Help us improve in just 2 minutes—share your thoughts in our reader survey.

Tax policy and the 2014 election: statewide ballot measures

On November 4, 2014, voters in 10 states weighed in on 20 separate statewide tax-related ballot measures. These measures impacted a wide variety of taxes and tax issues, including personal income tax, property taxes, excise taxes and more.

According to the Federation of Tax Administrators, taxpayers nationwide paid $846 billion in state taxes in 2013. Median per capita state tax collections equaled $2,556, roughly 6.3 percent of median personal income. This figure does not take into account federal or local tax collections. States levy taxes to help fund the variety of services they provide. Tax collections comprise approximately 40 percent of the states' total revenues. The rest comes from non-tax sources, such as intergovernmental aid (e.g., federal funds), lottery revenues and fees. The primary types of taxes levied by state governments include personal income tax, general sales tax, excise (or special sales) taxes and corporate income tax.[1][2]

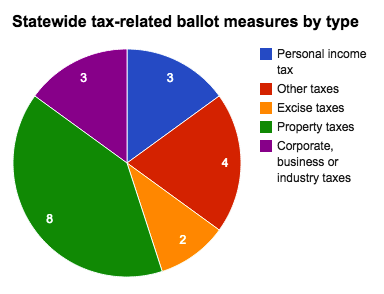

Of the 20 statewide tax-related measures on the ballot in November, eight dealt with property taxes. Three dealt with personal income tax, including a proposal in Tennessee to prohibit the state legislature from levying, authorizing or permitting any state or local tax on payroll or earned personal income. The chart below further details the breakdown of ballot measures by topic.

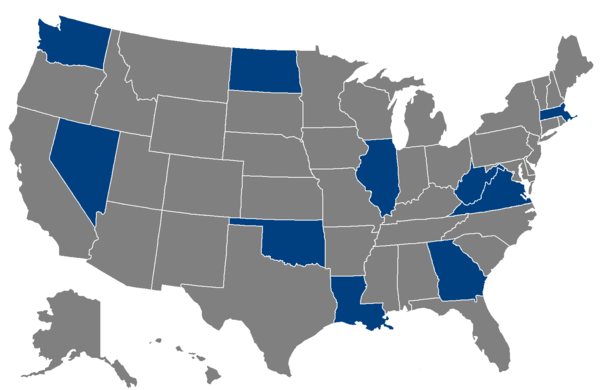

To learn more about what tax-related ballot measures were on the ballot in your state, simply select your state on the map below. You can also use the tabs below the map to navigate to information about all statewide tax-related ballot measures for the November 4 election, as well as past 2014 measures.

November 4, 2014 ballot measures

Georgia

Click here to learn more about tax policy in Georgia. |

|---|

The Georgia Income Tax Rate Cap, Amendment A was on the November 4, 2014 ballot in Georgia as a legislatively referred constitutional amendment, where it was approved. The measure was designed to prohibit the state from increasing the maximum state income tax rate above that in effect on January 1, 2015.[3]

The amendment was sponsored in the Georgia Legislature by six state senators, all Republicans, as Senate Resolution 415.[4]

The Georgia Private College Buildings Tax Exemption, Referendum 1 was on the November 4, 2014 ballot in Georgia as a legislatively referred state statute, where it was approved. The measure was designed to extend a "public property" ad valorem tax exemption to privately held and operated student dormitories and parking decks that are obliged by contract to serve universities within the University of Georgia system.[4]

The statute was part of a larger legislative package related to the privatization of student dormitories. The package, taken together, would lease dormitories to private firms who would collect revenues from operating the dorms. The package would leave some control of student dorm boarding prices to administrators. The leasing companies would take on any existing debt on leased properties and have the option of building new dormitories. Leases would last from 30 to 65 years, and many would include a renewal option. Private companies would bid on contracts and be selected following the referendum's approval.[5]

