Texas Sales and Use Tax Revenue for Transportation Amendment, Proposition 7 (2015)

| Proposition 7 | |

|---|---|

| |

| Type | Amendment |

| Origin | Texas Legislature |

| Topic | Gov't Finances |

| Status | Approved |

| Texas 2015 ballot |

|---|

| Proposition 1 - Taxes |

| Proposition 2 - Taxes |

| Proposition 3 - Residency |

| Proposition 4 - Gambling |

| Proposition 5 - Roads |

| Proposition 6 - Hunting |

| Proposition 7 - Taxes |

| All 2015 U.S. measures |

|---|

The Texas Sales and Use Tax Revenue for Transportation Amendment, Proposition 7 was on the November 3, 2015 ballot in Texas as a legislatively referred constitutional amendment, where it was approved. The measure supplied funding to the State Highway Fund from two tax revenue sources: the sales and use tax and state motor vehicle sales and rental tax.[1][2]

Election results

Election results via: Texas Secretary of State

| Texas Proposition 7 | ||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| 1295248 | 83.24% | |||

| No | 260810 | 16.76% | ||

Election results via: Texas Secretary of State

Introduction

If the state collects more than $28 billion from the sales and use tax in one fiscal year, the next $2.5 billion of tax revenue is to be directed to the State Highway Fund. This will run 15 years— September 1, 2017 through September 1, 2032. If the state collects more than $5 billion from the motor vehicle sales and rental tax in one fiscal year, 35 percent of the remaining revenue collected that year is to be added to the State Highway Fund. This will run 10 years— September 1, 2019 through September 1, 2029.[3]

The funds collected can only be used to build, maintain and restore non-tolled public roads and repay transportation-related debt. The proposition authorized the Legislature to reduce the amount deposited into the State Highway Fund by up to 50 percent in one fiscal year. This provision was meant to give lawmakers the ability to respond to economic downturns or other changes in the state's funding needs. Though both appropriations have expiration dates, the Legislature can extend the measure by 10-year increments with a majority vote in each chamber.[3]

When voters passed the amendment, it was "the largest single increase in transportation funding in Texas history," according to amendment author Sen. Robert Nichols (R-3).[4]

It was the second question in two years asking voters to divert existing revenue to the State Highway Fund. In 2014, Texans approved Proposition 1, authorizing the Legislature to allocate money from the Rainy Day Fund to the State Highway Fund.

Nichols and Sen. Jane Nelson (R-12) introduced the measure into the Texas Legislature as Senate Joint Resolution 5.[5]

Text of measure

Ballot title

The official ballot title was:[1]

| “ | The constitutional amendment dedicating certain sales and use tax revenue and motor vehicle sales, use, and rental tax revenue to the state highway fund to provide funding for nontolled roads and the reduction of certain transportation-related debt.[6] | ” |

Constitutional changes

| Texas Constitution |

|---|

|

| Preamble |

| Articles |

| 1 • 2 3 (1-43) • 3 (44-49) • 3 (50-67) 4 • 5 • 6 • 7 • 8 • 9 • 10 • 11 • 12 • 13 • 14 • 15 • 16 • 17 • Appendix |

- See also: Article 8, Texas Constitution

The amendment would add Section 7-c to Article 8 of the Texas Constitution. The full text can be read below:[1]

| Amendment to Section 7-c of Article 8 of the Texas Constitution | |||||

|---|---|---|---|---|---|

| Sec. 7-c. (a) Subject to Subsections (d) and (e) of this section, in each state fiscal year, the comptroller of public accounts shall deposit to the credit of the state highway fund $2.5 billion of the net revenue derived from the imposition of the state sales and use tax on the sale, storage, use, or other consumption in this state of taxable items under Chapter 151, Tax Code, or its successor, that exceeds the first $28 billion of that revenue coming into the treasury in that state fiscal year.

