Louisiana 2025 local ballot measures

| Louisiana Local Ballot Measures | |

|---|---|

2026 »

« 2024

| |

| |

| Louisiana ballot measures | |

| State measures | |

| Local measures | |

| 2025 ballot measures | |

| State measures | |

| Local measures | |

Ballotpedia covered local ballot measures for voters in Louisiana in 2025.

In 2025, Ballotpedia covered local ballot measures that appeared on the ballot for voters within the 100 largest cities in the U.S., within state capitals, and throughout California and Virginia. You can review the coverage scope of the local ballot measures project here.

Ballotpedia covered electoral system-related ballot measures, like ranked-choice voting, outside of the largest cities.

Election dates

East Baton Rouge Parish

• East Baton Rouge Parish, Louisiana, Proposition 1, Library Tax Funds Measure (November 2025): ✖

A "yes" vote supported rededicating $52.4 million in existing library tax funds for parish-wide general purposes and extending the 11.1-mill property tax for 10 years, from 2026 through 2035, with 8.3 mills continuing to fund the public library system and 2.8 mills dedicated to parish-wide general purposes. |

A "no" vote opposed rededicating $52.4 million in existing library tax funds for parish-wide general purposes and extending the 11.1-mill property tax for 10 years, from 2026 through 2035, with 8.3 mills continuing to fund the public library system and 2.8 mills dedicated to parish-wide general purposes. |

A "yes" vote supported rededicating $6 million in existing mosquito abatement tax funds for parish-wide general purposes and extending the 1.00-mill property tax for 10 years, from 2027 through 2036, with 0.50 mills continuing to fund mosquito and rodent control operations and 0.50 mills dedicated to parish-wide general purposes. |

A "no" vote opposed rededicating $6 million in existing mosquito abatement tax funds for parish-wide general purposes and extending the 1.00-mill property tax for 10 years, from 2027 through 2036, with 0.50 mills continuing to fund mosquito and rodent control operations and 0.50 mills dedicated to parish-wide general purposes. |

A "yes" vote supported extending the 2.25-mill property tax for 10 years, from 2027 through 2036, expected to generate about $13.7 million annually, with 2.00 mills dedicated to the East Baton Rouge Council on Aging for senior programs and facilities and 0.25 mills dedicated to parish-wide general purposes. |

A "no" vote opposed extending the 2.25-mill property tax for 10 years, from 2027 through 2036, expected to generate about $13.7 million annually, with 2.00 mills dedicated to the East Baton Rouge Council on Aging for senior programs and facilities and 0.25 mills dedicated to parish-wide general purposes. |

• Fire Protection District No. 6, Louisiana, Property Tax Measure (November 2025): ✖

A "yes" vote supported renewing a property tax of 5 mills for nine years, from 2026 through 2034, to generate about $351,194.50 annually for developing, operating, and maintaining fire protection facilities, including water supply and hydrants. |

A "no" vote opposed renewing a property tax of 5 mills for nine years, from 2026 through 2034, to generate about $351,194.50 annually for developing, operating, and maintaining fire protection facilities, including water supply and hydrants. |

A "yes" vote supported renewing the annual parcel fee for the South Burbank Crime Prevention and Development District for four years, from 2026 through 2029, at rates of $100 per parcel for each residential or commercial structure and $25 per unit for multi-unit properties, to fund crime prevention, security patrols, and related public safety programs, generating about $270,400 annually. |

A "no" vote opposed renewing the annual parcel fee for the South Burbank Crime Prevention and Development District for four years, from 2026 through 2029, at rates of $100 per parcel for each residential or commercial structure and $25 per unit for multi-unit properties, to fund crime prevention, security patrols, and related public safety programs, generating about $270,400 annually. |

• Zachary Community School System, Louisiana, Tax Measure (November 2025): ✖

A "yes" vote supported authorizing the Zachary Community School System to levy a 24-mill property tax for 20 years, from 2026 through 2045, expected to generate about $8.4 million annually, to fund salaries and benefits for school personnel and support the construction, improvement, maintenance, and operation of public schools, buildings, technology, and facilities within the system. |

A "no" vote opposed authorizing the Zachary Community School System to levy a 24-mill property tax for 20 years, from 2026 through 2045, expected to generate about $8.4 million annually, to fund salaries and benefits for school personnel and support the construction, improvement, maintenance, and operation of public schools, buildings, technology, and facilities within the system. |

