Texas Proposition 5, Sales Tax on Sporting Goods Dedicated to Parks, Wildlife, and Historical Agencies Amendment (2019)

| Texas Proposition 5 | |

|---|---|

| |

| Election date November 5, 2019 | |

| Topic State and local government budgets, spending and finance | |

| Status | |

| Type Constitutional amendment | Origin State legislature |

Texas Proposition 5, the Sales Tax on Sporting Goods Dedicated to Parks, Wildlife, and Historical Agencies Amendment, was on the ballot in Texas as a legislatively referred constitutional amendment on November 5, 2019.[1] The ballot measure was approved.

| A "yes" vote supported this constitutional amendment to dedicate revenue from the sales tax on sporting goods to the Texas Parks and Wildlife Department and the Texas Historical Commission. |

| A "no" vote opposed this constitutional amendment, thus allowing the legislature to decide how much of the revenue from the sales tax on sporting goods is allocated to the state Parks and Wildlife Department and the state Historical Commission. |

Election results

|

Texas Proposition 5 |

||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| 1,745,353 | 88.02% | |||

| No | 237,656 | 11.98% | ||

Overview

What did Proposition 5 change?

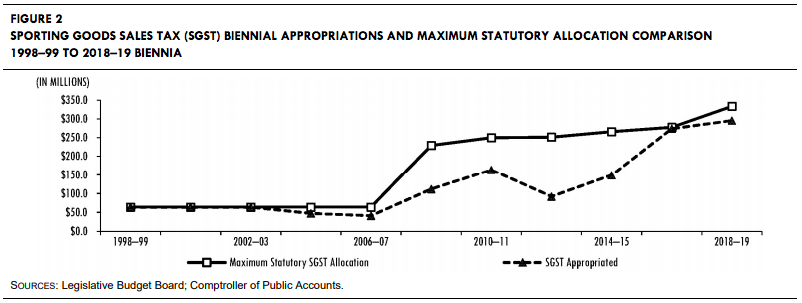

As of 2019, the Texas State Legislature was allowed to appropriate revenue from the sales tax (6.25 percent) on sporting goods to the state Parks and Wildlife Department and the state Historical Commission. The Texas Comptroller of Public Accounts was responsible for estimating how much revenue the sales tax on sporting goods generates using a national market data on sporting good sales.[2] According to the Texas Senate Research Center, "the actual appropriation is often much less than the [estimated revenue]."[3]

Proposition 5 added language to the Texas Constitution to dedicate revenue from the sales tax on sporting goods to the state Parks and Wildlife Department and the state Historical Commission. Whereas the existing law allowed the legislature to allocate the revenue for other uses, Proposition 5 required a two-thirds vote in each legislative chamber to reduce the amount for the parks, wildlife, and historical agencies. Furthermore, the ballot measure prohibited the legislature from decreasing the amount for the parks, wildlife, and historical agencies by more than 50 percent.[1]

Text of measure

Ballot title

The ballot title was as follows:[1]

| “ |

The constitutional amendment dedicating the revenue received from the existing state sales and use taxes that are imposed on sporting goods to the Texas Parks and Wildlife Department and the Texas Historical Commission to protect Texas’ natural areas, water quality, and history by acquiring, managing, and improving state and local parks and historic sites while not increasing the rate of the state sales and use taxes.[4] |

” |

Constitutional changes

- See also: Article 8, Texas Constitution

The measure added a Section 7-d to Article 8 of the Texas Constitution. The following language was added:[1]

Note: Hover over the text and scroll to see the full text.

Sec. 7-d. (a) Subject to Subsection (b) of this section, for each state fiscal year, the net revenue received from the collection of any state taxes imposed on the sale, storage, use, or other consumption in this state of sporting goods that were subject to taxation on January 1, 2019, under Chapter 151, Tax Code, is automatically appropriated when received to the Parks and Wildlife Department and the Texas Historical Commission, or their successors in function, and is allocated between those agencies as provided by general law. The legislature by general law may provide limitations on the use of money appropriated under this subsection.