(b) Subject to Subsections (d) and (e) of this section, in each state fiscal year, the comptroller of public accounts shall deposit to the credit of the state highway fund an amount equal to 35 percent of the net revenue derived from the tax authorized by Chapter 152, Tax Code, or its successor, and imposed on the sale, use, or rental of a motor vehicle that exceeds the first $5 billion of that revenue coming into the treasury in that state fiscal year. (c) Money deposited to the credit of the state highway fund under this section may be appropriated only to:

(d) The legislature by adoption of a resolution approved by a record vote of two-thirds of the members of each house of the legislature may direct the comptroller of public accounts to reduce the amount of money deposited to the credit of the state highway fund under Subsection (a) or (b) of this section. The comptroller may be directed to make that reduction only:

(e) Subject to Subsection (f) of this section, the duty of the comptroller of public accounts to make a deposit under this section expires:

(f) The legislature by adoption of a resolution approved by a record vote of a majority of the members of each house of the legislature may extend, in 10-year increments, the duty of the comptroller of public accounts to make a deposit under Subsection (a) or (b) of this section beyond the applicable date prescribed by Subsection (e) of this section. TEMPORARY PROVISION (a) This temporary provision applies to the constitutional amendment proposed by the 84th Legislature, Regular Session, 2015, dedicating a portion of the revenue derived from the state sales and use tax and the tax imposed on the sale, use, or rental of a motor vehicle to the state highway fund. (b) Section 7-c(a), Article VIII, of this constitution takes effect September 1, 2017. (c) Section 7-c(b), Article VIII, of this constitution takes effect September 1, 2019. (d) Beginning on the dates prescribed by Subsections (b) and (c) of this section, the legislature may not appropriate any revenue to which Section 7-c(a) or (b), Article VIII, of this constitution applies that is deposited to the credit of the state highway fund for any purpose other than a purpose described by Section 7-c(c), Article VIII, of this constitution. (e) This temporary provision expires September 1, 2020.[6] | |||||

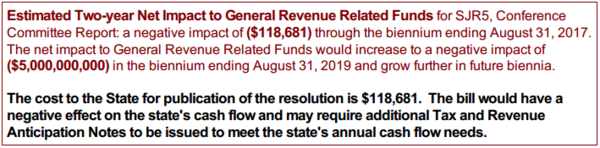

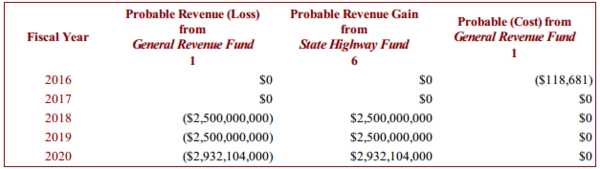

Fiscal note

The Texas Legislative Budget Board wrote the fiscal note for SJR 5:[7]

The five-year impact to the General Revenue Fund and State Highway Fund:[7]

Background

According to the Texas Department of Transportation, lawmakers passed SJR 5 in May 2015 after Gov. Greg Abbott named transportation funding one of the 84th Texas Legislature's emergency items in February 2015.[3]

Proposition 1

The amendment voters came on the heels of 2014's Proposition 1. Like this 2015 amendment, 2014's version sought to increase funding for the State Highway Fund by diverting revenue from elsewhere. Texans were asked to allocate half of the general revenue derived from oil and gas taxes from the Economic Stabilization Fund (ESF), also known as the Rainy Day Fund, to the State Highway Fund. Nearly 80 percent of voters agreed to the plan. It was anticipated that this would result in approximately $1.2 billion per year going toward transportation funding instead of the Rainy Day Fund. During the 2015 legislative session, legislators were able to divert $2.5 billion to the State Highway Fund under Proposition 1's provisions.[8]

Comparing 2015's amendment to Proposition 1, Rep. Joe Pickett (D-79) said, "Prop. 1 (passed by voters last November) was the biggest thing we've ever done on transportation. This [2015 amendment] trumps it by a lot."[9]

Support

Supporters

Officials

The following officials sponsored the measure in the legislature:[10][11]

- Sen. Robert Nichols (R-3)

- Sen. Jane Nelson (R-12)

- Sen. Kelly Hancock (R-9)

- Sen. Van Taylor (R-8)

- Sen. Paul Bettencourt (R-7)

- Sen. Sylvia Garcia (D-6)

- Sen. Charles Schwertner (R-5)

- Sen. Brandon Creighton (R-4)

- Sen. Kel Seliger (R-31)