Orleans Parish

A "yes" vote supported issuing an annual fee, up to $200, on every improved parcel of land in the Broadmoor Neighborhood Improvement District for the years between 2026 and 2030, to fund quality of life initiatives and the beautification and improvement of the area. |

A "no" vote opposed issuing an annual parcel fee to fund quality of life initiatives. |

A "yes" vote supported renewing the sales tax rate of 0.245% for the next five fiscal years to fund police patrols and public safety programs. |

A "no" vote opposed renewing the sales tax rate of 0.245%. |

A "yes" vote supported issuing an annual fee, up to $600, on every parcel within the Lakewood Crime Prevention and Improvement District to fund crime prevention and security measures for a period of eight years. |

A "no" vote opposed issuing an annual parcel fee to fund crime prevention and security measures. |

• Orleans Parish, Louisiana, Bond Issue to Fund Affordable Housing Projects Measure (November 2025): ✔

A "yes" vote supported issuing $45 million in bonds to fund the construction and improvement of affordable housing. |

A "no" vote opposed issuing $45 million in bonds to fund the construction and improvement of affordable housing. |

A "yes" vote supported issuing $415 million in bonds to fund the construction and renovation of roads, public safety facilities, recreational facilities, and other infrastructure. |

A "no" vote opposed issuing $415 million in bonds to fund the construction and renovation of roads, public safety facilities, recreational facilities, and other infrastructure. |

A "yes" vote supported issuing $50 million in bonds to fund the construction and renovation of stormwater drainage and management systems. |

A "no" vote opposed issuing $50 million in bonds to fund the construction and renovation of stormwater drainage and management systems. |

A "yes" vote supported amending the City of New Orleans Charter to extend the City Planning Commission and City Council's deadlines to act on the Master Plan. |

A "no" vote opposed amending the City of New Orleans Charter to extend the City Planning Commission and City Council's deadlines to act on the Master Plan. |

A "yes" vote supported amending the charter of the City of New Orleans to change the powers and duties of the city attorney to:

|

A "no" vote opposed amending the charter of the City of New Orleans to change the powers and duties of the city attorney. |

A "yes" vote supported renewing an annual fee, up to $200, on all taxable property in the Spring Lake Subdivision Improvement District to promote and encourage the beautification, security, and overall benefit of the area. |

A "no" vote opposed renewing an annual fee, up to $200, on all taxable property in the Spring Lake Subdivision Improvement District to promote and encourage the beautification, security, and overall benefit of the area. |

A "yes" vote supported issuing an annual fee on each parcel of land in the Tall Timbers Crime Prevention and Improvement District for five years to fund crime prevention in the area, the amount of the fee being:

|

A "no" vote opposed issuing an annual fee on each parcel of land in the Tall Timbers Crime Prevention and Improvement District. |

A "yes" vote supported issuing an annual fee on each parcel of land, less than $1,200, for seven years to fund crime prevention in the area. |

A "no" vote opposed issuing an annual fee on each parcel of land, less than $1,200, for seven years to fund crime prevention in the area. |

East Baton Rouge Parish

• Concord Estates Crime Prevention District, Louisiana, Parcel Tax Fee Measure (October 2025): ✔

A "yes" vote supported authorizing the Concord Estates Crime Prevention District to levy an annual parcel fee of $69.50 for six years beginning in 2026, expected to generate about $20,433 annually, to fund crime prevention and security services in the district. |

A "no" vote opposed authorizing the Concord Estates Crime Prevention District to levy an annual parcel fee of $69.50 for six years beginning in 2026, expected to generate about $20,433 annually, to fund crime prevention and security services in the district. |

• East Baton Rouge, Louisiana, Downtown Development Property Tax Measure (October 2025): ✔

A "yes" vote supported renewing a 10-mill property tax within the Downtown Development District of Baton Rouge for five years beginning in 2027, expected to generate about $741,390 annually, to fund planning, development, management, operations, and improvements in the district. |

A "no" vote opposed renewing a 10-mill property tax within the Downtown Development District of Baton Rouge for five years beginning in 2027, expected to generate about $741,390 annually, to fund planning, development, management, operations, and improvements in the district. |

A "yes" vote supported renewing an annual parcel fee of up to $100 for ten years beginning in 2026, with one possible increase up to $150 after five years, expected to generate about $51,800 annually, to fund crime prevention, security, beautification, and improvements in the Southern Heights Neighborhood Crime Prevention and Improvement District. |

