Historical North Carolina budget and finance information

![]() This article does not contain the most recently published data on this subject. If you would like to help our coverage grow, consider donating to Ballotpedia.

This article does not contain the most recently published data on this subject. If you would like to help our coverage grow, consider donating to Ballotpedia.

The historical North Carolina budget and finance information below applies to years prior to the most current fiscal year. With the exception of the tab labeled "Prior fiscal year budgets," the tabs below display information, from several different fiscal years, as it was presented on Ballotpedia in prior calendar years. For more current information regarding North Carolina's budget and finances, click here.

As published 2016

| North Carolina budget and finances | |

| General information | |

| Budget calendar: Biennial | |

| Fiscal year: 2017 | |

| State credit rating: AAA (as of 2014) | |

| Current governor: Pat McCrory | |

| Financial figures | |

| Total spending (state and federal funds): $44.4 billion (estimated for 2015) | |

| Per capita spending: $4,416.70 (estimated for 2015) | |

| Total state tax collections: $23.4 billion (2014) | |

| Per capita tax collections: $2,353.71 (2014) | |

| State debt: $107.6 billion (as of 2014) | |

| Per capita state debt: $11,032 (as of 2014) | |

| State budget and finance pages • Total state expenditures • State debt • Tax policy in North Carolina | |

In North Carolina, as in other states, lawmakers and public officials are elected in part to manage the state's finances. This includes generating revenues (money coming into the state from various sources) and approving expenditures (the money spent on governmental functions and servicing state debt). State budgets are complex and fluid, as they depend on anticipated revenues and planned expenditures, which may alter over the course of a fiscal year. If revenues do not keep pace with expenditures, states generally have to raise taxes, cut services, borrow money, or a combination of the three. State budget decisions are also influenced by policy decisions at the national level, such as the Affordable Care Act or energy and environmental regulations, and issues at the local level, such as crime and the quality of education.

The North Carolina state budget and financial data presented here come from different years because the states and the federal government report and publish the information at different times.

Definitions

The following terms are used to describe a state's finances:

- Revenues come mainly from tax collections, licensing fees, federal aid, and returns on investments.

- Expenditures generally include spending on government salaries, infrastructure, education, public pensions, public assistance, corrections, Medicaid, and transportation.

- State debt refers to the money borrowed to make up for a deficit when revenues do not cover spending.

- The state credit rating is the grade given by a credit rating agency based on the general financial health of the state's government and economy.

- State funds include general and other state-based funds. A general fund is "the predominant fund for financing a state's operations." Other state funds are "restricted by law for particular governmental functions or activities."[4]

- Federal funds are "funds received directly from the federal government."[4]

- Total spending is calculated by adding together the totals for state and federal funds used for expenditures.

Revenues

2014 revenues

The table below breaks down state government tax collections by source in 2014 (comparable figures from surrounding states are also provided to give additional context). Figures for all columns except "2013 population" and "Per capita collections" are rendered in thousands of dollars (for example, $2,448 translates to $2,448,000). Figures in the columns labeled "2013 population" and "Per capita collections" have not been abbreviated.[5]

Compared to neighboring states, North Carolina had the highest state tax collections per capita, at $2,354.

| State tax collections by source ($ in thousands), 2014 | ||||||||

|---|---|---|---|---|---|---|---|---|

| State | Property taxes | Sales and gross receipts | Licenses | Income taxes | Other taxes | Total | 2013 population | Per capita collections |

| North Carolina | N/A | $9,978,484 | $1,600,058 | $11,751,148 | $67,061 | $23,396,751 | 9,940,387 | $2,354 |

| Georgia | $788,350 | $7,310,132 | $609,944 | $9,909,378 | $10,698 | $18,628,502 | 10,097,132 | $1,845 |

| South Carolina | $21,664 | $4,628,363 | $471,862 | $3,750,341 | $60,334 | $8,932,564 | 4,829,160 | $1,850 |

| Tennessee | N/A | $8,758,085 | $1,335,392 | $1,416,190 | $296,662 | $11,806,329 | 6,547,779 | $1,803 |

| Virginia | $35,561 | $6,063,182 | $795,515 | $11,618,200 | $436,814 | $18,949,272 | 8,328,098 | $2,275 |

| United States | $14,232,835 | $411,414,175 | $51,120,024 | $357,104,785 | $31,880,270 | $865,752,089 | 318,907,401 | $2,715 |

| Source: U.S. Census Bureau, "2014 annual survey of state government tax collections by category," accessed April 4, 2016 | ||||||||

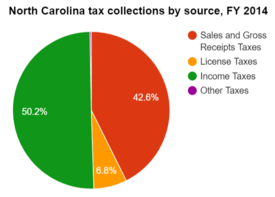

The table below lists 2014 tax collections by source as percentages of total collections. About 50.2 percent of North Carolina's total state tax collections came from income taxes.[5]

| State tax collections by source (as percentages), 2014 | |||||

|---|---|---|---|---|---|

| State | Property taxes | Sales and gross receipts | Licenses | Income taxes | Other taxes |

| North Carolina | N/A | 42.6% | 6.8% | 50.2% | 0.3% |

| Georgia | 4.2% | 39.2% | 3.3% | 53.2% | 0.1% |

| South Carolina | 0.2% | 51.8% | 5.3% | 42.0% | 0.7% |

| Tennessee | N/A | 74.2% | 11.3% | 12.0% | 2.5% |

| Virginia | 0.2% | 32.0% | 4.2% | 61.3% | 2.3% |

| Source: U.S. Census Bureau, "2014 annual survey of state government tax collections by category," accessed April 4, 2016 | |||||

Federal aid to the state budget

- See also: Federal aid to state budgets

State governments receive aid from the federal government to fund a variety of joint programs, mainly in the form of grants for such things as Medicaid, education, and transportation. In 2013 federal aid to the states accounted for roughly 30 percent of all state general revenues. Federal aid varies from state to state. For example, Mississippi received approximately $7.5 billion in federal aid in 2013, accounting for about 43 percent of the state's general revenues, the highest percentage of all of the states. By contrast, North Dakota received about $1.5 billion in federal aid in 2013, or just 19 percent of the state's general revenues, the lowest percentage in the nation.[6]

The table below notes what share of North Carolina’s general revenues came from the federal government in 2013. That year, North Carolina received approximately $15.5 billion in federal aid, 32.5 percent of the state's total general revenues. Taking into consideration the state's 2013 population, this came out to about $1,571 in federal aid per capita. Figures from surrounding states are provided for additional context.[7]

| Federal aid to state budgets, 2013 | |||||

|---|---|---|---|---|---|

| State | Total federal aid ($ in thousands) | Federal aid as a % of general revenues | Ranking (by % of general revenues) | Est. 2013 population | Aid per capita |

| North Carolina | $15,470,808 | 32.5% | 25 | 9,848,060 | $1,571 |

| Georgia | $14,323,163 | 37.3% | 7 | 9,992,167 | $1,433 |

| South Carolina | $6,698,952 | 30.2% | 30 | 4,774,839 | $1,403 |

| Tennessee | $10,819,977 | 39.5% | 3 | 6,495,978 | $1,666 |

| Virginia | $9,412,343 | 22.9% | 47 | 8,260,405 | $1,139 |

| Sources: United States Census Bureau, "State Government Finances: 2013," accessed April 4, 2016 United States Census Bureau, "State totals: Vintage 2013," accessed April 8, 2016 Note: Per-capita figures were generated by Ballotpedia by dividing total federal aid for the state by the estimated population of that state in 2013. | |||||

