Help us improve in just 2 minutes—share your thoughts in our reader survey.

Arkansas Three New Casinos Amendment, Issue 5 (2016)

| Arkansas Issue 5 | |

|---|---|

| |

| Election date November 8, 2016 | |

| Topic Gambling | |

| Status Not on the ballot | |

| Type Constitutional amendment | Origin Citizens |

| 2016 measures |

|---|

| November 8 |

| Issue 1 |

| Issue 2 |

| Issue 3 |

| Issue 6 |

| Polls |

| Voter guides |

| Campaign finance |

| Signature costs |

The Arkansas Three New Casinos Amendment, also known as Issue 5, was not on the November 8, 2016, ballot in Arkansas as an initiated constitutional amendment. The Arkansas Supreme Court struck Issue 5 from the ballot on October 13, 2016, on the basis that it violated the federal Professional and Amateur Sports Protection Act prohibiting sports gambling.[1] The measure appeared on the ballot, but the court instructed the Arkansas Secretary of State to neither count nor certify results.

| A "yes" vote would have allowed three casinos to operate: one in Boone County, one in Miller County, and one in Washington County. |

| A "no" vote would have opposed this proposal, thus allowing only video poker and blackjack at Hot Springs horse track and West Memphis dog track. |

Voters in Massachusetts, New Jersey, and Rhode Island voted on expanding the number of gambling facilities in their states in 2016.

Overview

Gambling in Arkansas

Casinos were prohibited in Arkansas in 2016. Issue 5 would have authorized three casinos in the state. Voters rejected previous attempts to establish casinos. In 2012, the Arkansas Supreme Court invalidated two casino-authorizing initiatives before votes were tabulated. At the time, state law permitted some forms of electronic wagering in Arkansas, as long as local voters first approve them. Voters approved electronic wagering at a horse racetrack in Hot Springs and a dog racetrack in West Memphis.

Initiative design

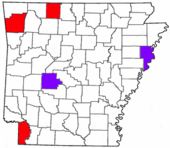

Issue 5 would have authorized the establishment of three new casinos: one in Boone County, one in Miller County, and one in Washington County. Operators of the proposed casinos in Boone and Miller counties were not been identified. The casino in Washington County would have been operated by the Cherokee Nation.[2] Any gaming permitted at a casino in Louisiana, Mississippi, Missouri, Nevada, Oklahoma, Tennessee, or Texas would have been permitted at the three casinos. Issue 5 would have established an Arkansas Gaming Commission to regulate the casinos. A tax would have been levied on the casino's net gaming receipts, with 18 percent of receipts going to the state, 0.5 percent to the county in which the casino is located, and 1.5 percent to the town in which the casino is located.[3][4]

State of the ballot measure campaigns

Arkansas Wins outraised opponents four-to-one. As of October 22, 2016, supporters had received about $6.2 million, while opponents had received $1.5 million. Cherokee Nation Businesses, LLC, which would have operated a casino under Issue 5, was a big financial backer of the measure, contributing $6 million. Oakland Racing and Gaming and Delaware North, owners of racetracks featuring electronic wagering, funded the opposition, with 95 percent of opponents’ received contributions coming from these two gambling firms. Polls showed weak support for Issue 5, with 38 percent in favor and 49 percent against.[5] Gov. Asa Hutchinson (R) opposed the amendment.[2]

Text of measure

Popular name

The popular name given for Issue 5 was as follows:[6]

| “ | An Amendment to Allow Three Casinos to Operate in Arkansas, One Each in the Following Counties: Boone County, Operated by Arkansas Gaming and Resorts, LLC; Miller County, Operated by Miller County Gaming, LLC; and Washington County, Operated by Washington County Gaming, LLC[7] | ” |

Ballot title

The ballot title for Issue 5 was as follows:[8]