- Sen. Jose R. Rodriguez (D-29)

- Sen. Charles Perry (R-28)

- Sen. Eddie Lucio (D-27)

- Sen. Donna Campbell (R-25)

- Sen. Royce West (D-23)

- Sen. Judith Zaffirini (D-21)

- Sen. Bob Hall (R-2)

- Sen. Carlos Uresti (D-19)

- Sen. Lois Kolkhorst (R-18)

- Sen. Joan Huffman (R-17)

- Sen. Donald Huffines (R-16)

- Sen. Larry Taylor (R-11)

- Sen. Konni Burton (R-10)

- Rep. Joe Pickett (D-79)

- Rep. John Otto (R-18)

- Rep. Patricia Harless (R-126)

- Rep. Yvonne Davis (D-111)

- Rep. Giovanni Capriglione (R-98)

- Rep. Nicole Collier (D-95)

- Rep. Drew Darby (R-72)

- Rep. Mary E. Gonzalez (D-75)

- Rep. Tracy King (D-80)

- Rep. Linda Koop (R-102)

- Rep. Matt Krause (R-93)

- Rep. Jeff Leach (R-67)

- Rep. Marisa Marquez (D-77)

- Rep. Armando Martinez (D-39)

- Rep. Doug Miller (R-73)

- Rep. Rick Miller (R-26)

- Rep. Joe Moody (D-78)

- Rep. Larry Phillips (R-62)

- Rep. Tony Tinderholt (R-94)

- Rep. James White (R-19)

- Rep. Bill Zedler (R-96)

Other officials who supported the amendment include:

Organizations

- Alamo Regional Mobility Authority[14]

- American Council of Engineering Companies of Texas

- Associated General Contractors of Texas

- Austin Chamber of Commerce

- Cameron County Regional Mobility Authority

- Central Texas Regional Mobility Authority

- Civil Engineering Consultants

- Dallas Regional Chamber

- Dallas Regional Mobility Coalition

- Earth Moving Contractors Association of Texas

- Fort Worth Chamber of Commerce

- Grayson County Regional Mobility Authority

- Greater El Paso Chamber of Commerce

- Greater Houston Partnership

- Move Texas Forward

- North East Texas Regional Mobility Authority

- San Antonio Chamber of Commerce

- San Antonio Mobility Coalition, Inc.

- Tarrant Regional Transportation Council

- Texans for Toll-Free Highways

- Texans Uniting for Reform & Freedom

- Texas Alliance of Energy Producers

- Texas Association of Builders

- Texas Association of Realtors

- Texas Business Leadership Council

- Texas Conference of Urban Counties

- Texas Forestry Association

- Texas Good Roads & Transportation Association

- Texas Independent Producers and Royalty Owners Association

- Texas Municipal League

- Texas Oil and Gas Association

- Texas Poultry Federation

- Texas Trucking Association

- Transportation Advocacy Group-Houston Region

- Transportation Advocates of Texas

Businesses

- AAA Texas[14]

- BNSF Railway

- Kiewit Infrastructure Group

- Old Castle Materials

- Zachry Corporation

Arguments in favor

State Sen. Robert Nichols, the proposition's author and chairman of the Transportation Committee, said the measure will give the Texas Department of Transportation an idea of how much funding it will receive for certain projects. He stated:[15]

| “ | TxDOT needs to know now how much money they’re going to have to spend six years from now before they can start on the project. If there’s no assurance they’re going to have the money, well then they can’t start the project. So that’s where the hang-up’s been.[6] | ” |

Gov. Greg Abbott argued:[12]

| “ | Road congestion costs rush hour drivers in Austin and Dallas more than $1,000 a year. And in Houston, it’s even more—almost $1,500 a year. But traffic is not just a “big city” problem. It hits every family’s wallet. As Texas continues to grow, congestion is growing in communities of every size.

