Massachusetts Question 1, Automatic Gas Tax Increase Repeal Initiative (2014)

| ||||||||||||

| ||||||||||||

The Massachusetts Automatic Gas Tax Increase Repeal Initiative, Question 1 was on the November 4, 2014 statewide ballot as an initiated state statute, where it was approved. The measure was designed to repeal a 2013 law that automatically adjusted gas taxes according to inflation, allowing for automatic annual increases in the state's gas tax.[1]

The law that this initiative sought to repeal also put a minimum cap on gas taxes to prevent gas tax decreases in the case of deflation. The tax increase was part of a transportation funding package that was vetoed by Governor Deval Patrick (D) because he wanted an even greater tax increase. But Patrick's veto was overruled by a House vote of 123 to 33 and a Senate vote of 35 to 5.[2]

Tank the Gas Tax, an organization supporting the initiative, stated that they collected at least 18,500 signatures by June 9, 2014. They turned in the signatures on June 18, 2014 in an attempt to qualify the initiative for the ballot.[3] The measure was certified for the 2014 ballot on July 2, 2014.[4]

Election results

Below are the official, certified election results:

| Massachusetts Question 1 | ||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| 1,095,229 | 52.97% | |||

| No | 972,271 | 47.03% | ||

Election results via: Massachusetts Secretary of State

Text of measure

Ballot summary

The ballot summary was as follows:[5]

| “ | This proposed law would eliminate the requirement that the state’s gasoline tax, which was 24 cents per gallon as of September 2013, (1) be adjusted every year by the percentage change in the Consumer Price Index over the preceding year, but (2) not be adjusted below 21.5 cents per gallon.

A YES VOTE would eliminate the requirement that the state’s gas tax be adjusted annually based on the Consumer Price Index. A NO VOTE would make no change in the laws regarding the gas tax. [6] |

” |

Full text

The full text of the measure was as follows:[5]

| “ | Be it enacted by the People, and by their authority, as follows:

SECTION 1. Section 1 of chapter 64A of the General Laws is hereby amended by striking out, in the definition of “tax per gallon”, the following words:-, “adjusted at the beginning of each calendar year, by the percentage, if any, by which the Consumer Price Index for the preceding year exceeds the Consumer Price Index for the calendar year that ends before such preceding year; provided, that the Consumer Price Index for any calendar year shall be as defined in section 1 of the Internal Revenue Code pursuant to 26 U.S.C. section 1; provided further, that the tax shall not be less than 21.5 cents per gallon.” SECTION 2. The provisions of this law are severable, and if any clause, sentence, paragraph or section of this measure, or an application thereof, shall be adjudged by any court of competent jurisdiction to be invalid, such judgment shall not affect, impair, or invalidate the remainder thereof but shall be confined in its operation to the clause, sentence, paragraph, section or application adjudged invalid. Effective January 1, 2015. [6] |

” |

Background

State gas tax

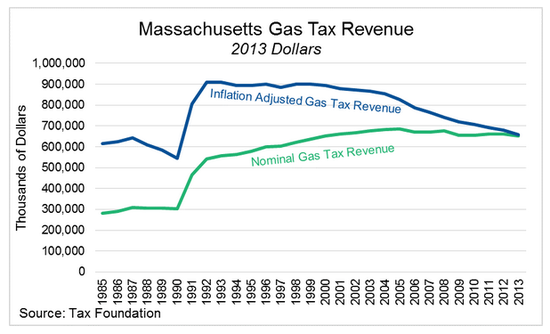

In 2013, the Democrat-controlled state legislature passed House Bill 3847, which raised the state’s gas tax from 21 to 24 cents per gallon and automatically tied the tax rate to inflation for future years, meaning it would increase by the same annual percentage as the Consumer Price Index (CPI). This marked the first increase in the tax since 1991. According to the Tax Foundation, "Since 1991, the last time Massachusetts passed a gas tax increase, Massachusetts gas tax revenues have fallen 18 percent after inflation adjustment while the total level of state and local gas tax collections across the nation have Increased by 15 percent. Over this same period, Massachusetts gas tax revenues have fallen from 0.5 percent of the state’s GDP to only 0.15 percent, showing that gas-tax revenues have diminished even as the rest of Massachusetts’ economy has grown." Given that the CPI had averaged approximately 1 or 2 percent in the previous several years, the tax would likely have increase by half a penny or less per year.[7][8]