An amendment to the Arkansas Constitution authorizing three casinos to operate in Arkansas, one in Boone County, Arkansas, operated by Arkansas Gaming and Resorts, LLC, an Arkansas Limited Liability Company, one in Miller County, Arkansas, operated by Miller County Gaming, LLC, an Arkansas Limited Liability Company, and one in Washington County, Arkansas, operated by Washington County Gaming, LLC, an Arkansas Limited Liability Company, all being subject to the laws enacted by the General Assembly in accord with this amendment and regulations promulgated by the Arkansas Gaming Commission in accord with laws enacted by the General Assembly; defining casino gaming and gaming as dealing, operating, carrying on, conducting, maintaining, or exposing for play any game played with cards, dice, equipment, or any mechanical, electromechanical, or electronic device or machine for money, property, checks, credit, or any representative value, as well as accepting wagers on sporting events or other events, including, without limiting the generality of the foregoing, any game, device, or type of wagering permitted at a casino operated within any one or more of the States of Louisiana, Mississippi, Missouri, Nevada, Oklahoma, Tennessee, or Texas as of November 8, 2016, or as subsequently permitted thereafter; creating the Arkansas Gaming Commission to regulate casinos in accord with laws enacted by the General Assembly, with the Arkansas Gaming Commission comprised of five (5) commissioners, each appointed by the Governor for staggered 5-year terms; providing for the General Assembly to appropriate monies to or for the use of the Arkansas Gaming Commission; requiring each casino to pay to the Arkansas State Treasury as general revenues a net casino gaming receipts tax equal to eighteen percent (18%) of its annual net casino gaming receipts; requiring each casino to pay to the county in which the casino is located a net casino gaming receipts tax equal to one-half of one percent (0.5%) of its annual net casino gaming receipts; requiring each casino to pay to the city or town in which the casino is located a net casino gaming receipts tax equal to one and one-half percent (l.5%) of its annual net casino gaming receipts; defining annual net casino gaming receipts as gross receipts for a 12-month period from casino gaming less amounts paid out or reserved as winnings to casino patrons for that 12-month period; subjecting each casino to the same income, property, sales, use, employment and other taxation as any for-profit business located in the county and city or town in which the casino is located, except that the Arkansas Gross Receipts Act of 1941 and local gross receipts taxes shall not apply to casino gaming receipts; allowing a casino to operate any day for any portion or all of any day; allowing the selling or complimentary serving of alcoholic beverages in casinos during all hours the casino operates but otherwise subject to all applicable Arkansas laws involving the distribution and sale of alcohol; permitting the shipment into Boone, Miller, and Washington counties in Arkansas of gambling devices shipped and delivered in accordance with applicable federal law (15 USC§§ 1171-1178 and amendments and replacements thereto); rendering the provisions of this amendment severable; declaring inapplicable all constitutional provisions and laws to the extent they conflict with this amendment, but not otherwise repealing, superseding, amending, or otherwise affecting Amendment 84 (bingo or raffles) or Amendment 87 (state lottery) to the Arkansas Constitution, or Arkansas Act 1151 of 2005 (Electronic Games of Skill). |

Constitutional changes

The measure would have added an amendment to the Arkansas Constitution:[3] Note: Hover over the text and scroll to see the full text.

Casinos and casino gaming are hereby authorized in the State of Arkansas as provided in this Amendment.

The Arkansas General Assembly shall from time to time enact laws, and appropriate monies to or for the use of the Arkansas Gaming Commission created under section 2 of this Amendment, to fulfill the purposes of this Amendment. Initial laws and appropriations enacted by the General Assembly pursuant hereto shall be in full force and effect no later than June 30, 2017.

A casino means a facility where casino gaming is conducted as authorized by this Amendment.

Casino gaming means to deal, operate, carry on, conduct, maintain, or expose for play any game played with cards, dice, equipment, or any mechanical, electromechanical, or electronic device or machine for money, property, checks, credit, or any representative value, as well as to accept wagers on sporting events or other events. The term casino gaming includes, without limiting the generality of the foregoing, any game, device, or type of wagering permitted at a casino operated within any one or more of the states of Louisiana, Mississippi, Missouri, Nevada, Oklahoma, Tennessee or Texas as of November 8, 2016, or as subsequently permitted thereafter.

For purposes of this Amendment, gaming means the same thing as casino gaming.

Section 2. Commission Created — Members — Powers.

There is hereby created the Arkansas Gaming Commission. The regulation of the casinos authorized by this Amendment, and the administration of the laws pertaining thereto, are hereby vested in the Arkansas Gaming Commission. The Arkansas Gaming Commission shall from time to time adopt regulations to regulate casinos and casino gaming in Arkansas in accord with laws enacted by the General Assembly. Initial regulations adopted by the Arkansas Gaming Commission shall be in full force and effect no later than March 31, 2018. The Arkansas Gaming Commission shall be comprised of five Commissioners, all of whom shall be appointed by the Governor. The first Commissioners of the Arkansas Gaming Commission shall be appointed no later than July 31, 2017, by the Governor for terms of one, two, three, four, and five years, respectively. The terms of the persons so appointed shall be determined by lot.

Upon the expiration of the foregoing terms of said Commissioners, successors shall be appointed by the Governor for terms of five years. Any vacancy arising in the membership on the Arkansas Gaming Commission for any reason other than the expiration of the regular term for which the Commissioner was appointed shall be filled by appointment by the Governor, to be thereafter effective until the expiration of such regular term.

The Governor shall have the power to remove any Commissioner for cause only, after notice and hearing before the Arkansas Gaming Commission. Such removal shall become effective only when approved in writing by a majority of the total number of the Commissioners, but without the right to vote by the Commissioner removed or by the successor Commissioner, which action shall be filed with the Secretary of State together with a complete record of the proceedings at the hearing. An appeal may be taken to the Pulaski County Circuit Court by the Governor or the Commissioner ordered removed, and the same shall be tried de novo on the record. An appeal may be taken from the Circuit Court to the Arkansas Supreme Court, which shall likewise be tried de novo.

Section 3. Authorized Locations and Licensees.

