Help us improve in just 2 minutes—share your thoughts in our reader survey.

Washington Initiative 1366, Sales Tax Decrease or Two-Thirds Vote for Tax Increase Measure (2015)

| Initiative 1366 | |

|---|---|

| |

| Type | Initiative |

| Origin | Citizens |

| Topic | Taxes |

| Status | Approved |

| Washington 2015 ballot |

|---|

| Initiative 1366 - Sales taxes |

| Initiative 1401 - Animals |

| Advisory 10 - Spill taxes |

| Advisory 11 - Marijuana |

| Advisory 12 - Gas taxes |

| Advisory 13 - Business taxes |

| All 2015 U.S. measures |

|---|

Washington Initiative 1366, the Sales Tax Decrease or Two-Thirds Vote for Tax Increase Measure, was on the ballot in Washington as an Initiative to the People on November 3, 2015. Voters approved the ballot measure. On May 26, 2016, the Washington Supreme Court overturned the ballot measure in Huff v. Wyman.

| Voting yes would have lowered state sales taxes from 6.5 to 5.5 percent if the legislature declines to change how tax increases are approved. |

| Voting no would have left current laws unchanged. The state's sales tax would remain at 6.5 percent. |

Aftermath

Lawsuit

Shortly after its passage in November 2015, opponents challenged the initiative, arguing the measure violated the state law that bans initiatives from pertaining to more than one subject. Plaintiffs, who included the League of Women Voters of Washington and two Democratic lawmakers, claimed the measure addressed two subjects, a state sales tax cut and a constitutional amendment, and illegally amended the state constitution, which ballot initiatives are not permitted to do.[1]

Attorney Paul Lawrence called the measure "an improper end-run around the constitution that would have serious negative consequences if upheld, not only because of the fiscal havoc it will cause, but more significantly for the damage it would do to the proper functioning of government here in Washington." Deputy Solicitor General Callie Castillo argued, "Simply because Plaintiffs disagree with the policy choice that the voters made—to reduce the state sales tax rate unless a contingency occurs—that does not make I-1366 unconstitutional or an illegitimate exercise of the people's initiative power."[1]

King County Court Judge William Downing struck the measure down on January 21, 2016. The court found that it was a disguised effort to propose a constitutional amendment, which cannot be imposed via initiative. Downing wrote, "It is solely the province of the legislative branch of our representative government to ‘propose’ an amendment to the state constitution. That process is derailed by the pressure-wielding mechanism in this initiative which exceeds the scope of initiative power." Tim Eyman, the initiative's author and lead proponent in 2015, responded, "We obviously disagree with the judge and his decision. but it does not change what the voters decided and I would certainly encourage this Legislature to move forward with it as it goes upward to the Supreme Court.”[1][2]

On May 26, 2016, the Washington Supreme Court unanimously ruled that the measure was unconstitutional. To read more, click here.[3]

Election results

| Washington Initiative 1366 | ||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| Yes | 760,518 | 51.52% | ||

| No | 715,684 | 48.48% | ||

Introduction

The initiative put the Legislature in a position where it must make a decision: either let the tax decrease take effect or stop it by referring an amendment to the ballot.

The Legislature can stop the sales tax decrease from taking effect on April 15, 2016, by referring an amendment to the ballot that asks voters whether it should take a two-thirds vote in the Legislature or voter approval to raise taxes.[4]

If the sales tax decrease does take effect, the state will lose about $1 billion in tax revenue. If the Legislature refers an amendment to the ballot and voters approve it, raising taxes will be a more difficult process.

The reason Initiative 1366 aimed to do this is because the Washington State Constitution only required the legislature to pass any piece of legislation, tax-related or other, by a simple majority vote, and Washington citizens do not have the power to initiate constitutional amendments.[5]

Text of measure

Ballot title

The official ballot title was:[6]

| “ | Initiative Measure No. 1366 concerns state taxes and fees.

This measure would decrease the sales tax rate unless the legislature refers to voters a constitutional amendment requiring two-thirds legislative approval or voter approval to raise taxes, and legislative approval for fee increases. Should this measure be enacted into law? Yes [ ] No [ ][7] |

” |

Ballot summary

The ballot summary was:[6]

| “ | This measure would decrease the state retail sales tax rate on April 15, 2016, from 6.5 percent to 5.5 percent. The sales tax rate would not be decreased if, by April 15, 2016, two-thirds of both legislative houses refer to the ballot a vote on a constitutional amendment that requires two-thirds legislative approval or voter approval to raise taxes, and majority legislative approval to set the amount of a fee increase.[7] | ” |

Fiscal notes

A fiscal impact statement for Initiative 1366 was issued by the Washington Office of Financial Management. The fiscal impact statement read:[8]

| Fiscal Impact Statement for Initiative 1366 | |||||

|---|---|---|---|---|---|

| Summary If the Legislature does not refer a constitutional amendment to voters for consideration at the November 2016 general election, over the next six fiscal years, sales tax revenue for the state General Fund would decrease $8 billion. Sales tax revenue for the state Performance Audit Account would decrease $12.8 million. State business and occupation (B&O) tax revenue would increase $39.9 million. Local tax revenue would increase $226.1 million. State expenditures would be $598,000. If an amendment is referred to voters, fiscal year 2017 state election expenditures would increase $101,000. There would be an unknown increase in local government election expenditures. General Assumptions

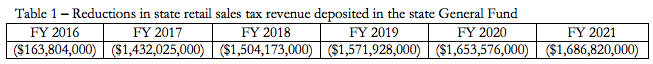

Analysis Scenario 1 – The Legislature does not refer a constitutional amendment to voters prior to April 15, 2016. On April 15, 2016, the state retail sales tax rate would decrease from 6.5 percent to 5.5 percent. State and Local Government Revenue Assumptions State Revenue Table 1 provides estimates of the retail sales tax reductions over the next six fiscal years to the state General Fund. State revenues deposited in the state General Fund may be used for any government purpose such as education; social, health and environmental services; and other general government activities.