Illinois

Click here to learn more about tax policy in Illinois. |

|---|

The Illinois Millionaire Tax Increase for Education Question was on the November 4, 2014 ballot in Illinois as an advisory question, where it was approved. The measure asked voters whether they supported increasing the tax on incomes greater than one million dollars by three percent for the purpose of providing additional revenue to school districts based on their number of students.[6]

The advisory question was introduced into the Illinois Legislature by Rep. Michael J. Madigan (D-22) as House Bill 3816.[7]

Louisiana

Click here to learn more about tax policy in Louisiana. |

|---|

The Louisiana Disabled Veterans Homestead Exemption Correction, Amendment 7 was on the November 4, 2014 ballot in Louisiana as a legislatively referred constitutional amendment, where it was approved. The measure empowered parishes to grant veterans rated with 100 percent “unemployability” a homestead exemption of $150,000.[8]

Previously, most residents of Louisiana received a $75,000 homestead exemption on property taxes.

In 2010, voters passed Amendment 3, which gave parishes the ability to grant veterans rated with 100 percent “service-connected disability” a homestead exemption of $150,000. This created situations where disabled veterans had, for example, an 80 percent "service-connected disability" rating, but a 100 percent "unemployability" rating, and the veterans were not permitted to receive the tax exemption. Amendment 7 is designed to resolve these types of situations.

The bill was sponsored in the legislature by State Senator Robert Adley (R-36) as Senate Bill 96.[8]

The Louisiana Orleans Parish Tax for Fire and Police Protection, Amendment 6 was on the November 4, 2014 ballot in Louisiana as a legislatively referred constitutional amendment, where it was approved. The measure authorized Orleans Parish to increase the annual ad valorem tax levied for fire and police protection and required that the revenue from the fire and police millages be used for fire and police protection service enhancements. It did this by raising the special millage caps for police and fire protection from five to ten mills. The measure also required a separate vote on the increase by constituents of Orleans Parish.[9]

The proposed amendment was introduced into the Louisiana Legislature by State Representative Walt Leger, III (D-91) as House Bill 111. Mayor Mitch Landrieu (D) of New Orleans proposed the amendment.[10]

The Louisiana Permanently Disabled Homeowners Tax Break, Amendment 9 was on the November 4, 2014 ballot in Louisiana as a legislatively referred constitutional amendment, where it was defeated. The measure would have deleted the requirement that permanently and totally disabled homeowners certify their adjusted gross income annually to have their property assessment capped.[8][11]

The bill was sponsored in the legislature by State Senator Jean-Paul J. Morrell (D-3) as Senate Bill 56.[8]

The Louisiana Tax Collector Involvement in Tax Sales, Amendment 3 was on the November 4, 2014 ballot in Louisiana as a legislatively referred constitutional amendment, where it was defeated. The measure would have permited authorized private firms to assist local governments in the tax sale process, including in the sale of property for delinquent taxes. The measure would have also mandated that the fee charged by the firm be included within the costs that the collector may recover in the tax sale.[12]

The amendment was sponsored in the Louisiana Legislature by Representative John Berthelot (R-88) as House Bill 488.[9]

The Louisiana Tax Rebate Debate, Amendment 14 was on the November 4, 2014 ballot in Louisiana as a legislatively referred constitutional amendment, where it was defeated. The measure would have prohibited legislators from introducing legislation related to tax exemptions, credits, rebates and other tax break programs during legislative sessions in even-numbered years.[8][13]

The bill was sponsored in the legislature by State Representative Edward James (D-101) as House Bill 131.[8]

Massachusetts

Click here to learn more about tax policy in Massachusetts. |

|---|

The Massachusetts Automatic Gas Tax Increase Repeal Initiative, Question 1 was on the November 4, 2014 statewide ballot as an initiated state statute, where it was approved. The measure was designed to repeal a 2013 law that automatically adjusted gas taxes according to inflation, allowing for automatic annual increases in the state's gas tax.[14]