Casinos allowed under this Amendment shall be limited to no more than one casino in each of the following Arkansas counties and shall be operated by designated licensees as follows, with all licensees hereunder being subject to the laws enacted by the General Assembly in accord with this Amendment and regulations promulgated by the Arkansas Gaming Commission in accord with laws enacted by the General Assembly:

- a. Boone County, operated by Arkansas Gaming And Resorts, LLC, an Arkansas limited liability company, its successors or assigns;

- b. Miller County, operated by Miller County Gaming, LLC, an Arkansas limited liability company, its successors or assigns; and

- c. Washington County, operated by Washington County Gaming, LLC, an Arkansas limited liability company, its successors or assigns.

Section 4. Taxation.

Each casino shall pay an annual net casino gaming receipts tax equal to eighteen percent (18%) of its annual net casino gaming receipts to the Arkansas State Treasury as general revenues. Each casino shall pay an annual net casino gaming receipts tax equal to one-half of one percent (0.5%) of its annual net casino gaming receipts to the county in which the casino is located. Each casino shall pay an annual net casino gaming receipts tax equal to one and one-half percent (1.5%) of its annual net casino gaming receipts to the city or town in which the casino is located. Annual net casino gaming receipts are defined as gross receipts for a 12-month period from casino gaming, less amounts paid out or reserved as winnings to casino gaming patrons for that 12-month period. Amounts paid out or reserved as winnings to casino gaming patrons and the annual net casino gaming receipts taxes paid or reserved are deductible for purposes of calculating the casino's net income under the Income Tax Act of 1929 (Ark. Code Ann.§§ 26-51-101 et seq.) and any amendments or replacements thereto.

The tax imposed by Arkansas Gross Receipts Act of 1941 (Ark. Code Ann.§§ 26-52-101 et seq.), any amendments or replacements thereto, and any related local gross receipts taxes, shall not apply to casino gaming receipts, and no additional tax on casino gross receipts shall be imposed by the State or by counties, municipalities or other units of local government. Except for the exclusion in the previous sentence, each casino shall be subject to the same income, property, sales, use, employment or other taxation or assessments as any for-profit business located in the county and city or town in which the casino is located. No additional State or local taxes, fees, or assessments shall be imposed on the casinos except as authorized in this Amendment.

Section 5. Other Operational Provisions.

Casinos may operate any or all days of the year and for any or all portions of a 24-hour day.

Casinos shall be permitted to sell alcoholic beverages or provide complimentary servings of alcoholic beverages during all hours in which the casino is operating. Casinos shall be subject to all applicable Arkansas laws involving the distribution and sale of alcohol that do not conflict with the previous sentence.

Section 6. Legal Shipment of Gambling Devices into State.

All shipments of gambling devices, including slot machines, into any county of this State within which casino gaming is authorized, the registering, recording, and labeling of which have been duly performed by the manufacturer and/or dealer thereof in accordance with 15 U.S.C. §§ 1171- 1178 and amendments and replacements thereto, shall be deemed legal shipments thereof into any such county of this State within which casino gaming is authorized.

Section 7. Severability.

If any provision of this Amendment, or the application of any such provision to any person or circumstance is held invalid, the validity of any other provision of this Amendment, or the application of such provision to other persons and circumstances, shall not be affected thereby, and to this end the provisions of this Amendment are declared to be severable.

Section 8. Inconsistent Provisions Inapplicable.

All provisions of the Constitution of this State and statutes of this State, including, but not limited to, laws forbidding the judicial enforcement of gambling debts and statutes declaring gambling to be crimes, to the extent inconsistent or in conflict with any provision of this Amendment are expressly declared null and void as to, and do not apply to, any activities allowed under this Amendment. However, this Amendment does not repeal, supersede, amend, or otherwise affect Amendment 84 (bingo or raffles) or Amendment 87 (state lottery) to the Arkansas Constitution, or Act 1151 of 2005 (electronic games of skill) (Ark. Code Ann. § § 23-113-101 et seq.).[7]

Support

Arkansas Wins led the campaign in support of Issue 5.[9]

Supporters

Arguments

The University of Arkansas Division of Agriculture's 2016 Ballot Issue Guide summarized proponents' arguments in three bullet points:[4]

| “ |

|

” |

Arkansas Wins argued the amendment would encourage economic development and bring in tax revenue. The campaign stated:[12]

| “ | Issue 5 will spur economic development and tourism across Arkansas and will create thousands of good paying jobs.