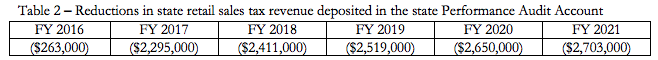

Table 2 provides estimates of the retail sales tax reductions over the next six fiscal years to the state Performance Audit Account. State revenues deposited in the state Performance Audit Account are used by the Washington State Auditor to conduct comprehensive performance audits required under RCW 43.09.470.

Table 3 provides estimates of the increases in state B&O taxes deposited in the state General Fund over the next six fiscal years. The state B&O tax is a gross receipts tax. It is measured on the value of products, gross proceeds of sales or gross income of the business. Due to price elasticity, state B&O tax revenue could increase with the change in the state retail sales tax rate.

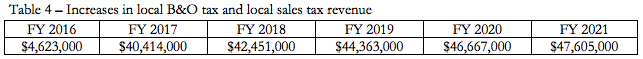

Local Government Revenue State Expenditure Assumptions

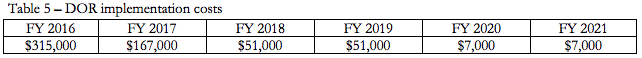

State Expenditures The timing of the rate change and the number of businesses affected by the rate change contribute to DOR’s costs. A change in the state retail sales tax rate would affect about 200,000 businesses that file monthly, quarterly or annual tax returns. These businesses collect retail sales tax from customers and then pass the sales tax revenue to the state when filing a return. A rate change that occurs on April 15, 2016, would be reflected on tax returns due May 25, 2016. These tax returns should reflect a sales tax rate of 6.5 percent for transactions that occur April 1 to April 14, 2016. Transactions that occur April 15, 2016, or later should reflect a sales tax rate of 5.5 percent. Based on experience, returns filed immediately after a rate change have more errors than other returns. It is assumed that a high number of tax returns submitted in May 2016 will contain errors. DOR staff must manually process and resolve each return that is in error, is out-of-balance or amends a previous return. In addition to increased labor costs for processing a higher number of incorrect returns, DOR would experience other expenditures, as follows. Fiscal year 2016:

Fiscal years 2016 through 2021:

State and Local Government Expenditure Assumptions

State Expenditures Voters’ Pamphlet costs are based on the number of pamphlets printed, the number of pages in each regional edition of the pamphlet, layout and composition work, distribution, postage, translating the pamphlet into minority languages as required by federal law and producing the pamphlet in accessible formats for voters with disabilities. The content required by Chapter 29A.32 RCW also contributes to the expense. For constitutional amendments, the Secretary is required to include the text of the amendment, pro and con arguments, the legal identification of the amendment, the official ballot title, an explanatory statement prepared by the Attorney General and the total number of votes cast for and against the amendment in the Legislature. Based on historical Voters’ Pamphlet expenses, the estimated cost of the 2016 Voters’ Pamphlet is $12,625 per page. Due to constraints in the printing process and the minimum contents required by state and federal law, the Secretary generally assumes each amendment or measure will use eight pages in the pamphlet. If the amendment described in this initiative uses eight pages, it would add $101,000 to the total cost of the pamphlet. Local Government Expenditures The 39 counties in Washington incur costs for conducting elections, including printing ballots and ballot materials, distributing blank ballots, and canvassing and tabulating voted ballots. A jurisdiction with candidates or measures on the ballot reimburses counties for its prorated share of election costs. However, as provided for in RCW 29A.04.420, the state reimburses counties only for its share of election costs when federal and state races or state measures and constitutional amendments appear on the ballot in an odd-numbered year.[7] | |||||

Background

Initiative 1053

In 2010, Washington voters approved Initiative 1053. This Tim Eyman-backed initiative required a two-thirds vote in the legislature or voter approval to increase taxes. On February 28, 2013, the Washington Supreme Court ruled Initiative 1053 unconstitutional on the basis that the Washington State Constitution requires a majority vote on legislation, not a two-thirds vote.[9] The state constitution would need to be amended in order to require tax increase legislation be approved by a two-thirds majority. However, Washingtonians do not have the power to initiate constitutional amendments. Initiative 1053 changed a statute, not the constitution. Therefore, the legislature would need to amend the constitution and refer the issue to the ballot, which was viewed as not likely to happen.[10]

Initiative 1366 aimed to circumvent citizens' lack of power to initiate constitutional amendments. Eyman's 2015 initiative put the state legislature in a bind, forcing them to either put his two-thirds requirement amendment on the ballot or allow the sales tax to decrease from 6.5 to 5.5 percent.

Sales tax

As of July 1, 2015, Washington state has a sales tax rate of 6.5 percent. Initiative 1366 will decrease the tax to 5.5 percent, unless the legislature refers a two-thirds requirement to increase taxes amendment. Eight states have sales tax rates higher than Washington's. Two other states have a 6.5 percent sales tax. The average state sales tax rate is 5.05 percent. Washington's sales tax is 1.45 percentage points higher than the average.