A "no" vote opposed renewing an annual parcel fee of up to $100 for ten years beginning in 2026, with one possible increase up to $150 after five years, expected to generate about $51,800 annually, to fund crime prevention, security, beautification, and improvements in the Southern Heights Neighborhood Crime Prevention and Improvement District. |

Orleans Parish

• New Orleans, Louisiana, Castle Manor Improvement Parcel Tax Measure (October 2025): ✖

A "yes" vote supported authorizing the city to levy an annual parcel fee of up to $100 for residential parcels and $200 for commercial parcels for the first three years, and up to $125 for residential parcels and $225 for commercial parcels for the next two years, generating an estimated $65,000 annually for five years beginning in 2026 to fund beautification, security, and supplemental law enforcement in the Castle Manor Improvement District. |

A "no" vote opposed authorizing the city to levy an annual parcel fee of up to $100 for residential parcels and $200 for commercial parcels for the first three years, and up to $125 for residential parcels and $225 for commercial parcels for the next two years, generating an estimated $65,000 annually for five years beginning in 2026 to fund beautification, security, and supplemental law enforcement in the Castle Manor Improvement District. |

A "yes" vote supported amending the New Orleans Home Rule Charter to prohibit laws from discriminating against a person based on conviction history. |

A "no" vote opposed amending the New Orleans Home Rule Charter to prohibit laws from discriminating against a person based on conviction history. |

East Baton Rouge Parish

• Central Community School Board, Louisiana, School Bond Measure (May 2025): ✖

A "yes" vote supported authorizing the board to issue up to $35 million in bonds for school construction, improvements, and equipment, with no estimated increase to the current property tax rate of 23.65 mills. |

A "no" vote opposed authorizing the board to issue up to $35 million in bonds for school construction, improvements, and equipment, with no estimated increase to the current property tax rate of 23.65 mills. |

A "yes" vote supported renewing a property tax of 0.72 mills for 10 years, expected to generate $3.89 million annually, to fund the I CARE alcohol and drug abuse prevention program. |

A "no" vote opposed renewing a property tax of 0.72 mills for 10 years, expected to generate $3.89 million annually, to fund the I CARE alcohol and drug abuse prevention program. |

A "yes" vote supported renewing a property tax of 1.04 mills for 10 years, expected to generate $5.6 million annually, for operating and maintaining the public school system. |

A "no" vote opposed renewing a property tax of 1.04 mills for 10 years, expected to generate $5.6 million annually, for operating and maintaining the public school system. |

A "yes" vote supported renewing a property tax of 5.99 mills for 10 years, expected to generate $32.3 million annually, to fund salaries and benefits for public school employees. |

A "no" vote opposed renewing a property tax of 5.99 mills for 10 years, expected to generate $32.3 million annually, to fund salaries and benefits for public school employees. |

A "yes" vote supported renewing a property tax of 4.98 mills for 10 years, expected to generate $26.88 million annually, to replace reduced state and local revenues and support school operations. |

A "no" vote opposed renewing a property tax of 4.98 mills for 10 years, expected to generate $26.88 million annually, to replace reduced state and local revenues and support school operations. |

A "yes" vote supported renewing a property tax of 7.14 mills for 10 years, expected to generate $38.5 million annually, to improve and maintain salaries and benefits for public school employees. |

A "no" vote opposed renewing a property tax of 7.14 mills for 10 years, expected to generate $38.5 million annually, to improve and maintain salaries and benefits for public school employees. |

• East Baton Rouge Parish, Louisiana, District Attorney Millage Measure (May 2025): ✖

A "yes" vote supported levying a property tax of 4 mills for 20 years, expected to generate $24.4 million annually, to fund the office of the District Attorney for East Baton Rouge Parish. |

A "no" vote opposed levying a property tax of 4 mills for 20 years, expected to generate $24.4 million annually, to fund the office of the District Attorney for East Baton Rouge Parish. |

Orleans Parish

• Lake Vista Crime Prevention District, Louisiana, Crime Prevention Parcel Fee Measure (May 2025): ✔

A "yes" vote supported authorizing New Orleans to levy a parcel fee not to exceed $220 per parcel within the Lake Vista Crime Prevention District for four years to fund additional law enforcement and security personnel. |

A "no" vote opposed authorizing New Orleans to levy a parcel fee not to exceed $220 per parcel within the Lake Vista Crime Prevention District for four years to fund additional law enforcement and security personnel. |

• Orleans Law Enforcement District, Lousiana, Law Enforcement Property Tax Renewal Measure (May 2025): ✔