The law that this initiative sought to repeal also put a minimum cap on gas taxes to prevent gas tax decreases in the case of deflation. The tax increase was part of a transportation funding package that was vetoed by Governor Deval Patrick (D) because he wanted an even greater tax increase. But Patrick's veto was overruled by a House vote of 123 to 33 and a Senate vote of 35 to 5.[15]

Tank the Gas Tax, an organization supporting the initiative, stated that they collected at least 18,500 signatures by June 9, 2014. They turned in the signatures on June 18, 2014 in an attempt to qualify the initiative for the ballot.[16] The measure was certified for the 2014 ballot on July 2, 2014.[17]

Nevada

Click here to learn more about tax policy in Nevada. |

|---|

The Nevada Margin Tax for Public Schools Initiative, Question 3 was on the November 4, 2014 ballot in the state of Nevada as an indirect initiated state statute, where it was defeated. The measure would have instituted a two percent margin tax on businesses operating in Nevada. Revenue from the tax would have been allocated to public schools, from kindergarten through high school, and kept in the State Distributive School Account.[18]

The two percent taxed margin could have been be determined using two different methods:[18]

- Taxation of 70% of total revenue of the business

- Taxation of a business’ total revenue minus compensation to owners and employers or cost related to goods sold. A business would choose whether to subtract compensation or cost of goods, but not both.

The measure would have also temporarily increased the two percent modified business tax on financial institutions to 2.29 percent or 2.42 percent. Revenue would have been used to pay for the administration of the margin tax.

Had it been approved, the margin tax would have started to accrue on January 1, 2015.[18]

The initiative was filed by the Nevada AFL-CIO, led by Executive Secretary Treasurer Danny Thompson, and the Nevada State Education Association (NSEA). However, on May 2, 2014, the AFL-CIO passed a resolution to officially oppose the measure. It was supported by the Nevada State Education Association.[19]Supporters call the measure The Education Initiative.[20] Opponents call the measure The Margin Tax Initiative.

The Nevada Mining Tax Cap Amendment, Question 2 was on the 2014 ballot in the state of Nevada as a legislatively referred constitutional amendment, where it was defeated. The measure, known as SJR 15 in the legislature, asked voters whether the five percent tax cap on mining should be removed from the Nevada Constitution, thereby allowing legislators to raise taxes on mining activity.[21] A similar measure failed to make the 2012 ballot.

North Dakota

Click here to learn more about tax policy in North Dakota. |

|---|

The North Dakota Clean Water, Wildlife and Parks Amendment, Measure 5 was on the November 4, 2014 ballot in North Dakota as an initiated constitutional amendment, where it was defeated. The measure would have redirected five percent of the state's oil extraction tax revenue to a Clean Water, Wildlife, and Parks Trust (the "trust") and a Clean Water, Wildlife, and Parks Fund (the "fund").[22]

Of the revenue received from the oil extraction tax, 90 percent would have been deposited into the fund, while 10 percent would have been deposited into the trust.

The fund would have been used to provide grants to public and private agencies to aid their work in improving water quality, natural flood control, fish and wildlife habitat, parks and outdoor recreation areas, access for fishing and hunting, land acquisition for parks and outdoor education for children. The fund would have been governed by a Clean Water, Wildlife, and Parks Commission, which would have been comprised of the governor, attorney general and agriculture commissioner. A Citizen Accountability Board would have been appointed for three-year terms to review grant applications and make recommendations to the commission.

The principal and earnings of the trust could not have been used until after January 1, 2019, and only with a two-thirds majority vote in the North Dakota Legislature.

The initiative would have required that every twenty-five years, voters be able to decide on the question of whether to continue the fund’s financing from the oil extraction tax.

The amendment would have gone into effect on January 1, 2015.[22]

The measure was sponsored by North Dakotans for Clean Water, Wildlife and Parks.