By voting for Proposition 7 on the Constitutional Amendment ballot, you will be directing an unprecedented $4 billion a year to the state highway fund for the building and repairing of Texas roads — without adding a penny in new fees, tolls, taxes or debt. And none of this money can be used for toll roads. Proposition 7 does not raise your taxes. Instead, it constitutionally dedicates sales taxes already collected: $2.5 billion will come from state sale tax revenue plus about $1.5 billion from taxes paid when people purchase or rent motor vehicles in Texas. If you want better roads, vote for Proposition 7. You are making sure there is money in the bank for large road projects. I’ve directed the Texas Transportation Commission to address the worst traffic chokepoints and work with planners to get new roads built swiftly and effectively.[6] |

” |

Phil Neighbors, president of the San Angelo Chamber of Commerce, said:[16]

| “ | What the proposition does is allow the residents of Texas to finally get the level of funding for our road system where it needs to be with a dependable source for the future. The chamber supported that legislation in the legislative session, so now we’re happy to endorse Proposition 7 now that it’s going before the voters and urge everyone to vote in favor of it.[6] | ” |

Kelly R. Hall, president and CEO of the Longview Chamber of Commerce in Gregg County, argued:[17]

| “ | The amendment will authorize a new, stable source of funding for transportation in Texas, dedicated to the construction and maintenance of roads. Passing the amendment will provide a significant step toward meeting the unmet funding needs for transportation projects in Texas. A strong transportation system is fundamental to Texas' quality of life and economic vitality; it helps attract new businesses and generates jobs.[6] | ” |

Bill Hammond, CEO of the Texas Association of Business, stated:[18]

| “ | The plan to constitutionally dedicate a portion of the motor vehicle sales tax revenue to transportation projects is exactly what the business community has called for, and we will strongly support this proposed constitutional amend. Texas must continue to build and improve infrastructure to support our fast growth and dynamic economy. I believe this plan will go a long way in providing a stable source of revenue to built non-tolled projects that will help keep out state moving.[6] | ” |

Jack Ladd, president of Move Texas Forward, said:[19]

| “ | The two most important arguments for it is it doesn’t raise your taxes, and it doesn’t go toward toll roads. ... The gas tax is losing its fervor because [automobiles] are getting more and more fuel-efficient. That’s not a dependable source of funding anymore.[6] | ” |

Jeremy Martin, senior vice president of strategy for the Greater Austin Chamber of Commerce, argued:[19]

| “ | If we want to develop the transportation system that we want and deserve here in Central Texas, we need to dedicate more funding to it. … Funding from Prop. 7 could further accelerate projects such as I-35.[6] | ” |

Dallas County Judge Clay Jenkins, a member of the Regional Transportation Council, said:[20]

| “ | It’s very important. None of that money can be used for any kind of tolled project. This is only for traditional roads and we desperately need more capacity on our traditional roads, particularly the roads coming in and out of Dallas.[6] | ” |

Mark Riley, Parker County judge, chair of the Regional Transportation Council and vice-chair of the Tarrant Regional Transportation Coalition, said:[21]

| “ | Texans pay a state fuel tax of 20 cents per gallon. Of the total tax collected 25 percent goes to public education, 5.7 cents is divided between the State Office of Administrative Hearings, the Attorney General (TxDOT legal services) and the Texas A&M Transportation Institute (research). After the diversions, 9.3 cents remains of the state fuel tax for funding of the state-wide transportation system and paying associated debt costs.

There are many Texans who believe, and rightfully so, the diversions should end. It is easier said than done. In the November 5, 1946 Constitutional Amendment Election, voters approved dedicating 25 percent of fuel taxes to education. Therefore, another election would be required to change the allocation. As for the other diversions, if the legislature were to travel that road, there must be funding to replace those fuel dollars currently diverted. Not an easy task, but over multiple sessions and continued economic growth, it can be done. Prop 7 will also allocate to the highway fund a portion of the motor vehicle sales tax beginning in 2020. As Texas continues to experience economic prosperity, we must stay focused on the critical elements that make our state great. Infrastructure is one of those priorities. A good transportation system is one of the best economic engines available.[6] |

” |

Opposition

Opponents

Organizations

- Center for Public Policy Priorities[14]

- Texas American Federation of Teachers

Arguments against

The Texas Legislative Council released an analysis of the proposed amendments and listed the following arguments against Proposition 7:[22]

| “ | Although funding transportation projects is an important state priority, the proposed amendment is not the best method by which to address transportation funding. The proposed amendment, which would constitutionally dedicate billions of dollars of state tax revenue each year only to transportation-related projects and the payment of transportation-related debt, would tie the hands of future legislatures during a time when the legislature has discretion over less than 20 percent of the state's budget. This could lead to the state being required to make substantial cuts in essential state services, such as public education and health and human services, in the event of a downturn in the state's economy.