The following sales tax rates are accurate as of July 1, 2015, according to the Sales Tax Institute.[11]

| State | 2015 sales tax | State | 2015 sales tax | State | 2015 sales tax |

|---|---|---|---|---|---|

| Alabama | 4.00% | Louisiana | 4.00% | Ohio | 5.75% |

| Alaska | 0.00% | Maine | 5.50% | Oklahoma | 4.50% |

| Arizona | 5.60% | Maryland | 6.00% | Oregon | 0.00% |

| Arkansas | 6.50% | Massachusetts | 6.25% | Pennsylvania | 6.00% |

| California | 7.50% | Michigan | 6.00% | Rhode Island | 7.00% |

| Colorado | 2.90% | Minnesota | 6.875% | South Carolina | 6.00% |

| Connecticut | 6.35% | Mississippi | 7.00% | South Dakota | 4.00% |

| Delaware | 0.00% | Missouri | 4.225% | Tennessee | 7.00% |

| Florida | 6.00% | Montana | 0.00% | Texas | 6.25% |

| Georgia | 4.00% | Nebraska | 5.50% | Utah | 4.70% |

| Hawaii | 4.00% | Nevada | 6.85% | Vermont | 6.00% |

| Idaho | 6.00% | New Hampshire | 0.00% | Virginia | 4.30% |

| Illinois | 6.25% | New Jersey | 7.00% | Washington | 6.50% |

| Indiana | 7.00% | New Mexico | 5.125% | West Virginia | 6.00% |

| Iowa | 6.00% | New York | 4.00% | Wisconsin | 5.00% |

| Kansas | 6.50% | North Carolina | 4.75% | Wyoming | 4.00% |

| Kentucky | 6.00% | North Dakota | 5.00% | Washington, D.C. | 5.75% |

Revenue from the state sales tax accounted for 47.2 percent of all revenue, or about $15.6 billion, in the state general fund during the 2013-15 budget period. It also accounted for 43.94 percent of all revenue received from state taxes and 19.05 percent of all revenue in total.[12]

The sales tax is Washington's largest source of revenue.[13]

Support

The campaign in support of the initiative was led by Voters Want More Choices.[14] The petition drive for the initiative was sponsored by Tim Eyman and M.J. Fagan.[6] Eyman took out a $150,000 mortgage on his home to help jumpstart the campaign.[15]

Supporters

Officials

- Sen. Michael Baumgartner (R-6)[16]

- Sen. Doug Ericksen (R-42)

Organizations

- Washington Republican Party[16]

- Jefferson County Republican Party

- Citizens Committee for the Right to Keep and Bear Arms[17]

Arguments in favor

State Senators Michael Baumgartner (R-6) and Doug Ericksen (R-42) wrote an e-mail encouraging Republicans to support Initiative 1366. The senators argued:[16]

| “ | As members of the state senate we believe that a 2/3 requirement for tax increases or to create new taxes will accomplish many positive things for the people of Washington.

First, let us be clear, the ability of the government to take the hard earned dollars from the people of Washington should be treated differently from other types of legislation. The power of the state to take these dollars has a huge impact on our families and our communities. The more the government takes, the less families have to spend on what they consider to be priorities. The only way to control the size and growth of government is to make it more difficult to raise taxes. Each year in Olympia taxes are raised and government is not reformed. A 2/3 requirement will force your legislators to do the following:

All of us understand the need for the government to collect taxes as part of civilized society. This initiative does not eliminate taxes, but simply makes it harder to raise taxes.[7] |

” |

We Believe-We Vote, a coalition of Christian citizens and community leaders who aim to give informed voter information to the faith-based community, said:[18]

| “ |

1. Voters have approved initiatives requiring a 2/3 vote to raise taxes 5 times before, over the last 20 years. History shows us that without this common sense tax payer protection, the legislature does the easy thing and raises taxes. This year’s Legislature, without the two-thirds requirement in effect, increased taxes a whopping $17.5 billion. 2. If I-1366 becomes a constitutional amendment, Olympia will be encouraged to reform government, prioritize spending and re-evaluate existing programs before raising taxes – just as it should be. 3. If Olympia decides to decrease the sales tax rate instead, the consumer will benefit. Additionally, the cities and state will reap huge increases in local B&O tax and local sales tax revenue, according to the Office of Financial Management prediction based on increases in consumer spending due to a lower sales tax.[7] |

” |

Doug Ericksen wrote in an opinion column to The Bellingham Herald:[19]

| “ | You work hard for your money and I believe it should be harder for the government to take it. As much as candidates promise not to raise your taxes, taxes are increased almost every year. The 2/3-for-taxes constitutional amendment will protect the taxpayers by helping those politicians keep their promises by making tax increases the last resort and not the first choice.

Let’s face it: reforming government is hard but politicians taking your money and giving it to others is easy. The 2/3s amendment will force legislators to work together, prioritize spending and make government more efficient — all the things they say they want to do. The opponents of I-1366 claim that making it tougher to raise taxes only benefits billionaires and big companies. As taxpaying members of the middle class, you and I are smart enough to know that’s not true: making it tougher to raise taxes benefits all of us. Tax-hiking politicians claim they only want to raise taxes on the rich, but when the votes are taken, powerful lobbyists protect their clients and you and I are the ones who get stuck paying the bill.[7] |

” |

Opposition

The campaign against the initiative was led by The NO on I-1366 Coalition.[20] The campaign organization had five officers: Northwest Progressive Institute founder Andrew Villeneuve, former Secretary of State Sam Reed (R), former Sen. Randy Gordon (D-41), former Rep. Phyllis Gutiérrez Kenney (D-46b) and NW Media Allies owner Sue Evans.[21] Opponents have likened the initiative to "blackmail" and a "hostage-taking scheme."[22][23]

Opponents

Organizations

- Washington State PTA[24]