The North Dakota Property Transfer Tax Ban Amendment, Measure 2 was on the November 4, 2014 ballot in the state of North Dakota as a legislatively referred constitutional amendment, where it was approved. The measure was designed to prohibit the state and any political subdivision from imposing mortgage, sales or transfer taxes on the mortgage or transfer of real property.[23]

The amendment was introduced into the North Dakota Legislature as House Concurrent Resolution 3006.[23]

As of September 2014, 36 states, including bordering Minnesota and South Dakota, imposed transfer taxes. The other 14 did not, and five states, such as Montana and Wyoming, had banned transfer taxes in their state constitutions.[24]

Oklahoma

Click here to learn more about tax policy in Oklahoma. |

|---|

The Oklahoma Homestead Exemption Transfer for Disabled Veterans Amendment, State Question 770 was on the November 4, 2014 ballot in Oklahoma as a legislatively referred constitutional amendment, where it was approved. The measure was designed to allow a qualifying disabled veteran or his or her surviving spouse to sell their homestead, acquire another homestead property in the same calendar year and keep their property tax homestead exemption.[25]

The amendment was sponsored in the Oklahoma Legislature as House Bill No. 2621. The bill placed two measures on the ballot, including this one and State Question 771.[25]

The Oklahoma Homestead Exemption for Surviving Spouse of Military Personnel Amendment, State Question 771 was on the November 4, 2014 ballot in Oklahoma as a legislatively referred constitutional amendment, where it was approved. The measure was designed establish a property tax homestead exemption for the surviving spouses of military personnel who die in the line of duty. The homestead exemption would no longer be available upon the spouse remarrying.[25]

The amendment was sponsored in the Oklahoma Legislature as House Bill No. 2621. The bill placed two measures on the ballot, including this one and State Question 770.[25]

Tennessee

Click here to learn more about tax policy in Tennessee. |

|---|

The Tennessee Income Tax Prohibition, Amendment 3 was on the November 4, 2014 ballot in the state of Tennessee as a legislatively referred constitutional amendment, where it was approved. The measure was designed to prohibit the state legislature from levying, authorizing or permitting any state or local tax upon payroll or earned personal income.[26]

The amendment did not apply to any tax in effect on January 1, 2011. The only income tax in effect on that date was on certain stock dividend and interest income. Therefore, the amendment did not prohibit a personal income tax on certain stock dividend and interest income.[27]

The amendment was sponsored in the Tennessee Legislature by State Senator Brian Kelsey (R-31) and State Representative Glen Casada (R-63) as Senate Joint Resolution 1.[26]

In Tennessee, a legislatively referred constitutional amendment must earn a majority of those voting on the amendment and "a majority of all the citizens of the state voting for governor.”

Virginia

Click here to learn more about tax policy in Virginia. |

|---|

The Virginia Property Tax Exemption for Surviving Spouses of Armed Forces Amendment was on the November 4, 2014 ballot in Virginia as a legislatively referred constitutional amendment, where it was approved. The measure was designed to exempt real property from taxation for any surviving spouse of a member of the United States armed forces who was killed in action, as determined by the Department of Defense. The exemption would not apply to surviving spouses who remarry. Also, the tax exemption would only apply to the surviving spouse's primary place of residence.[28]

The amendment was introduced into the Virginia Legislature by Delegate David Ramadan (R-87) as House Bill 46.