Spending

Estimated 2015 expenditures

- See also: Total state expenditures

The table below breaks down estimated spending totals for fiscal year 2015 (comparable figures from surrounding states are included to provide additional context). Figures for all columns except "Population” and “Per capita spending" are rendered in millions of dollars (for example, $2,448 translates to $2,448,000,000). Figures in the columns labeled "Population” and “Per capita spending" have not been abbreviated.[2]

North Carolina's total estimated government spending in fiscal year 2015 was $44.4 billion, which was the second highest amount when compared to surrounding states.

| Total estimated state spending, FY 2015 ($ in millions) | |||||

|---|---|---|---|---|---|

| State | State funds | Federal funds | Total spending | Population | Per capita spending |

| North Carolina | $30,426 | $13,930 | $44,356 | 10,042,802 | $4,416.70 |

| Georgia | $30,593 | $12,901 | $43,494 | 10,214,860 | $4,257.91 |

| South Carolina | $14,926 | $7,631 | $22,557 | 4,896,146 | $4,607.09 |

| Tennessee | $18,806 | $13,156 | $31,962 | 6,600,299 | $4,842.51 |

| Virginia | $36,257 | $9,706 | $45,963 | 8,382,993 | $5,482.89 |

| Per-capita figures are calculated by taking the state's total spending and dividing by the number of state residents according to United States Census Bureau estimates.[8] Source: National Association of State Budget Officers, "Examining fiscal 2013-2015 state spending," accessed April 4, 2016 | |||||

Spending by function

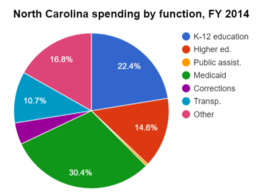

State spending in North Carolina can be further broken down by function (elementary and secondary education, public assistance, etc.). Fiscal year 2014 information is included in the table below (information from neighboring states is provided for additional context). Figures are rendered as percentages, indicating the share of the total budget spent per category.[2]

In fiscal year 2014, Medicaid accounted for 30.4 percent of North Carolina's total expenditures.

| State spending by function as a percent of total expenditures, FY 2014 | |||||||

|---|---|---|---|---|---|---|---|

| State | K-12 education | Higher education | Public assistance | Medicaid | Corrections | Transportation | Other |

| North Carolina | 22.4% | 14.6% | 0.5% | 30.4% | 4.5% | 10.7% | 16.8% |

| Georgia | 24.3% | 18.8% | 0.1% | 21.6% | 3.6% | 5.9% | 25.7% |

| South Carolina | 18.4% | 23.6% | 0.4% | 24.6% | 2.8% | 6.5% | 23.7% |

| Tennessee | 18.3% | 14.2% | 0.3% | 30.6% | 3.1% | 5.7% | 27.8% |

| Virginia | 15.1% | 15.2% | 0.3% | 17.2% | 2.7% | 12.0% | 37.4% |

| Source: National Association of State Budget Officers Note: "Other" expenditures include "Children's Health Insurance Program (CHIP), institutional and community care for the mentally ill and developmentally disabled, public health programs, employer contributions to pensions and health benefits, economic development, environmental projects, state police, parks and recreation, housing and general aid to local governments."[2] | |||||||

Spending trends

Between 2010 and 2014, the share of the North Carolina state budget spent on Medicaid increased from 24.2 percent in 2010 to 30.4 percent in 2014. See the table below for further details (figures are rendered as percentages, indicating the share of the total budget spent per category).[2][9][10]

| Spending by function from 2010 to 2014 (as percentages) | |||||||

|---|---|---|---|---|---|---|---|

| Year | K-12 education | Higher education | Public assistance | Medicaid | Corrections | Transportation | Other |

| 2014 | 22.4% | 14.6% | 0.5% | 30.4% | 4.5% | 10.7% | 16.8% |

| 2013 | 24.8% | 12.4% | 0.5% | 30% | 4.6% | 10.7% | 17% |

| 2012 | 23.2% | 9.0% | 0.5% | 24.7% | 4.2% | 9.9% | 28.4% |

| 2011 | 18.3% | 12.5% | 0.5% | 22.1% | 2.8% | 8.7% | 35.1% |

| 2010 | 19.3% | 12.4% | 0.5% | 24.2% | 2.9% | 7.1% | 33.5% |

| Source: National Association of State Budget Officers Note: "Other" expenditures include "Children's Health Insurance Program (CHIP), institutional and community care for the mentally ill and developmentally disabled, public health programs, employer contributions to pensions and health benefits, economic development, environmental projects, state police, parks and recreation, housing and general aid to local governments."[2] | |||||||

Fiscal year budgets

Fiscal years 2016 and 2017

On September 18, 2015, North Carolina Governor Pat McCrory signed into law the state's 2016-2017 biennial budget, several months after the July 1, 2016, start of the biennium. Between July 1 and September 18, the legislature adopted and the governor signed three stop-gap spending bills to keep the state government running. Upon signing the biennial budget into law, McCrory said, "The budget submitted to me by the General Assembly includes many of the goals and ideas we put forward to provide the tools North Carolina needs to continue what we have accomplished during the past three years. Now we can work together to implement a common-sense vision for our great state that includes job creation, education, healthcare, and transportation." The budget increased spending for public schools by $410 million over the previous year. The budget also "set aside $600 million this year for emergency reserves and building repairs and $225 million over two years to prepare for Medicaid overhaul."[11][12]

State debt

- See also: State debt

According to a January 2014 report by the nonprofit organization State Budget Solutions, North Carolina had a state debt of approximately $107.6 billion. Its state debt per capita was $11,032. In this report for fiscal year 2012, state debt was calculated based on four components: "market-valued unfunded public pension liabilities, outstanding government debt, unfunded other post employment benefit (OPEB) liabilities, and outstanding unemployment trust fund loans." The report revealed that altogether state governments faced a combined $5.1 trillion in debt, which amounted to $16,178 per capita in the nation.[13][14]

| Total 2012 state debt | |||

|---|---|---|---|

| State | Total state debt | State debt per capita | Per capita debt ranking |

| North Carolina | $107,580,297,000 | $11,032 | 42 |

| Georgia | $115,193,862,000 | $11,612 | 39 |

| South Carolina | $71,105,557,000 | $15,053 | 23 |

| Tennessee | $41,049,738,000 | $6,358 | 50 |

| Virginia | $91,339,102,000 | $11,158 | 41 |

| Sources: State Budget Solutions, "State Budget Solutions' Fourth Annual State Debt Report," January 8, 2014 | |||

Taxpayer burden

|

TIA Methodology: To figure a state’s taxpayer burden or surplus, TIA looked at a state’s total reported assets minus capital assets and assets restricted by law (buildings, roads, land, etc.) to calculate “available assets,” which were then compared to the amount of money the state owes in bills, including retirement obligations such as pension plans and healthcare benefits for retirees. If the difference between available assets and total bills was positive, TIA called this a surplus; if it was negative, this was a burden. This amount was then divided by the number of individual tax returns with a positive tax liability, thus expressing the total state surplus or burden on a per-taxpayer basis. |

According to a report released in September 2015 by the nonprofit Truth in Accounting (TIA), North Carolina ranked 23rd worst in the country in “taxpayer burden.” Rather than using per capita state debt, TIA ranked states based on what it called a “taxpayer burden,” a term that reflects “the amount each taxpayer would have to send to their state’s treasury in order for the state to be debt-free.” On the other hand, states that had sufficient resources to pay their bills were said to have a “taxpayer surplus,” which represents the amount that each taxpayer would receive if the state were to disburse its excess funds.