- AARP Washington State

- Alzheimers Association

- Association of Manufactured Homeowners

- Catholic Community Services of Washington

- Children’s Alliance

- Community Health Network of Washington

- Economic Opportunity Institute

- Faith Action Network

- Group Health Cooperative Senior Caucus

- Hearing Loss Association of Washington

- League of Women Voters of Washington

- Mainstream Republicans of Washington State

- Washington State Democratic Party

- OneAmerica Votes

- Planned Parenthood of the Northwest

- Puget Sound Advocates for Retirement Action

- Association of Washington School Principals

- Fuse Washington

- Healthy Washington Coalition

- League of Education Voters

- National Council of Jewish Women

- NAMI Washington

- Northwest Progressive Institute

- Statewide Poverty Action Network

- Retired Public Employees of Washington

- Seattle Metropolitan Chamber of Commerce

- TaxSanity

- Transition 2030

- Washington Community Action Network

- Washington Conservation Voters

- Washington Environmental Council

- Washington Low Income Housing Alliance

- Washington Roundtable

- Washington State Progressive Caucus

- Washington State School Directors’ Association

- Chelan County Democrats

- Douglas County Democrats

- Franklin County Democrats

- King County Democrats

- Kitsap County Democrats

- Island County Democrats

- Mason County Democrats

- Metropolitan Democratic Club

- Pierce County Democrats

- Snohomish County Democrats

- San Juan County Democrats

- Thurston County Democrats

- Whatcom County Democrats

- 5th District Democrats

- 7th District Democrats

- 8th District Democrats

- 23rd District Democrats

- 31st District Democrats

- 32nd District Democrats

- 41st District Democrats

- 44th District Democrats

- 45th District Democrats

- 46th District Democrats

- 47th District Democrats

- 48th District Democrats

- 30th District Democrats

- 36th District Democrats

- 37th District Democrats

Officials

- Dan Evans, former governor

- Sam Reed, former secretary of state

- Ralph Munro, former secretary of state

- King County Executive Dow Constantine

- King County Assessor Lloyd Hara

- King County Councilmember Joe McDermott

- Louise Miller, former King County councilmember

- Sen. Andy Billig (D-3)

- Sen. David Frockt (D-46)

- Sen. Steve Hobbs (D-44)

- Sen. Sharon Nelson (D-34)

- Sen. Pramila Jayapal (D-37)

- Adam Kline, former Senator (D-37)

- State Rep. Reuven Carlyle (D-36a)

- State Rep. Zack Hudgins (D-11a)

- State Rep. Chris Reykdal (D-22a)

- State Rep. Marcus Riccelli (D-3a)

- State Rep. Gael Tarleton (D-36b)

- State Rep. Roger Goodman (D-45a)

- Eugene V. Lux, former state representative

- Marcie Maxwell, former state representative (D-41a)

- Seattle City Councilmember Sally Bagshaw

- Bellevue Mayor Claudia Balducci

- SeaTac City Councilmember Kathryn Campbell

- Kirkland City Councilmember Dave Asher

- Kirkland City Councilmember Shelley Kloba

- Kirkland City Councilmember Jay Arnold

- Sherril Huff, director of King County's Department of Elections [25]

Arguments against

The NO on I-1366 Coalition argued on its website:[24]

| “ | Because Tim Eyman does not have the votes in the Washington State Legislature to advance a constitutional amendment to permanently overturn the LEV decision and reinstate the undemocratic two-thirds requirement for revenue, he is resorting to blackmail with I-1366. By attaching a time bomb to the sales tax, Eyman is hoping to coerce representatives and senators who believe in majority rule to abandon their beliefs and approve a constitutional amendment to sabotage Article II, Section 22.

Either outcome of I-1366 would be disastrous for Washington State. ... Adoption of a constitutional amendment requiring a two-thirds vote to raise or recover revenue would fundamentally upset the balance that our founders tried to strike between majority rule and minority rights. It is important to understand that whenever a two-thirds vote of a body is required to do something, one-third has control over the outcome. To put it another way: a supermajority vote requirement results in a submajority being in charge.[7] |

” |

Joel Connelly wrote in a Seattlepi.com blog:[26]

| “ | The immediate impact would be to deprive the state of $1.4 billion in revenue, at a time when the Legislature is under court order to fully fund K-12 education and trying to provide vital support to preschool.

Over six years, I-1366 could blow an $8 billion hole in the state budget, into which would fall vital services and improvements in a vital, growing state. It would put an end to post-recession recovery of such agencies as Washington State Parks. What if the constitutional amendment were forced on the ballot, and were to pass? It would lock in place America’s most regressive state tax system. Our sales tax-dependent state takes a much higher percentage of income from middle-class and low-income residents than it does from the rich. Even a modest change to that tax system — say, a small capital gains tax on the very wealthy — could be blocked by as few as 17 state Senators, in a Legislature with 147 members. The minority tyranny would be comparable to the 1940s and 1950s filibuster era in Congress, when a band of Southern senators were able to block all civil rights legislation — even legislation against lynching — for half-a-century.[7] |

” |

Paul Benz, co-director of the Faith Action Network, said of Tim Eyman:[27]

| “ | He’s trying to put the budgeting process in the hands of a few ideological legislators, or force $8 billion in cuts over the next six years, and we cannot accept that. ... These cuts will be devastating to the state’s most valuable citizens, the young and the homeless. We can’t allow Tim Eyman and his wealthy friends to turn back the progress we’ve made. That’s why we are here asking Washington voters to reject this false choice. ... We can’t allow a handful of ideological legislators to dictate the agenda for all of our state. If Eyman gets his way, 17 of the 147 legislators will control the fate of so many. That is not our Washington way. We don’t allow the few to control the many.[7] | ” |

Campaign finance

2/3-For-Taxes Constitutional Amendment Initiative - VWMC sponsored the initiative. The campaign reported $1.7 million in contributions.[28]