Voter guide summary

The official summary of Question 1 according to the state voter guide was as follows:

| “ | This proposed law would eliminate the requirement that the state’s gasoline tax, which was 24 cents per gallon as of September 2013, (1) be adjusted every year by the percentage change in the Consumer Price Index over the preceding year, but (2) not be adjusted below 21.5 cents per gallon. A YES VOTE would eliminate the requirement that the state’s gas tax be adjusted annually based on the Consumer Price Index. A NO VOTE would make no change in the laws regarding the gas tax.[6] | ” |

| —Massachusetts Information for Voters: 2014 Ballot Questions[9] | ||

Support

The measure was sponsored by the group Tank the Gas Tax.[10]

Supporters

Officials

- State Rep. Geoff Diehl (R-7)[11]

- State Rep. Kevin Kuros (R-8)[12]

- State Rep. Ryan Fattman (R-18)

- State Rep. Shaunna O'Connell (R-3)[13]

- State Rep. Jim Lyons (R-18)

Individuals

- Jeffrey T. Kuhner, President of the Edmund Burke Institute for American Renewal[14]

- Kristina Egan, Director of Transportation for Massachusetts[15]

Arguments

- Tank the Gas Tax deemed the tax a slippery slope, saying, “If we don’t stop the linkage of this tax to inflation, then the legislature will surely link other taxes to inflation.”[10]

- Rep. Ryan Fattman (R-18) said, "Families now paying more at the pump to drive to work rightfully wonder why they should also be stuck with the bill to drive their elected officials to work. Working families struggling to afford their own car payments, insurance, or the once every few year vacation wonder why their representatives “expense” their gas, car leases, and world wide travel on campaign accounts, special interests money or even taxpayer funds."[16]

- Jeffrey T. Kuhner, President of the Edmund Burke Institute for American Renewal, argued, “… the law is more than a corrupt attempt to hike taxes through the back door. It represents a fundamental assault on the very basis of our constitutional republic: No taxation without representation. This law does the very opposite. It enshrines the pernicious principle of taxation without representation. Democratic lawmakers have given themselves a free pass from voting for any future gas-tax increases. This violates the basic precept of self-government; namely, that elected representatives can only raise the people’s taxes with their explicit consent through a vote in the legislature.”[14]

- According to support arguments listed in the state's voter guide:

| “ | Voting yes simply stops the linkage of the gas tax to inflation. This linkage causes the tax to increase every year without a vote of the Legislature. That's taxation without representation. If the Legislature wants to increase taxes, they should have to vote for it. No tax should automatically increase. This initiative cuts no money for bridge or road repair. It just requires the Legislature to take a vote if and when they want to raise the tax. You already pay hefty gas taxes - 26.5 cents for state taxes and 18.4 cents for federal. For an average 15 gallon fill-up, you spend $6.73 in taxes. Within the last year the administration has re-instituted tolls, raised registry fees by 20%, and raised other taxes. And the last time gas taxes were increased the money was diverted from road repair. The state has a spending problem, not a revenue problem.[6] | ” |

| —Steven Aylward, Committee to Tank Automatic Gas Tax Hikes[9] | ||

Campaign contributions

| Total campaign cash as of November 20, 2014 | |

| $98,448 | |

| $2,940,370 | |

As of November 20, 2014, one campaign organization had received an aggregate total of $98,448 in contributions.[17]

PAC info:

| PAC/Ballot measure group | Amount raised | Amount spent |

|---|---|---|

| Committee to Tank the Automatic Gas Tax Hikes | $98,448 | $97,557 |

| Total | $98,448 | $97,557 |

Top contributors:

| Donor | Amount |

|---|---|

| A1 Auto | $10,000 |

| Liberty Initiative Fund | $5,000 |

| Strong Economy for Growth | $5,000 |

| Strong Economy Massachusetts Independent Expenditures PAC | $5,000 |

| Massachusetts Ambulance Association | $2,500 |

Opposition

The official opposition campaign was called Vote No on Question One, in conjunction with the Committee for Safer Roads and Bridges.[18]

Opponents

- Governor Deval Patrick (D)[19]

- Medford Mayor Michael J. McGlynn[20]

- Committee for Safer Roads and Bridges[9]

- Bill Vernon, Director and National Federation of Independent Business Massachusetts[15]