Based on analysis of North Carolina’s Comprehensive Annual Financial Report from June 30, 2014, and actuarial reports for the state’s retirement plans, TIA concluded that $26.8 billion in promised retirement benefits were unfunded, but none of these liabilities were reported on North Carolina’s balance sheet. With all of the unfunded retirement benefits included in the total debt, the state had a shortfall of $23.3 billion, or a taxpayer burden of $8,400.[15]

Public pensions

Between fiscal years 2008 and 2012, the funded ratio of North Carolina's state-administered pension plans decreased from 104.6 percent to 93.9 percent. The state paid 100 percent of its annual required contribution, and for fiscal year 2012 the pension system's unfunded accrued liability totaled $3.8 billion. This amounted to $415 in unfunded liabilities per capita.[16][17]

Credit ratings

- See also: State credit ratings

Credit rating agencies, such as Standard and Poor's, assign grades to states that take into account a state's ability to pay debts and the general health of the state's economy. Generally speaking, a higher credit rating indicates lower interest costs on the general obligation bonds states sometimes sell to investors in order to finance large-scale undertakings (e.g., road construction and other public works projects). This in turn results in lower interest costs, thereby lowering the cost to taxpayers.[18][19]

The table below lists the Standard and Poor's credit ratings for North Carolina and surrounding states from 2004 to 2014. Standard and Poor's grades range from AAA, the highest available, to BBB, the lowest.[20]

| State credit ratings, 2004 to 2014 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| State | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 |

| North Carolina | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA |

| Georgia | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA |

| South Carolina | AA+ | AA+ | AA+ | AA+ | AA+ | AA+ | AA+ | AA+ | AA+ | AA+ | AAA |

| Tennessee | AA+ | AA+ | AA+ | AA+ | AA+ | AA+ | AA+ | AA+ | AA+ | AA | AA |

| Virginia | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA |

| Source: Stateline: The Daily News Service of The Pew Charitable Trusts, "Infographic: S&P State Credit Ratings, 2001-2014," June 9, 2014 | |||||||||||

Economic indicators

- See also: Economic indicators by state

Broadly defined, a healthy economy is typically one that has a "stable and strong rate of economic growth" (gross state product, in this case) and low unemployment, among many other factors. The economic health of a state can significantly affect its healthcare costs, insurance coverage, access to care, and citizens' physical and mental health. For instance, during economic downturns, employers may reduce insurance coverage for employees, while those who are laid off may lose coverage altogether. Individuals also tend to spend less on non-urgent care or postpone visits to the doctor when times are hard. These changes in turn may affect the decisions made by policymakers as they react to shifts in the industry. Additionally, a person's socioeconomic status has profound effects on their access to care and the quality of care received.[21][22][23]

In 2013, most residents in North Carolina earned incomes between 200 and 399 percent of the federal poverty level, with a median annual household income of $44,254. At 19 percent, North Carolina had the largest portion of residents that earned incomes below 100 percent of the federal poverty level among its neighboring states.[24][25][26][27]

Note: Gross state product (GSP) on its own is not necessarily an indicator of economic health; GSP may also be influenced by state population size. Many factors must be looked at together to assess state economic health.

| Various economic indicators by state | ||||||||

|---|---|---|---|---|---|---|---|---|

| State | Distribution of population by FPL* (2013) | Median annual income (2011-2013) | Unemployment rate | Total GSP (2013)† | ||||

| Under 100% | 100-199% | 200-399% | 400%+ | Sept. 2013 | Sept. 2014 | |||

| North Carolina | 19% | 21% | 32% | 28% | $44,254 | 7.7% | 6.7% | $471,365 |

| South Carolina | 16% | 19% | 35% | 30% | $43,716 | 7.3% | 6.6% | $183,561 |

| Tennessee | 18% | 20% | 34% | 28% | $42,785 | 8.2% | 7.3% | $287,633 |

| Virginia | 11% | 15% | 26% | 48% | $65,635 | 5.5% | 5.5% | $452,585 |

| United States | 15% | 19% | 30% | 36% | $52,047 | 7.2% | 5.9% | $16,701,415 |

| * Federal Poverty Level. "The U.S. Census Bureau's poverty threshold for a family with two adults and one child was $18,751 in 2013. This is the official measurement of poverty used by the Federal Government." † Median annual household income, 2011-2013. ‡ In millions of current dollars. "Gross State Product is a measurement of a state's output; it is the sum of value added from all industries in the state." Source: The Henry J. Kaiser Family Foundation, "State Health Facts" | ||||||||

Budget process

The state operates on a biennial budget cycle. The sequence of key events in the budget process is as follows:[28]

- Budget instructions are sent to state agencies in October.

- State agency budget requests are submitted in December.

- The governor submits his or her proposed budget to the North Carolina State Legislature in March.

- The legislature adopts a budget between June and August. A simple majority is required to pass a budget.

- The biennial budget cycle begins in July.

North Carolina is one of six states in which the governor cannot exercise line item veto authority.[28][29]

The governor is constitutionally and statutorily required to submit a balanced budget. Likewise, the legislature is constitutionally and statutorily required to pass a balanced budget.[28]

Agencies, offices, and committees

The following state legislative committees are involved in budget and financial matters:

- Appropriations Committee, North Carolina House of Representatives

- Appropriations on Agriculture and Natural and Economic Resources Committee, North Carolina House of Representatives

- Appropriations on Capital Committee, North Carolina House of Representatives

- Appropriations on Department of Transportation Committee, North Carolina State Senate

- Appropriations on Education Committee, North Carolina House of Representatives

- Appropriations on Education/Higher Education Committee, North Carolina State Senate

- Appropriations on General Government and Information Technology Committee, North Carolina State Senate

- Appropriations on General Government Committee, North Carolina House of Representatives

- Appropriations on Health and Human Services Committee, North Carolina House of Representatives

- Appropriations on Health and Human Services Committee, North Carolina State Senate

- Appropriations on Information Technology Committee, North Carolina House of Representatives

- Appropriations on Justice and Public Safety Committee, North Carolina House of Representatives

- Appropriations on Justice and Public Safety Committee, North Carolina State Senate

- Appropriations on Natural and Economic Resources Committee, North Carolina State Senate

- Appropriations on Transportation Committee, North Carolina House of Representatives

- Finance Committee, North Carolina House of Representatives

- Finance Committee, North Carolina State Senate

- Ways & Means Committee, North Carolina State Senate

The North Carolina Auditor prepares and publishes audit reports as independent evaluations of the state's financial records and public program performance.