Vote No on 1366 and No on Tim Eyman's I-1366 registered to oppose the initiative. Together, the committees reported $158,973.73 in contributions.[28]

| Cash Contributions | In-Kind Contributions | Total Contributions | Cash Expenditures | Total Expenditures | |

|---|---|---|---|---|---|

| Support | $152,473,929.64 | $1,313,103.25 | $153,787,032.89 | $152,296,464.08 | $153,609,567.33 |

| Oppose | $33,610,003.43 | $80.63 | $33,610,084.06 | $31,382,394.77 | $31,382,475.40 |

| Total | $186,083,933.07 | $1,313,183.88 | $187,397,116.95 | $183,678,858.85 | $184,992,042.73 |

Support

The following table includes contribution and expenditure totals for the committee in support of the initiative.[28]

| Committees in support of Initiative 1366 | |||||

|---|---|---|---|---|---|

| Committee | Cash Contributions | In-Kind Contributions | Total Contributions | Cash Expenditures | Total Expenditures |

| 2/3-For-Taxes Constitutional Amendment Initiative - VWMC | $1,704,639.45 | $1,536,997.59 | $3,241,637.04 | $0.00 | $1,536,997.59 |

| Total | $1,704,639.45 | $1,536,997.59 | $3,241,637.04 | $0.00 | $1,536,997.59 |

Donors

The following table shows the top donors to the support committee:[28]

| Donor | Cash Contributions | In-Kind Contributions | Total Contributions |

|---|---|---|---|

| Association of Washington Business | $1,126,000.00 | $0.00 | $1,126,000.00 |

| Kemper Holdings | $1,093,000.00 | $0.00 | $1,093,000.00 |

| Beer Institute | $800,000.00 | $0.00 | $800,000.00 |

| Clyde P Holland, Jr | $540,000.00 | $0.00 | $540,000.00 |

| Phyllis & Michael Dunmire | $530,000.00 | $0.00 | $530,000.00 |

Opposition

The following table includes contribution and expenditure totals for the committees in opposition to the initiative.[28]

| Committees in opposition to Initiative 1366 | |||||

|---|---|---|---|---|---|

| Committee | Cash Contributions | In-Kind Contributions | Total Contributions | Cash Expenditures | Total Expenditures |

| Vote No on 1366 | $145,270.00 | $7,253.73 | $152,523.73 | $152,392.73 | $159,646.46 |

| No on Tim Eyman's 1366 | $3,255.00 | $3,195.00 | $6,450.00 | $3,255.00 | $6,450.00 |

| Total | $148,525.00 | $10,448.73 | $158,973.73 | $155,647.73 | $166,096.46 |

Donors

The top donors to the opposition committees are as follows:[28]

| Donor | Cash Contributions | In-Kind Contributions | Total Contributions |

|---|---|---|---|

| SEIU Washington State Council | $40,000.00 | $0.00 | $40,000.00 |

| Washington Education Association | $30,758.00 | $0.00 | $30,758.00 |

| Washington Federation of State Employees Council 28 | $25,000.00 | $0.00 | $25,000.00 |

| Washington State Hospital association | $15,000.00 | $0.00 | $15,000.00 |

| No on Tim Eyman's 1366 | $10,500.00 | $0.00 | $10,500.00 |

Methodology

To read Ballotpedia's methodology for covering ballot measure campaign finance information, click here.

Media editorials

Support

Ballotpedia did not find media editorials supporting the measure. If you are aware of an editorial, please email it to editor@ballotpedia.org.

Oppose

The News Tribune editorial board wrote:[29]

| “ | Citizens who think I-1366 is needed to rein in a runaway Legislature should consider the actual track record of Washington’s lawmakers.

They’ve been extremely reluctant to enact general revenue increases, though they have cut specific tax preferences — by extending the sales tax to candy and beverages, for example. During the Great Recession and its aftermath, the Legislature chose to cannibalize higher education, mental health care and other social services rather than backfill with taxes. Yes, there are some liberal Democrats who’ve long wanted a income tax, but they’ve lost that battle year after year. Tax opponents have been doing pretty well in Olympia, with the exception of transportation packages that clearly benefit the state as a whole. But public benefits mean little to people who oppose any new tax, any time, for any purpose. And the whole purpose of I-1366 is to empower them. A supermajority requirement makes sense for something as fundamental and permanent as a constitutional amendment. It doesn’t for the regular business of the Legislature. State operating budgets shouldn’t be hostage to tax cranks who could effectively wield twice the voting power of other lawmakers. I-1366 is all about giving the minority an unfair share of legislative influence. The majority of voters ought to reject it.[7] |

” |

The Columbian editorial stated:[30]

| “ | While voters are likely to take a jaundiced view of assertions that the state needs more money, Initiative 1366 would make it nearly impossible for government to effectively address the needs of the people. Combining the reduction in state revenue and the court-ordered increase to education funding would require more than $11 billion in cuts to other programs, damaging the state’s ability to provide social programs, public health programs and other services. It also would place the Legislature in a position where it can be held hostage by a minority of lawmakers. As Sam Reed, a former Republican Secretary of State, said: “This measure would empower those hard-core ideologues on each side, either the right wing or the left wing, because all they’ve got to do is get a third to block something.”

Those are the ideological reasons for opposing I-1366. The practical ones are equally compelling, as it is possible that the measure would not pass judicial scrutiny. Eyman, who is under investigation for allegedly misusing campaign funds related to previous measures, acknowledges that I-1366 might not pass constitutional muster but says that it still would send a message to lawmakers. Unfortunately, I-1366 is not the way to deliver that message.[7] |

” |

The Seattle Times editorial board argued:[31]

| “ | The public deserves better performance and more fiscally responsible public servants.