There are better alternatives for providing transportation funding that would not affect the state's ability to respond to future budget crises. There is currently a considerable budget surplus available to the legislature that could be appropriated for transportation projects. In addition, the rates of other taxes the revenue from which is already dedicated to transportation could be increased to provide additional funding.[6] |

” |

Media editorials

Support

The Dallas Morning News recommended voting for the amendment, arguing:[23]

| “ | It won’t solve all of our road-funding problems immediately, but voters still should say yes to a constitutional change that at least gets investments in roads back on course. Early voting begins Monday. If approved, 35 percent of all motor vehicle sales and rental taxes in excess of $5 billion, along with $2.5 billion a year from state general tax revenue in excess of $28 billion, would go to road construction and maintenance.

That projects to about $3 billion a year in short order, with more coming. The sales tax provision would take effect in September 2017, with the motor vehicles tax part in September 2019. The motor vehicles money would sunset in 2030, with the general sales tax portion going away in 2033, unless the Legislature voted to extend them 10 years. Voters last year approved a constitutional change that took energy production taxes that otherwise would have gone to the state’s rainy day fund to help replenish the depleted state highway fund. Proposition 7 would further that commitment to better fund roads. Other approaches haven’t gotten the job done. The gasoline tax, our largest revenue source for highway construction and road maintenance, has remained unchanged for more than two decades. Adjusted for inflation, the 20-cent-per-gallon tax, approved in 1991, is worth a mere 9.2 cents per gallon today. Texas has turned to bonds and tolled road to fund projects, but those approaches have run their course, too. For example, payments on debt for transportation now are greater than expenditures for new construction. Proposition 7 provides safeguards in case of slower economic times. With two-thirds votes in the House and Senate, lawmakers could reduce the dispersal up to 50 percent for the next budget cycle to address other critical needs.The measure also would add financial certainty for planning expensive road projects, which require years of lead time. And while reducing the need for tolled roads, it also would prohibit its dedicated funds from going to such roads.[6] |

” |

The Houston Chronicle argued:[24]

| “ | This Rube Goldberg constitutional contraption is the outgrowth of lawmakers unwilling to raise the gas tax or user fees to pay for the state's transportation needs - "underfunded for several decades," says state Sen. Robert Nichols, R-Jacksonville, who chairs the Senate Transportation Committee. Although we would prefer lawmakers who are forthright enough to address the issue head-on, this amendment is probably the best we can hope for. As Nichols points out, it gives the Texas Department of Transportation "a predictable revenue source six to eight years out." The Houston area, by the way, will get nearly $204 million a year if Proposition 7 is approved. We recommend a YES vote on Proposition 7.[6] | ” |

The San Angelo Standard-Times wrote:[25]

| “ | Considering the amount of money involved, it's telling that there is virtually no opposition to Proposition 7. It passed both houses of the Legislature by a combined vote of 172-1. Presumably that shows lawmakers recognize that they haven't done their job for too long and that Texas' future economic growth depends on correcting the problem.

Also presumably voters will give their stamp of approval. While West Texans see the need for additional spending because of damage done to highways by oil field equipment, millions of people in and around large cities know well that new roads are needed to relieve the terrible congestion that is guaranteed to worsen. It's been too long coming, but finally a steady, reliable source of funding for Texas highways is in sight.[6] |

” |

The Corpus Christi Caller-Times said:[26]

| “ | Usually a claim of being able to fund an underfunded function of government without raising taxes or fees has a hitch somewhere. But Proposition 7 appears to be the real deal. The two thresholds chosen by the Legislature for when sales and vehicle taxes go into the highway fund are plenty high enough not to box in state government. Nor are they so high that Proposition 7 would be just a theory on paper.