Transparency

- See also: "Following the Money" report, 2015

The U.S. Public Interest Research Group, a consumer-focused nonprofit organization based in Washington, D.C., released its annual report on state transparency websites in March 2015. The report, entitled "Following the Money," measured how transparent and accountable state websites were with regard to state government spending.[30] According to the report, North Carolina received a grade of B+ and a numerical score of 89.5, indicating that North Carolina was "Advancing" in terms of transparency regarding state spending.[30]

As published 2015

|

The information on this tab contains:

|

Between fiscal years 2013 and 2014, total government spending in North Carolina increased by approximately $972 million, from $42.9 billion in fiscal year 2013 to an estimated $43.8 billion in 2014. This represented a 2.3 percent increase. The cumulative rate of inflation during the same period was 1.58 percent, calculated using the Consumer Price Indices for January 2013 and January 2014. As of 2014, financial services firm Standard and Poor's had assigned North Carolina a credit rating of AAA.[31][32][33]

Spending

Definitions

The following terms are used to describe a state's finances:

- Revenues come mainly from tax collections, licensing fees, federal aid, and returns on investments.

- Expenditures generally include spending on government salaries, infrastructure, education, public pensions, public assistance, corrections, Medicaid, and transportation.

- State debt refers to the money borrowed to make up for a deficit when revenues do not cover spending.

- The state credit rating is the grade given by a credit rating agency based on the general financial health of the state's government and economy.

- State funds include general and other state-based funds. A general fund is "the predominant fund for financing a state's operations." Other state funds are "restricted by law for particular governmental functions or activities."[4]

- Federal funds are "funds received directly from the federal government."[4]

- Total spending is calculated by adding together the totals for state and federal funds used for expenditures.

2014 expenditures

- See also: Total state expenditures

The table below breaks down estimated spending totals for fiscal year 2014 (comparable figures from surrounding states are included to provide additional context). Figures for all columns except "Population” and “Per capita spending" are rendered in millions of dollars (for example, $2,448 translates to $2,448,000,000). Figures in the columns labeled "Population” and “Per capita spending" have not been abbreviated.[33]

North Carolina spent an estimated $43.8 billion in fiscal year 2014.

| Total estimated state spending, FY 2014 ($ in millions) | |||||

|---|---|---|---|---|---|

| State | State funds | Federal funds | Total spending | Population | Per capita spending |

| North Carolina | $30,996 | $12,850 | $43,846 | 9,943,964 | $4,409.31 |

| Georgia | $29,545 | $11,834 | $41,379 | 10,097,343 | $4,098.01 |

| South Carolina | $14,445 | $6,993 | $21,438 | 4,832,482 | $4,436.23 |

| Tennessee | $18,832 | $13,231 | $32,063 | 6,549,352 | $4,895.60 |

| Virginia | $35,123 | $9,568 | $44,691 | 8,326,289 | $5,367.46 |

| Per-capita figures are calculated by taking the state's total spending and dividing by the number of state residents according to United States Census Bureau estimates.[34] Source: National Association of State Budget Officers | |||||

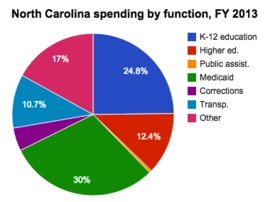

Spending by function

State spending in North Carolina can be further broken down by function (elementary and secondary education, public assistance, etc.). Fiscal year 2013 information is included in the table below (information from neighboring states is provided for additional context). Figures are rendered as percentages, indicating the share of the total budget spent per category.[33]

About 30 percent of North Carolina's total expenditures went towards Medicaid in fiscal year 2013.

| State spending by function as a percent of total expenditures, FY 2013 | |||||||

|---|---|---|---|---|---|---|---|

| State | K-12 education | Higher education | Public assistance | Medicaid | Corrections | Trans- portation |

Other |

| North Carolina | 24.8% | 12.4% | 0.5% | 30% | 4.6% | 10.7% | 17% |

| Georgia | 24.1% | 19% | 0.1% | 21.3% | 3.7% | 5.7% | 26.2% |

| South Carolina | 17.6% | 19.5% | 0.4% | 22% | 2.7% | 5.4% | 32.4% |

| Tennessee | 17.8% | 13.9% | 0.4% | 30.8% | 2.8% | 6.1% | 28.2% |

| Virginia | 15.1% | 15.3% | 0.4% | 16.7% | 2.8% | 11% | 38.7% |

| Source: National Association of State Budget Officers Note: "Other" expenditures include "Children's Health Insurance Program (CHIP), institutional and community care for the mentally ill and developmentally disabled, public health programs, employer contributions to pensions and health benefits, economic development, environmental projects, state police, parks and recreation, housing and general aid to local governments."[33] | |||||||

Spending trends

Spending on K-12 education fluctuated each year between 2009 and 2013, rising from 22.5 percent in 2009 to 24.8 percent in 2013. This overall rise occurred despite a drop to 18.3 percent in 2011. See the table below for further details (figures are rendered as percentages, indicating the share of the total budget spent per category).[33][9][10][35][36]

| Spending by function from 2009 to 2013 (as percentages) | |||||||

|---|---|---|---|---|---|---|---|

| Year | K-12 education | Higher education | Public assistance | Medicaid | Corrections | Transportation | Other |

| 2013 | 24.8% | 12.4% | 0.5% | 30% | 4.6% | 10.7% | 17% |

| 2012 | 23.2% | 9.0% | 0.5% | 24.7% | 4.2% | 9.9% | 28.4% |

| 2011 | 18.3% | 12.5% | 0.5% | 22.1% | 2.8% | 8.7% | 35.1% |

| 2010 | 19.3% | 12.4% | 0.5% | 24.2% | 2.9% | 7.1% | 33.5% |

| 2009 | 22.5% | 13.5% | 0.6% | 24.9% | 3.6% | 8.8% | 26.1% |

| Source: National Association of State Budget Officers Note: "Other" expenditures include "Children's Health Insurance Program (CHIP), institutional and community care for the mentally ill and developmentally disabled, public health programs, employer contributions to pensions and health benefits, economic development, environmental projects, state police, parks and recreation, housing and general aid to local governments."[33] | |||||||

Revenues

2013 revenues

The table below breaks down state government tax collections by source in 2013 (comparable figures from surrounding states are also provided to give additional context). Figures for all columns except "Population" and "Per capita revenue" are rendered in thousands of dollars (for example, $2,448 translates to $2,448,000). Figures in the columns labeled "Population" and "Per capita revenue" have not been abbreviated.[5]

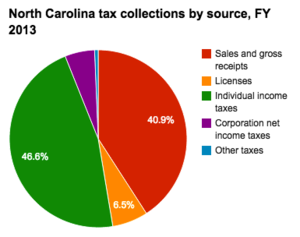

The largest single source of tax collections in North Carolina during fiscal year 2013 was individual income taxes, which accounted for approximately $11.1 billion of total tax collections.

| State tax collections by source ($ in thousands) | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| State | Property taxes | Sales and gross receipts | Licenses | Individual income taxes | Corporation net income taxes | Other taxes | Total | 2013 population | Per capita collections |

| North Carolina | N/A | $9,714,217 | $1,543,201 | $11,068,166 | $1,285,907 | $157,087 | $23,768,578 | 9,848,917 | $2,413.32 |

| Georgia | $61,052 | $7,408,422 | $744,401 | $8,772,227 | $797,255 | $10,795 | $17,794,152 | 9,994,759 | $1,780.35 |

| South Carolina | $8,549 | $4,476,982 | $439,843 | $3,357,518 | $386,669 | $51,744 | $8,721,305 | 4,771,929 | $1,827.63 |

| Tennessee | N/A | $9,128,175 | $1,421,174 | $262,842 | $1,256,173 | $298,527 | $12,366,891 | 6,497,269 | $1,903.40 |

| Virginia | $33,188 | $6,192,666 | $806,572 | $10,900,860 | $772,001 | $481,566 | $19,186,853 | 8,270,345 | $2,319.96 |

| Source: Tax Policy Center, "State Tax Collection Sources 2000-2013," June 20, 2014 | |||||||||