But the way to get there is not with threats, bludgeons and a ticking time bomb, which is basically what Initiative 1366 would deliver to the Legislature. Voters should reject I-1366 and find better ways to hold lawmakers accountable, such as voting underperformers out of office. If voters look beyond the measure’s sound bites and sloganeering, they’ll find a toxic, complex proposal that would make the Legislature even more dysfunctional. This is the most cynical ploy yet by professional initiative-backer Tim Eyman to manipulate Washington’s government.[7] |

” |

The Yakima Herald-Republic editorial board said:[32]

| “ | We have supported Eyman two-thirds initiatives in the past, when Democratic-dominated legislatures seemed intent on raising taxes as a first resort. The Legislature has gotten the message in recent years, at least on raising general taxes; the recently approved gas-tax increase is designated to transportation needs. But philosophy aside, this initiative carries several problems in its prospective implementation.

The measure would cut the state’s sales tax rate by one cent unless the Legislature refers to voters a constitutional amendment requiring two-thirds legislative approval or voter approval to raise taxes and legislative approval for fee increases. At best, this constitutional arm-twisting; critics call it extortion. If approved, it certainly will be challenged in court on constitutional grounds. The amendment, which would impose a supermajority vote on the Legislature, could be tossed by a simple majority of voters. If the Legislature doesn’t put it on the ballot, it would cut $8 billion from the state budget over the next six years, at a time when the state is being held in contempt of court over school funding. If that money is taken away, pressure would grow for the state to replace it through other means, as in a carbon tax or an income tax. The resulting judicial and legislative uncertainty would prove disruptive to school districts, state agencies and businesses, all of whom would be thrown off in their budgeting.[7] |

” |

The Tri-City Herald argued:[33]

| “ | Usually, the legality of an initiative is determined after it has been approved by voters. Using the courts to forbid a proposal before it makes the ballot could start a frightening trend that would discourage future citizen efforts to change state laws. Even the most ill-conceived measures deserve debate.

Initiatives cause anxiety for state officials because they are typically not the best way to make law. There is no compromising, no hashing out of details and no thought to how to implement changes — especially if they are financial — once the initiative is approved. I-1366 is a mix of troubling issues. Eyman and his supporters are manipulating the initiative process to get their way, and that leaves a bad taste. Even so, we believe they have the right to pursue the effort and put the measure on the ballot. We just hope voters don’t swallow what they’re offering.[7] |

” |

Polls

The Elway Poll below was conducted in October 2015 after Washington voters had began mailing in votes for the November 3 election. The poll shows a decrease in support from the July 2015 poll.

| Washington Initiative 1366 Poll (October 2015) | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Poll | Support | Oppose | Undecided | Margin of error | Sample size | ||||||||||||||

| Elway Poll 10/13/2015 - 10/15/2015 | 42% | 42% | 16% | +/-4.5 | 500 | ||||||||||||||

| Note: The polls above may not reflect all polls that have been conducted in this race. Those displayed are a random sampling chosen by Ballotpedia staff. If you would like to nominate another poll for inclusion in the table, send an email to editor@ballotpedia.org. | |||||||||||||||||||

The following Elway Poll released in July 2015 surveyed 502 voters about the initiative.[34]

| Washington Initiative 1366 Poll (July 2015) | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Poll | Support | Oppose | Undecided | Sample size | |||||||||||||||

| Elway Poll | 49% | 36% | 15% | 502 | |||||||||||||||

| Note: The polls above may not reflect all polls that have been conducted in this race. Those displayed are a random sampling chosen by Ballotpedia staff. If you would like to nominate another poll for inclusion in the table, send an email to editor@ballotpedia.org. | |||||||||||||||||||

Lawsuits

- See also: List of ballot measure lawsuits in 2015

Huff v. Wyman

Litigation was filed against Initiative 1366 on July 30, 2015.[13] Plaintiffs, including Sen. David Frockt (D-46), Rep. Reuven Carlyle (D-36a) and Thurston County Auditor Mary Hall (D), contend, “The people acting through the initiative have no power directly or by force of threat to invoke the constitutional amendment process.”[35] According to Mary Hall, "This [initiative] is a misuse of our democratic process. Initiatives were never intended to play a role in amending the state constitution. I-1366 is manipulating the intent of the initiative process. Allowing this to get on the ballot could set a dangerous precedent."[13]

Tim Eyman, a key sponsor of Initiative 1366, deemed opponents' litigation as an "end democracy" strategy. He continued, "ultimately, opponents’ lawsuit has less to do with I-1366 than it does the right of the people to discuss, debate, and vote on the issues contained in it. Opponents want to prevent that conversation."[36]

Secretary of State Kim Wyman (R) asked the court to allow a vote on Initiative 1366. She claimed, "The subject matter of I-1366 is not outside the scope of the people’s initiative power."[37]

A hearing for the case was heard by the King County Superior Court on August 14, 2015.[38] Judge Dean Lum ruled in favor of keeping Initiative 1366 on the ballot. He stated:

| “ | Although I-1366 appears to exceed the scope of the initiative power, our Supreme Court has not clearly and squarely ruled on whether the First Amendment to the United States Constitution and/or Article 1 Section 5 of the Washington State Constitution provide additional protections against pre-election challenges even in circumstances where the initiative may itself be invalid. The Supreme Court may clarify this issue prior to the election, but this trial court cannot. ... Our Supreme Court has invalidated these sponsor's prior initiatives on multiple occasions ... but only after the election had occurred. Here, although the ultimate decision is obviously the Supreme Court's, there is a substantial possibility that I -1366 will be found to be invalid for exceeding the scope of the initiative process, and that voters will be voting on a measure which will never go in to effect.[7] | ” |

| —Judge Dean Lum[39] | ||

Petitioners appealed Huff v. Wyman to the Washington Supreme Court on August 14.[39]