Washington

Click here to learn more about tax policy in Washington. |

|---|

The Washington Elimination of Agricultural Tax Preferences for Marijuana, Advisory Vote No. 8 was on the November 4, 2014 ballot in Washington as an advisory question. The measure asked voters whether the Washington State Legislature should repeal or maintain the elimination of agricultural tax preferences for various aspects of the marijuana industry. This measure came out of Senate Bill 6505.[29]

The Washington Leasehold Excise Tax on Tribal Property, Advisory Vote No. 9 was on the November 4, 2014 ballot in Washington as an advisory question. The measure asked voters whether the Washington State Legislature should repeal or maintain the leasehold excise tax on certain leasehold interests in tribal property. This measure came out of Engrossed Substitute House Bill 1287.[29]

West Virginia

Click here to learn more about tax policy in West Virginia. |

|---|

The West Virginia Nonprofit Youth Organization Tax Exemption, Amendment 1 was on the November 4, 2014 ballot in West Virginia as a legislatively referred constitutional amendment, where it was approved. The measure was designed to provide that properties owned by nonprofit youth organizations that are used for "adventure, educational or recreational activities for young people and others" and that were constructed for a minimum of $100 million are exempt from ad valorem property taxation. The measure was also designed to permit these nonprofit properties to be leased or used to generate revenue and still be exempted from property taxation.[30]

The measure will not become effective until the legislature adopts legislation prescribing requirements, limitations and conditions for the use of the tax exempt facility in order to protect local businesses from “unfair competition and unreasonable loss of revenue.”[30]

The measure's legislatively assigned name was Nonprofit Youth Organization Tax Exemption Support Amendment.[30]

As of November 2014, the Boy Scout's Summit Bechtel Family National Scout Reserve was the only existing entity in West Virginia that would be affected by the amendment's approval.

The amendment was sponsored in the West Virginia Legislature by Speaker of the House Timothy Miley (D-48) as House Joint Resolution 108.[31]

Other 2014 ballot measures

Alaska

Click here to learn more about tax policy in Alaska. |

|---|

The Alaska Oil Tax Cuts Veto Referendum, Ballot Measure 1 was on the August 19, 2014, primary ballot in Alaska as a veto referendum, where it was defeated.

With 100 percent of precincts reporting, the election results were too close to call for approximately a week due to outstanding absentee and early voting ballots, though it appeared the state's voters had opted to reject the measure, with about 52 percent voting "no".[32] It was finally determined that the measure was, indeed, defeated.[33] The referendum sought to repeal Senate Bill 21, also known as the Oil and Gas Production Tax and the More Alaska Production Act (MAPA), which was passed by the Alaska State Legislature and granted tax breaks to oil companies.[34][35]

To land the referendum on the ballot, supporters had to collect at least 30,169 valid signatures by July 13, 2013. They ultimately collected more than 52,000 signatures by the deadline, 45,664 of which were confirmed valid by the state's Division of Elections.[34][36][37][38][39]

Those who supported the referendum and sought to repeal SB 21 believed the tax breaks would only benefit oil companies and not the citizens of Alaska. Those who were against the referendum believed the tax cuts outlined in SB 21 were necessary to incentivize these companies to continue drilling for oil in Alaska. At the time of the election, a majority of Alaska's budget was balanced using revenue from oil taxation.[34] As of July 2014, the opposition campaign had outraised the support campaign by a margin of one hundredfold.[39] Had Ballot Measure 1 been approved and SB 21 repealed, the former oil and gas tax structure, Alaska’s Clear and Equitable Share (ACES), would have been reinstated. The change back to ACES would have taken place 30 days after the approval of Ballot Measure 1.[35] However, the measure was defeated, thereby keeping the MAPA tax structure in place.[33]

The full text of SB 21 can be found here.[40]

Michigan

Click here to learn more about tax policy in Michigan. |

|---|

The Michigan Use Tax and Community Stabilization Share, Proposal 1 was on the August 5, 2014, ballot in Michigan as a legislatively referred state statute, where it was approved.

The measure activated a package of legislatively approved bills that was designed to do the following:[41][42]

- Phase out the Personal Property Tax or PPT on industrial and commercial personal property.

- Levy an Essential Services Assessment millage tax on industrial property that is exempted from the PPT.

- Split the State Use Tax into two taxes, a State Share Tax and a Local Community Stabilization Share Tax.