(b) The legislature by adoption of a resolution approved by a record vote of two-thirds of the members of each house of the legislature may direct the comptroller of public accounts to reduce the amount of money appropriated to the Parks and Wildlife Department and the Texas Historical Commission, or their successors in function, under Subsection (a) of this section. The comptroller may be directed to make that reduction only:

- (1) in the state fiscal year in which the resolution is adopted, or in either of the following two state fiscal years; and

- (2) by an amount that does not result in a reduction of more than 50 percent of the amount that would otherwise be appropriated to the Parks and Wildlife Department and the Texas Historical Commission, or their successors in function, in the affected state fiscal year under Subsection (a) of this section.

(c) Money appropriated to the Parks and Wildlife Department and the Texas Historical Commission, or their successors in function, under Subsection (a) of this section may not be considered available for certification by the comptroller of public accounts under Section 49a(b), Article III, of this constitution.

(d) In this section, "sporting goods" means an item of tangible personal property designed and sold for use in a sport or sporting activity, excluding apparel and footwear except that which is suitable only for use in a sport or sporting activity, and excluding board games, electronic games and similar devices, aircraft and powered vehicles, and replacement parts and accessories for any excluded item.[4]

Readability score

- See also: Ballot measure readability scores, 2019

| Using the Flesch-Kincaid Grade Level (FKGL and Flesch Reading Ease (FRE) formulas, Ballotpedia scored the readability of the ballot title and summary for this measure. Readability scores are designed to indicate the reading difficulty of text. The Flesch-Kincaid formulas account for the number of words, syllables, and sentences in a text; they do not account for the difficulty of the ideas in the text. The state legislature wrote the ballot language for this measure.

|

Support

Texas Coalition for State Parks led the campaign in support of the constitutional amendment. Joseph Fitzsimons, a former chairperson of the Texas Parks and Wildlife Commission, headed the coalition.[5][6]

Supporters

The Texas Coalition for State Parks provided a list of coalition organizations on the campaign’s website, which is available here.[7]

Officials

- Lt. Gov. Dan Patrick (R)[8]

- Sen. Dawn Buckingham (R-24)[9]

- Sen. Lois Kolkhorst (R-18)[9]

- Sen. Donna Campbell (R-25)[9]

- Sen. Peter Flores (R-19)[9]

- Sen. Juan Hinojosa (D-20)[9]

- Sen. Joan Huffman (R-17)[9]

- Sen. Bryan Hughes (R-1)[9]

- Sen. Jose Menendez (D-26)[9]

- Sen. Robert Nichols (R-3)[9]

- Sen. Charles Perry (R-28)[9]

- Sen. Jose Rodriguez (D-29)[9]

- Sen. Judith Zaffirini (D-21)[9]

- Rep. John Cyrier (R-17)[10]

Parties

Organizations

- Audubon Texas

- Ducks Unlimited

- Environment Texas

- Lone Star Chapter Sierra Club

- National Parks Conservation Association

- National Wildlife Federation

- The Nature Conservancy

- Progress Texas[12]

- Rails-to-Trails Conservancy

- Texas Conservation Alliance

- Texas Deer Association

- Texas Food & Fuel Alliance

- Texas Foundation for Conservation

- Texas Land Trust Council

- Texas Parks & Wildlife Foundation

- Texas Recreation and Park Society

- Texas Municipal League

- Texas Wildlife Association

- The Trust for Public Land

Arguments

- Rep. John Cyrier (R-17) said:[10]

| “ | Despite the vital importance of our state parks system, since 1993, more than half of the sporting good sales tax revenue originally intended for state parks has been diverted to other uses. As a result, state parks suffer from more than $800 million in deferred maintenance. ... It is time to fix this problem. Our parks are vital to our state’s economy, emergency response efforts, wildlife management, and recreational opportunities.[4] | ” |

- The League of Women Voters of Texas published arguments for and arguments against the ballot measure. The following is the argument in support:[13]

| “ |

|

” |

Opposition

Arguments

- The League of Women Voters of Texas published arguments for and arguments against the ballot measure. The following is the argument in opposition:[13]

| “ |

|

” |

Campaign finance

| Total campaign contributions: | |

| Support: | $752,878.72 |

| Opposition: | $0.00 |

The Texas Coalition for State Parks PAC registered in support of the ballot measure. The political action committee (PAC) reported $752,879 in contributions and $752,879 in expenditures. There was no committee registered to oppose the ballot measure.[14]

Support

The following table includes contribution and expenditure totals for the committee in support of the measure.[14]

|

| |||||||||||||||||||||||

Donors

The following were the top five donors who contributed to the support committee.[14]

| Donor | Cash | In-kind | Total |

|---|---|---|---|

| Kelcy Lee Warren | $250,000.00 | $0.00 | $250,000.00 |

| Lee Bass | $50,000.00 | $0.00 | $50,000.00 |

| Thomas Daniel Friedkin and Debra Friedkin | $50,000.00 | $0.00 | $50,000.00 |

| Lyda Hill | $50,000.00 | $0.00 | $50,000.00 |

| John L. Nau III | $50,000.00 | $0.00 | $50,000.00 |

Methodology

To read Ballotpedia's methodology for covering ballot measure campaign finance information, click here.