The casinos authorized by Issue 5 will pay a tax of 18% to the State of Arkansas, 0.5% to the county, and 1.5% to the city in which the casino is located, resulting in tens of millions of dollars in new tax revenue to the state and local communities that can be used to fund priorities such as roads and education, or be used to cut taxes.[7] |

” |

Other arguments in support of the measure included:

- Robert Coon, a spokesperson for Arkansas Wins, said, "This amendment will create thousands of good paying jobs, generate tens of millions of dollars in new tax revenue, increase tourism, and stimulate our state and local economies."[13]

Opposition

Protect Arkansas Values — Stop Casinos Now led the campaign in opposition to Issue 5.[14]

Opponents

Officials

- Gov. Asa Hutchinson (R)[2]

- Sen. Cecile Bledsoe (R-3)[15][16]

- Sen. Ron Caldwell (R-23)

- Sen. Eddie Cheatham (D-26)

- Sen. Alan Clark (R-13)

- Sen. John Cooper (R-21)

- Sen. Jonathan Dismang (R-28)

- Sen. Jane English (R-34)

- Sen. Jake Files (R-8)

- Sen. Scott Flippo (R-17)

- Sen. Jim Hendren (R-2)

- Sen. Jimmy Hickey, Jr. (R-11)

- Sen. Keith Ingram (D-24)

- Sen. Missy Irvin (R-18)

- Sen. Bruce Maloch (D-12)

- Sen. Bobby Pierce (D-27)

- Sen. Jason Rapert (R-35)

- Sen. Bill Sample (R-14)

- Sen. David J. Sanders (R-15)

- Sen. Greg Standridge (R-16)

- Sen. Gary Stubblefield (R-6)

- Sen. Larry Teague (D-10)

- Sen. Eddie Joe Williams (R-29)

- Rep. Bob Ballinger (R-97)

- Rep. Scott Baltz (D-61)

- Rep. Rick Beck (R-65)

- Rep. Nate Bell (I-20)

- Rep. Camille Bennett (D-14)

- Rep. David Branscum (R-83)

- Rep. Justin Boyd (R-77)

- Rep. Karilyn Brown (R-41)

- Rep. Charlie Collins (R-84)

- Rep. Bruce Cozart (R-25)

- Rep. Andy Davis (R-31)

- Rep. Gary Deffenbaugh (R-79)

- Rep. Jana Della Rosa (R-90)

- Rep. Charlotte Douglas (R-75)

- Rep. Dan Douglas (R-91)

- Rep. Trevor Drown (R-68)

- Rep. Les Eaves (R-46)

- Rep. Charlene Fite (R-80)

- Rep. Deborah Ferguson (D-51)

- Rep. Lanny Fite (R-23)

- Rep. Vivian Flowers (D-17)

- Rep. Mickey Gates (R-22)

- Rep. Justin Gonzales (R-19)

- Rep. Michelle Gray (R-62)

- Rep. Justin Harris (R-81)

- Rep. Kim Hammer (R-28)

- Rep. Kenneth Henderson (R-71)

- Rep. Kim Hendren (R-92)

- Rep. David Hillman (D-13)

- Rep. Grant Hodges (R-96)

- Rep. Monte Hodges (D-55)

- Rep. Mike Holcomb (R-10)

- Rep. Douglas House (R-40)

- Rep. Joe Jett (D-56)

- Rep. Greg Leding (D-86)

- Rep. Tim Lemons (R-43)

- Rep. Robin Lundstrum (R-87)

- Rep. Stephen Magie (D-72)

- Rep. Julie Mayberry (R-27)

- Rep. Mark McElroy (D-11)

- Rep. George McGill (D-78)

- Rep. Ron McNair (R-98)

- Rep. David Meeks (R-70)

- Rep. Stephen Meeks (R-67)

- Rep. Josh Miller (R-66)

- Rep. Reginald Murdock (D-48)

- Rep. Milton Nicks, Jr. (D-50)

- Rep. Betty Overbey (D-69)

- Rep. James Ratliff (D-60)

- Rep. Chris Richey (D-12)

- Rep. John Payton (R-64)

- Rep. Rebecca Petty (R-94)

- Rep. Marcus Richmond (R-21)

- Rep. Laurie Rushing (R-26)

- Rep. Brandt Smith (R-58)

- Rep. Jim Sorvillo (R-32)

- Rep. Nelda Speaks (R-100)

- Rep. Dan Sullivan (R-53)

- Rep. Clarke Tucker (D-35)

- Rep. DeAnn Vaught (R-4)

- Rep. John Vines (D-25)

- Rep. Dave Wallace (R-54)

- Rep. Marshall Wright (D-49)

- Rep. Richard Womack (R-18)

Former officials

- Former Gov. Mike Beebe (D)[17]

Organizations

- Arkansas State Chamber of Commerce[18]

Businesses

- Oaklawn Racing and Gaming[10]

- Southland Park Gaming and Racing

Arguments

The University of Arkansas Division of Agriculture's 2016 Ballot Issue Guide summarized opponents' arguments in four bullet points:[4]

| “ |

|

” |

Protect Arkansas Values — Stop Casinos Now argued five points in opposition to Issue 5:[19]

| “ |

1.Our Constitution will be Compromised. 2. No Local Control. 3. No state has ever done this before. 4. Invites Corruption into Arkansas. 5. Forces Changes in our Culture and Values. |

” |

Other arguments in opposition to the measure included:

- Gov. Asa Hutchinson (R) said, "I continue to oppose initiated efforts to bring casino gambling to Arkansas. ... The proposed amendment dictates specific locations for casino gambling that prevent the people who live there from having control over what type of community they will have in the future."[2]