- Create a Local Community Stabilization Authority to administer the Local Community Stabilization Share Tax.

- Replace the revenue local governments would lose without the PPT with revenue from the Local Community Stabilization Share Tax.

- Replace some of the revenue the state government would lose with revenue from the Essential Services Assessment.

Missouri

Click here to learn more about tax policy in Missouri. |

|---|

The Missouri Temporary Sales Tax Increase for Transportation, Amendment 7 was on the August 5, 2014, primary election ballot in Missouri as a legislatively referred constitutional amendment, where it was defeated.

The measure would have imposed a temporary 0.75 percent increase on the state sales and use tax to fund transportation projects. The duration of the tax would have been no more than 10 years. The measure was sponsored by Rep. Dave Hinson (R-119) and Rep. Dave Schatz (R-61) in the Missouri House of Representatives, where it was known as House Joint Resolution 68. It was also supported by Sen. Mike Kehoe (R-6).[43][44][45][46]

In May 2014, Gov. Jay Nixon (D) chose to place this measure, along with four others, on the August 5 primary election ballot, instead of the November 4 general election ballot.[45] If the measure had been approved by voters, it would have marked the first statewide tax increase since 1993 and the first tax increase for roads since 1992.[47]

Tax policy in the states

To learn more about tax policy in your state, simply select your state from the map below. These pages include information about each state's tax rates, tax revenues, local ballot measures and more.

News items

This section links to a Google news search for the term "Tax + policy"

See also

- Issue pages on local ballot measures

- State and local government budgets, spending and finance on the ballot

- State tax policy pages

- Personal income tax

- Sales tax

- Excise taxes

- Corporate income tax

Footnotes

- ↑ Brunori, D. (2011). State Tax Policy: A Political Perspective. Washington, D.C.: The Urban Institute Press

- ↑ Federation of Tax Administrators, "2013 State Tax Revenue," accessed October 27, 2014

- ↑ Georgia Legislature, "Senate Resolution 415," accessed March 20, 2014

- ↑ 4.0 4.1 Georgia Legislature, "2013-2014 Regular Session - SR 415," accessed February 25, 2014 Cite error: Invalid

<ref>tag; name "gabill" defined multiple times with different content - ↑ Diverse, "Georgia Could Become Biggest Test of Private Dorms," April 6, 2014

- ↑ Illinois General Assembly, "Full Text of HB3816," accessed May 23, 2014

- ↑ Illinois General Assembly, "Bill Status of HB3814," accessed May 23, 2014

- ↑ 8.0 8.1 8.2 8.3 8.4 8.5 Louisiana Legislature, "Senate Bill No. 96," accessed January 16, 2014 Cite error: Invalid

<ref>tag; name "laamendment" defined multiple times with different content Cite error: Invalid<ref>tag; name "laamendment" defined multiple times with different content - ↑ 9.0 9.1 Louisiana Legislature, "House Bill No. 111," accessed April 9, 2014

- ↑ The Lens, "Legislature approves property tax hike for New Orleans police & fire; now heads to voters," May 29, 2014

- ↑ The Times-Picayune, "Louisiana voters to decide on eight constitutional amendments in 2014," June 12, 2013

- ↑ Louisiana Legislature, "House Bill No. 488," accessed June 13, 2014

- ↑ The Times-Picayune, "Louisiana voters to decide on eight constitutional amendments in 2014," June 12, 2013

- ↑ News Telegram, "Referendums could deep-six casinos, gas tax," November 29, 2013

- ↑ Masslive.com, "Massachusetts lawmakers override Gov. Deval Patrick's veto of bill to raise taxes by $500 million," July 24, 2013

- ↑ Tank the Gas Tax, "Signature Collection," June 9, 2014

- ↑ New England Public Radio, "4 Ballot Questions Before Mass. Voters," July 3, 2014

- ↑ 18.0 18.1 18.2 Nevada Secretary of State, "The Education Initiative," accessed May 1, 2014