On May 26, 2016, the Washington Supreme Court unanimously ruled that the measure was unconstitutional. Chief Justice Barbara Madsen wrote that Initiative 1366 "is the kind of logrolling of unrelated measures” that is prohibited by the Washington Constitution. Initiatives in Washington are limited to state statutes, meaning any constitutional amendments must be referred to voters by the state legislature. Madsen wrote, "This argument fails to appreciate the ‘do this or else’ structure of the initiative. The new norm would be for initiative sponsors to pair one drastic or undesirable measure with an ultimatum that it go into effect unless a specific constitutional amendment is proposed to the people." Justice Steven Gonzalez wrote, "Initiatives are not the proper vehicle to amend the constitution."[40]

Path to the ballot

Supporters were required to collect at least 246,372 valid signatures by July 2, 2015, in order to land the initiative on the ballot. Petitioners submitted approximately 334,044 signatures by the deadline.[41] Tim Eyman said he "[a]bsolutely guarantees that the 2/3-For-Taxes Constitutional Amendment Initiative will be on this November's ballot."[42]

Initiative 1366 was certified for the ballot on July 29, 2015.[23]

Eyman encountered legal trouble in September 2015 after the state's Public Disclosure Commission determined he moved thousands between initiative campaigns and kept about $170,000 for himself. The commission asked Attorney General Bob Ferguson to pursue civil and criminal violations.[43]

The legal issues interfered with scheduling a televised initiative debate with opponent Aaron Ostrom, executive director of FUSE Washington. Eyman told local news sources he was finding someone to lead the debate's support in his place, but FUSE argued Eyman had agreed to a debate and backed out two times. As of September 25, 2015, Eyman said state Sen. Pam Roach is the front runner to represent the initiative's support side in a future debate all parties are still working to schedule.[44]

As of October 11, 2015, the attorney general's office had not stated when it will complete the investigation.[45]

State profile

| Demographic data for Washington | ||

|---|---|---|

| Washington | U.S. | |

| Total population: | 7,160,290 | 316,515,021 |

| Land area (sq mi): | 66,456 | 3,531,905 |

| Race and ethnicity** | ||

| White: | 77.8% | 73.6% |

| Black/African American: | 3.6% | 12.6% |

| Asian: | 7.7% | 5.1% |

| Native American: | 1.3% | 0.8% |

| Pacific Islander: | 0.6% | 0.2% |

| Two or more: | 5.2% | 3% |

| Hispanic/Latino: | 12% | 17.1% |

| Education | ||

| High school graduation rate: | 90.4% | 86.7% |

| College graduation rate: | 32.9% | 29.8% |

| Income | ||

| Median household income: | $61,062 | $53,889 |

| Persons below poverty level: | 14.4% | 11.3% |

| Source: U.S. Census Bureau, "American Community Survey" (5-year estimates 2010-2015) Click here for more information on the 2020 census and here for more on its impact on the redistricting process in Washington. **Note: Percentages for race and ethnicity may add up to more than 100 percent because respondents may report more than one race and the Hispanic/Latino ethnicity may be selected in conjunction with any race. Read more about race and ethnicity in the census here. | ||

Presidential voting pattern

- See also: Presidential voting trends in Washington

Washington voted for the Democratic candidate in all seven presidential elections between 2000 and 2024.

Pivot Counties (2016)

Ballotpedia identified 206 counties that voted for Donald Trump (R) in 2016 after voting for Barack Obama (D) in 2008 and 2012. Collectively, Trump won these Pivot Counties by more than 580,000 votes. Of these 206 counties, five are located in Washington, accounting for 2.43 percent of the total pivot counties.[46]

Pivot Counties (2020)

In 2020, Ballotpedia re-examined the 206 Pivot Counties to view their voting patterns following that year's presidential election. Ballotpedia defined those won by Trump won as Retained Pivot Counties and those won by Joe Biden (D) as Boomerang Pivot Counties. Nationwide, there were 181 Retained Pivot Counties and 25 Boomerang Pivot Counties. Washington had four Retained Pivot Counties and one Boomerang Pivot County, accounting for 2.21 and 4.00 percent of all Retained and Boomerang Pivot Counties, respectively.

More Washington coverage on Ballotpedia

- Elections in Washington

- United States congressional delegations from Washington

- Public policy in Washington

- Endorsers in Washington

- Washington fact checks

- More...

Recent news

The link below is to the most recent stories in a Google news search for the terms Washington Initiative 1366 Tax. These results are automatically generated from Google. Ballotpedia does not curate or endorse these articles.

See also

- Washington 2015 ballot measures

- 2015 ballot measures

- Initiative to the People

- Laws governing the initiative process in Washington

External links

Footnotes

- ↑ 1.0 1.1 1.2 Herald Net, "Judge to weigh legality of Eyman's tax-cut ballot measure," January 18, 2016

- ↑ Herald Net, "Judge rules Eyman’s tax-cut ballot measure unconstitutional," January 21, 2016

- ↑ Spokesman-Review, "Washington Supreme Court strikes down 2015 Eyman initiative," accessed January 27, 2020

- ↑ Washington Secretary of State, "Initiative 1366," accessed July 3, 2015

- ↑ The Seattle Times, "Eyman initiative sets up choice: tax cut or constitutional change," May 17, 2015

- ↑ 6.0 6.1 6.2 Washington Secretary of State, "Proposed Initiatives to the People - 2015: I-1366," accessed February 16, 2015