Campaign advertisements

The following video advertisements were produced by Protect Arkansas Values — Stop Casinos Now:[20]

|

Campaign finance

| Total campaign contributions: | |

| Support: | $6,165,600.00 |

| Opposition: | $1,540,294.30 |

Two campaign committees were registered in support of Issue 5, and two were registered in opposition as of October 2016. The contribution and expenditure totals below were current of October 22, 2016.[5]

Support

| PAC | Amount raised | Amount spent |

|---|---|---|

| Arkansas Wins in 2016, LLC | $25,600.00 | $25,600.00 |

| Arkansas Winning Initiative, Inc. | $6,147,400.00 | $3,965,486.11 |

| Total | $6,165,600.00 | $3,983,686.11 |

Top donors

The following were the top donors who contributed to the supporting committees as of October 22, 2016:[5]

| Donor | Amount |

|---|---|

| Cherokee Nation Businesses, LLC | $6,000,000 |

| Arkansas Gaming and Resorts | $65,000 |

Opposition

One of the opposing committees, the Family Council Action Committee, was registered in opposition to Issue 4, Issue 5, Issue 6, and Issue 7. It was impossible to disaggregate how much the committee spent on each measure. The total amounts expended by the Family Council Action Committee were likely spread across the measures.[5]

| PAC | Amount raised | Amount spent |

|---|---|---|

| Committee to Protect Arkansas' Values Stop Casinos Now | $1,536,304.30 | $1,130,243.46 |

| Family Council Action Committee | $3,990.00 | $7,491.42 |

| Total | $1,540,294.30 | $1,137,734.88 |

Top donors

As of October 22, 2016, the following were the top donor in opposition to Issue 5:[5]

| Donor | Cash | In-kind | Total |

|---|---|---|---|

| Oaklawn Racing and Gaming | $748,377 | $0.00 | $748,377 |

| Delaware North | $721,277 | $0.00 | $721,277 |

| Isle of Capri | $20,000 | $0.00 | $20,000 |

| Arkansas Thoroughbred Breeds | $10,000 | $0.00 | $10,000 |

| Arkansas Horsemens Benevolent | $10,000 | $0.00 | $10,000 |

Methodology

To read Ballotpedia's methodology for covering ballot measure campaign finance information, click here.

Polls

- In mid-September 2016, Talk Business & Politics-Hendrix College found 38 percent of respondents in support of and 49 percent in opposition to Issue 5. The poll indicated that people under 45, African-Americans, Democrats, and residents of northwestern Arkansas were more included to support the measure compared to other groups.[21]

| Arkansas Issue 5 (2016) | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Poll | Support | Oppose | Undecided | Margin of error | Sample size | ||||||||||||||

| Talk Business & Politics-Hendrix College 9/15/2016 - 9/17/2016 | 38.0% | 49.0% | 13.0% | +/-3.4 | 831 | ||||||||||||||

| Note: The polls above may not reflect all polls that have been conducted in this race. Those displayed are a random sampling chosen by Ballotpedia staff. If you would like to nominate another poll for inclusion in the table, send an email to editor@ballotpedia.org. | |||||||||||||||||||

Background

Gambling laws in Arkansas

The state of Arkansas has a long history of ballot measures related to gambling regulation. In 1956, voters legalized pari-mutuel wagering on horse races in Hot Springs, Arkansas, via Amendment 50 and defeated an amendment, titled Amendment 49, designed to ban gambling on dog and horse races. A wagering amendment was defeated in 1964. In 1984, an initiative, titled Amendment 66, was certified for the ballot. Amendment 66 would have legalized gambling in Garland County. Voters defeated the measure two-to-one. Voters also defeated Amendment 4, which would have allowed casino gambling in Hot Springs, in 1996.

Advocates of legalized gambling briefly continued their losing streak into the 21st century. In 2000, Amendment 5 was defeated. The measure would have authorized casinos in six counties. Charitable raffles and bingo were viewed more favorably by Arkansans, and the state passed Amendment 1, which legalized them, in 2006. Although Issue 3 and Issue 4 appeared on some ballots in 2012, the two casino-legalizing amendments were struck down by the Arkansas Supreme Court before results could be tabulated.

The Arkansas Legislature passed a bill in 2005 authorizing racetracks to feature electronic games of chance with local voter approval. Voters authorized the Hot Springs horse track and West Memphis dog track to feature video poker and blackjack.[22]