And if Proposition 7 meets or exceeds its revenue-generating expectations, there's no real danger of skewing the state budget too heavily toward transportation. The state has been underfunding it to the point that the Texas Department of Transportation has been saying it needs $5 billion more a year just to keep up.[6] |

” |

The Longview News-Journal argued:[27]

| “ | Proposition 7 would allocate some sales tax funds from purchase and rental of vehicles to state transportation projects. The proposition is expected to raise about $2.5 billion annually for Texas roads. Texas highways have been allowed to deteriorate until they're in terrible condition because lawmakers have lacked the will to allocate enough money to fix them. This at least gives us a method to keep up with maintenance. This may be the most important proposition on the ballot, and we strongly suggest a vote in favor.[6] | ” |

Oppose

Ballotpedia did not find media editorials opposing the measure. If you are aware of an editorial, please email it to editor@ballotpedia.org.

Path to the ballot

- See also: Amending the Texas Constitution

The constitutional amendment was filed by Sen. Robert Nichols (R-3) and Sen. Jane Nelson (R-12) as Senate Joint Resolution 5 on February 4, 2015.[5] A two-thirds vote in both chambers of the Texas State Legislature was required to refer this amendment to the ballot. Texas is one of sixteen states that require a two-thirds supermajority for constitutional amendments.

On March 4, 2015, the Texas Senate approved SJR 5 with 28 senators voting "yea" and two voting "nay." The Texas House of Representatives approved an amended version on April 30, 2015, with 138 representatives voting "yea" and three voting "nay." Since the house passed an amended version, the Senate needed to approve the amended version. The Senate unanimously approved the amended version on May 29, and the House approved the final version on May 30, with 142 representatives voting "yea" and one voting "nay."[5]

Senate vote

March 4, 2015, Senate vote

| Texas SJR 5 Senate Vote | ||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| 28 | 93.33% | |||

| No | 2 | 6.67% | ||

House vote

April 30, 2015, House vote

| Texas SJR 5 House Vote | ||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| 138 | 97.87% | |||

| No | 3 | 2.13% | ||

State profile

| Demographic data for Texas | ||

|---|---|---|

| Texas | U.S. | |

| Total population: | 27,429,639 | 316,515,021 |

| Land area (sq mi): | 261,232 | 3,531,905 |

| Race and ethnicity** | ||

| White: | 74.9% | 73.6% |

| Black/African American: | 11.9% | 12.6% |

| Asian: | 4.2% | 5.1% |

| Native American: | 0.5% | 0.8% |

| Pacific Islander: | 0.1% | 0.2% |

| Two or more: | 2.5% | 3% |

| Hispanic/Latino: | 38.4% | 17.1% |

| Education | ||

| High school graduation rate: | 81.9% | 86.7% |

| College graduation rate: | 27.6% | 29.8% |

| Income | ||

| Median household income: | $53,207 | $53,889 |

| Persons below poverty level: | 19.9% | 11.3% |

| Source: U.S. Census Bureau, "American Community Survey" (5-year estimates 2010-2015) Click here for more information on the 2020 census and here for more on its impact on the redistricting process in Texas. **Note: Percentages for race and ethnicity may add up to more than 100 percent because respondents may report more than one race and the Hispanic/Latino ethnicity may be selected in conjunction with any race. Read more about race and ethnicity in the census here. | ||

Presidential voting pattern

- See also: Presidential voting trends in Texas

Texas voted Republican in all seven presidential elections between 2000 and 2024.

Pivot Counties (2016)

Ballotpedia identified 206 counties that voted for Donald Trump (R) in 2016 after voting for Barack Obama (D) in 2008 and 2012. Collectively, Trump won these Pivot Counties by more than 580,000 votes. Of these 206 counties, one is located in Texas, accounting for 0.5 percent of the total pivot counties.[28]

Pivot Counties (2020)

In 2020, Ballotpedia re-examined the 206 Pivot Counties to view their voting patterns following that year's presidential election. Ballotpedia defined those won by Trump won as Retained Pivot Counties and those won by Joe Biden (D) as Boomerang Pivot Counties. Nationwide, there were 181 Retained Pivot Counties and 25 Boomerang Pivot Counties. Texas had one Retained Pivot County, 0.55 percent of all Retained Pivot Counties.

More Texas coverage on Ballotpedia

- Elections in Texas

- United States congressional delegations from Texas

- Public policy in Texas

- Endorsers in Texas

- Texas fact checks

- More...