The table below lists 2013 tax collections by source as percentages of total collections. Almost 90 percent of North Carolina's total state tax collections came from a combination of sales taxes and gross receipts and individual income taxes.[5]

| State tax collections by source (as percentages) | ||||||

|---|---|---|---|---|---|---|

| State | Property taxes | Sales and gross receipts | Licenses | Individual income taxes | Corporation net income taxes | Other taxes |

| North Carolina | N/A | 40.87% | 6.49% | 46.57% | 5.41% | 0.66% |

| Georgia | 0.34% | 41.63% | 4.18% | 49.30% | 4.48% | 0.06% |

| South Carolina | 0.10% | 51.33% | 5.04% | 38.50% | 4.43% | 0.59% |

| Tennessee | N/A | 73.81% | 11.49% | 2.13% | 10.16% | 2.41% |

| Virginia | 0.17% | 32.28% | 4.20% | 56.81% | 4.02% | 2.51% |

| Source: Tax Policy Center, "State Tax Collection Sources 2000-2013," June 20, 2014 | ||||||

State debt

- See also: State debt

According to a January 2014 report by the nonprofit organization State Budget Solutions, North Carolina had a state debt of approximately $107.6 billion. Its state debt per capita was $11,032. In this report for fiscal year 2012, state debt was calculated based on four components: "market-valued unfunded public pension liabilities, outstanding government debt, unfunded other post employment benefit (OPEB) liabilities, and outstanding unemployment trust fund loans." The report revealed that altogether state governments faced a combined $5.1 trillion in debt, which amounted to $16,178 per capita in the nation.[37][38]

| Total 2012 state debt | |||

|---|---|---|---|

| State | Total state debt | State debt per capita | Per capita debt ranking |

| North Carolina | $107,580,297,000 | $11,032 | 42 |

| Georgia | $115,193,862,000 | $11,612 | 39 |

| South Carolina | $71,105,557,000 | $15,053 | 23 |

| Tennessee | $41,049,738,000 | $6,358 | 50 |

| Virginia | $91,339,102,000 | $11,158 | 41 |

| Sources: State Budget Solutions, "State Budget Solutions' Fourth Annual State Debt Report," January 8, 2014 | |||

Public pensions

Between fiscal years 2008 and 2012, the funded ratio of North Carolina's state-administered pension plans decreased from 104.6 percent to 93.9 percent. The state paid 100 percent of its annual required contribution, and for fiscal year 2012 the pension system's unfunded accrued liability totaled $3.8 billion. This amounted to $415 in unfunded liabilities per capita.[16][39]

Credit ratings

- See also: State credit ratings

Credit rating agencies, such as Standard and Poor's, assign grades to states that take into account a state's ability to pay debts and the general health of the state's economy. Generally speaking, a higher credit rating indicates lower interest costs on the general obligation bonds states sometimes sell to investors in order to finance large-scale undertakings (e.g., road construction and other public works projects). This in turn results in lower interest costs, thereby lowering the cost to taxpayers.[18][40]

The table below lists the Standard and Poor's credit ratings for North Carolina and surrounding states from 2004 to 2014. Standard and Poor's grades range from AAA, the highest available, to BBB, the lowest.[41]

| State credit ratings, 2004 to 2014 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| State | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 |

| North Carolina | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA |

| Georgia | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA |

| South Carolina | AA+ | AA+ | AA+ | AA+ | AA+ | AA+ | AA+ | AA+ | AA+ | AA+ | AAA |

| Tennessee | AA+ | AA+ | AA+ | AA+ | AA+ | AA+ | AA+ | AA+ | AA+ | AA | AA |

| Virginia | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA | AAA |

| Source: Stateline: The Daily News Service of The Pew Charitable Trusts, "Infographic: S&P State Credit Ratings, 2001-2014," June 9, 2014 | |||||||||||

Federal aid to the state budget

- See also: Federal aid to state budgets

State governments receive aid from the federal government to fund a variety of joint programs, such as Medicaid. Federal aid varies from state to state. For example, Mississippi received approximately $7.7 billion in federal aid in 2012, which accounted for more than 45 percent of the state's general revenues. By contrast, Alaska received roughly $2.9 billion in federal aid in 2012, just under 20 percent of the state's general revenues.[7]

The table below notes what share of North Carolina’s general revenues came from the federal government in 2012. That year, North Carolina received approximately $15.2 billion in federal aid, 33.2 percent of the state's total general revenues. Figures from surrounding states are provided for additional context.[7]

| Federal aid to state budgets, 2012 | |||

|---|---|---|---|

| State | Total federal aid ($ in thousands) | Federal aid as a % of general revenue | Ranking |

| North Carolina | $15,192,577 | 33.24% | 25 |

| Georgia | $13,794,726 | 37.92% | 7 |

| South Carolina | $6,892,660 | 32.41% | 28 |

| Tennessee | $11,198,575 | 40.97% | 3 |

| Virginia | $9,278,113 | 23.53% | 49 |

| Source: United States Census Bureau, "State Government Finances: 2012," accessed February 24, 2014 | |||

Stimulus

According to Recovery.gov, the official government website for the Recovery Accountability and Transparency Board, under the American Recovery and Reinvestment Act, North Carolina received $6.26 billion in federal funding from the American Recovery and Reinvestment Act between February 2009 and June 2013.[42]

Budget process

The state operates on a biennial budget cycle. The sequence of key events in the budget process is as follows:[28]

- Budget instructions are sent to state agencies in October.

- State agency budget requests are submitted in December.

- The governor submits his or her proposed budget to the North Carolina State Legislature in March.

- The legislature adopts a budget between June and August. A simple majority is required to pass a budget.

- The biennial budget cycle begins in July.

North Carolina is one of six states in which the governor cannot exercise line item veto authority.[28][43]

The governor is constitutionally and statutorily required to submit a balanced budget. Likewise, the legislature is constitutionally and statutorily required to pass a balanced budget.[28]

Agencies, offices, and committees

The North Carolina Auditor prepares and publishes audit reports as independent evaluations of the state's financial records and public program performance.