Casinos across the states

The American Gaming Association produced data on commercial casinos, which included land-based, riverboat, dockside, and racetrack casinos, for the year 2012. The table below compares the number of casinos, total commercial casino revenue, total tax revenue, tax revenue as a percentage of total revenue, total employee wages, and employee wages per capita for each state with operating commercial casinos. Native American-owned casinos were excluded from AGA's calculations.[23]

| State | Date of legalization | Number of casinos in 2012 | Gross casino/gaming revenue (in millions) | Tax revenue (in millions) | Tax revenue as % of gaming revenue | Employee wages (in millions) | Casino employees | Casino employee wages per capita |

|---|---|---|---|---|---|---|---|---|

| Colorado | 1990 | 41 | $766.25 | $104.26 | 13.61% | $216.74 | 9,278 | $23,360.64 |

| Delaware | 1994 | 3 | $526.67 | $217.44 | 41.29% | $105.19 | 2,775 | $37,906.31 |

| Florida | 2006 | 6 | $427.89 | $161.76 | 37.80% | $104.66 | 3,319 | $31,533.59 |

| Illinois | 1990 | 10 | $1,639.00 | $574.34 | 35.04% | $324.48 | 7,687 | $42,211.53 |

| Indiana | 1993 | 13 | $2,614.00 | $806.56 | 30.86% | $461.82 | 12,543 | $36,818.94 |

| Iowa | 1989 | 18 | $1,467.00 | $334.43 | 22.80% | $341.09 | 9,558 | $35,686.34 |

| Kansas | 2007 | 3 | $341.15 | $92.17 | 27.02% | $50.45 | 1,344 | $37,537.20 |

| Louisiana | 1991 | 18 | $2,404.00 | $579.45 | 24.10% | $631.00 | 15,061 | $41,896.29 |

| Maine | 2004 | 2 | $99.22 | $43.11 | 43.45% | $11.90 | 879 | $13,538.11 |

| Maryland | 2008 | 3 | $377.81 | $218.20 | 57.75% | $17.47 | 499 | $35,010.02 |

| Michigan | 1996 | 3 | $1,417.00 | $319.75 | 22.57% | $366.53 | 7,972 | $45,977.17 |

| Mississippi | 1990 | 30 | $2,251.00 | $272.73 | 12.12% | $847.66 | 23,277 | $36,416.20 |

| Missouri | 1993 | 13 | $1,769.00 | $471.410 | 26.65% | $335.90 | 9,631 | $34,876.96 |

| Nevada | 1931 | 265 | $10,860.00 | $868.60 | 8.00% | $7,693.0 | 170,206 | $45,198.17 |

| New Jersey | 1976 | 12 | $3,051.00 | $254.84 | 8.35% | $912.22 | 34,726 | $26,269.08 |

| New Mexico | 1997 | 5 | $241.48 | $62.79 | 26.00% | $29.77 | 918 | $32,429.19 |

| New York | 2001 | 9 | $1,802.00 | $822.67 | 45.65% | $189.63 | 5,233 | $36,237.34 |

| Ohio | 2009 | 4 | $429.83 | $138.18 | 32.15% | $91.27 | 4,197 | $21,746.49 |

| Oklahoma | 2004 | 2 | $113.06 | $20.38 | 18.03% | N/A[24] | 870 | N/A[24] |

| Pennsylvania | 2004 | 11 | $3,158.00 | $1,487.00 | 47.09% | $339.77 | 10,162 | $33,435.35 |

| Rhode Island | 1992 | 2 | $527.96 | $328.98 | 62.31% | N/A[24] | N/A[24] | N/A[24] |

| South Dakota | 1989 | 35 | $107.36 | $16.62 | 15.48% | $38.170 | 1,686 | $22,639.38 |

| West Virginia | 1994 | 5 | $948.81 | $402.50 | 42.42% | $134.68 | 4,351 | $30,953.80 |

Reports and analyses

Economic Impact Group

Arkansas Wins contracted Economic Impact Group, an economic modeling and analysis consulting firm, to estimate the "economic impacts derived from the construction and operations of the three proposed casinos in Boone, Miller, and Washington counties." The firm estimated the three casinos would increase annual tax revenue $122 million. The following points are from the report's executive summary:[25]

| “ | One-Time Construction Impacts

Ongoing Annual Impacts from Casino Operations

|

” |

The full report is available here

Path to the ballot

Attorney General Leslie Rutledge approved Issue 5 for circulation on June 1, 2016.[8]

Supporters of Issue 5, an initiated constitutional amendment, had until July 8, 2016, to submit 84,859 valid signatures. Furthermore, proponents were required to collect signatures equaling at least 5 percent of the previous gubernatorial votes in at least 15 of the state's counties. For example, if 1,000 people voted for governor in a county, the signatures of 50 qualified electors would be required.

Supporters submitted more than 92,000 signatures on July 8, 2016.[26] Arkansas Secretary of State Mark Martin verified only 63,725 of the necessary 84,859 signatures. Since over 75 percent of them were legitimate, Martin's office granted the casino campaign an additional 30 days to collect the remainder.[27] On August 15, 2016, Arkansas Wins submitted an additional 50,000 signatures.[28] The secretary of state's office certified on the measure on September 1, 2016.[22] Between the two sets of signatures, a total of 93,102 were validated.[29]

Cost of signature collection:

Sponsors of the measure hired Stampede Consulting, LLC, and National Ballot Access to collect signatures for the petition to qualify this measure for the ballot. A total of $799,367.21 was spent to collect the 84,859 valid signatures required to put this measure before voters, resulting in a total cost per required signature (CPRS) of $9.42.[30][31]