Arguments

- Governor Patrick said, "I think it was done in the right way, and I think those that are advocating that the indexing be undone need to answer for why it is they keep showing up for all the ribbon-cuttings every time there's a new bridge or a new road project done, but don't seem to want to participate in how to pay for it."[11]

- According to the official opposition campaign's website, "Massachusetts residents should vote NO on Question 1 because this ballot measure would eliminate a key part of the funding that has been set aside by the state Constitution to pay for transportation projects across the state. It would jeopardize $1 billion in transportation improvements over the next decade – putting our public safety at further risk. Question 1 would mean our roads and bridges will continue to deteriorate – threatening the safety of Massachusetts drivers and their families. That’s why Massachusetts voters should vote NO."[18]

- According to opposition arguments listed in the state's voter guide:

| “ | Question One threatens the safety of you and your family when traveling on Massachusetts’ roads and bridges. The problems are startling: according to the Federal Highway Administration, 53% of all bridges in the state are either structurally deficient or functionally obsolete. Moreover, 27 bridges have been closed because they are unsafe. Potholes and bad roads cost Massachusetts residents $2.3 billion a year in car repairs. After decades of neglect, the poor condition of Massachusetts bridges and roads is now a significant public safety crisis. The longer we wait, the more it will cost every taxpayer to fix the problems. A Yes vote would make things even worse, by taking away existing gas tax revenues that we need to solve this public safety crisis – revenues that, under the state constitution, can only be used for transportation needs. Vote NO on Question One, and let’s fix our unsafe bridges and roads now.[6] | ” |

| —Committee for Safer Roads and Bridges[9] | ||

Campaign contributions

As of November 20, 2014, one campaign organization had received more than $2.9 million in contributions.[17]

PAC info:

| PAC/Ballot measure group | Amount raised | Amount spent |

|---|---|---|

| NO on One Committee | $2,940,370 | $2,619,840 |

| Total | $2,940,370 | $2,619,840 |

Top contributors:

| Donor | Amount |

|---|---|

| Construction Industries of Massachusetts | $400,000 |

| CIM Advancement Fund | $300,000 |

| American Council of Engineering Companies of Massachusetts | $170,000 |

| Flagship Associates LLC | $115,000 |

| Mass Aggregate & Asphalt Pavement Association | $100,000 |

| Suffolk Construction Company, Inc. | $100,000 |

| Utility Contractors Association of New England Inc. | $100,000 |

Media editorial positions

Support

- The News Telegram said,

| “ | Question 1 on the Nov. 4 ballot will ask Massachusetts voters whether they wish to eliminate a requirement that the state's 24-cent-per-gallon gas tank be automatically adjusted each year to reflect the percentage change in the Consumer Price Index — in short, whether the tax should be raised to keep pace with inflation.

We strongly urge a "yes" vote to eliminate the automatic increase. [6] |

” |

| —News Telegram[21] | ||

Opposition

- The Boston Globe said,

| “ | GAS TAXES pay for bridges, highways, and other transportation projects, and passing ballot Question 1 — which would prevent the state gas tax from rising with inflation — would make it harder for the Commonwealth to keep people and goods moving around. Voters should reject this measure.[6] | ” |

| —Boston Globe[22] | ||

Polls

- See also: Polls, 2014 ballot measures

| Massachusetts Question 1 (2014) | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Poll | Support | Oppose | Undecided | Margin of error | Sample size | ||||||||||||||

| UMass Amherst/WBZ Poll 9/18/2014-9/23/2014 | 47.0% | 33.0% | 20.0% | +/-4.4 | 708 | ||||||||||||||

| The MassINC Polling Group 9/11/2014-9/14/2014 | 39.0% | 45.0% | 16.0% | +/-4.4 | 504 | ||||||||||||||

| AVERAGES | 43% | 39% | 18% | +/-4.4 | 606 | ||||||||||||||

| Note: The polls above may not reflect all polls that have been conducted in this race. Those displayed are a random sampling chosen by Ballotpedia staff. If you would like to nominate another poll for inclusion in the table, send an email to editor@ballotpedia.org. | |||||||||||||||||||

Path to the ballot

Supporters first had to submit the initiative, signed by ten voters, to the Massachusetts Attorney General by August 7, 2013. The attorney general then had to determine whether the measure met the legal requirements for circulation, which it did.[23]

In order to qualify for the ballot, supporters were required to collect a minimum of 68,911 valid signatures by November 20, 2013, and submit them to local registrars for certification. Then, these certified petitions were successfully filed with the secretary of state on the December 4, 2013, deadline, after which the secretary of state determined enough valid signatures had been collected.[11]