- Appropriations Committee, North Carolina House of Representatives

- Appropriations on Agriculture and Natural and Economic Resources Committee, North Carolina House of Representatives

- Appropriations on Capital Committee, North Carolina House of Representatives

- Appropriations on Department of Transportation Committee, North Carolina State Senate

- Appropriations on Education Committee, North Carolina House of Representatives

- Appropriations on Education/Higher Education Committee, North Carolina State Senate

- Appropriations on General Government and Information Technology Committee, North Carolina State Senate

- Appropriations on General Government Committee, North Carolina House of Representatives

- Appropriations on Health and Human Services Committee, North Carolina House of Representatives

- Appropriations on Health and Human Services Committee, North Carolina State Senate

- Appropriations on Information Technology Committee, North Carolina House of Representatives

- Appropriations on Justice and Public Safety Committee, North Carolina House of Representatives

- Appropriations on Justice and Public Safety Committee, North Carolina State Senate

- Appropriations on Natural and Economic Resources Committee, North Carolina State Senate

- Appropriations on Transportation Committee, North Carolina House of Representatives

- Finance Committee, North Carolina House of Representatives

- Finance Committee, North Carolina State Senate

- Ways & Means Committee, North Carolina State Senate

Studies and reports

U.S. PIRG "Following the Money" report

- See also: "Following the Money" report, 2014

The U.S. Public Interest Research Group, a consumer-focused nonprofit organization based in Washington, D.C., released its annual report on state transparency websites in April 2014. The report, entitled "Following the Money," measured how transparent and accountable state websites were with regard to state government spending.[44] According to the report, North Carolina received a grade of B+ and a numerical score of 88.5, indicating that North Carolina was an "advancing" state in terms of transparency regarding state spending.[44]

As published 2014

|

The information on this tab contains:

|

Between fiscal year 2009 and fiscal year 2013, North Carolina's total expenditures increased by approximately $2.7 billion, from $48.7 billion in 2009 to $51.4 billion in 2013. This represented a 5.25 percent increase, below the cumulative rate of inflation during the same period (9.06 percent, calculated using the Consumer Price Indices for January 2009 and January 2013).[45][46]

Spending

Definitions

Although each state executes its budget process differently, the National Association of State Budget Officers (NASBO) breaks down state expenditures into four general categories. This allows for comparisons among the 50 states. NASBO's categories are as follows:[47]

- General fund: "The predominant fund for financing a state’s operations. Revenues are received from broad-based state taxes. However, there are differences in how specific functions are financed from state to state."[47]

- Other funds: "Expenditures from revenue sources that are restricted by law for particular governmental functions or activities. For example, a gasoline tax dedicated to a highway trust fund would appear in the 'Other funds' column. For Medicaid, other state funds include provider taxes, fees, donations, assessments, and local funds."[47]

- Federal funds: "Funds received directly from the federal government."[47]

- Bonds: "Expenditures from the sale of bonds, generally for capital projects."[47]

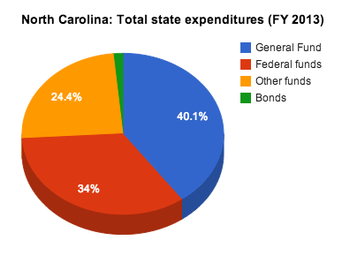

2013

The table below breaks down expenditures for fiscal year 2013 (comparable figures from surrounding states are provided to give additional context).[47] Figures for all columns except "Per capita expenditures" are rendered in millions of dollars (for example, $2,448 translates to $2,448,000,000). Figures in the column labeled "Per capita expenditures" have not been abbreviated.

| Total state expenditures, FY 2013 ($ in millions)[47] | |||||||

|---|---|---|---|---|---|---|---|

| State | General fund | Federal funds | Other funds | Bonds | Total | Per capita expenditures** | |

| North Carolina | $20,602 | $17,459 | $12,543 | $785 | $51,389 | $5,218.19 | |

| Georgia | $18,303 | $11,752 | $10,211 | $808 | $41,074 | $4,110.62 | |

| South Carolina | $6,350 | $7,792 | $8,158 | $0 | $22,300 | $4,670.31 | |

| Tennessee | $12,622 | $13,055 | $5,394 | $382 | $31,453 | $4,841.92 | |

| Virginia | $17,691 | $9,546 | $16,191 | $1,167 | $44,595 | $5,398.65 | |

| **Per capita figures are calculated by taking the state's total expenditures and dividing by the number of state residents according to United States Census estimates.[48] Source: National Association of State Budget Officers | |||||||

Spending by function

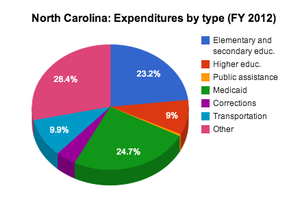

2012

Source: National Association of State Budget Officers

State expenditures in North Carolina can be further broken down by function (elementary and secondary education, public assistance, etc.). Fiscal year 2012 data is included in the table below (information from neighboring states is provided for additional context). Figures are rendered as percentages, indicating the share of the total budget spent per category.

| Expenditures by function, FY 2012 (as percentages)[47] | |||||||

|---|---|---|---|---|---|---|---|

| State | Elementary and secondary ed. | Higher ed. | Public assistance | Medicaid | Corrections | Transportation | Other |

| North Carolina | 23.2% | 9.0% | 0.5% | 24.7% | 4.2% | 9.9% | 28.4% |

| Georgia | 24.0% | 18.7% | 0.1% | 21.5% | 3.7% | 5.2% | 26.8% |

| South Carolina | 15.9% | 21.0% | 0.4% | 21.7% | 2.7% | 6.6% | 31.7% |

| Tennessee | 17.7% | 12.8% | 0.4% | 30.7% | 2.7% | 6.4% | 29.3% |

| Virginia | 16.0% | 13.1% | 0.4% | 16.2% | 2.9% | 11.3% | 40.1% |

| Source: National Association of State Budget Officers Note: "Other" expenditures include "Children's Health Insurance Program (CHIP), institutional and community care for the mentally ill and developmentally disabled, public health programs, employer contributions to pensions and health benefits, economic development, environmental projects, state police, parks and recreation, housing and general aid to local governments."[47] | |||||||

Spending trends

From 2008 to 2012, expenditures on elementary and secondary education, corrections and transportation increased, with corrections expenditures increasing the most at 0.9 percentage points, a 27.3 percent increase in the share of the budget. During the same time period, expenditures on higher education, public assistance and Medicaid decreased, with higher education expenditures decreasing the most at 2.8 percentage points, a 23.7 percent decrease in the share of the budget. The table below details changes in expenditures from 2008 to 2012.[47][9][10][35][36] Figures are rendered as percentages, indicating the share of the total budget spent per category.

| Expenditures from 2008 to 2012 (as percentages) | |||||||

|---|---|---|---|---|---|---|---|

| Year | Elementary and secondary ed. | Higher ed. | Public assistance | Medicaid | Corrections | Transportation | Other |

| 2012 | 23.2% | 9.0% | 0.5% | 24.7% | 4.2% | 9.9% | 28.4% |

| 2011 | 18.3% | 12.5% | 0.5% | 22.1% | 2.8% | 8.7% | 35.1% |

| 2010 | 19.3% | 12.4% | 0.5% | 24.2% | 2.9% | 7.1% | 33.5% |

| 2009 | 22.5% | 13.5% | 0.6% | 24.9% | 3.6% | 8.8% | 26.1% |

| 2008 | 22.4% | 11.8% | 0.6% | 26.4% | 3.3% | 9.1% | 26.3% |

| Change in % | 0.80% | -2.80% | -0.10% | -1.70% | 0.90% | 0.80% | 2.10% |

| Source: National Association of State Budget Officers Note: "Other" expenditures include "Children's Health Insurance Program (CHIP), institutional and community care for the mentally ill and developmentally disabled, public health programs, employer contributions to pensions and health benefits, economic development, environmental projects, state police, parks and recreation, housing and general aid to local governments."[47] | |||||||

Revenues

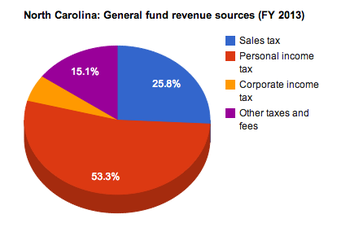

2013 revenues

Source: National Association of State Budget Officers

The table below breaks down general fund revenues by source in fiscal year 2013 (comparable figures from surrounding states are also provided to give additional context).[47] Figures for all columns except "Per capita revenue" are rendered in millions of dollars (for example, $2,448 translates to $2,448,000,000). Figures in the column labeled "Per capita revenue" have not been abbreviated.