Media editorials

- See also: 2019 ballot measure media endorsements

Support

- Austin American-Statesman: “YES to guarantee all sales tax revenue from sporting goods purchases would go toward maintaining state parks and historic sites — something lawmakers have long promised and largely failed to do.”[15]

- The Austin Chronicle: “This would appropriate state sales taxes on sporting goods to fund parks and preservation efforts. That's been state law since 1993, but that hasn't stopped the Lege, particularly in the past decade, from raiding the kitty to plug other holes in its budgets; this measure is supposed to tie their thievin' hands.”[16]

- Corpus Christi Caller-Times: “This is dedicated funding that the Legislature nevertheless makes a habit of raiding. This amendment would put an end to the raiding.”[17]

- The Eagle: “If passed, this proposition would force lawmakers to spend these funds as voters intended — and only as voters originally intended.”[18]

- Fort Worth Star-Telegram: “Lawmakers love accounting tricks that help the state balance the books. One is to keep sales taxes on sporting goods, meant to be dedicated to state parks and historical preservation, in general revenue accounts. This amendment would help parks get the boost they’re meant to have and strike a blow for truth in taxation.”[19]

- Houston Chronicle: “These funds would be used to care for Texas’ wild areas, its water sources and its state parks. Our state parks need help, as current facilities ages and as our population grows. This amendment would help focus lawmakers’ attention on giving them that help.”[20]

- Longview News-Journal: “This closes a loophole that should have been stitched shut years ago, but the revenue has been coveted by lawmakers to help balance the budget. This has harmed parks and curtailed growth.”[21]

- San Antonio Express-News: "This is not a new tax. It would ensure sales taxes on sporting goods would go to state parks as intended."[22]

- Waco Tribune-Herald: “It’s important to note the key role state parks play not only in wildlife habitat and conservation but the state economy through hunting, fishing and tourism. Voting for Proposition 5 doesn’t mean new taxes, only ensuring existing taxes touted to the public as benefiting state parks and historical sites actually do so. We urge its passage.”[23]

Opposition

- The Dallas Morning News: “Our parks are in need of constant upkeep as we attract more Texans. So it’s good to fund a robust parks system and historical commission to protect our architectural treasures. Proposition 5 would dedicate revenue from taxes on sporting goods to this purpose. That is a perfectly fine thing for our legislature to do, but this would bind future Texans to a taxing structure that might not make sense later.”[24]

Overview of media editorials

The following table provides an overview of the positions that media editorial boards had taken on the Texas 2019 ballot measures:

Background

Revenue from sporting goods sales

In 1993, the Texas State Legislature passed House Bill 706 (HB 706), which authorized the legislature to dedicate revenue from the sales tax on sporting goods to the Parks and Wildlife Department and Historical Commission. The Texas Comptroller of Public Accounts was responsible for estimating how much revenue the sales tax on sporting goods generates using a national market data on sporting good sales.[2]

As of 2019, the state's tax code defined sporting goods as items designed and sold for sport and sporting activities.[25] In 2018, the Comptroller of Public Accounts reported that two-thirds of the revenue was from the sale of bicycles and related supplies, hunting and firearm equipment, exercise equipment, and fishing tackle.[2]

The Texas Legislative Budget Board released the following graph to illustrate the difference between the estimated revenue from the sales tax on sporting goods and the amount the legislature appropriated for the parks, wildlife, and historical agencies.

Texas Parks and Wildlife Department

The Texas Parks and Wildlife Department (PWD) was created as a state executive department in 1963 to acquire and manage state parks and protect and oversee fish and wildlife resources.[26] Commissioners oversee the PWD, with the governor appointing each member of the commission. For the fiscal year of 2019, the PWD had a budget of $419.0 million. The three largest portions of the budget were for state and local parks (31.5 percent), law enforcement (20.7 percent), and department administration (9.6 percent).[27]

Texas Historical Commission

The Texas Historical Commission was established in 1953 to preserve and administer the state’s historic and prehistoric resources, including the National Register of Historic Places in Texas.[28] Commissioners oversee the Historical Commission, with each member appointed by the governor.