A "yes" vote supported authorizing the Orleans Parish Sheriff to renew a property tax for the Law Enforcement District of the Parish of Orleans at a rate of $246 per $100,000 of assessed property value for ten years to fund the operation, maintenance, and upkeep of jails and related facilities. |

A "no" vote opposed authorizing the Orleans Parish Sheriff to renew a property tax for the Law Enforcement District of the Parish of Orleans at a rate of $246 per $100,000 of assessed property value for ten years to fund the operation, maintenance, and upkeep of jails and related facilities. |

East Baton Rouge Parish

• St. George, Louisiana, Home Rule City Charter Adoption Measure (March 2025): ✖

A "yes" vote supported adopting the home rule city charter as drafted by the charter commission. |

A "no" vote opposed adopting the home rule city charter as drafted by the charter commission. |

A "yes" vote supported authorizing the district to renew a parcel fee for 10 years beginning in 2027 at a rate of $95 for residential parcels and $250 for commercial parcels to fund crime prevention and district security. |

A "no" vote opposed authorizing the district to renew a parcel fee for 10 years beginning in 2027 at a rate of $95 for residential parcels and $250 for commercial parcels to fund crime prevention and district security. |

Orleans Parish

• Lakeview Crime Prevention District, Louisiana, Parcel Fee Measure (March 2025): ✔

A "yes" vote supported authorizing the district to levy a parcel fee not to exceed $150 per parcel for 10 years beginning in 2027 to fund crime prevention. |

A "no" vote opposed authorizing the district to levy a parcel fee not to exceed $150 per parcel for 10 years beginning in 2027 to fund crime prevention. |

Tangipahoa Parish

A "yes" vote supported repealing the existing 10-mill property tax ($1,000 per $100,000 of assessed value) for the Tangipahoa Parish Law Enforcement District and replacing it with a 0.75% parish-wide sales tax starting July 1, 2025. |

A "no" vote opposed repealing the existing 10-mill property tax ($1,000 per $100,000 of assessed value) for the Tangipahoa Parish Law Enforcement District and replacing it with a 0.75% parish-wide sales tax starting July 1, 2025. |

• Tangipahoa Parish Mosquito Abatement District, Louisiana, Property Tax Renewal Measure (March 2025): ✔

A "yes" vote supported renewing a property tax of 4.98 mills ($498 per $100,000 of assessed value) in Tangipahoa Parish's Mosquito Abatement District No. 1 for 10 years (2027-2036) to fund mosquito and arthropod control efforts, including acquiring and maintaining equipment and materials. |

A "no" vote opposed renewing a property tax of 4.98 mills ($498 per $100,000 of assessed value) in Tangipahoa Parish's Mosquito Abatement District No. 1 for 10 years. |

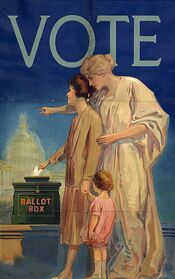

How to cast a vote

- See also: Voting in Louisiana

See below to learn more about current voter registration rules, identification requirements, and poll times in Louisiana.

Poll times

In Louisiana, polls are open from 6:00 a.m. to 8:00 p.m. Central Time for Tuesday elections. For Saturday elections, polls are open from 7:00 a.m. to 8:00 p.m. Central Time. Anyone in line when the polls close must be allowed to vote.[1][2]

Registration

- Check your voter registration status here.

To vote in Louisiana, one must provide documentary proof of United States citizenship and be a resident of the state and parish in which they register. A voter must be at least 18 years old by Election Day.[3]

Registration completed via mail or in person must occur at least 30 days before Election Day. Registration completed online must occur at least 20 days before Election Day. Registrants must present a valid form of identification to register. Pre-registration is available beginning at age 16 for voters registering at a Registrar of Voters office or at the Louisiana Office of Motor Vehicles.[3]

Voters may register in person at any Registrar of Voters office or any of the following places:[3]

- Louisiana Office of Motor Vehicles

- Louisiana Department of Social Services

- WIC offices

- Food stamp offices

- Medicaid offices

- Offices serving persons with disabilities such as the Deaf Action Centers and Independent Living Offices

- Armed Forces recruitment offices

Automatic registration

- See also: Automatic voter registration

Louisiana does not practice automatic voter registration.[4]

Online registration

- See also: Online voter registration

Louisiana has implemented an online voter registration system. Residents can register to vote by visiting this website.