| Revenue sources in the general fund, FY 2013 ($ in millions)[47] | |||||||

|---|---|---|---|---|---|---|---|

| State | Sales tax | Personal income tax | Corporate income tax | Gaming tax | Other taxes and fees | Total | Per capita revenue |

| North Carolina | $5,309 | $10,958 | $1,192 | $0 | $3,100 | $20,559 | $2,087.62 |

| Georgia | $5,226 | $8,486 | $706 | $0 | $3,562 | $17,980 | $1,799.41 |

| South Carolina | $2,448 | $2,796 | $265 | $0 | $742 | $6,251 | $1,309.15 |

| Tennessee | $6,643 | $126 | $1,083 | $0 | $3,551 | $11,403 | $1,755.39 |

| Virginia | $3,249 | $11,093 | $821 | $0 | $1,259 | $16,421 | $1,987.92 |

| **Per capita figures are calculated by taking the state's total revenues and dividing by the number of state residents according to United States Census estimates for 2013.[48] Source: National Association of State Budget Officers | |||||||

Revenue trends

The table below details the change in revenue sources in the general fund from 2009 to 2013.[47][9] Figures for all columns except "Per capita revenue" are rendered in millions of dollars (for example, $2,448 translates to $2,448,000,000). Figures in the column labeled "Per capita revenue" have not been abbreviated.

| Revenue sources in the general fund, North Carolina ($ in millions)[47][9] | |||||||

|---|---|---|---|---|---|---|---|

| Year | Sales tax | Personal income tax | Corporate income tax | Gaming tax | Other taxes and fees | Total | Per capita revenue |

| 2013 | $5,309 | $10,958 | $1,192 | $0 | $3,100 | $20,559 | $2,087.62 |

| 2012 | $5,258 | $10,272 | $1,133 | $0 | $2,869 | $19,532 | $2,003.62 |

| 2011 | $5,872 | $9,735 | $1,014 | $0 | $2,536 | $19,157 | $1,984.90 |

| 2010 | $5,565 | $9,048 | $1,198 | $0 | $1,934 | $17,745 | $1,856.26 |

| 2009 | $4,678 | $9,470 | $836 | $0 | $1,795 | $16,779 | $1,788.64 |

| Change in % | 13.49% | 15.71% | 42.58% | N/A | 72.70% | 22.53% | 16.72% |

| **Per capita figures are calculated by taking the state's total revenues and dividing by the number of state residents according to United States Census estimates.[48][49] Source: National Association of State Budget Officers | |||||||

Historical spending

The information on state budget historical spending below was compiled by the National Association of State Budget Officers. Figures reflect the reported "Total Expenditures" in Table 1. Figures for all columns are rendered in millions of dollars (for example, $2,448 translates to $2,448,000,000).[47][10]

| Historical state spending in North Carolina ($ in millions) | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fiscal year | General Fund | Other funds | Federal funds | Bonds | Budget totals | ||||||||||||

| Total | % of Budget | Total | % of Budget | Total | % of Budget | Total | % of Budget | ||||||||||

| 2011-2012 | $20,195 | 43% | $11,207 | 24% | $14,513 | 31% | $652 | 1% | $46,567 | ||||||||

| 2010-2011 | $18,503 | 36% | $14,220 | 28% | $17,711 | 35% | $473 | 1% | $50,907 | ||||||||

| 2009-2010 | $18,513 | 38% | $12,583 | 26% | $17,163 | 35% | $488 | 1% | $48,747 | ||||||||

| Averages: | $19,070 | 39% | $12,670 | 26% | $16,462 | 34% | $538 | 1% | $48,740 | ||||||||

Budget transparency

| Transparency evaluation | |

|---|---|

| NC Open Book | |

| Searchability | |

| Grants | |

| Contracts | |

| Line item expenditures | |

| Dept./agency budgets | |

| Public employee salaries | |

| Last evaluated in 2009. | |

North Carolina became more transparent in 2009 after the launch of NC Open Book, the government spending transparency website.

Prior to the launch of NC Open Book, the Office of the State Auditor established a searchable database that reported on private organizations receiving state funds. That database can be found here.

Government tools

The table to the right is helpful in evaluating the level of transparency provided by NC Open Book.

Limitations and Suggestions

NC Open Book does not list state employee salaries, nor does it provide line-item expenditures.

Multi-measure budget transparency profile

The Institute of Government and Public Affairs at the University of Illinois created a multi-measure transparency profile for North Carolina, which measured state transparency as of September 2011 using indicators from a range of organizations. These indicators measured both website transparency and other recognized facets of governmental transparency. In addition, IGPA presented four unique indicators of non-transparency based on the observation that transfers or reassignments between general and special funds can obscure the true fiscal condition of a state.[50][51]

IGPA devised a budget transparency index based on information available from the National Association of State Budget Officers. North Carolina tied for 20th in the nation with 12 other states, earning five out of eight possible points.[51]

| North Carolina - IGPA score for budget process, contents and disclosure | |

|---|---|

| Budget transparency indicator | Yes or no? |

| Performance measures | |

| "Generally Accepted Accounting Principles" budget | |

| Multi-year forecasting | |

| Annual cycle | |

| Binding revenue forecast | |

| Legislative revenue forecast | |

| Nonpartisan staff | |

| Constitution or statutory tax/spend limitations | |

| TOTAL | 5 |

In addition to the individual state profile, IGPA offers a 50-state comparison and profiles for other states.[51]

Prior fiscal year budgets

Fiscal years 2016 and 2017

As of September 25, 2015 the state had not yet finalized its official budget for the 2016-2017 biennium. While debate continued, lawmakers passed temporary spending measures so that state spending could continue. North Carolina Governor Pat McCrory announced on August 18, 2015 that he and the state's legislative leaders had agreed on a budget spending amount of $21.735 billion.[11]

Fiscal years 2014 and 2015

![]() See budget bill: Senate Bill 402

See budget bill: Senate Bill 402

| North Carolina state budget -- 2014 | |

| North Carolina State Legislature | |

| Text: | Senate Bill 402 |

| Legislative history | |

| Introduced: | March 25, 2013 |

| House: | June 13, 2013 |

| Vote (lower house): | 77-40 |

| Senate: | May 23, 2013 |

| Vote (upper house): | 33-17 |

| Governor: | Pat McCrory |

| Signed: | July 26, 2013 |

The 2014-2015 biennial budget was signed into law by Governor Pat McCrory on July 26, 2013.[52] A copy of the full appropriations bill can be found here.