Referred amendments on the ballot

- See also: List of Texas ballot measures

The following statistics are based on ballot measures between 1995 and 2018 in Texas:

- Ballots featured 159 constitutional amendments.

- An average of 13 measures appeared on odd-year statewide ballots.

- The number of ballot measures on odd-year statewide ballots ranged from 7 to 22.

- Voters approved 91 percent (145 of 159) and rejected 9 percent (14 of 159) of the constitutional amendments.

| Legislatively-referred constitutional amendments, 1995-2018 | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Total number | Approved | Percent approved | Defeated | Percent defeated | Odd-year average | Odd-year median | Odd-year minimum | Odd-year maximum | |

| 159 | 145 | 91.2% | 14 | 8.8% | 13.1 | 12.5 | 7 | 22 | |

In 2019, 216 constitutional amendments had been filed in the Texas State Legislature. Legislators were permitted to file constitutional amendments through March 8, 2019, unless permission was given to introduce an amendment after the deadline. Between 2009 and 2017, an average of 187 constitutional amendments were filed during regular legislative sessions. The state legislature approved an average of nine constitutional amendments during regular legislative sessions. Therefore, the average rate of certification during regular legislative sessions was 4.7 percent. In 2019, 10 of the 216 proposed constitutional amendments were certified for the ballot, meaning the rate of certification was 4.6 percent.

Path to the ballot

- See also: Amending the Texas Constitution

In Texas, a two-thirds vote is needed in each chamber of the Texas State Legislature to refer a constitutional amendment to the ballot for voter consideration.

The constitutional amendment was introduced into the state legislature as Senate Joint Resolution 24 (SJR 24) on December 20, 2018.[9]

On April 10, 2019, the Texas State Senate voted 30-0 to approve SJR 24. On April 23, the Texas House of Representatives voted to approve SJR 24, but the chamber also amended the bill. The vote was 143-1. As the state House amended SJR 24, a concurrence vote was needed in the state Senate. On May 21, the state Senate voted to approve the amended SJR 24. The vote was 30-1.[9]

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

How to cast a vote

- See also: Voting in Texas

Poll times

In Texas, all polling places are open from 7:00 a.m. to 7:00 p.m. local time. Texas is divided between the Central and Mountain time zones. An individual who is in line at the time polls close must be allowed to vote.[29]

Registration Texas

- Check your voter registration status here.

To register to vote in Texas, an applicant must be a United States citizen, a resident of the county in which he or she is registering, and at least 17 years and 10 months old.[30]

The deadline to register to vote is 30 days before the election. Prospective voters can request a postage-paid voter registration form online or complete the form online and return it to the county voter registrar. Applications are also available at a variety of locations including the county voter registrar’s office, the secretary of state’s office, libraries, and high schools. Voter registration certificates are mailed to newly registered voters.[31]

Automatic registration

Texas does not practice automatic voter registration.[32]

Online registration

- See also: Online voter registration

Texas does not permit online voter registration.[32]

Same-day registration

Texas does not allow same-day voter registration.[32]

Residency requirements

Prospective voters must reside in the county in which they are registering to vote.[33]

Verification of citizenship

Texas does not require proof of citizenship for voter registration. An individual applying to register to vote must attest that they are a U.S. citizen under penalty of perjury.

State law requires election officials to conduct a check of registered voters' citizenship status. Section 18.068 of the Texas Election Code says the following:

| “ |

The secretary of state shall quarterly compare the information received under Section 16.001 of this code and Section 62.113, Government Code, to the statewide computerized voter registration list. If the secretary determines that a voter on the registration list is deceased or has been excused or disqualified from jury service because the voter is not a citizen, the secretary shall send notice of the determination to the voter registrar of the counties considered appropriate by the secretary.[4] |