Same-day registration

- See also: Same-day voter registration

Louisiana does not allow same-day voter registration.[5]

Residency requirements

Louisiana law requires 20 days of residency in the state before a person may vote.[3]

Verification of citizenship

Louisiana state law requires a voter registration applicant to provide proof of citizenship to register to vote. As of February 2026, the state had not implemented the requirement.[6][7]

All 49 states with voter registration systems require applicants to declare that they are U.S. citizens in order to register to vote in state and federal elections, under penalty of perjury or other punishment.[8] Six states — Alabama, Arizona, Kansas, Louisiana, New Hampshire, and Wyoming — have laws requiring individuals provide proof of citizenship at the time of voter registration, whether in effect or not. Two states, Georgia and Mississippi, require a person provide proof of citizenship if their citizenship status cannot be verified by other means. One state, Ohio, requires proof of citizenship only when registering to vote at a Bureau of Motor Vehicles facility. In three states — California, Maryland, and Vermont — at least one local jurisdiction allows noncitizens to vote in some local elections. Noncitizens registering to vote in those elections must complete a voter registration application provided by the local jurisdiction and are not eligible to register as state or federal voters.

Verifying your registration

The site Geaux Vote, run by the Louisiana Secretary of State office, allows residents to check their voter registration status online.

Voter ID requirements

Louisiana requires voters to present photo identification while voting.[9]

Voters can present the following forms of identification. This list was current as of November 2025. Click here to ensure you have the most current information.

| “ |

Each voter is required to identify themselves by giving their name and address to a commissioner and by presenting either a Louisiana driver's license, a Louisiana special identification card, LA Wallet digital driver's license, a United States military identification card that contains the voter's name and picture or other generally recognized picture identification card that contains the name and signature of the applicant. If no photo ID is available, the voter can complete a Voter Identification Affidavit (AV-34) but is subject to challenge by law.[10] |

” |

To view Louisiana state law pertaining to voter identification, click here.

Registered voters can bring their voter information card to the Office of Motor Vehicles to receive a free Louisiana special identification card.[9]

See also

Footnotes

- ↑ Louisiana Secretary of State, "FAQ: Voting on Election Day," accessed November 12, 2025

- ↑ Louisiana Secretary of State, "Vote on Election Day," accessed November 12, 2025

- ↑ 3.0 3.1 3.2 3.3 Louisiana Secretary of State, "Register to Vote," accessed November 12, 2025

- ↑ NCSL, "Automatic Voter Registration," accessed November 12, 2025

- ↑ NCSL, "Same-Day Voter Registration," accessed November 12, 2025

- ↑ Louisiana Secretary of State, "Louisiana Voter Registration Application," accessed January 27, 2026

- ↑ United States District Court For The Middle District of Louisiana, "DEFENDANTS’ MEMORANDUM OF LAW IN SUPPORT OF THEIR MOTION TO DISMISS PLAINTIFFS’ AMENDED COMPLAINT," December 23, 2025

- ↑ Under federal law, the national mail voter registration application (a version of which is in use in all states with voter registration systems) requires applicants to indicate that they are U.S. citizens in order to complete an application to vote in state or federal elections, but does not require voters to provide documentary proof of citizenship. According to the U.S. Department of Justice, the application "may require only the minimum amount of information necessary to prevent duplicate voter registrations and permit State officials both to determine the eligibility of the applicant to vote and to administer the voting process."

- ↑ 9.0 9.1 Louisiana Secretary of State, "Vote on Election Day," accessed November 12, 2025

- ↑ Note: This text is quoted verbatim from the original source. Any inconsistencies are attributable to the original source.

Topics: Absentee and mail voting • Administrative organization • Agriculture policy • Athletics and sports • Bail policy • Bond issues • Budget stabilization funds • Business taxes • Citizenship voting requirements • Civil trials • Constitutional rights • Criminal sentencing • Drinking water systems • Election administration and governance • Family-related policy • Firearms policy • Food policy • Healthcare governance • Higher education funding • Highways and bridges • Homestead tax exemptions • Income taxes • Juvenile criminal justice • Local government finance and taxes • Parks, land, and natural area conservation • Pollution, waste, and recycling policy • Property tax exemptions • Property taxes • Public assistance programs • Public education funding • Public employee retirement funds • Public school teachers and staff • Redistricting policy • Restricted-use funds • Revenue allocation • Revenue and spending limits • Sales taxes • Severance taxes • Sewage and stormwater • State judicial authority • State judicial selection • State judiciary oversight • State judiciary structure • State legislative authority • State legislative vote requirements • Vaccinations and disease policy • Veterans policy • Voter ID policy • Water storage