacted by this voter registration list maintenance process.”[31]

All 49 states with voter registration systems require applicants to declare that they are U.S. citizens in order to register to vote in state and federal elections, under penalty of perjury or other punishment.[32] Seven states — Alabama, Arizona, Georgia, Kansas, Louisiana, New Hampshire, and Wyoming — have laws requiring verification of citizenship at the time of voter registration, whether in effect or not. In three states — California, Maryland, and Vermont — at least one local jurisdiction allows noncitizens to vote in some local elections. Noncitizens registering to vote in those elections must complete a voter registration application provided by the local jurisdiction and are not eligible to register as state or federal voters.

Verifying your registration

The Texas Secretary of State’s office allows residents to check their voter registration status online by visiting this website.

Voter ID requirements

Texas requires voters to present photo identification while voting.[33]

The following list of accepted ID was current as of February 2023. Click here for the Texas Secretary of State's page on accepted ID to ensure you have the most current information.

- Texas driver’s license issued by the Texas Department of Public Safety (DPS)

- Texas Election Identification Certificate issued by DPS

- Texas Personal Identification Card issued by DPS

- Texas handgun license issued by DPS

- United States Military Identification Card containing the person’s photograph

- United States Citizenship Certificate containing the person’s photograph

- United States passport (book or card)

Identification provided by voters aged 18-69 may be expired for no more than four years before the election date. Voters aged 70 and older can use an expired ID card regardless of how long ago the ID expired.[33]

Voters who are unable to provide one of the ID options listed above can sign a Reasonable Impediment Declaration and provide one of the following supporting documents:[33]

- Copy or original of a government document that shows the voter’s name and an address, including the voter’s voter registration certificate

- Copy of or original current utility bill

- Copy of or original bank statement

- Copy of or original government check

- Copy of or original paycheck

- Copy of or original of (a) a certified domestic (from a U.S. state or territory) birth certificate or (b) a document confirming birth admissible in a court of law which establishes the voter’s identity (which may include a foreign birth document)

The following voters are exempt from showing photo ID:[33]

- Voters with a disability

- Voters with a disability "may apply with the county voter registrar for a permanent exemption to presenting an acceptable photo identification or following the Reasonable Impediment Declaration procedure in the county."

- Voters who have a religious objection to being photographed

Voters who do not have a photo ID can obtain a Texas Election Identification Certificate (EIC) at any Texas driver’s license office during regular business hours. Voters can also obtain an Election Identification Certificate from a mobile station. Locations are listed here.[33]

See also

External links

Footnotes

- ↑ 1.0 1.1 1.2 Texas State Legislature, "House Joint Resolution 151," accessed April 26, 2016

- ↑ 2.0 2.1 2.2 2.3 2.4 Note: This text is quoted verbatim from the original source. Any inconsistencies are attributable to the original source. Cite error: Invalid

<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content - ↑ 3.0 3.1 3.2 Texas State Legislature, "HJR 151 Overview," accessed April 26, 2019

- ↑ 4.0 4.1 League of Women Voters of Texas, "Voters Guide 2019," accessed October 24, 2019

- ↑ Texas Ethics Commission, "Campaign Finance Reports Search & Lists," accessed May 1, 2019

- ↑ Austin American-Statesman, “Statesman recommendations on Nov. 5 ballot propositions,” October 21, 2019

- ↑ The Austin Chronicle, “Chronicle Endorsements for the November 5 Election,” October 18, 2019

- ↑ Corpus Christi Caller-Times, “Why should you vote? Here are the reasons the Nov. 5 election is important to Texans,” October 8, 2019

- ↑ The Dallas Morning News, “We recommend these 7 amendments to the Texas constitution,” October 18, 2019

- ↑ The Eagle, “Recommendations for 10 constitutional amendments,” October 21, 2019

- ↑ Fort Worth Star-Telegram, “We recommend voting this way on Texas income tax proposal, other state propositions,” October 21, 2019

- ↑ Houston Chronicle, “Our recommendations for voting on the 10 proposed constitutional amendments,” October 19, 2019

- ↑ San Antonio Express-News, “Our recommendations for voting on the 10 proposed constitutional amendments,” October 19, 2019

- ↑ Longview News-Journal, “Editorial: Vote 'yes' on all but one Texas constitutional amendment,” October 23, 2019

- ↑ San Antonio Express-News, "From the Editorial Board: A voters guide for Props 1 through 10," October 17, 2019

- ↑ Waco Tribune-Herald, “Editorial: Our take on Proposition 5 and other proposed constitutional amendments,” October 22, 2019

- ↑ Texas Education Agency, "Texas Permanent School Fund," accessed June 10, 2019

- ↑ Texas Education Agency, "Texas Permanent School Fund - Annual Report," accessed June 10, 2019

- ↑ Texas Education Agency, "Per Capita Rates," accessed June 10, 2019

- ↑ Texas Statutes, "Education Code §43," accessed June 17, 2019

- ↑ Texas Legislative Budget Board, "The Permanent School Fund and the Available School Fund," accessed July 22, 2019

- ↑ VoteTexas.gov, "Who, What, Where, When, How," accessed February 27, 2023

- ↑ Texas Secretary of State, “Request for Voter Registration Applications,” accessed February 27, 2023

- ↑ Texas Secretary of State, “Voter Registration,” accessed February 27, 2023

- ↑ 25.0 25.1 25.2 NCSL, "State Profiles: Elections," accessed July 28, 2024

- ↑ Texas Secretary of State, "Request for Voter Registration Applications," accessed July 28, 2024

- ↑ Texas Constitution and Statutes, “Election Code,” accessed February 23, 2023

- ↑ The Texas Tribune, “Texas officials flag tens of thousands of voters for citizenship checks,” January 25, 2019

- ↑ The New York Times, “Federal Judge Halts ‘Ham-Handed’ Texas Voter Purge,” February 28, 2019

- ↑ The New York Times, “Texas Ends Review That Questioned Citizenship of Almost 100,000 Voters,” April 26, 2019

- ↑ Texas Secretary of State, “Secretary Whitley Announces Settlement In Litigation On Voter Registration List Maintenance Activity,” April 26, 2019

- ↑ Under federal law, the national mail voter registration application (a version of which is in use in all states with voter registration systems) requires applicants to indicate that they are U.S. citizens in order to complete an application to vote in state or federal elections, but does not require voters to provide documentary proof of citizenship. According to the U.S. Department of Justice, the application "may require only the minimum amount of information necessary to prevent duplicate voter registrations and permit State officials both to determine the eligibility of the applicant to vote and to administer the voting process."

- ↑ 33.0 33.1 33.2 33.3 33.4 Texas Secretary of State, "Required Identification for Voting in Person," accessed February 27, 2023 Cite error: Invalid

<ref>tag; name "tvid" defined multiple times with different content

|

State of Texas Austin (capital) |

|---|---|

| Elections |

What's on my ballot? | Elections in 2025 | How to vote | How to run for office | Ballot measures |

| Government |

Who represents me? | U.S. President | U.S. Congress | Federal courts | State executives | State legislature | State and local courts | Counties | Cities | School districts | Public policy |