” |

| —Section 18.068, Texas Election Code[34] | ||

In January 2019, the Texas secretary of state’s office announced that it would be providing local election officials with a list of registered voters who obtained driver’s licenses or IDs with documentation such as work visas or green cards. Counties would then be able to require voters on the list to provide proof of citizenship within 30 days.[35] The review was halted by a federal judge in February 2019, and Secretary of State David Whitley rescinded the advisory in April.[36][37] A news release from Whitley’s office stated that “... going forward, the Texas Secretary of State's office will send to county voter registrars only the matching records of individuals who registered to vote before identifying themselves as non-U.S. citizens to DPS when applying for a driver's license or personal identification card. This will ensure that naturalized U.S. citizens who lawfully registered to vote are not impacted by this voter registration list maintenance process.”[38]

All 49 states with voter registration systems require applicants to declare that they are U.S. citizens in order to register to vote in state and federal elections, under penalty of perjury or other punishment.[39] Seven states — Alabama, Arizona, Georgia, Kansas, Louisiana, New Hampshire, and Wyoming — have laws requiring verification of citizenship at the time of voter registration, whether in effect or not. One state, Ohio, requires proof of citizenship only when registering to vote at a Bureau of Motor Vehicles facility. In three states — California, Maryland, and Vermont — at least one local jurisdiction allows noncitizens to vote in some local elections. Noncitizens registering to vote in those elections must complete a voter registration application provided by the local jurisdiction and are not eligible to register as state or federal voters.

Verifying your registration

The Texas Secretary of State’s office allows residents to check their voter registration status online by visiting this website.

Voter ID requirements

Texas requires voters to present photo identification while voting.[40]

The following list of accepted ID was current as of February 2023. Click here for the Texas Secretary of State's page on accepted ID to ensure you have the most current information.

- Texas driver’s license issued by the Texas Department of Public Safety (DPS)

- Texas Election Identification Certificate issued by DPS

- Texas Personal Identification Card issued by DPS

- Texas handgun license issued by DPS

- United States Military Identification Card containing the person’s photograph

- United States Citizenship Certificate containing the person’s photograph

- United States passport (book or card)

Identification provided by voters aged 18-69 may be expired for no more than four years before the election date. Voters aged 70 and older can use an expired ID card regardless of how long ago the ID expired.[40]

Voters who are unable to provide one of the ID options listed above can sign a Reasonable Impediment Declaration and provide one of the following supporting documents:[40]

- Copy or original of a government document that shows the voter’s name and an address, including the voter’s voter registration certificate

- Copy of or original current utility bill

- Copy of or original bank statement

- Copy of or original government check

- Copy of or original paycheck

- Copy of or original of (a) a certified domestic (from a U.S. state or territory) birth certificate or (b) a document confirming birth admissible in a court of law which establishes the voter’s identity (which may include a foreign birth document)

The following voters are exempt from showing photo ID:[40]

- Voters with a disability

- Voters with a disability "may apply with the county voter registrar for a permanent exemption to presenting an acceptable photo identification or following the Reasonable Impediment Declaration procedure in the county."

- Voters who have a religious objection to being photographed

Voters who do not have a photo ID can obtain a Texas Election Identification Certificate (EIC) at any Texas driver’s license office during regular business hours. Voters can also obtain an Election Identification Certificate from a mobile station. Locations are listed here.[40]

See also

External links

Footnotes

- ↑ 1.0 1.1 1.2 1.3 Texas State Legislature, "SJR 24," accessed May 21, 2019

- ↑ 2.0 2.1 2.2 Texas Legislative Budget Board, "Sporting Goods Sales Tax Allocation," accessed July 8, 2019

- ↑ Texas State Legislature, "Senate Research Center Analysis of SJR 24," May 29, 2019

- ↑ 4.0 4.1 4.2 4.3 4.4 4.5 Note: This text is quoted verbatim from the original source. Any inconsistencies are attributable to the original source. Cite error: Invalid

<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content - ↑ Texas Coalition for State Parks, "Homepage," accessed October 8, 2019

- ↑ Hill County Alliance, "Kolkhurst, Cyrier file bills to constitutionally dedicate funds for state and local parks," February 1, 2019

- ↑ Texas Coalition for State Parks, "Coalition," accessed October 8, 2019

- ↑ Twitter, "Dan Patrick," October 23, 2019

- ↑ 9.00 9.01 9.02 9.03 9.04 9.05 9.06 9.07 9.08 9.09 9.10 9.11 9.12 9.13 Texas State Legislature, "SJR 24 Overview," accessed April 11, 2019