See also

External links

- Senate Joint Resolution 5

- Texas Secretary of State - What's On the Ballot 2015

- Texas Legislative Council 2015 Analyses of Proposed Constitutional Amendments

- Texas House of Representatives House Research Organization Focus Report - Amendments Proposed for November 2015 Ballot

Footnotes

- ↑ 1.0 1.1 1.2 Texas Legislature, "SJR No. 5," accessed May 1, 2015

- ↑ Texas Legislature, "SJR No. 5 Analysis," accessed May 1, 2015

- ↑ 3.0 3.1 3.2 Texas Department of Transportation, "FAQ: Proposition 7 – Constitutional Amendment for Transportation Funding," accessed October 7, 2015

- ↑ Austin American-Statesman, "TxDOT funding amendment on the way to voters after House vote," May 30, 2015

- ↑ 5.0 5.1 5.2 Texas Legislature, "HJR No. 5 History," accessed May 1, 2015

- ↑ 6.00 6.01 6.02 6.03 6.04 6.05 6.06 6.07 6.08 6.09 6.10 6.11 6.12 6.13 6.14 6.15 6.16 Note: This text is quoted verbatim from the original source. Any inconsistencies are attributable to the original source. Cite error: Invalid

<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content - ↑ 7.0 7.1 Texas Legislative Budget Board, "SJR No. 5 Fiscal Note," accessed June 1, 2015

- ↑ The Texas Tribune, "Texans to Vote on Plan to Boost Road Funding," May 30, 2015

- ↑ El Paso Times, "State Rep. Joe Pickett's $2.5 billion transportation bill headed to voters," May 30, 2015

- ↑ Texas Legislature, "SJR No. 5 Sponsors," accessed May 1, 2015

- ↑ 12.0 12.1 MyStatesman.com, "Abbott: Vote to save your time and money," October 19, 2015

- ↑ Lieutenant Governor of Texas, "Lt. Governor Patrick and Senator Nichols Announce Transportation Bill," accessed June 8, 2015

- ↑ 14.0 14.1 14.2 Texas Legislature, "SJR No. 5 Witnesses," accessed May 1, 2015

- ↑ Midland Reporter-Telegram, "Proposition 7 could bring more highway funds," August 4, 2015

- ↑ San Angelo Standard-Times, "Summit speakers urge support for road funding," August 5, 2015

- ↑ Longview News-Journal, "Hall: Move Texas forward with Proposition 7," August 22, 2015

- ↑ Move Texas Forward, "Move Texas Forward and Coalition Partners Support for SB5 and SJR5," accessed June 8, 2015

- ↑ 19.0 19.1 Community Impact Newspaper, "Transportation funding for Texas roads back on ballot this November," September 30, 2015

- ↑ CBS DFW, "State: More Funds Dedicated To Texas Roads If Prop 7 Passes," October 21, 2015

- ↑ Star-Telegram, "Pave the road to the future, vote yes for Proposition 7," October 20, 2015

- ↑ Texas Legislative Council, "Analyses of Proposed Constitutional Amendments," accessed October 26, 2015

- ↑ The Dallas Morning News, "Editorial: Why you should consider voting yes on Prop. 7 even if road fixes aren't immediate," October 13, 2015

- ↑ The Houston Chronicle, "Texas propositions," October 14, 2015

- ↑ San Angelo Standard-Times, "OUR OPINION: Pass Prop 7 for Texas roads," accessed October 26, 2015

- ↑ Corpus Christi Caller-Times, "Proposition 7 is a smart way to fund road work," October 18, 2015

- ↑ Longview News-Journal, "Editorial: All 7 state constitutional amendments worthy of approval," October 20, 2015

- ↑ The raw data for this study was provided by Dave Leip of Atlas of U.S. Presidential Elections.

|

State of Texas Austin (capital) |

|---|---|

| Elections |

What's on my ballot? | Elections in 2026 | How to vote | How to run for office | Ballot measures |

| Government |

Who represents me? | U.S. President | U.S. Congress | Federal courts | State executives | State legislature | State and local courts | Counties | Cities | School districts | Public policy |