- ↑ Las Vegas Review Journal, "Nevada AFL-CIO opposes proposed margins tax to fund public schools," May 2, 2014

- ↑ Las Vegas Review-Journal, "Tax plan has miles to go before it's passed," June 8, 2012

- ↑ Las Vegas Review Journal, "Mining tax measure placed on 2014 statewide ballot," May 23, 2013

- ↑ 22.0 22.1 North Dakota Secretary of State, "Initiative Petition," accessed April 24, 2014

- ↑ 23.0 23.1 North Dakota Legislature, "House Concurrent Resolution No. 3006," accessed January 21, 2014

- ↑ Williston Herald, "Measure 2 gains local support, ire toward Legislature," September 16, 2014

- ↑ 25.0 25.1 25.2 25.3 Oklahoma Legislature, "Enrolled House Bill No. 2621," accessed May 29, 2014

- ↑ 26.0 26.1 Tennessee Legislature, "Senate Joint Resolution 1," accessed January 23, 2014

- ↑ The Tennessean, "Amendment 3 would ban income taxes in Tennessee," September 29, 2014

- ↑ Virginia Department of Elections, "Proposed Constitutional Amendment," accessed September 29, 2014

- ↑ 29.0 29.1 Washington Secretary of State, "Word from AG: Two Advisory Votes on 2014 ballot," June 27, 2014

- ↑ 30.0 30.1 30.2 West Virginia Legislature, "House Joint Resolution No. 108," accessed May 1, 2014

- ↑ West Virginia Legislature, "House Joint Resolution 108 Status," accessed February 26, 2014

- ↑ NewsMiner.com, "Repeal of Alaska oil tax trails with most votes counted," August 20, 2014

- ↑ 33.0 33.1 New York Times, "Alaska Referendum Upholds Tax System for Oil Companies," August 27, 2014

- ↑ 34.0 34.1 34.2 Anchorage Daily News, "Critics of oil tax cuts move ahead with referendum to repeal the legislation," April 18, 2013

- ↑ 35.0 35.1 Alaska Dispatch News, "Revenue forecasts: 'Facts' used in oil tax debate may not be," August 4, 2014

- ↑ Alaska Dispatch, "Deadline looming, Alaska oil tax repeal petition gains momentum," June 11, 2013

- ↑ Alaska Public Media, "Repeal Group Exceeds 45,000 Signatures For Referendum," July 12, 2013

- ↑ Alaska Dispatch, "Oil-tax repeal backers claim 51,000 Alaska signatures, far more than needed," July 13, 2013

- ↑ 39.0 39.1 Anchorage Daily News, "Oil companies are spending millions to stop repeal of Alaska tax cuts," February 9, 2014

- ↑ The Alaska State Legislature, "28th Legislature(2013-2014): Bill Text 28th Legislature, Senate Bill 21," accessed March 27, 2014

- ↑ Senate Fiscal Agency, "Ballot Proposal 14-1," accessed July 28, 2014

- ↑ Citizens Research Council of Michigan, "Statewide Ballot Issues: Proposal 2014-1," accessed July 15, 2014

- ↑ Missouri State Legislature, "SENATE SUBSTITUTE FOR HOUSE JOINT RESOLUTION NO. 68 JOINT RESOLUTION," accessed May 14, 2014

- ↑ Open States, "Missouri 2014 Regular Session: HJR 68 Proposes a constitutional amendment imposing a 1% temporary increase in the state sales and use tax to be used for transportation projects," accessed May 14, 2014

- ↑ 45.0 45.1 MissouriNet, "Senate sponsor OK with transportation tax on August ballot," May 26, 2014

- ↑ St. Louis Post-Dispatch, "McCaskill backs Missouri transportation sales tax," May 21, 2014 (dead link)

- ↑ Columbia Daily Tribune, "Transportation sales tax to go on Missouri ballot," May 15, 2014