McCrory announced a budget adjustment proposal on May 14, 2014. McCrory's proposal can be accessed here.[2]

Fiscal year 2013

- See also: North Carolina state budget (2012-2013)

Fiscal year 2012

- See also: North Carolina state budget (2011-2012)

Fiscal year 2011

- See also: North Carolina state budget (2010-2011)

Fiscal year 2010

- See also: North Carolina state budget (2009-2010)

See also

Footnotes

- ↑ Bureau of Labor Statistics, "CPI Detailed Report Data for February 2015," accessed April 4, 2016

- ↑ 2.0 2.1 2.2 2.3 2.4 2.5 2.6 National Association of State Budget Officers, "Examining fiscal 2013-2015 state spending," accessed April 4, 2016 Cite error: Invalid

<ref>tag; name "nasbo2015" defined multiple times with different content Cite error: Invalid<ref>tag; name "nasbo2015" defined multiple times with different content - ↑ InflationData.com, "Cumulative Inflation Calculator," accessed April 4, 2016. The cumulative rate of inflation during the same period declined -0.1 percent, calculated using the Consumer Price Indices for January 2014 and January 2015.

- ↑ 4.0 4.1 4.2 4.3 National Association of State Budget Officers, "State Expenditure Report: 2013-2015," accessed April 7, 2016

- ↑ 5.0 5.1 5.2 5.3 U.S. Census Bureau, "2014 annual survey of state government tax collections by category," accessed April 4, 2016 Cite error: Invalid

<ref>tag; name "taxcollections" defined multiple times with different content Cite error: Invalid<ref>tag; name "taxcollections" defined multiple times with different content - ↑ United States Census Bureau, "State Government Finances: 2013," accessed March 21, 2016

- ↑ 7.0 7.1 7.2 United States Census Bureau, "State Government Finances: 2012," accessed February 24, 2014

- ↑ United States Census Bureau, "State and County QuickFacts," accessed April 4, 2016

- ↑ 9.0 9.1 9.2 9.3 9.4 National Association of State Budget Officers, "State Expenditure Report, 2009-2011," accessed February 24, 2014

- ↑ 10.0 10.1 10.2 10.3 National Association of State Budget Officers, "State Expenditures Report, 2010-2012," accessed February 24, 2014

- ↑ 11.0 11.1 National Association of State Budget Officers, "Summaries of Fiscal Year 2016 Proposed and Enacted Budgets," accessed September 22, 2015

- ↑ ABC Eyewitness News 11, "Gov. Pat McCrory Signs State Budget," September 18, 2015

- ↑ State Budget Solutions, "State Budget Solutions' Fourth Annual State Debt Report," January 8, 2014

- ↑ In 2016, State Budget Solutions was absorbed by the American Legislative Exchange Council.

- ↑ Truth in Accounting, "Financial State of the States," September 2015

- ↑ 16.0 16.1 Morningstar, "The State of State Pension Plans 2013: A Deep Dive Into Shortfalls and Surpluses," accessed September 16, 2013

- ↑ The Pew Charitable Trusts, “The Fiscal Health of State Pension Plans: Funding Gap Continues to Grow,” accessed April 16, 2015

- ↑ 18.0 18.1 Stateline: The Daily News Service of The Pew Charitable Trusts, "Infographic: S&P State Credit Ratings, 2001-2012," July 13, 2012

- ↑ Bankrate, "The 6 states with the worst credit ratings," September 27, 2012

- ↑ Stateline: The Daily News Service of The Pew Charitable Trusts, "Infographic: S&P State Credit Ratings, 2001-2014," June 9, 2014

- ↑ Academy Health, "Impact of the Economy on Health Care," August 2009

- ↑ The Conversation, "Budget explainer: What do key economic indicators tell us about the state of the economy?" May 6, 2015

- ↑ Health Affairs, "Socioeconomic Disparities In Health: Pathways And Policies," accessed July 13, 2015

- ↑ The Henry J. Kaiser Family Foundation, "Distribution of Total Population by Federal Poverty Level," accessed July 17, 2015

- ↑ The Henry J. Kaiser Family Foundation, "Median Annual Household Income," accessed July 17, 2015

- ↑ The Henry J. Kaiser Family Foundation, "Unemployment Rate (Seasonally Adjusted)," accessed July 17, 2015

- ↑ The Henry J. Kaiser Family Foundation, "Total Gross State Product (GSP) (millions of current dollars)," accessed July 17, 2015

- ↑ 28.0 28.1 28.2 28.3 28.4 28.5 National Association of State Budget Officers, "Budget Processes in the States, Spring 2021," accessed January 24, 2023

- ↑ National Conference of State Legislatures, "Separation of Powers: Executive Veto Powers," accessed January 26, 2024

- ↑ 30.0 30.1 U.S. Public Interest Research Group, "Following the Money 2015 Report," accessed April 4, 2016

- ↑ Bureau of Labor Statistics, "CPI Detailed Report Data for February 2014," accessed April 9, 2014

- ↑ InflationData.com, "Cumulative Inflation Calculator," February 28, 2014

- ↑ 33.0 33.1 33.2 33.3 33.4 33.5 National Association of State Budget Officers, "State Expenditure Report: 2012-2014," accessed February 18, 2015

- ↑ United States Census Bureau, "State and County QuickFacts," accessed February 23, 2014

- ↑ 35.0 35.1 National Association of State Budget Officers, "State Expenditure Report, 2009," accessed February 24, 2014

- ↑ 36.0 36.1 National Association of State Budget Officers, "State Expenditure Report, 2008," accessed February 24, 2014

- ↑ State Budget Solutions, "State Budget Solutions' Fourth Annual State Debt Report," January 8, 2014

- ↑ In 2016, State Budget Solutions was absorbed by the American Legislative Exchange Council.

- ↑ The Pew Charitable Trusts, “The Fiscal Health of State Pension Plans: Funding Gap Continues to Grow,” accessed April 16, 2015

- ↑ Bankrate, "The 6 states with the worst credit ratings," September 27, 2012

- ↑ Stateline: The Daily News Service of The Pew Charitable Trusts, "Infographic: S&P State Credit Ratings, 2001-2014," June 9, 2014

- ↑ Recovery.gov, "Stimulus Spending by State," accessed February 21, 2014

- ↑ National Conference of State Legislatures, "Separation of Powers: Executive Veto Powers," accessed January 26, 2024

- ↑ 44.0 44.1 U.S. Public Interest Research Group, "Following the Money 2014 Report," accessed April 15, 2014

- ↑ Bureau of Labor Statistics, "CPI Detailed Report Data for February 2014," accessed April 9, 2014

- ↑ InflationData.com, "Cumulative Inflation Calculator," February 28, 2014

- ↑ 47.00 47.01 47.02 47.03 47.04 47.05 47.06 47.07 47.08 47.09 47.10 47.11 47.12 47.13 47.14 47.15 National Association of State Budget Officers, "State Expenditure Report, 2011-2013," accessed February 21, 2014

- ↑ 48.0 48.1 48.2 United States Census Bureau, "Annual Estimates of the Resident Population: April 1, 2010 to July 1, 2013," accessed February 26, 2014

- ↑ United States Census Bureau, "Vintage 2009: Annual Population Estimates," accessed February 26, 2014

- ↑ Institute of Government and Public Affairs at University of Illinois, "Home page," accessed February 21, 2014

- ↑ 51.0 51.1 51.2 Institute of Government and Public Affairs at University of Illinois, "Budget Transparency Profiles - All 50 States," September 2011

- ↑ Open States, "North Carolina Senate Bill 402," accessed April 30, 2014

|

State of North Carolina Raleigh (capital) |

|---|---|

| Elections |

What's on my ballot? | Elections in 2026 | How to vote | How to run for office | Ballot measures |

| Government |

Who represents me? | U.S. President | U.S. Congress | Federal courts | State executives | State legislature | State and local courts | Counties | Cities | School districts | Public policy |