- ↑ 10.0 10.1 Gonzales Inquirer, "Constitutional amendment would shore up funding for state parks," May 2, 2019

- ↑ Texas Republican Party, "2019 Constitutional Election," accessed October 28, 2019

- ↑ Progress Texas, "2019 Texas Statewide Ballot Guide," October 4, 2019

- ↑ 13.0 13.1 League of Women Voters of Texas, "Voters Guide 2019," accessed October 24, 2019

- ↑ 14.0 14.1 14.2 Texas Ethics Commission, "Campaign Finance Reports Search & Lists," accessed October 8, 2019

- ↑ Austin American-Statesman, “Statesman recommendations on Nov. 5 ballot propositions,” October 21, 2019

- ↑ The Austin Chronicle, “Chronicle Endorsements for the November 5 Election,” October 18, 2019

- ↑ Corpus Christi Caller-Times, “Why should you vote? Here are the reasons the Nov. 5 election is important to Texans,” October 8, 2019

- ↑ The Eagle, “Recommendations for 10 constitutional amendments,” October 21, 2019

- ↑ Fort Worth Star-Telegram, “We recommend voting this way on Texas income tax proposal, other state propositions,” October 21, 2019

- ↑ Houston Chronicle, “Our recommendations for voting on the 10 proposed constitutional amendments,” October 19, 2019

- ↑ Longview News-Journal, “Editorial: Vote 'yes' on all but one Texas constitutional amendment,” October 23, 2019

- ↑ San Antonio Express-News, "From the Editorial Board: A voters guide for Props 1 through 10," October 17, 2019

- ↑ Waco Tribune-Herald, “Editorial: Our take on Proposition 5 and other proposed constitutional amendments,” October 22, 2019

- ↑ The Dallas Morning News, “We recommend these 7 amendments to the Texas constitution,” October 18, 2019

- ↑ Texas State Legislature, "Tax Code Sec. 151.801.," accessed July 8, 2019

- ↑ Texas Parks and Wildlife Department, "Agency History," accessed July 15, 2019

- ↑ Texas Parks and Wildlife Department, "Financial Overview (2019)," accessed July 15, 2019

- ↑ Texas Historical Commission, "About Us," accessed July 15, 2019

- ↑ VoteTexas.gov, "Who, What, Where, When, How," accessed February 27, 2023

- ↑ Texas Secretary of State, “Request for Voter Registration Applications,” accessed February 27, 2023

- ↑ Texas Secretary of State, “Voter Registration,” accessed February 27, 2023

- ↑ 32.0 32.1 32.2 NCSL, "State Profiles: Elections," accessed July 28, 2024

- ↑ Texas Secretary of State, "Request for Voter Registration Applications," accessed July 28, 2024

- ↑ Texas Constitution and Statutes, “Election Code,” accessed February 23, 2023

- ↑ The Texas Tribune, “Texas officials flag tens of thousands of voters for citizenship checks,” January 25, 2019

- ↑ The New York Times, “Federal Judge Halts ‘Ham-Handed’ Texas Voter Purge,” February 28, 2019

- ↑ The New York Times, “Texas Ends Review That Questioned Citizenship of Almost 100,000 Voters,” April 26, 2019

- ↑ Texas Secretary of State, “Secretary Whitley Announces Settlement In Litigation On Voter Registration List Maintenance Activity,” April 26, 2019

- ↑ Under federal law, the national mail voter registration application (a version of which is in use in all states with voter registration systems) requires applicants to indicate that they are U.S. citizens in order to complete an application to vote in state or federal elections, but does not require voters to provide documentary proof of citizenship. According to the U.S. Department of Justice, the application "may require only the minimum amount of information necessary to prevent duplicate voter registrations and permit State officials both to determine the eligibility of the applicant to vote and to administer the voting process."

- ↑ 40.0 40.1 40.2 40.3 40.4 Texas Secretary of State, "Required Identification for Voting in Person," accessed February 27, 2023 Cite error: Invalid

<ref>tag; name "tvid" defined multiple times with different content

|

State of Texas Austin (capital) |

|---|---|

| Elections |

What's on my ballot? | Elections in 2025 | How to vote | How to run for office | Ballot measures |

| Government |

Who represents me? | U.S. President | U.S. Congress | Federal courts | State executives | State legislature | State and local courts | Counties | Cities | School districts | Public policy |