- ↑ 7.00 7.01 7.02 7.03 7.04 7.05 7.06 7.07 7.08 7.09 7.10 7.11 7.12 7.13 7.14 Note: This text is quoted verbatim from the original source. Any inconsistencies are attributable to the original source. Cite error: Invalid

<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content Cite error: Invalid<ref>tag; name "quotedisclaimer" defined multiple times with different content - ↑ Washington Office of Financial Management, "Fiscal Impact Statement for Initiative 1366," accessed July 30, 2015

- ↑ Washington Supreme Court, "League of Educ. Voters v. State ," February 28, 2013

- ↑ The Seattle Times, "After Supreme Court ruling, will Olympia increase taxes?" February 28, 2014

- ↑ Sales Tax Institute, "State Sales Tax Rates," accessed July 3, 2015

- ↑ Washington Legislature, "A Citizen's Guide to the Washington State Budget 2014," accessed July 3, 2015

- ↑ 13.0 13.1 13.2 Seattle Post‑Intelligencer, "Latest Eyman initiative could blow $1.4 billion hole in state budget," July 29, 2015

- ↑ Voters Want More Choices, "Homepage," accessed July 3, 2015

- ↑ Seattle Post‑Intelligencer, "Tim Eyman mortgages house to get back in the initiative game," February 10, 2015

- ↑ 16.0 16.1 16.2 Jefferson County Republican Party, "State Republican Party endorses 2/3-For-Taxes Constitutional Amendment Initiative I-1366," accessed July 3, 2015

- ↑ PR Newswire, "CCRKBA Endorses Two-Thirds for Taxes Initiative 1366 in WA," June 25, 2015

- ↑ We Believe-We Vote, "Ballot Measures," accessed October 27, 2015

- ↑ The Bellingham Herald, "Whatcom View: Washington Initiative 1366 offers permanent protection taxes hikes," October 25, 2015

- ↑ The NO on I-1366 Coalition, "Homepage," accessed July 3, 2015

- ↑ Permanent Defense, "NO on I-1366 Committee forms; will respond to Tim Eyman’s signature turn-in tomorrow," July 1, 2015

- ↑ Union-Bulletin, "Tim Eyman back with new anti-tax initiative," May 19, 2015

- ↑ 23.0 23.1 The Seattle Times, "Eyman’s latest measure qualifies for ballot," July 29, 2015

- ↑ 24.0 24.1 Who Opposes I-1366?, "Homepage," accessed October 27, 2015

- ↑ Washington Policy Center, "Initiative Measure No. 1366," August 1, 2015

- ↑ Seattlepi.com, "The case against Tim Eyman’s Initiative 1366: Don’t blow an $8 billion hole in the state budget," October 25, 2015

- ↑ No1366.org "Faith leaders stand in opposition to Tim Eyman’s I-1366," October 13, 2015

- ↑ 28.0 28.1 28.2 28.3 28.4 28.5 Washington Campaign Finance Database, "Committees in support and opposition to Initiative 1366," accessed February 17, 2025

- ↑ The News Tribune, "I-1366 lets legislative minority grab majority power," September 24, 2015

- ↑ The Columbian, "In Our View: Vote ‘No’ On Initiative 1366," October 14, 2015

- ↑ The Seattle Times, "The Times recommends: Voters should reject supermajority measure Initiative 1366," October 3, 2015

- ↑ Yakima Herald-Republic, "Endorsements: No on Initiative 1366, Yes on Initiative 1401," October 15, 2015

- ↑ Tri-City Herald, "Our Voice: Voters should have their say, then say ‘no’," August 9, 2015

- ↑ Crosscut, "Lawsuit aims to halt Eyman initiative," July 30, 2015

- ↑ Washington Superior Court, "Huff v. Wyman," July 30, 2015

- ↑ Yakima Herald, "Initiative 1366's opponents don't trust voters," August 8, 2015

- ↑ The Enumclaw Courier-Herald, "Secretary Wyman asks court to allow vote on I-1366," August 11, 2015

- ↑ The Seattle Times, "Suit filed over Eyman tax measure, just a day after it makes the ballot," July 30, 2015

- ↑ 39.0 39.1 K5, "Judge OKs Eyman tax-limiting initiative for ballot," August 14, 2015

- ↑ Spokesman-Review, "Washington Supreme Court strikes down 2015 Eyman initiative," accessed January 27, 2020

- ↑ Northwest Public Radio, "Ivory And Taxes Likely To Make Washington's Fall Ballot," July 2, 2015

- ↑ Sky Valley Chronicle, "Tim Eyman Says New Tax Hammering Initiative Will be on November Ballot," July 3, 2015

- ↑ KOMONews.com, "Tim Eyman investigation in hands of state attorney general," September 24, 2015

- ↑ [http://blog.seattlepi.com/seattlepolitics/2015/09/25/tim-eyman-seeks-less-radioactive-surrogate-for-tv-initiative-debate-sen-pam-roach/ Seattle PI, " Tim Eyman seeks less radioactive surrogate for TV initiative debate — Sen. Pam Roach," September 25, 2015]

- ↑ Herald Net, "Tim Eyman stays mum on state's investigation of his compensation," October 11, 2015

- ↑ The raw data for this study was provided by Dave Leip of Atlas of U.S. Presidential Elections.

State of Washington Olympia (capital) | |

|---|---|

| Elections |

What's on my ballot? | Elections in 2025 | How to vote | How to run for office | Ballot measures |

| Government |

Who represents me? | U.S. President | U.S. Congress | Federal courts | State executives | State legislature | State and local courts | Counties | Cities | School districts | Public policy |