Lawsuits

| Lawsuit overview | |

| Issue: Ballot language and signature validity | |

| Court: Arkansas Supreme Court | |

| Ruling: Ruled in favor of plaintiffs, removing the measure from the ballot | |

| Plaintiff(s): The Committee to Protect Arkansas Values/Stop Casinos Now | Defendant(s): Secretary of State Mark Martin |

| Plaintiff argument: Ballot title misled voters to believe that gambling on sports events would be permitted, while federal law prohibited it | Defendant argument: Language was clear and succinct, and the Supreme Court did not have jurisdiction to hear the case |

Protect Arkansas Values — Stop Casinos Now filed litigation against Secretary of State Mark Martin (R) on September 6, 2016. The plaintiff argued that the ballot title did not adequately explain the amendment and would mislead voters. Protect Arkansas Values also alleged that Arkansas Wins, the committee sponsoring Issue 5, did not follow state law regarding paid petitioners. Arkansas Wins contended that the language was not misleading and the Supreme Court did not have jurisdiction to hear the case.[32]

On September 29, 2016, a judge appointed to study the allegation that proponents did not follow petition circulation laws found more than 12,000 questionable signatures. If the Supreme Court invalidated the questionable signatures, then Issue 5 would have been struck from the ballot.[29]

On September 30, 2016, Protect Arkansas Values submitted an additional complaint against Issue 5. Specifically, the plaintiff alleged that the amendment included sports betting, which was illegal under federal law. Retired Judge Bill Walmsley, who submitted the complaint for Protect Arkansas Values, said, "It violates the federal law. So, the federal law would trump this constitutional amendment and would prohibit any type of sports betting." Robert Coon of Arkansas Wins responded, "Sports betting is mentioned in the amendment. It's there intentionally. It is to give future legislature the opportunity to pursue that should federal law change. Ultimately, the amendment itself, if passed by the voters, would not enable sports betting in Arkansas."[33]

On October 13, 2016, the Arkansas Supreme Court ruled in favor of the plaintiff, noting that Issue 5 conflicted with the federal Professional and Amateur Sports Protection Act (PASPA) prohibiting sports gambling. Associate Justice Karen R. Baker wrote the court's opinion:[1]

| “ | The title informs voters that the Amendment will permit sports gambling, as well as any type of wagering allowed in Nevada, which necessarily includes wagers on sports. However, here, PASPA prohibits sports gambling in Arkansas. Accordingly, the Amendment's language clearly conflicts with Federal law that prohibits sports gambling in Arkansas. Yet the ballot title does not inform the voters that the Amendment violates federal law. … We conclude that the ballot title of the proposed Amendment is insufficient. It fails to convey to the voter the scope and import of the proposed measure.[7] | ” |

State profile

| Demographic data for Arkansas | ||

|---|---|---|

| Arkansas | U.S. | |

| Total population: | 2,977,853 | 316,515,021 |

| Land area (sq mi): | 52,035 | 3,531,905 |

| Race and ethnicity** | ||

| White: | 78% | 73.6% |

| Black/African American: | 15.5% | 12.6% |

| Asian: | 1.4% | 5.1% |

| Native American: | 0.6% | 0.8% |

| Pacific Islander: | 0.2% | 0.2% |

| Two or more: | 2.1% | 3% |

| Hispanic/Latino: | 6.9% | 17.1% |

| Education | ||

| High school graduation rate: | 84.8% | 86.7% |

| College graduation rate: | 21.1% | 29.8% |

| Income | ||

| Median household income: | $41,371 | $53,889 |

| Persons below poverty level: | 22.9% | 11.3% |

| Source: U.S. Census Bureau, "American Community Survey" (5-year estimates 2010-2015) Click here for more information on the 2020 census and here for more on its impact on the redistricting process in Arkansas. **Note: Percentages for race and ethnicity may add up to more than 100 percent because respondents may report more than one race and the Hispanic/Latino ethnicity may be selected in conjunction with any race. Read more about race and ethnicity in the census here. | ||

Presidential voting pattern

- See also: Presidential voting trends in Arkansas

Arkansas voted Republican in all seven presidential elections between 2000 and 2024.

Pivot Counties (2016)

Ballotpedia identified 206 counties that voted for Donald Trump (R) in 2016 after voting for Barack Obama (D) in 2008 and 2012. Collectively, Trump won these Pivot Counties by more than 580,000 votes. Of these 206 counties, one is located in Arkansas, accounting for 0.5 percent of the total pivot counties.[34]

Pivot Counties (2020)

In 2020, Ballotpedia re-examined the 206 Pivot Counties to view their voting patterns following that year's presidential election. Ballotpedia defined those won by Trump won as Retained Pivot Counties and those won by Joe Biden (D) as Boomerang Pivot Counties. Nationwide, there were 181 Retained Pivot Counties and 25 Boomerang Pivot Counties. Arkansas had one Retained Pivot County, 0.55 percent of all Retained Pivot Counties.

More Arkansas coverage on Ballotpedia

- Elections in Arkansas

- United States congressional delegations from Arkansas

- Public policy in Arkansas

- Endorsers in Arkansas

- Arkansas fact checks

- More...