The Massachusetts General Court had until May 7, 2014, to either accept or reject the measure or take no action. No action was taken; therefore, the original supporters of the measure had to collect an additional 11,485 signatures and submit them to local registrars for certification by June 18, 2014, which they did. These signatures then had to be filed with the secretary of state no later than July 2, 2014.[23][24][25] The measure was certified for the 2014 ballot on July 2, 2014.[4]

See also

- 2014 ballot measures

- Massachusetts 2014 ballot measures

- Laws governing the initiative process in Massachusetts

External links

Basic information

- Text of the Automatic Gas Tax Increase Repeal Initiative

- Online poll: Do you think the gas tax should be repealed

- Secretary of State guide to state ballot measures

- Massachusetts 2014 Voter Guide

Support

Opposition

Additional reading

Footnotes

- ↑ News Telegram, "Referendums could deep-six casinos, gas tax," November 29, 2013

- ↑ Masslive.com, "Massachusetts lawmakers override Gov. Deval Patrick's veto of bill to raise taxes by $500 million," July 24, 2013

- ↑ Tank the Gas Tax, "Signature Collection," June 9, 2014

- ↑ 4.0 4.1 New England Public Radio, "4 Ballot Questions Before Mass. Voters," July 3, 2014

- ↑ 5.0 5.1 Massachusetts Secretary of State, "Question 1: Eliminating Gas Tax Indexing," accessed September 17, 2014

- ↑ 6.0 6.1 6.2 6.3 6.4 6.5 6.6 Note: This text is quoted verbatim from the original source. Any inconsistencies are attributable to the original source.

- ↑ Fox News, "Automatic gas tax emerging as key campaign issue in Massachusetts," May 26, 2014

- ↑ Tax Foundation, "Massachusetts Ballot Referendum Challenges Gas Tax Indexing," July 22, 2014

- ↑ 9.0 9.1 9.2 9.3 Massachusetts Secretary of State, "Massachusetts Information for Voters: 2014 Ballot Questions," accessed September 30, 2014

- ↑ 10.0 10.1 Tank the Gas Tax website, accessed March 14, 2014

- ↑ 11.0 11.1 11.2 South Coast Today, "Bottle bill expansion, limits to gas-tax on track for 2014 ballot," December 4, 2013

- ↑ Worcester Telegram & Gazette, "Repeal of casino law, capping eternal gas tax, among ballot questions," December 9, 2013

- ↑ Cape Cod Today, "Gas tax indexing question on 2014 ballot," November 22, 2013

- ↑ 14.0 14.1 Washington Post, "Boston’s second Tea Party," December 5, 2013

- ↑ 15.0 15.1 The Daily Free Press, "Massachusetts advocacy networks weigh in on four upcoming ballot questions," October 30, 2014

- ↑ Shrewsbury Chronicle, "Fattman: Mobilizing against a gas tax hike," December 6, 2013

- ↑ 17.0 17.1 OCPF, "Question 1: Eliminating Gas Tax Indexing," accessed October 30, 2014

- ↑ 18.0 18.1 Vote No on Question One, "FAQs," accessed September 30, 2014

- ↑ Boston Herald, "Gov. Patrick lashes out at push to repeal gas tax law," December 2, 2013

- ↑ Medford Transcript, "Medford Mayor Michael McGlynn supports No vote on Question 1," October 22, 2014

- ↑ News Telegram, "Yes on Question 1," October 6, 2014

- ↑ Boston Globe, "No on Question 1: Keep gas tax tied to inflation," October 22, 2014

- ↑ 23.0 23.1 State Ballot Question Petitions, "CALENDAR FOR AN INITIATIVE PETITION FOR A CONSTITUTIONAL AMENDMENT," accessed December 3, 2013

- ↑ Weymouth News, "State House News -- Initiative petition campaigns keep on pace for 2014 ballot," December 4, 2013

- ↑ Massachusetts Secretary of State, "State Ballot Question Petitions," accessed May 13, 2014

State of Massachusetts Boston (capital) | |

|---|---|

| Elections |

What's on my ballot? | Elections in 2026 | How to vote | How to run for office | Ballot measures |

| Government |

Who represents me? | U.S. President | U.S. Congress | Federal courts | State executives | State legislature | State and local courts | Counties | Cities | School districts | Public policy |