Recent news

The link below is to the most recent stories in a Google news search for the terms Arkansas 2016 Casinos Issue 5. These results are automatically generated from Google. Ballotpedia does not curate or endorse these articles.

Related measures

2016

| Gambling measures on the ballot in 2016 | |

|---|---|

| State | Measures |

| Massachusetts | Massachusetts Authorization of a Second Slots Location, Question 1 |

See also

External links

Basic information

- Text of Issue 5

- Arkansas 2016 Ballot Issues

- University of Arkansas 2016 Guide to Arkansas Ballot Measures

Support

Opposition

Footnotes

- ↑ 1.0 1.1 Arkansas Supreme Court, "Ruling in The Committee to Protect Arkansas Values/Stop Casinos Now v. Martin," October 13, 2016

- ↑ 2.0 2.1 2.2 2.3 Arkansas Online, "Casino measure backer: Tribe's a partner," June 24, 2016

- ↑ 3.0 3.1 Arkansas Attorney General, "Initiative Petition," accessed September 28, 2016

- ↑ 4.0 4.1 4.2 University of Arkansas, "2016 Guide to Arkansas Ballot Measures," accessed September 28, 2016

- ↑ 5.0 5.1 5.2 5.3 5.4 Arkansas Ethics Commission, "Committees," accessed October 22, 2016

- ↑ Arkansas Secretary of State, "2016 Ballot Issues," accessed September 20, 2016

- ↑ 7.0 7.1 7.2 7.3 7.4 7.5 7.6 7.7 Note: This text is quoted verbatim from the original source. Any inconsistencies are attributable to the original source. Cite error: Invalid

<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content - ↑ 8.0 8.1 Arkansas Attorney General, "Opinion No. 2016-058," June 1, 2016

- ↑ Arkansas Wins, "Homepage," accessed September 28, 2016

- ↑ 10.0 10.1 Talk Business & Politics, "Anti-casino group funded by Oaklawn, Southland to fight ‘out-of-state opportunists’," September 14, 2016

- ↑ Harrison Daily, “Former mayor sees potential in casinos,” October 1, 2016

- ↑ Arkansas Wins, "About Us," accessed September 28, 2016

- ↑ Arkansas Online, "Proposal for three state casinos makes ballot", September 2, 2016

- ↑ Protect Arkansas Values, "Homepage," accessed September 28, 2016

- ↑ Harrison Daily, "List of 40 legislators joining the anti-casino committee," September 13, 2016

- ↑ UALR Public Radio, "Eighty-Seven Arkansas Legislators Now Opposed To Casino Amendment," September 28, 2016

- ↑ The Gazette, "Former Arkansas Gov. Mike Beebe opposing casinos measure," September 21, 2016

- ↑ The Daily Progress, "Arkansas State Chamber of Commerce opposing casinos measure," September 22, 2016

- ↑ Protect Arkansas Values, "Protect Arkansas Values," accessed September 28, 2016

- ↑ Youtube, "Protect Arkansas Values — Stop Casinos Now," accessed September 28, 2016

- ↑ KATV, "NEW POLL: Casino initiative trails, but has a chance for passage," September 26, 2016

- ↑ 22.0 22.1 Arkansas Business, "Measure Allowing Casinos in 3 Arkansas Counties Makes Ballot," September 1, 2016

- ↑ American Gaming Association, "2013 State of the State," May 2014

- ↑ 24.0 24.1 24.2 24.3 24.4 Firms declined to provide data to the AGA.

- ↑ Economic Impact Group, "Arkansas Issue 5: The Estimated Economic Impact of Casino: Operations in Boone, Miller, and Washington Counties," October 10, 2016

- ↑ KATV, "Arkansas casino measure backers submit petitions," July 8, 2016

- ↑ Sentinel-Record, "Arkansas casino campaign wins more time to gather signatures," July 28, 2016

- ↑ News & Observer, "Arkansas casino group turns in 50,000 additional signatures," August 15, 2016

- ↑ 29.0 29.1 KNWA‑TV, "Petition Problems Could Invalidate Issue 4," September 29, 2016

- ↑ Arkansas Ethics Commission,"Arkansas Winning Initiative, Inc 7/15/16 report," accessed September 12, 2016

- ↑ Arkansas Ethics Commission,"Arkansas Winning Initiative, Inc 8/12/16 report," accessed September 12, 2016

- ↑ Southwest Times Record, "Backers of Arkansas casino proposal ask court to toss legal challenge," September 20, 2016

- ↑ THV 11, "Ark. casino ballot measure faces new criticism," September 30, 2016

- ↑ The raw data for this study was provided by Dave Leip of Atlas of U.S. Presidential Elections.

|

State of Arkansas Little Rock (capital) |

|---|---|

| Elections |

What's on my ballot? | Elections in 2025 | How to vote | How to run for office | Ballot measures |

| Government |

Who represents me? | U.S. President | U.S. Congress | Federal courts | State executives | State legislature | State and local courts | Counties | Cities | School districts | Public policy |